Trading in forex is directly tied to the different skills that you have. One of those important skills is to be able to pick the right time frame for trading. In fact, picking the right time frame is so important that it has a field of its own in trading. And that is exactly what we are going to discuss here.

We want to see what a time frame in forex is, how many different kinds of time frames there are, how you should choose the right time frame, what the criteria for picking the right time frame in forex are, and finally why it is important to stick to your own time frame and do not change it when you are at a loss.

What Exactly Is a Forex Time Frame?

Timing is a hot topic in forex trading. Not least because of the market’s own working hours. As you know the forex market is peculiar in many different aspects. One of these aspects are the working hours of the market.

The foreign exchange market is a network of decentralized trading terminals around the world, each of which is known as a session. These sessions put together form the forex market as a whole. Because of this special structure we have a market that is basically active all the time.

This is because whenever one session ends another starts or has already started. This way we have a continually running market of decentralized sessions. Although this is a huge positive aspect of the forex market, it does also add a little bit to its complexity.

Complexity because you have to pick the exact right time for trading in this sea of potential time frames.

But we want to focus on smaller scales of timing in this market, i.e. time frames.

Of course similar to other forms of trading and when you need to have an open position in the market, the time frames in the forex market are divided into minutes, hours, days, and even weeks.

The way you pick these time frames will be dependent on many different factors, such as your own trading strategy and trading style, the particular session in which you want to trade, your trading pair, the overlap of two sessions with each other, and last but not least the opening and closing hours of the particular session in which you are trading.

You should read: 1 Minute Time Frame Trading Strategy

What Are the Different Types of Time Frame in Forex?

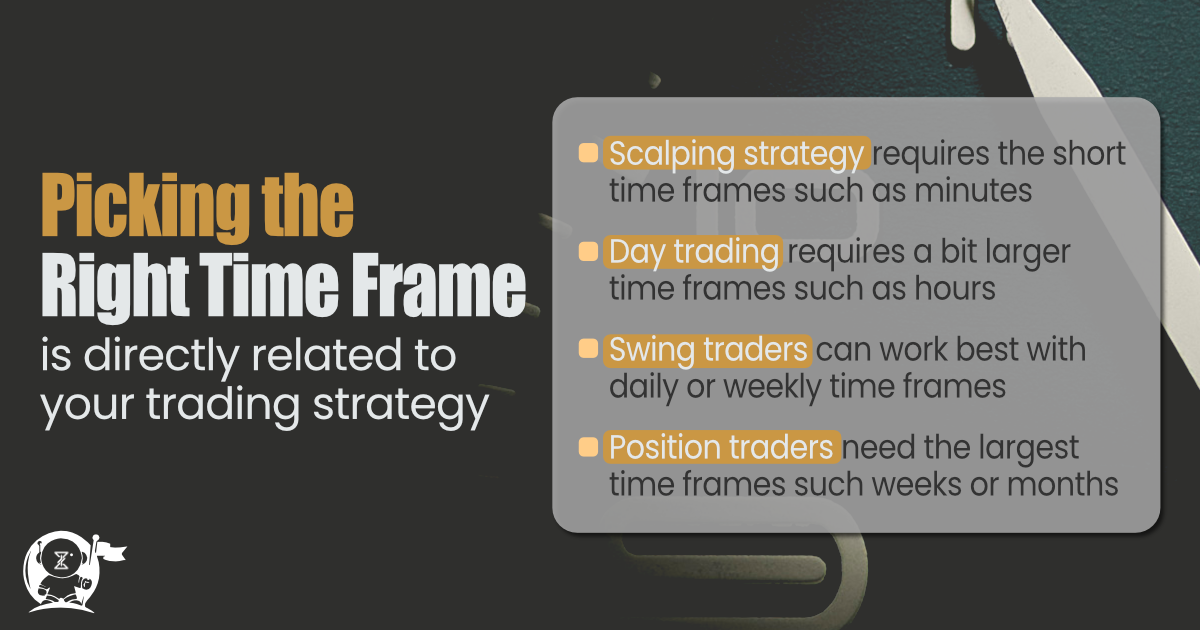

In the previous section we discussed the general definition of a time frame in the forex market and talked about some of the criteria that are important in picking the right time frame. But in order to pick the exact right time frame, you need to know the different types that are associated with the different types of trading strategies. So let’s take a look at the most prevalent trading strategies and the most optimal time frames for them.

- Scalping: this strategy of trading is considered among one of the small time frame trading strategies. As such, traders who opt for this method of trading will require really small time frames. In fact, this is where we have the smallest time frames. In scalping, time frames can be as small as only minutes and even less than a minute. This is because scalping aims to obtain benefits from even the smallest price changes. In scalping we have even one minute time frames.

- Day trading: day trading is the next step after scalping. It is also among small to mid-range time frame strategies. As the name suggests, trades in this strategy are closed within the same trading day. So this means the time frames that are most optimal for day trading are daily time frames. But daily time frames that include minutes and hours. So in day trading we have time frames that can range from minutes, hours, to anything within the same day.

- Swing trading: this is where we get to larger time frames. In swing trading, traders would normally work with days or weeks as their optimal time frame. This is because swing trading hopes to capitalize on trend swings that occur in the market and not on small changes.

- Position trading: lastly, we have the biggest time frame strategy. Position trading, as the name suggests, is all about a position. You hold your position for as long as it is necessary in order to benefit from the gains that are obtained over time. As a result the optimal time frame for position trading are weeks and can even last for months.

You should read: What is the symbol of silver in Forex and the best time to trade silver?

Why Is It Important to Stick to a Time Frame Even at a Loss?

So now you know the importance of having a time frame associated with your trading strategy. Let’s see why it is not a good idea to change your time frame even when you are at a loss.

The time frame that you have chosen from trading is specifically suitable for that method of trading. So you cannot just change your time frame if you are using scalping and increase the time frame of your trades. This will expose your trades to an unnecessary level of risk that is not needed for scalp trading.

So even if you are sustaining losses, it is not necessarily the case that changing your time frame will fix the issue.

You should read: What is a statement? Forex trading statement review

Conclusion

Time frame is one of the most important factors in the forex market and it basically refers to the time windows in which your position remains open. As such we can have time frames in the forex market ranging from less than a minute to weeks or even months. In this article we discussed the importance of time frames and why you should not change your time frame when you are at a loss.