Surely you’ve heard the old adage that says, for everything there is a season. This isn’t just metaphorical advice for life, it’s also crucial guidance for any forex trader. Whatever currency pair you’re trading, and whatever strategy you’ve chosen, the timing of your trades can make all the difference. This is especially true when trading gold in forex.

Trading in FX (forex) markets is all about time. For real estate traders, it’s location, location, location. And for FX traders, it might as well be timing, timing, timing. Getting your timing right is essential if you want to maximize profits from trading foreign currencies.

Many newcomers enter the FX trading world full of enthusiasm, attempting to trade around the clock to capture every possible gain. But this approach can be extremely harmful. The human body needs adequate rest to function properly, and trading nonstop can quickly lead to burnout and poor decision-making.

That’s why it’s critical to identify the most ideal trading hours and stick to them. Unlike conventional markets such as stocks, forex markets are unique in that they are essentially active 24 hours a day, five days a week.

The solution is a deep understanding of how the forex market operates and which hours are most advantageous for the specific trades you want to execute. In this article, we’ll take a detailed look at forex trading hours, the best days of the week to trade, and how to optimize your strategy for trading gold, specifically the XAU/USD pair.

Is Forex Running All the Time?

How come you hear all the time that forex is a 24-hour market? How is it exactly that FX market run around the clock? Well the thing is that conventional markets are active during the conventional working hours of the country or time zone in which they are located. This means that, for example, the New York Stock Exchange runs from Monday to Friday during the normal working hours based on the Eastern Time zone in the United States – i.e. from 9:30 in the morning to 4:00 in the afternoon.

The same is true for all traditional markets around the world, such as the New York Mercantile Exchange or NYMEX which also has its own special division for the exchange and trading of gold futures.

So, at what times are forex sessions running? The timing of the forex market is no different from those of the other markets. Only the different thing is that there are several foreign currency exchange markets around the world. So, when we add up all these hours, it can be seen that FX markets are active 24 hours all day and all night from Monday to Friday.

In fact, these FX markets are active around the world in four major time zones – all the way from Tokyo to the other part of the world in New York city.

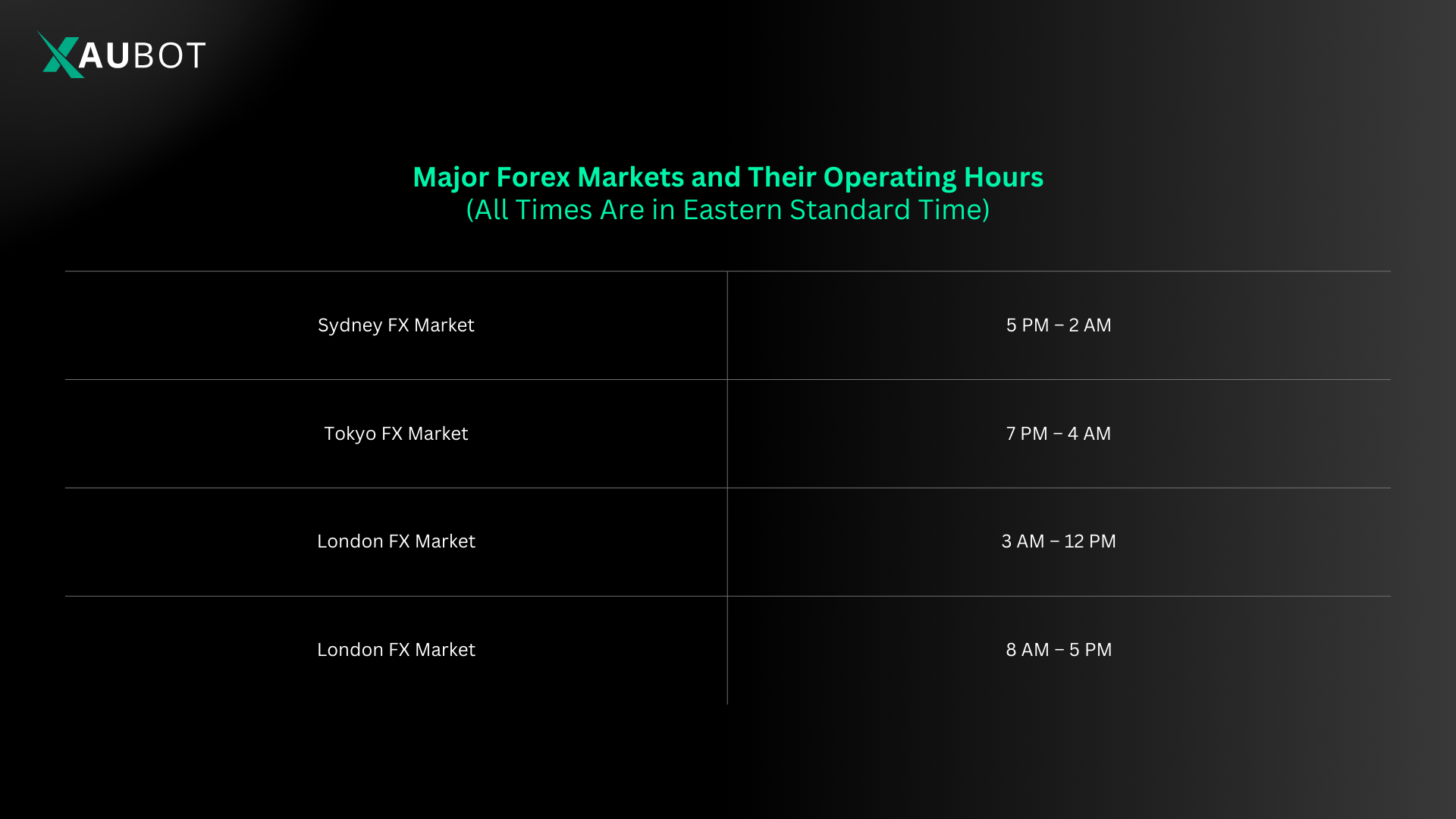

Now, we will take a look at these four major forex markets around the world to see what are their hours of operation (which are taken into account as the hours mentioned for the NYSE mentioned above, which is the Easter Standard time zone) and their specific highs and lows with regard to trading volume and other relevant metrics for gold traders in FX to make the most benefits.

What is the best time in Sydney Forex session?

Very much like the celebration of the New Year’s in the Georgian calendar, in forex trading, the party begins in Sydney! Officially speaking, it is the forex market in Sydney that marks the beginning of the FX trading week on Sunday afternoon local time.

The official trading hours for the forex market in this part of the world is from 5 in the afternoon to the late hours of 2 in the morning (5 pm – 2 am). So the trading week for gold FX traders begins at 5 PM in Sydney, Australia.

Sydney FX market is definitely not the largest forex market in the world in terms of trading volume and other indices. However, it is like the first line of defense being hit with the largest wave of traders. This is because traders have just gone through the off days in the trading week, and not just for the forex market but for all the other trading markets. So they are hungry for trading and getting back into the waters.

This is why the Sydney market receives some of the highest initial volume of FX trading, which also includes the gold trading pair as the XAU/USD which is gold denominated by the US dollar.

What is the best time in Tokyo Forex session?

It is time to take the bulk of forex trading aboard the oriental express, because it is time for the FX markets in Asia. There are certain major markets in this old and great continent, namely Tokyo, Hong Kong, and Singapore.

But among these markets the Tokyo market is the most prominent one, given the fact it is the first market to open up in the continent of Asia. The forex market in Tokyo, Japan starts operating from 7 in the afternoon and the later hours of 4 in the morning (ET – Easter Time).

Which Forex Pairs are Most Active in Tokyo Trading Hours?

Again, the reason the Tokyo forex market is regarded to be among the four major FX markets around the world is the sheer volume of trading that takes place in this market. There are certain trading pairs that are quite hot in this market that forex trading need to consider. These foreign currency trading pairs are the USD/JPY and GBP/JPY which are both the Japanese Yen denominated by US dollar and British pound. On the other hand, the city of Tokyo itself is one of the largest exchanges for gold in all its forms, be it physical or futures in the world. As such, the FX market of Tokyo is also a good market for the trading of gold. This is because certain movements in this city can impact that price of physical gold.

Although gold is considered to be a rather stable and sturdy asset, there are, however, certain factors that can impact that price of this precious metal. Extremely high volume movements of gold bars and ingots by market whales and even central banks are among these factors impacting the price of gold. As was just mentioned, Tokyo is regarded an international hub for gold traders and the exchange of gold in general. So, a smart forex gold trader would observe this market very carefully to take the right positions.

What is the best time in London Forex session?

Moving further westward we get to the biggest market for foreign currencies in the world – London, UK. The forex market in London begin operations at 3 in the morning until 12 PM (3am – 12pm).

London is like the beating heart of the trading world. Whether it is foreign exchange or gold or other assets, London is where the most of the action is. And as the beating heart of the whole operation, forex traders need to observe this market carefully. Big decisions are made in this city and they can surely affect way outside the boundaries of the Great Britain.

What is the best time in New York Forex session?

Only second to the London forex market, the NY forex market is the second largest in the world. This FX market opens up at 8 in the morning and runs until 5 in the afternoon (8am – 5pm).

Now, as was mentioned with regard to the Tokyo market above, each market will involve one currency more than the others depending on certain factors, most importantly the location of the market. As such the Japanese Yen had the primacy in Tokyo forex market. And so in the NY forex market the US dollar is involved in almost all the trades.

The mighty US dollar itself is also subject to certain movements and factors that take place in its country of origin; factors including moves made by the NYSE, company mergers and liquidations, and above all the US Federal Reserve adjusting the rates of interest to impact inflation and deflation.

Best Currency Pairs to Consider in New York

Given the fact that the most prominent gold trading pair in forex markets is the gold denominated by US dollar or the XAU/USD, then it can be seen why the New York trading hours are the most prime hours for the trading of this precious metal for forex traders.

A Comparison of Forex Market Schedules

So now you have quite a clear image of how forex markets can remain open all the time, in fact 24 hours 5 days a week. It is because the overlap between all the markets. When you add up all the hours that markets are open from Sydney to New York, then it becomes apparent how FX market remain active around the clock.

As a matter of fact, forex markets are active from 5 in the afternoon on Sunday in Sidney until 5 in the afternoon on Friday in New York. Although, forex traders must know that all trading hours are not equally opportune for profiting from the market. Of course any trader with enough experience would clearly know that certain hours are more profitable than other hours.

Overlapping is a vital factor, because when more than one forex markets are operating at the same time, it means there is a rise in the trading volume, creating the fertile grounds for traders.

This creates two main situations in terms of trading in forex markets. When one market is only active, or rather one foreign currency pairs are being traded in only one market with a relatively lower trading volume, this means the pip range would also be relatively low. Pip or percentage in point indicates how much change occurs in the exchange rate of a certain foreign currency trading pair in forex.

On the other hand, overlapping forex markets would provide forex trader with a much higher pip range, meaning higher volume, higher liquidity, and higher change and movements in currency pair prices.

Therefore, one can only easily conclude that the best time to trade gold or any other trading pair in forex markets would be when two markets overlap in terms of their hours of operation. The resultant high price ranges would provide better opportunities for traders to benefit from price movements.

When it comes to trading gold, of course one of the best choices to do so are forex markets. Now for trading gold in forex markets, these overlapping hours also come into play. We will now take a look at some of these most important of these to see which one is more important for gold trading.

Sydney-Tokyo Trading Hours:

The overlap between the two forex markets of Sydney and Tokyo takes place from 2 in the morning to 4 in the morning Eastern Standard Time. So there is a 2-hour window to benefit from the high volume trading in the market. Gold is heavily traded in both Australia and Japan, so it is one of the best time to benefit from the trading of gold in forex market. This can be carried out directly and indirectly using a number of pairs, including EUR/JPY, USD/JPY, USD/EUR, and of course XAU/USD.

London-Tokyo Trading Hours:

The next major overlap concerns the two markets of London and Tokyo. Given the fact that these two cities are located at two very far apart points on earth, the window of opportunity that is created between them is rather small. In fact, it is only one hour – from 3 to 4 in the morning. But nevertheless it is quite a ripe hour since it is the last hour for trading in Tokyo forex market and the first one for the London market. So, even though it is only one hour, the pip range is quite high.

London-New York Trading Hours:

Luckily the last overlapping FX markets that we are going to discuss has the longest length of overlap among all the others. The fact that it is lucky is because these two markets put together account for much more than two third of all the trades carried out in forex markets. The reason is that US dollar and British pound of course make up the majority of all the foreign currency trades executed in FX. The overlap between these two markets lasts for 4 hours from 8 in the morning to 12 at noon. This 4-hour window provides the best opportunity for forex gold traders to execute their positions in their forex trading platform of choice such as the MetaTrader 4 or MetaTrader 5 or other platforms for that matter. The reason is that the pair XAU/USD is rather stable given the fact that gold itself is a stable asset.

As such one cannot hope to gain a lot of benefit from trading in many long positions. However, if positions are opened and closed quicker, profits can be made from the price movements in the market.

So, now that we know when the FX markets are most opportune for trading currencies pairs and gold, let’s see when is the best and worst time for trading gold in forex markets.

When Is the Best Time for Trading Gold in Forex?

So far, we have been able to see which forex markets around the world offer a higher level of trading volume, since higher activity equates to higher trading and thus higher pip ranges. Higher pip ranges, in return, will provide move price movements and thus creating the suitable situation for gold traders to benefit from even the slightest changes in the price of the XAU/USD trading pair.

It is very important to figure out which markets offer higher activity, for instance London FX market is much busier than its Asian counterparts. Nonetheless, there are other temporal factors to take into account to find out the best time for trading gold in forex markets.

There are certain days during the week that are better for trading gold than others. As a general measure, the middle of the week is when the activity in forex markets, regardless of market, reaches its peak. That is when the market has the highest range of pip.

So even in a busy market such as the London FX market, during the middle of the week, traders will have access to the highest pip ranges. These really busy times in forex present the best moments for traders to profit by implementing various strategies.

Therefore, to provide a generalized time window for trading gold in forex it would be the overlap between the busiest markets around the world during the busiest days of the week. This would mean the overlap of the London and New York markets in the middle of the week.

Make sure to jot down, save, and memorize the trading hours of the most active markets and also commit the days of the week to memory.

When Is the Worst Time for Trading Gold in Forex?

Just like the best time for trading gold in forex, there is similarly a worst time for trading this precious metal in FX markets.

Forex traders should be weary not to pick their major trading hours to fall within certain times, such as the final hours of the market. This would be the final hours of Friday in New York market. The reason is that pip ranges are at their lowest after 12 pm ET on Friday until the market closes. Most traders tend not to trade heavily when the market is about to close. So be careful about that.

Similarly, when the market opens in Sydney on Sunday, even though there is a sudden rush of traffic to the forex market after the weekend, but the market activity has not yet taken off as well as it should. This means the FX market would not provide the highest pip range at this time.

Also, sometimes even if forex traders have chosen the very best time for trading and have considered the days of the week, the location of the market, the activity, volume, pip range, etc., there are still other events that can impact the market. So it is highly important to consider these factors as well.

Such factors could drive the market upward or downward – though historically it can be said that mostly it is downward, which means their negative impact has proven to be stronger.

So, what are they?

Factors Impacting FX Pip Ranges

As was mentioned, aside from the timing of the trades, people who want to make money from forex should also consider certain other factors. It is because even if you have chosen the very best time of the day and the week for trading, these factors could still impact the FX market and bring the pip ranges down.

Such factors include:

- Consumer Price Index (CPI): the consumer price index or CPI has long been regarded as one of the best measures to indicate the amount of inflation in any economy. Inflation is one of the most important factors impacting the market. And of course it can have many impacts for gold traders in forex specifically. Inflation can both drive up and also push down the price of gold as a result of the implications it can have on the market and more prominently on the consumers themselves.

- Consumer Consumption & Confidence: these two measures are regarded among the best factors to evaluate the health and performance of any economy in the world. Of course consumer consumption indicates the status of the economy as a whole and whether it is moving upwards or downwards. In other words, whether the market is bullish or bearish depends on the very basic factors of consumer consumption. On the other hand, consumer confidence measures the trusts of people in the economy and how they feel with regard to the status of any given market. Both of these factors need to be considered if you want to be a professional gold trader in forex.

- Trade Deficit: this measurement is perhaps one of the most important ones for any trader in any market, especially for gold traders in FX markets. Trade deficit basically measures the deficit or difference between the amount of import and export in a given economy. This is the difference between a producer economy and a consumer economy. Trade deficit determines and heavily impacts exchange rates, since it is itself directly related to trading.

- Growth Domestic Product (GDP): last but not least is the growth domestic product. GDP is universally agreed upon to be the single most important economic index for the strength of any economy. GDP measures the amount of production for all goods and services in any country and economy. Paying attention to such factors as GDP is of course only for the highly professional forex traders. Especially in light of the fact that foreign currencies are directly and indirectly tied to the country of their origin and the economic performance of that country can also directly and indirectly impact that fiat currency. The way it ties to gold trading in forex has to do with the fact that gold is denominated by a fiat currency to form a trading pair for gold in forex.

Conclusion

Let’s face it, if you want to pick forex trading as your main profession and become a professional trader, or day trader as they are often called, of even if you want to pick forex trading as a side hustle to bring in more money, you need to be realistic. What does realism mean in forex trading? It means as much as you may want to, you just cannot trade all the time. It would be really nice, sure, but it just isn’t feasible.

Especially when it comes to trading the precious metal gold in forex markets. The reason it is specifically vital to pick the right trading regimen time-wise to trade gold in FX markets, has to do with the fact that gold usually pays off in the long run, since it is highly unlikely for it to experience sudden and extreme price swings.

Therefore, it must be a significant part of your trading strategy to pick the best time for trading. Think about it. If you have only a certain amount of time for trading in forex, might as well make it the best and most profitable hours.

When it comes to trading gold in forex, a general rule of thumb is to regard the working hours of the busiest markets as the most suitable times for trading. Ordinarily, these would be the operating hours for the London and New York markets. Even better, as a trader you can go for the overlap between these two markets to benefit from the combined trading volume of the two.

Furthermore, the best time of the week for trading in forex is the middle of the week. So opt for the middle of the week and the overlap of London and New York FX markets. That gives you the best chances of benefiting from trading gold. This is because this peak would yield the absolute highest pip ranges that could go above 70 at times.