Prop trading is among the most profitable methods of trading in all financial markets, especially the forex market. There are different approaches you can take to execute prop trading, whether you are an individual trader who wants to leave his money to a prop trading firm or if you are an individual trader who wants to engage in prop trading and work for a trading firm.

Whether you opt to trade for a prop trading firm as an individual trader or you want to entrust a firm with your assets and have them take it into the market via prop trading, you need to know how much money is to be made from prop trading. So read along to find out how much a prop trader can make in 2024.

How can you engage in prop trading?

|

You may like: Best Prop Trading Firms 2024

Prop Trading: Firm or Individual

In order to find out how much you can potentially make off of prop trading, we need to first analyze the ways in which prop trading is possible. There are basically two main ways down this road.

First of all, you can trade as an individual. This basically means we will look at prop trading from the perspective of an individual, whether the individual wants to engage in the prop trading themselves or whether they want to give their money for a prop trading firm and have them trade for him or her.

The second way would be to analyze the amount of money that can potentially be made from prop trading from the perspective of a firm or corporation. In this case we do not really have an allocation of funds or delegation of tasks. Rather, the first itself will engage in prop trading which can be done for any number of reasons.

So let’s look at all these different ways in which prop trading is done and see how much profits can be obtained through them.

Prop Trading as an Individual

Prop trading is a special form of trading in which a firm will use its capital to trade. This stands in opposition to a hedge fund, where the firm will gather money from its clients and then use the gathered capital to invest in other projects and pay its customers.

Doesn’t it sound like prop trading is only for firms and companies? Well, not really. As an individual, there are two ways in which you can engage in prop trading. Let’s take a deep look inside both of them and then discuss their income.

- Becoming a prop trader

According to statistics, out of all the traders that are actively trading, about only 25% of them are gaining a return on the capital they put in trading. Clearly this means trading is no easy task and should not be taken lightly. So if you are a serious and professional trader, you might want to start trading for another company as a job. One such job opportunity is to work for a prop trading firm. In this way you will have access to the company’s capital and full liquidated force in the market. This way you will be able to gain extremely valuable knowledge and experience about dealing with large sums of money and trading with it.

- Using a prop trading firm

The second way an individual can engage in prop trading is when the individual is not a professional trader and does not want to work in that capacity. Rather in this case we have an individual who is looking to invest their capital in a diverse market to gain steady profits. Normally, you would think of a hedge fund where you would give them your money and they basically guarantee to provide you with steady profits through special investment opportunities. But the other way to go is to use a prop trading firm. They are pretty similar to hedge funds, but with the difference that you have a much higher control over your own capital and also there is a much higher chance of profits in terms of sheer percentages. But at the same time there is a higher threat of risk.

Individual trader in prop trading

|

How Much Does an Individual Prop Trader Make?

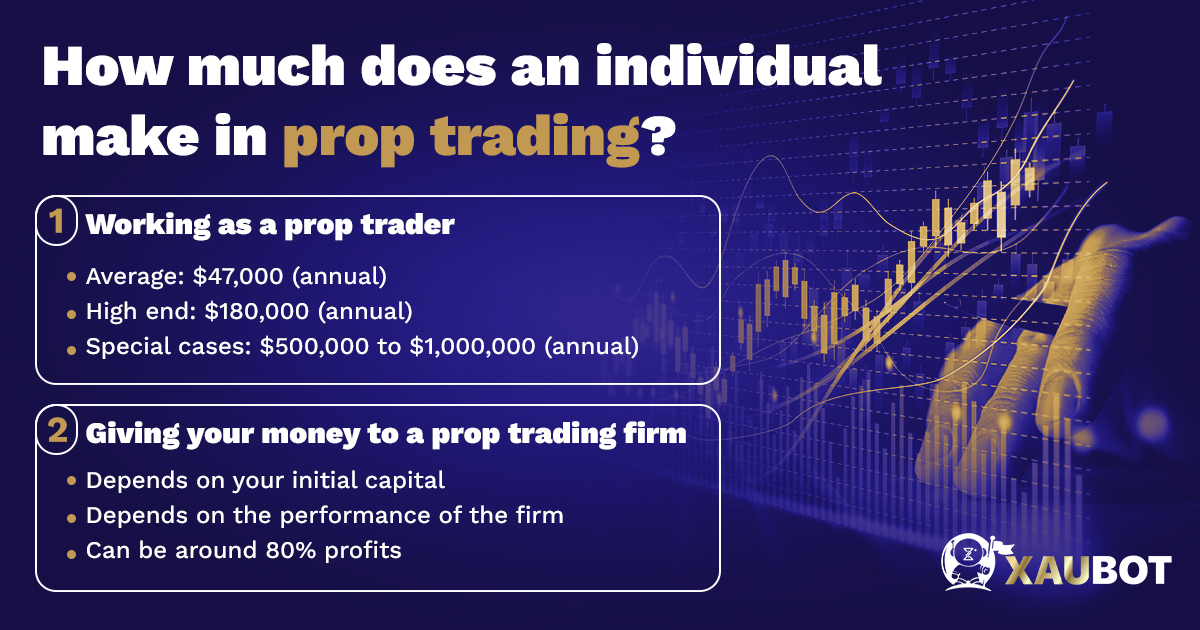

So given the two ways mentioned above, let us see how much an individual can make with prop trading.

- If you decide to work as a prop trader for a firm, you can make an average of about $47,000. But keep in mind this is an averaged out income, which means there are those who are making lower. And this income is an annual income. So you can see that the average is really low and keep in mind that there are those who earn lower. But at the same time, the high end of the income for prop traders can be as high as $180,000 yearly in the US. There are special circumstances under which a prop trader can even make 500,000 to 1 million dollars a year.

- If you decide to give your money to a prop trading firm, the amount of money you can make totally depends on your initial capital. It also depends on the firm you have chosen. But on average, using a prop trading firm, you can get a return of as high as 80%.

How much does an individual make in prop trading?

Average: $47,000 (annual) High end: $180,000 (annual) Special cases: $500,000 to $1,000,000 (annual)

Depends on your initial capital Depends on the performance of the firm Can be around 80% profits |

You may like: What Is Three Black Crows Candle Pattern?

How Much Do Firms Make from Prop Trading?

On the other hand, there are firms and corporations that want to engage in prop trading themselves. This is done as a means of keeping their liquid capital moving and not static. The amount of profits that a firm can make through prop trading depends on so many factors. For instance, how much capital they have at their disposal and what markets they choose for trading.

Although there are many factors involved, the chances for profits are high. But so are the threats of risk. That said, in prop trading, a firm or company can keep 100% of the profits made.

How much do prop trading firms make?

|

You may like: How to Use Ichimoku Kinko Hyo in Forex?

Conclusion

Prop trading is known as a very lucrative and profitable method of trading in financial markets, including the forex market. The amount of profits and money you can make via prop trading is related to many factors. In this article we discussed this topic by looking at the different ways in which prop trading can be done, namely as an individual prop trader or as a pro trading firm.