No decision is reliable when it is made under pressure and panic in Forex Trading. Least of all financial decisions. But this is something that happens from time to time in various financial markets. It might happen to individual traders and investors or it might also happen to a collective of them. This is what we would refer to as panic selling and there are quite a bit of implications that follow this phenomenon.

So in this article we are going to take a closer look at panic sell in trading and see what it is, what consequences it has, what causes it, and how you can avoid or maybe even potentially benefit from it.

You should read: What is xaubot?

The Definition of Panic Selling in Forex Trading

It is a known fact that financial markets are heavily driven by trader sentiments. This is what many of the well-established financial and economic theories are based on. Basically, it is the sentiment of the traders or investors in the market that drives the market forward.

Out of all the different types of emotion and sentiment that traders might be feeling, there are two that have been distilled from the rest and are usually taken to be the two major emotions behind any market decision by a trader – and they are fear and greed.

Let’s start with greed. As the name clearly suggests, this sentiment or feeling will push traders to purchase more and more. For instance, in the stock market, if greed is the overwhelming sentiment toward a certain asset or stock, then it will clearly push investors and brokers toward that asset and they will keep buying that asset in a frenzy state.

But here in this article we want to focus mainly on fear. The feeling that causes the exact opposite of greed. Fear will cause selling of an asset or financial instrument. It doesn’t really matter which financial market we are in. It can be the stock market, the real estate market, the forex market, or even the crypto market. When fear takes over, brokers are bombarded with sell orders.

But as we mentioned in the intro, it is completely natural for individual traders or investors to be overwhelmed by fear from time to time and sell prematurely. It is when fear takes over the majority of the market participants that we have a problem at our hands.

When fear takes over the majority of market participants that is when we have the phenomenon known as panic selling. In panic selling we have a large, sometimes even the majority, of market participants trying to sell a proportion or the entirety of their assets in that market.

We have seen this time and again with the crash of the stock market in the infamous Black Monday in 1987 when seemingly everyone decided to up and sell their stocks. And again in 2008 when we had a crash of the real estate market and other subsequent markets. and of course we have seen this phenomenon numerous times in the cryptocurrency market with various digital currencies and projects.

All markets have seen panic selling in one form or another at one point or another. Now that we know the definition of a panic sell, let’s see what factors contribute to this phenomenon taking place in the financial world.

You should read: Top 10 News Releases that Impact the Forex Market

What Factors Contribute to the Formation of a Panic Sell?

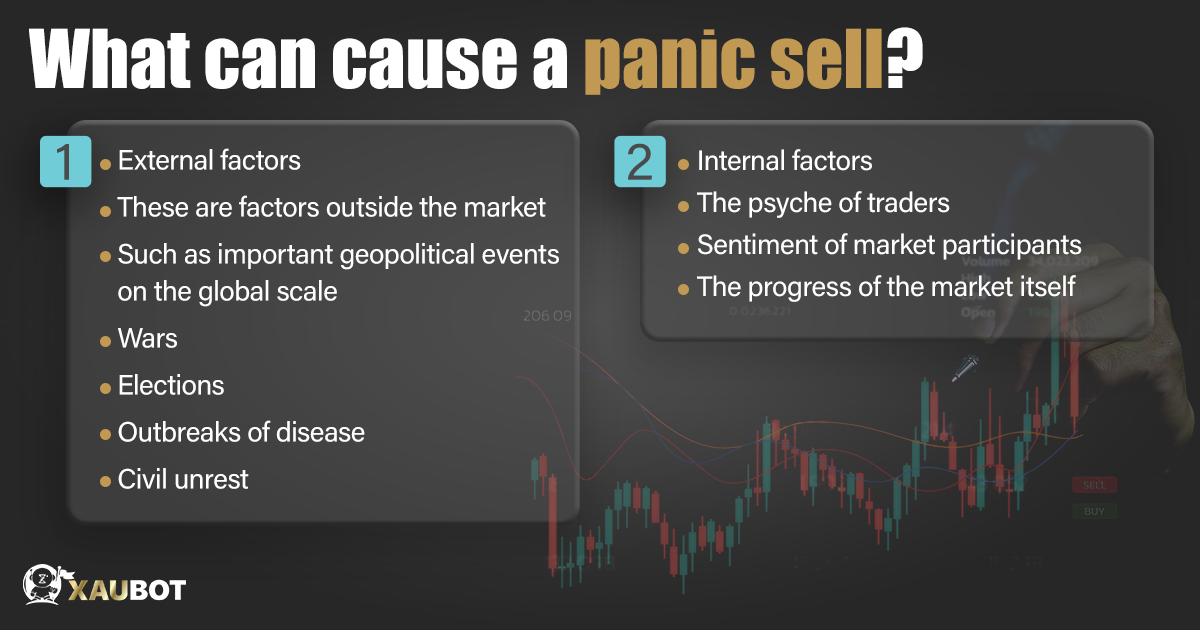

So why does panic sell occur in the first place? There are countless factors that ultimately contribute to the decision of traders. But we can divide these factors into two major categories:

- External factors

External factors are those that impact the market or the traders themselves form outside. Naturally we can count geopolitical and important global events under this category.

And it can even be regarded as a natural reaction to when these things happen in the world. Something horrible happens at a large scale that makes the future unpredictable and unstable, you are not really thinking about your dividends after a 5-year period with your favorite hedge fund!

No. In this situation you run to sell. And this is what we have seen countless times whenever a large geopolitical event takes place in the world with global consequences, such as wars or outbreaks of disease.

- Internal factors

There is another group of factors that are more driven internally. These factors can be related to the traders themselves or to the market in which they are active.

First of all, there are psychological factors that impact the overall sentiment of traders in a market. There could be a peer pressure sort of effect that forces traders to sell off their assets in fear that they might be falling behind the majority.

But there are also factors that involve the market itself. For instance, a slowed down progress after a period of bullish run can easily cause impatient traders to sell their asset in anticipation of prices going even lower.

You should read: Central Bank Policy

What Happens to Forex Trading After a Panic Sell?

Now let us see what actually happens to the market following a panic sell.

It is a basic principle that markets are driven by supply and demand. If the majority of asset holders in any market decide to sell, then naturally the value of that asset will be driven down.

It is basic economics. When an asset is not wanted by most participants, it means there is very little demand for it. When there is such a low demand, and in fact it is being deterred by traders, then the value will naturally go down.

This is why after a panic sell, if it is large enough, we can even expect the total crash of the asset or the entire market.

You should read: Economic Indicator in Forex Ultimate Guide

Conclusion

Many of our decisions in life are driven by our emotions. It is only natural. Financial decisions are no exception. Panic selling is one example of this phenomenon. It occurs when a large number of traders or asset holders in any market decide to sell on a large scale. Panic selling can cause prices to plummet and sharply decrease. But it can even cause the asset or the market to crash altogether.