Prop trading is a method of trading in the financial markets in which a financial firm will use its own capital in order to carry out high stake trades. In this form of trading, the initial equity for trading is quite high and thus the profits that can be gained are also quite high.

Not just for this method of trading, but trading in financial markets of all kinds needs to be a highly thought out and calculated approach in which every possible aspect of the trade and its outcome are taken into account.

For this reason, in this article we are going to focus on the strategies that are more suitable for prop trading and also discuss the importance of such strategies and whether or not you should engage in this form of trading.

The Importance of Different Strategies in Prop Trading

You might think to yourself that having a well thought out and detailed trading strategy is important with any form and method of trading. But the thing is that with prop trading, this matter is heightened and much more significant than other trading approaches.

Why?

Well, it is because in prop trading, a company or financial firm is engaging in the act of trading with a huge sum of money, which at times can be the total liquid assets at the disposal of the firm. So this means the stakes are quite high in prop trading. But this is also exactly where the benefit of prop trading can be found.

Because the initial equity is quite high, this means the possibility for profits can also be substantial. If you think about the profits gained in financial markets through trading in the form of percentage and not the dollar value, you can see that if the initial capital is higher, then the resultant profits can also be much more significant.

As a result, every single move that is made in this market needs to be highly calculated and different aspects of trade ought to be taken into account in order to increase the odds of a successful trade.

You need to keep in mind that the downside of prop trading can be substantial losses that might be sustained if the trade ends in loss rather than profit.

Significance of trading strategies in prop trading

|

You should read: Best Prop Trading Firms 2024

Should You Engage in Prop Trading?

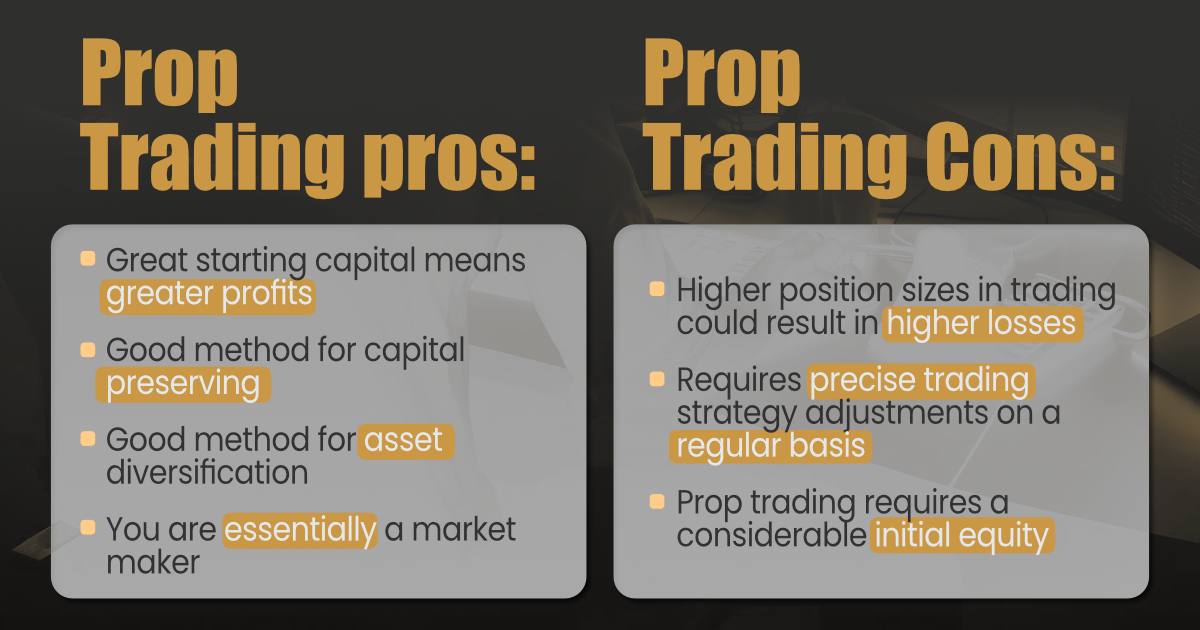

Now the million dollar question is whether you should engage in prop trading or not. Again, because the stakes are quite high in this method of trading, you should carefully weigh the pros and cons to find out a calculated approach to prop trading.

So let’s take a look at some of the major pros and cons of prop trading. Well, on the plus side, prop trading is an excellent method for companies to preserve their capital and keep all the profits for themselves. Also in this way you are basically a market maker who can affect the prices to a great extent.

On the other hand, because prop trading takes place with a large sum of money, the obtained profits are usually quite considerable even if the favorable change was small in terms of percentages.

However on the downside, you need to consider the risks associated with prop trading. Remember that prop trading is done with a substantial starting capital, which means the risk of loss is that much greater than other forms of trading.

| Is prop trading a good idea for you?

Consider the pros and cons Pros:

Cons:

|

Top Strategies for Profitable Prop Trading

Prop Trading Through News

In this strategy, the firm of individuals in charge of prop trading will use the capital at their disposal in order to execute trades in financial markets such as forex based on fundamental analysis and fundamental factors, with special emphasis on news releases and the release of economic data.

This is where the financial firm will monitor the market for fundamental and big picture events that could change the trajectory of prices. This method could actually work well with prop trading, since this trading method is usually carried out by financial firms and companies that have a deep root in economic venues. This means they have a much better understanding of fundamental factors that impact the market at large.

Prop Trading Through Trends (Swing Trading/Position Trading)

Another popular method for prop trading is through trend trading. In this method, the prop trading firm will rely on predominant market trends in order to execute trades and carry out decisions in this regard.

This is also a particularly useful approach for prop trading, since trading based on trend is more often than not a mid to long term approach, which on its own can yield more considerable profits.

We mentioned mid to long term approach to trend trading, which means the prop trading firm needs to opt for swing trading or position trading strategies. Both of these strategies focus on the trends in the market that take form in the mid to long term. And because prop trading is done with a large sum of money, this approach would be safer and at the same time ideal for profitability as well.

You should read: How Much Can Prop Trading Make 2024?

Prop Trading Through Scalping/Day Trading

The next approach to prop trading is in the form of shorter term and shorter time frames, such as scalping and day trading. Basically any form of high frequency trading where you would not leave the capital in the open position exposed to market forces for a long time.

While this prop trading strategy would yield quicker results, it does come with a much higher risk factor. This is because prop trading is done with a substantial capital and high frequency trading has the highest degree of risk among all trading strategies. So tread with caution.

Major strategies for prop trading:

|

Conclusion

Prop trading can be regarded as one of the most profitable approaches to trading in financial markets, especially financial markets with narrow margins such as the forex market. There are many strategies that could result in profitability with prop trading. Most notably among them we can refer to fundamental trading, trend trading, and high frequency trading, in addition to other forms of trading based on technical analysis.