MetaTrader has long been the champion for traders across various markets, most well-known among forex traders. But these days, this trading platform is increasingly becoming more popular among crypto traders.

Due to the rising popularity of diversified assets, including digital assets in the global economy, so has the popularity of trading platforms such as MetaTrader, whether MT4 or MT5, has risen among traders who are interested in such assets.

For this reason, we are going to dedicate this article to discuss the capabilities of MetaTrader in how it supports trading crypto and how automation can enhance this feature even more so.

A Brief Background: MetaTrader and the Rise of Crypto

MetaTrader was originally launched by MetaQuotes Software company back in 2005. The original version which is still around was MT4. And then five years later, its successor was launched, which of course was MetaTrader 5, introduced in 2010.

These platforms have been the biggest names in the world of forex trading for a very long time, with their real time charts, technical indicators, and the possibility for automated trading in the form of expert advisors or EAs.

So it began with a special focus on the foreign exchange market. But as time went on and digital currencies gained more and more traction among traders, MetaTrader began integrating these asset classes into its platform. By 2018, traders could trade all major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), and many others on MetaTrader.

So an already familiar platform and interface which have already been used extensively by traders for forex pairs and CFDs started being used for crypto as well.

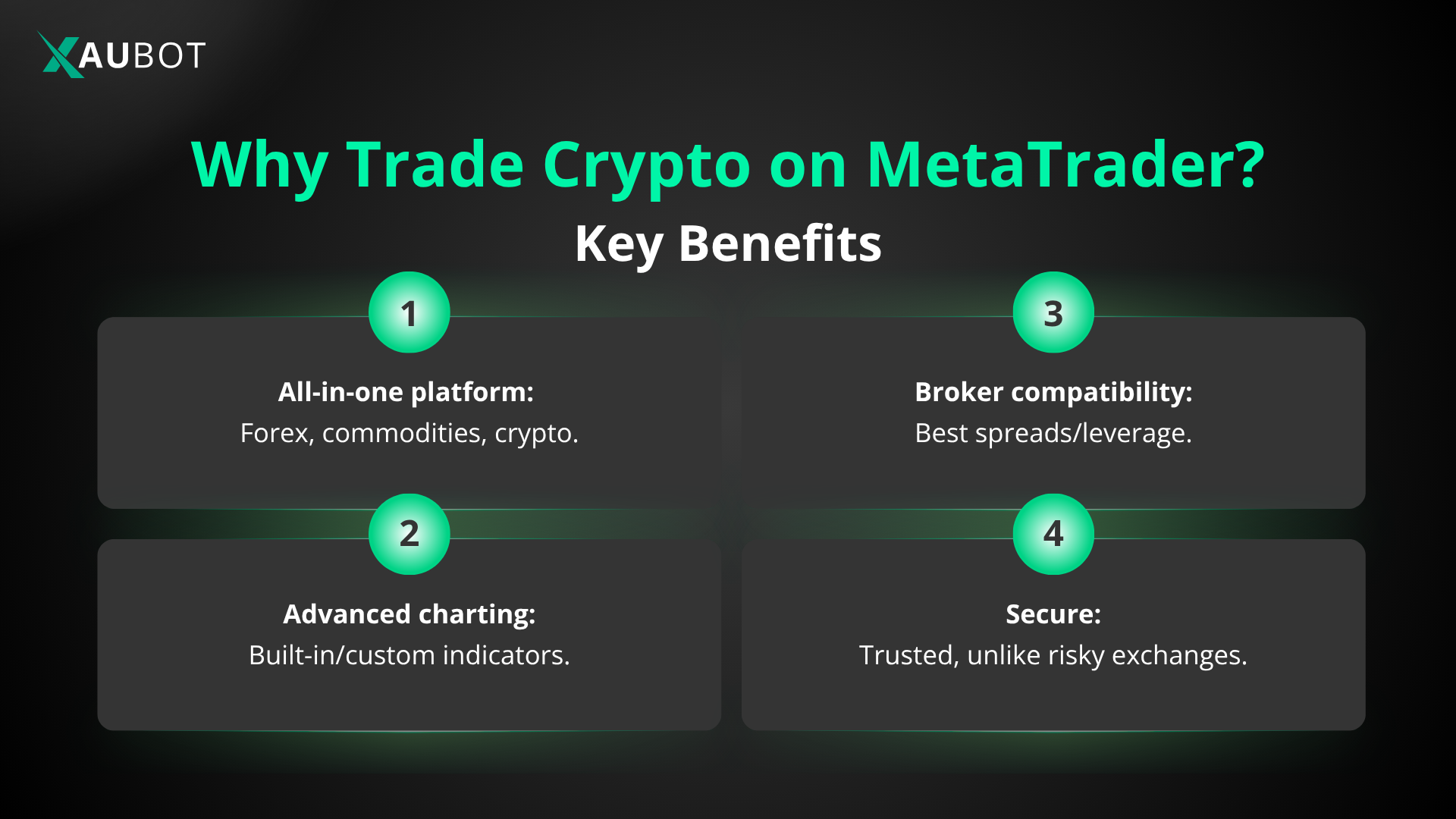

Why Trade Cryptocurrency on MetaTrader?

The world of crypto trading has grown so large these days that there is no shortage of crypto exchanges and similar platforms where you can trade crypto. So the question has to be asked; why use MetaTrader for trading crypto?

There are solid reasons behind this choice, which all stem from the firm and reliable roots of MetaTrader itself. These include the following:

- Unified Platform for All Markets

First and foremost, for those traders who already have a diversified portfolio, it might be quite the hassle to handle multiple platforms at the same time, switching between them just to be able to handle your trades.

But MetaTrader allows you to trade multiple asset classes, such as forex pairs, commodities, indices, and crypto all within the same platform. This all-in-one possibility is truly priceless when you think about not needing separate accounts to manage all of your investments.

- Advanced Charting and Analysis Tools

MetaTrader 4 and 5 both offer some of the most advanced and significant charting tools available across trading platforms. There are numerous built-in technical indicators on these platforms, not to mention the possibility of adding as many as you want. These advanced analysis tools make MetaTrader into such an ideal option for crypto trading.

- Reliable Execution and Broker Integration

An important factor to always remember when it comes to trading platforms is the compatibility of the platform with brokers. The thing about MetaTrader is that it has made such a big name for itself that it has been integrated into almost all known brokers. This means you will be able to pick the broker with the best spreads and leverage options.

- Security and Stability

In the world of crypto trading where there are many crypto exchanges popping up almost all the time, security is a big issue. A lot of these platforms are unfortunately fraudulent and the crypto world is full of examples where users lost all their assets because of this issue.

But this is basically non-existent with MetaTrader. This platform has been able to provide its security and reliability over the years as a secure and safe platform.

MetaTrader 4 vs MetaTrader 5 for Crypto Trading

So far, we have discussed a bit about the possibility of trading crypto on the trading platform MetaTrader. But as you must have noticed, two names kept popping up; MetaTrader 4 and 5. So which one is better for crypto trading? MT4 or MT5?

Of course you can use both the MT4 and MT5 to trade crypto and actually speculate on the price of crypto without actually owning it. But at the same time, there are certain differences to consider between these two iterations of MetaTrader.

|

Feature |

MetaTrader 4 (MT4) | MetaTrader 5 (MT5) |

|

Release Year |

2005 | 2010 |

|

Market Coverage |

Primarily Forex |

Multi-asset (Forex, Stocks, Crypto, Futures) |

|

Order Types |

4 main types | 6 advanced types |

|

Timeframes |

9 |

21 |

| Programming Language | MQL4 |

MQL5 |

|

Built-in Economic Calendar |

No |

Yes |

| Crypto Support | Through brokers offering CFD crypto pairs |

More native integration and broader crypto CFDs support |

So basically, as it can be seen on the chart, MT5 has more features and tools compared with MT4. With its more modern infrastructure, MT5 is probably a better choice for crypto trading. But at the same time, MT4 still remains quite a popular choice.

How to Automate Crypto Trading on MetaTrader

This is where one of the biggest advantages of MetaTrader is to be found – i.e. automation.

MetaTrader is exceptionally good with automation through the use of expert advisors. You can use various algorithms to enhance your crypto trading and automate the process.

Using Expert Advisors (EAs)

An Expert Advisor can monitor the crypto market continuously and place trades automatically when certain signals appear. For example:

- Buy Bitcoin when the 50-day moving average crosses above the 200-day average.

- Sell Ethereum when RSI exceeds 70.

- Set stop losses and take profits automatically.

You can find thousands of EAs online already developed to automate crypto trading on MetaTrader.

Building Custom Indicators

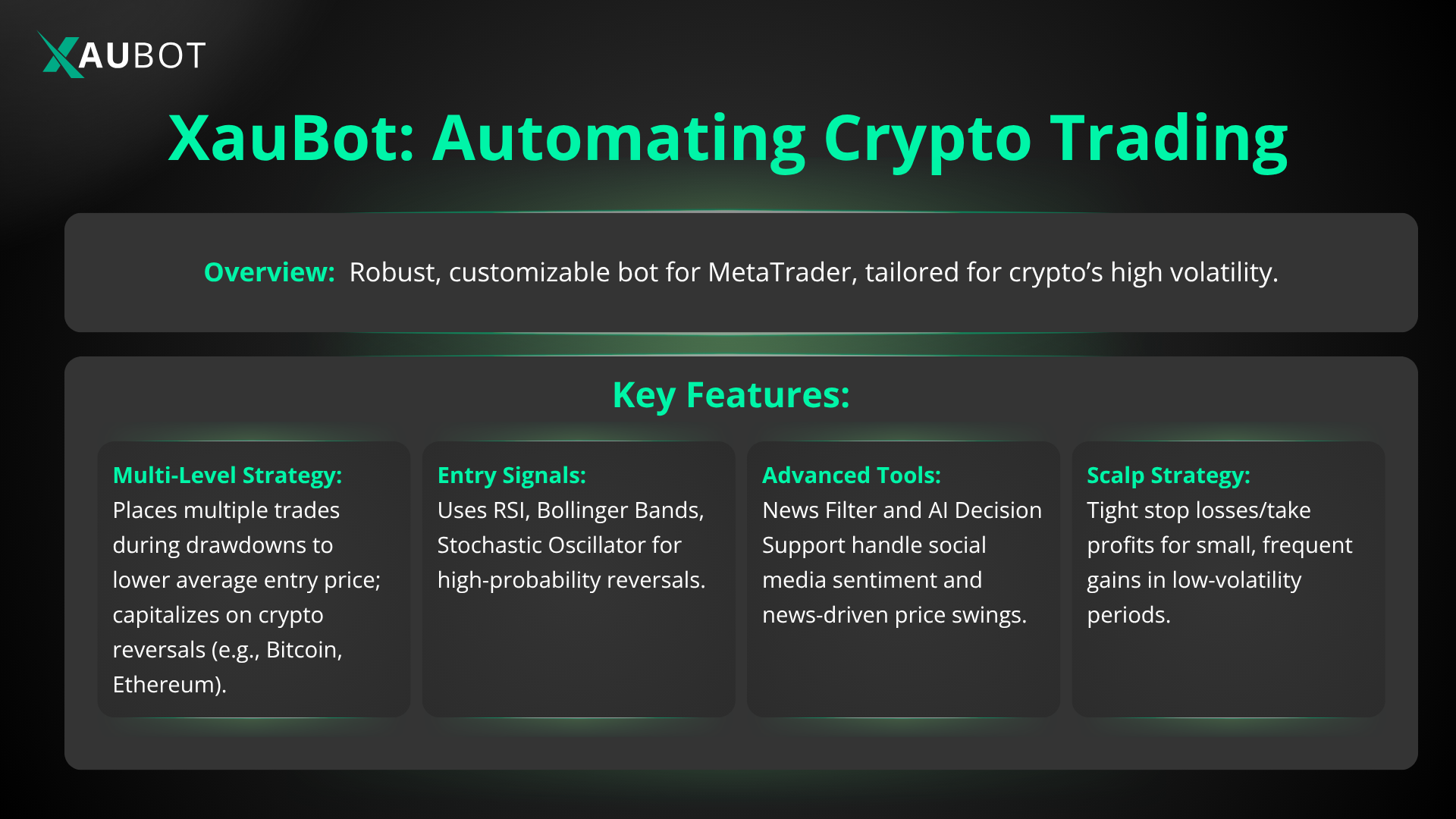

XauBot stands out as an ideal solution for bot generation in the crypto market due to its robust, customizable framework tailored for high-volatility environments like cryptocurrencies.

Our platform’s Multi-Level Strategy excels in crypto’s unpredictable price swings, allowing the bot to place multiple trades at strategic intervals during drawdowns, effectively lowering the average entry price and capitalizing on frequent reversals common in assets like Bitcoin or Ethereum.

Combined with the default XauBot entry strategy, which leverages RSI, Bollinger Bands, and Stochastic Oscillator for high-probability reversal signals, users can build bots that thrive in 24/7 markets, filtering out noise and focusing on proven reversal points.

Furthermore, XauBot’s integration of advanced tools like the News Filter and AI Decision Support makes it particularly suited for crypto, where social media sentiment and sudden news events can drive massive movements.

For scalping enthusiasts, the Scalp Strategy offers tight take profits and stop losses, ideal for capturing small, frequent gains in low-volatility crypto periods.

Final Thoughts

MetaTrader started as a platform just for forex, but now it lets you trade many types of assets, including cryptocurrencies. You can chart, analyze, and even automate crypto trades all in one safe place. MT4 and MT5 combine the reliability of traditional trading with the innovation of digital assets.

Whether you trade manually using charts or are a developer making a crypto trading bot, MetaTrader gives you the tools you need to succeed in the fast-moving crypto world.