There are many different strategies for trading in the forex market. These different strategies have varying degrees of risk exposure for the assets and also varying degrees of required skills and technique on the part of the trader. You can choose the best strategy for your condition based on various factors, such as your risk tolerance, initial equity, and also your trading skills.

One such strategy is known as Martingale strategy. It has been originally taken from the world of betting and wagering, but we will go into the history and background of this strategy soon. In this article, we want to take a look at the Martingale trading strategy and its use in the forex market. We will also discuss its pros and cons in the foreign exchange market.

You should read: The Concept of Market Sentiment and Its Importance in the Forex Market

Where Does the Martingale Trading Strategy Come from?

The Martingale strategy has its origin in the world of betting and wagering. According to this betting system, gamblers would double down their hand every time they lost. This would be in the hope that they would finally encounter a winning hand, and since they had doubled down, the winnings would be more than what they had already lost.

As you can see, this form of gambling is highly risky. But high risk could potentially mean high rewards. That is, of course, if everything works in your favor.

And it certainly does work sometimes. This is exactly why the Martingale strategy was taken and in a way adapted in the world of trading and investment.

The way the Martingale strategy works in the financial markets depends on the particular market in which it is being used.

But the idea behind it is actually quite straightforward. You would double down, whatever that means, in the market in which you are trading. This “doubling down” has different meanings of course. Let’s see what it means in the forex market.

You should read: Investment traps in the financial markets that you should watch out for!

How Does Martingale Function in Forex?

So we discussed the background of the Martingale strategy. Now let’s see how it works in the forex market. As you know in the forex market we open positions in order to execute our trades. Now these positions can be either long or short positions, given the market condition and the trajectory we want to go with. But long or short are beside the point here. What is important is the position that you open in the forex market.

Each position has a size in the forex market. Position size is basically the amount of money or the amount of asset that is claimed as part of the position. There are various methods to calculate this size. In fact, this is where position sizing comes. position sizing is a hugely important and serious technique in the forex market, which as the name suggests, seeks to calculate the best size for each position.

In this regard, we can even say that the Martingale strategy is a position sizing strategy. Because, as we will see, it basically tells traders what the size of each position should be.

As we discussed in the case of gambling, the gambler would double down his hand after a loss. Naturally in the forex market, the Martingale strategy dictates that the size of the position be doubled after each loss.

So for example, imagine we have a position with a 1 to 1 risk to reward ratio. This means you can win exactly the same as your position size or lose the same as your position size.

If you open this position with $100 with the Martingale strategy you can:

- Win the first position and profit $100

- Lose the first position and lose $100, but open the second position with $200 and win $200 which is a profit of $100

- Lose the first and the second positions and lose $200, but open the third hand with $400 and win the position to profit $400, which is a profit of $200.

As you can see with the Martingale strategy you double the size of the position every time you lose the position. This is clearly a very high risk trading strategy. But at the same time, the Martingale strategy can guarantee that you will eventually profit if you know how to place the right order. This is because no matter how many positions you lose, when you eventually win, it will cover all the losses and it will also give you profits, just like the example we provided above.

No matter how many positions you lose, when you eventually win, it will be a profit overall.

But another point that you need to keep in mind, other than the high risk associated with this trading strategy, is the fact that it requires a high initial equity. But let’s discuss these in the pros and cons section.

You should read: What is pride in investing and how does it cause you to fail?

The Advantages and Disadvantages of the Martingale Trading Strategy

There are clear pros and cons when it comes to the Martingale strategy. So let’s go over the pros and cons of this trading strategy in the forex market.

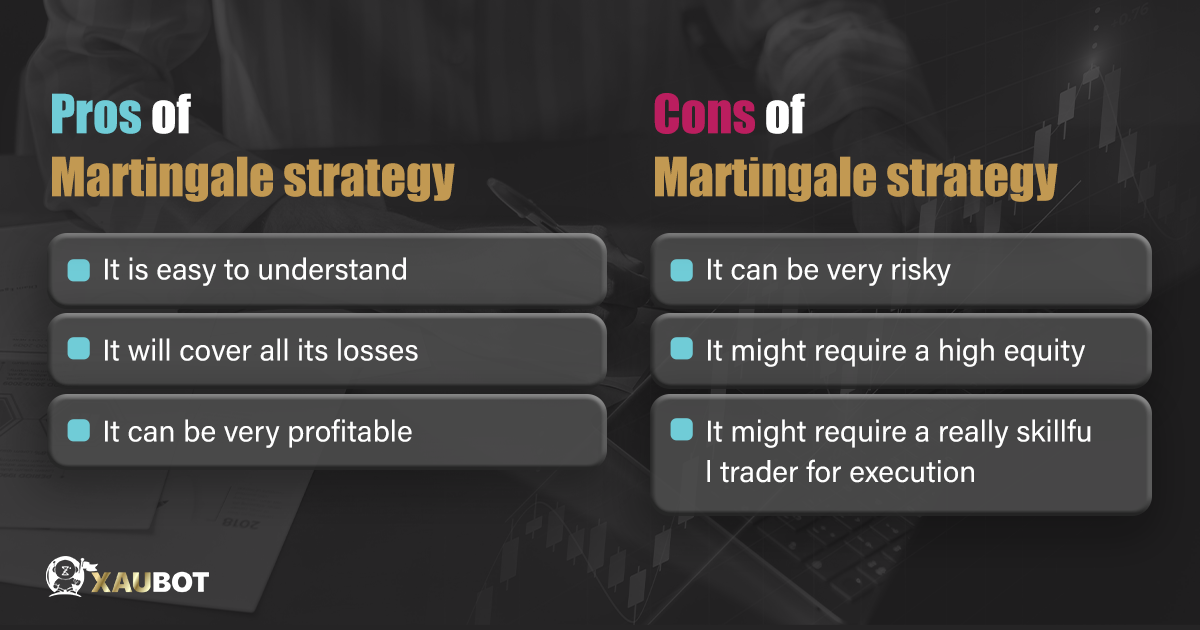

Pros of Martingale strategy:

- Easy to understand: it really doesn’t take a genius trader to understand the idea behind the Martingale strategy. You can easily understand how it works and how it can be profitable in the end. So this is a strategy that can be implemented by almost all traders.

- Could cover all losses: the special feature of the Martingale strategy is that it can cover all the losses in the end – provided that you eventually win.

- Can be quite beneficial: when and if you do win in the end, the profits can be quite surmountable compared to all the losses that you had to sustain to get there.

Cons of Martingale strategy:

- Can be very risky: risk is a concept that goes hand in hand with the Martingale strategy. We really don’t want to explain just how risky the Martingale strategy can be if you don’t eventually win!

- Might require a high equity: because you need to keep doubling your position size, it might require a high equity on your part.

- Might require a really skillful trader: depending on how you want to execute the Martingale strategy, it might require you to be a very skillful and experienced trader – especially if you are a manual trader.

You should read: What Is Panic Sell in Forex Trading?

Conclusion

The Martingale strategy is a rather conventional gambling method that has passed the test of time by many gamblers. That is why it has been adapted into almost all financial markets, including the forex market. In this article we discussed the Martingale strategy in the forex market, how it works, and also its advantages and disadvantages.