If you have ever used MetaTrader 5 (MT5) for forex or stocks, you have probably asked yourself whether you can trade Bitcoin and Ethereum on the same platform. The answer is yes. Cryptocurrency trading has become a standard feature on MT5, and many traders now prefer it over traditional crypto exchanges.

Crypto Trading Is Available on MT5

Most established forex brokers now offer cryptocurrency CFDs (Contracts for Difference) on MT5. With CFDs you do not own the actual coins or need a wallet. You simply trade the price movement of Bitcoin, Ethereum, or other cryptocurrencies against the US dollar. You can go long or short, use leverage, and close positions at any time, exactly as you would with currency pairs or commodities.

Common cryptocurrency pairs include:

- BTC/USD

- ETH/USD

- LTC/USD

- XRP/USD

- Increasingly SOL/USD, ADA/USD, BNB/USD, DOGE/USD and others

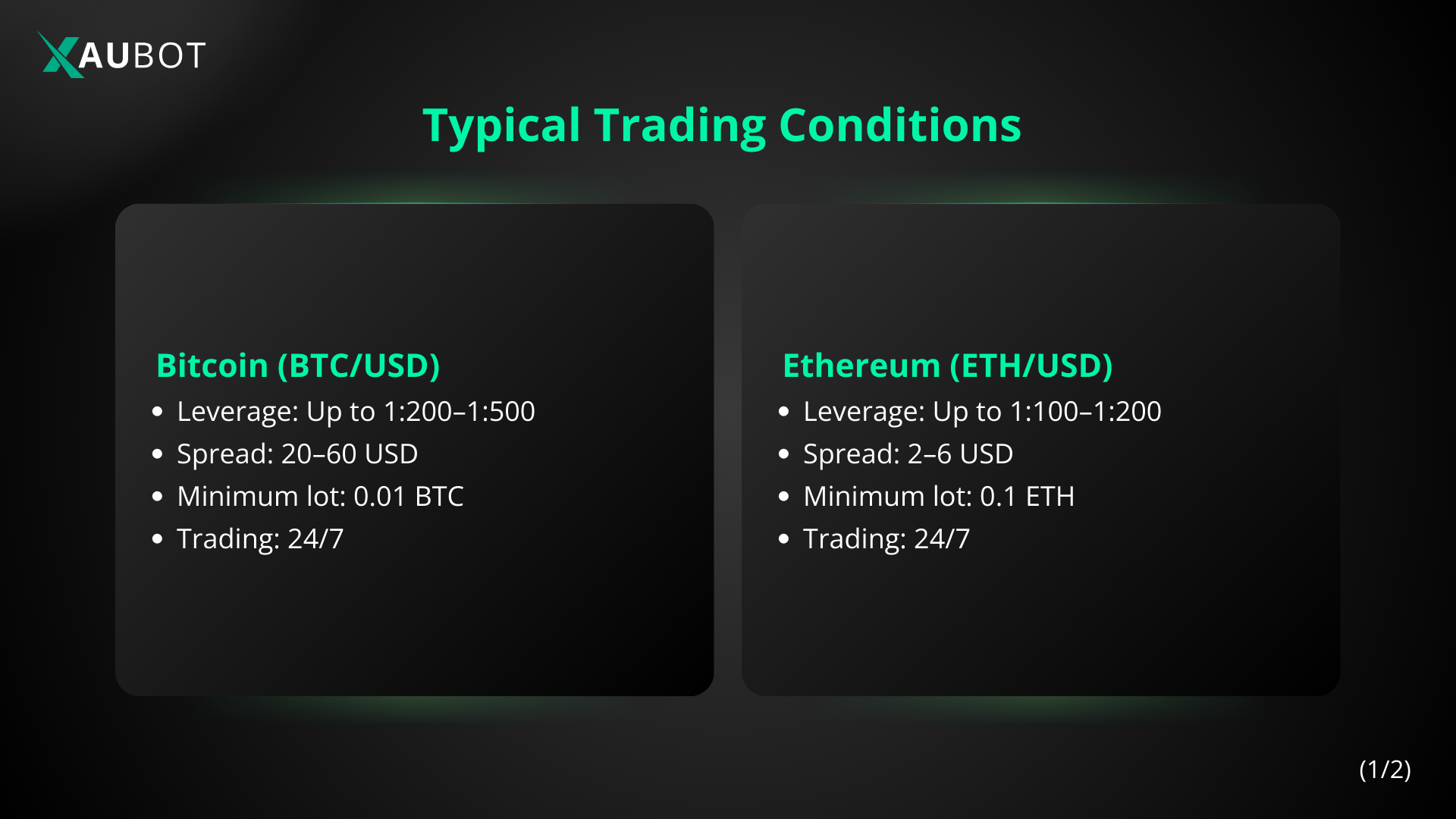

Typical 2025 conditions at competitive brokers:

- Bitcoin (BTC/USD): leverage up to 1:200–1:500, average spread 20–60 USD, minimum lot 0.01 BTC

- Ethereum (ETH/USD): leverage up to 1:100–1:200, average spread 2–6 USD, minimum lot 0.1 ETH

- Both trade 24 hours a day, 7 days a week

Typical trading conditions you will see at good brokers (examples as of 2025):

- Bitcoin (BTC/USD): leverage up to 1:200 at many brokers, average spread 20-60 USD, minimum lot 0.01 BTC

- Ethereum (ETH/USD): leverage up to 1:100 or 1:200, average spread 2-6 USD, minimum lot 0.1 ETH

- 24/7 trading, including weekends (unlike stocks or indices)

A Quick Look at Bitcoin and Ethereum on MT5

Bitcoin (BTC/USD)

- First appeared on MT5: late 2017 (a handful of brokers added it when Bitcoin hit $20,000)

- By 2018–2019 most major brokers had it

- Still the most liquid and most heavily traded crypto CFD

- Highest trading volume on weekends when traditional markets are closed

- Tends to have the tightest spreads among cryptocurrencies

- Larger tick size ($1 per coin move) means bigger dollar swings per pip

Ethereum (ETH/USD)

- First added by brokers: early to mid-2018

- Gained real popularity after the 2020–2021 DeFi and NFT boom

- Slightly wider spreads than Bitcoin but much lower dollar cost per point move

- Lower margin requirements per position because the coin price is smaller

- Often shows stronger correlation with altcoins and DeFi tokens than Bitcoin does

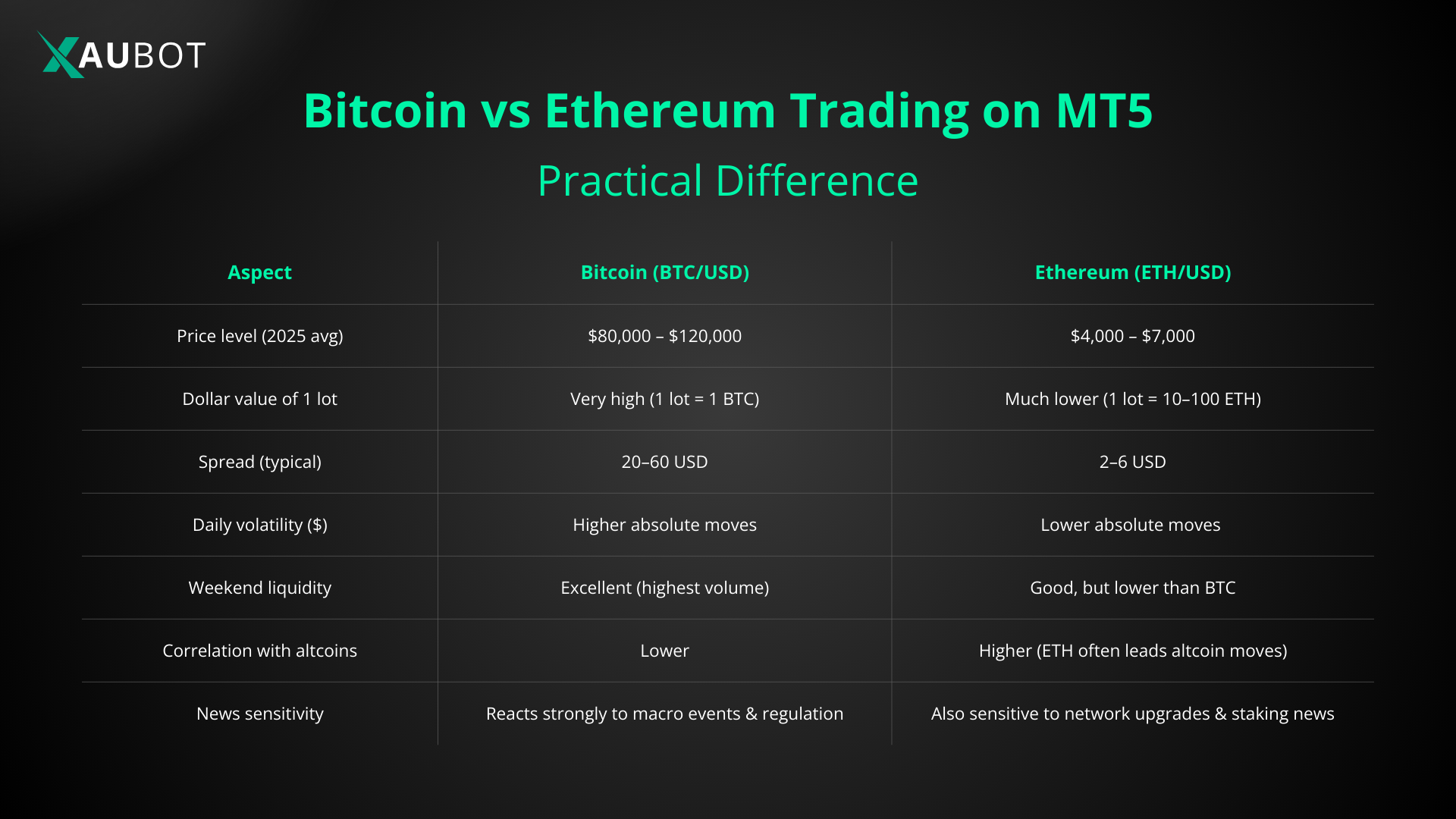

Bitcoin vs Ethereum Trading on MT5 – Practical Differences

Because of these differences many traders treat them differently:

- Bitcoin is often used as the “crypto gold” which means it has larger positions and longer swings.

- Ethereum is favored by shorter-term and altcoin traders because smaller dollar moves make scalping and tight stops easier.

Why Many Traders Prefer MT5 for Bitcoin and Ethereum

1. Familiar Platform

Traders who already use MT5 for forex or indices do not need to learn a new interface. The charts, indicators, and order system remain the same.

2. Superior Charting and Analysis Tools

MT5 still offers more timeframes (21 in total), better drawing tools, depth-of-market information, and full support for custom indicators and scripts than most exchange platforms.

3. Higher Leverage

While crypto exchanges typically limit leverage to 3-20x, many MT5 brokers provide 1:50, 1:100, 1:200 or even higher on BTC and ETH.

4. No Wallet or Withdrawal Concerns

Funds stay inside your brokerage account. There are no seed phrases, no exchange hacks, and no multi-day withdrawal delays.

5. Regulated Environment

When you choose a properly regulated broker (FCA, CySEC, ASIC, etc.), you gain a level of investor protection that many crypto exchanges cannot match.

6. Excellent Support for Automated Trading

MT5 was designed for Expert Advisors from the start. Traders routinely run and backtest cryptocurrency strategies with years of tick data.

7. Reliable Order Execution

Stop losses and take profits generally execute with far less slippage than on many centralized exchanges during volatile periods.

Important Limitations to Consider

Trading crypto on MT5 has clear drawbacks:

- You never own the actual Bitcoin or Ethereum. You cannot send coins to a wallet, stake ETH, or use them on the Blockchain.

- Overnight swap fees apply (sometimes $10-$50 per night for a standard BTC position).

- High leverage can lead to rapid and total loss of capital if the market moves against you.

- Spreads can widen significantly on weekends or during extreme news events.

- Not all brokers offer competitive crypto conditions; some have very wide spreads or high commissions.

- Profits are treated as regular trading income in most countries (tax rules differ from holding actual crypto).

Final Thoughts

For active trading, swing trading, scalping, or running automated strategies, MetaTrader 5 is one of the most powerful and widely used platforms for both Bitcoin and Ethereum. The combination of professional charting tools, high leverage, reliable execution, and a regulated environment continues to attract thousands of traders who treat crypto as just another market to analyze and trade.

Traders focused on long-term holding, staking rewards, or Blockchain participation will still need direct ownership through wallets and exchanges. For everyone else engaged in price speculation and technical analysis, trying a demo account with a reputable MT5 broker remains a sensible and often eye-opening next step.