Gold remains one of the most dynamic assets in trading, with XAUUSD often delivering sharp intraday moves driven by economic data, geopolitical events, and safe-haven flows. Scalping gold captures these quick price fluctuations for small but frequent profits.

An AI-powered gold trading bot takes this to the next level by processing vast data in real time, spotting patterns humans might miss, and executing trades with precision and speed.

AI bots for gold scalping stand out because they adapt to changing volatility, filter noise on low timeframes, and enforce strict risk rules without emotion. Platforms like XauBot make it straightforward to generate custom scalping bots tailored for MT4 or MT5, incorporating advanced logic for gold’s unique behavior.

Why Scalp Gold with an AI Bot?

Gold offers ideal conditions for scalping. It shows high liquidity during key sessions, tight spreads on major brokers, and frequent micro-trends from news spikes or institutional flows. Traditional manual scalping struggles with speed and consistency, but AI changes that.

Key advantages include:

- Lightning-fast analysis of price, volume, and indicators

- Adaptive learning from recent market regimes

- Emotion-free execution during volatile bursts

- Precise risk controls like tight stops and dynamic position sizing

- Ability to run 24/5 while focusing on high-probability setups

Many successful setups target 5 to 40 points per trade, accumulating gains through volume rather than large wins.

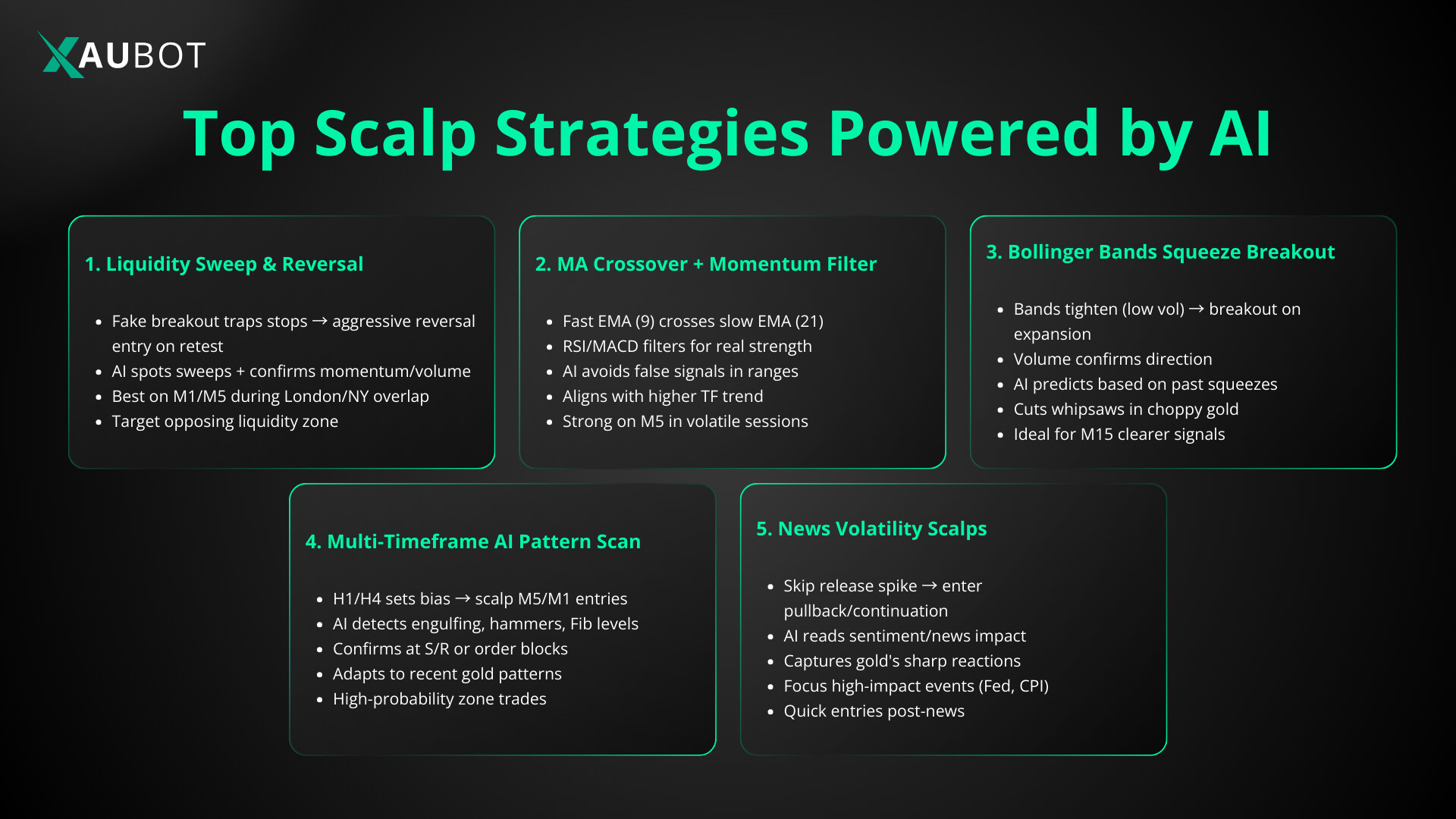

Top Scalp Strategies Powered by AI

AI bots excel when built around proven scalping frameworks optimized for gold. Here are some of the most effective approaches seen in recent performance.

Liquidity Sweep and Reversal Strategy

This remains a favorite for 1-minute or 5-minute charts. The bot waits for price to sweep a recent high or low (trapping stops), followed by aggressive displacement in the opposite direction. Entry occurs on retest of the fair value gap created by the reversal. AI enhances this by detecting sweeps with pattern recognition and confirming momentum shifts using volume or oscillator data. Targets often sit at the opposing liquidity pool, with stops placed beyond the sweep extreme.

Moving Average Crossover with Momentum Filter

Combine fast and slow exponential moving averages (for instance 9 and 21 periods) on M5 charts. The bot enters on crossovers aligned with momentum from RSI or MACD. AI adds value by filtering false signals during ranging markets or low-volatility periods, only allowing trades when higher-timeframe trend aligns or during peak sessions.

Bollinger Bands Squeeze Breakout

On M15 charts, the bot identifies periods of low volatility (bands contract), then enters on expansion breakout with volume confirmation. AI improves accuracy by incorporating machine learning to predict breakout direction based on prior squeezes and current market context, reducing whipsaws common in gold.

Multi-Timeframe Confirmation with AI Pattern Detection

Use higher timeframe (H1 or H4) for overall bias, then scalp entries on M5 or M1. The bot confirms with support and resistance, Fibonacci levels, or candlestick patterns. Advanced AI scans for high-probability setups like engulfing candles or hammers at key zones, adapting parameters based on recent gold behavior.

News-Driven Volatility Scalps

Around major releases (inflation data, Fed decisions), gold spikes create opportunities. The bot avoids trading right at release but enters post-spike on pullbacks or continuations, using AI to gauge sentiment from integrated data feeds.

Best Timeframes and Sessions for AI Gold Scalping

Lower timeframes suit pure scalping, while AI handles the noise effectively.

- M1 to M5 charts deliver the highest trade frequency and suit aggressive setups like liquidity sweeps

- M15 provides clearer signals with less random fluctuation, ideal for balanced scalpers

Focus on high-liquidity windows:

- London open through New York overlap (peak volatility and tight spreads)

- Avoid low-volume Asian sessions where spreads widen

Many top-performing bots restrict activity to these overlap hours for optimal edge.

Risk Management Essentials in AI Gold Bots

Gold moves fast, so robust controls prevent drawdowns.

Always incorporate:

- Fixed or dynamic stop-loss (often 10 to 30 points based on ATR)

- Risk per trade limited to 0.5 to 2 percent of account

- Trailing stops or partial closes to lock profits

- Maximum daily loss limits to pause trading

- Spread filters to skip poor broker conditions

AI shines here by adjusting risk dynamically according to volatility or win streak.

Final Thoughts

An AI gold trading bot transforms scalping from high-stress manual work into systematic, high-frequency execution. With gold’s volatility, these bots capture consistent small wins that compound over time. Focus on quality setups, ironclad risk rules, and regular optimization.

Embrace the speed and precision AI brings to gold trading, and turn quick moves into steady account growth in today’s fast markets.