Using trading bots for automated trading in the financial markets has changed trading forever. It is an undeniable fact that a vast majority of all trades in this market are executed with the help of automated trading systems.

The better thing is that recently we are witnessing a democratization in automated bots. What is democracy with bots? The ability for each and every user to build and develop their very own bot. This way every trader has a voice in this domain.

In this article we are going to show you how you can build and use expert advisors or bots. The information we will present to you will most likely apply to general platforms around, but we will mainly focus on the XAUBOT Bot generator platform to show you the steps.

What Is an EA or Bot in Trading?

An expert advisor or bot is the automated trading software that is installed on the trading platform MetaTrader either 4 or 5.

Using trading bots can help you automate the trading process and therefore enjoy the many benefits that are seen in automated trading. These include the lack of emotional decision making, enhanced speed of accuracy of execution, enhanced risk management, nonstop trading, and hopefully consistent results over a long period of time.

The reason we said “hopefully” is because obtaining consistent profitability with a trading bot depends on the configuration of the bot.

And since in this article we are going to show you how to build and use trading bots, then it means consistent profitability will directly be related to how well you configure and build your trading bot according to your needs and conditions.

Guide to Building Your Trading Bots for Automated Trading

Alright let’s get down to business. Before we begin with the actual steps, we should make something clear. The focus of the guide ahead is going to be the XAUBOT Bot Generator. But at the same time, keep in mind that we hope to give you a general look into how Bot generators and builders work and what steps you need to go through in order to build your very own bot.

Creating a bot involves different steps, which according to the platform that you use might be different, but in general it includes choosing the right market, defining trading logic, setting entry conditions, managing risk, and adjusting the bot you just built with filters.

Now we will go through these steps one by one and see how you need to choose the options that you have at every step.

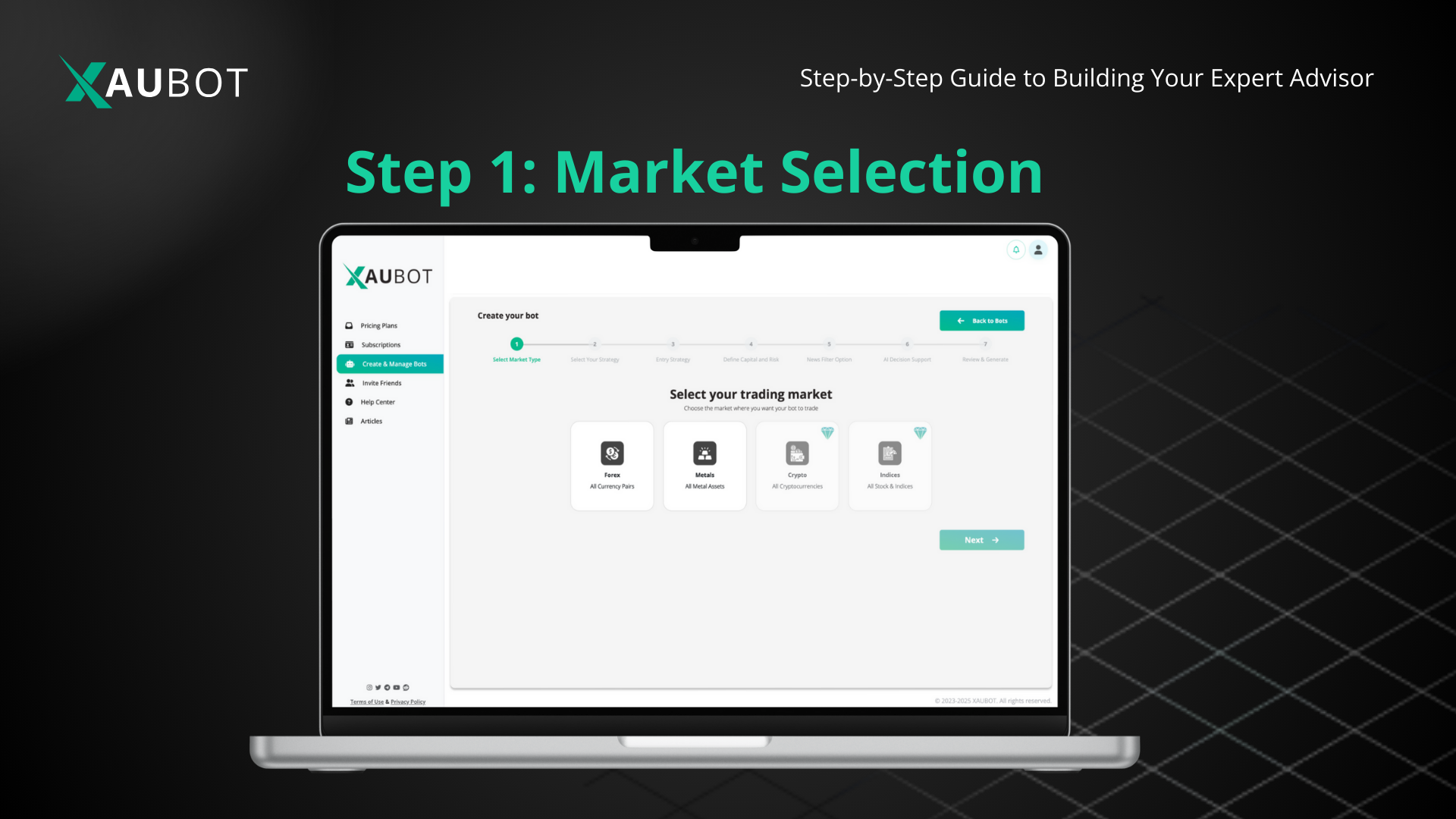

Step 1: Market Selection

The very first decision that you need to make is to choose the financial market for which you want to develop a bot. Different platforms might offer bot builders for different markets. In the case of XAUBOT, you will have the following options to choose from;

- Forex pairs (e.g., EUR/USD, GBP/USD)

- Metals (e.g., Gold, Silver)

- Crypto assets

- Indices and Stock

This is of course the building block of your entire expert advisor or trading bot. Choose the market carefully. Preferably it has to be one that you have enough experience with in the past.

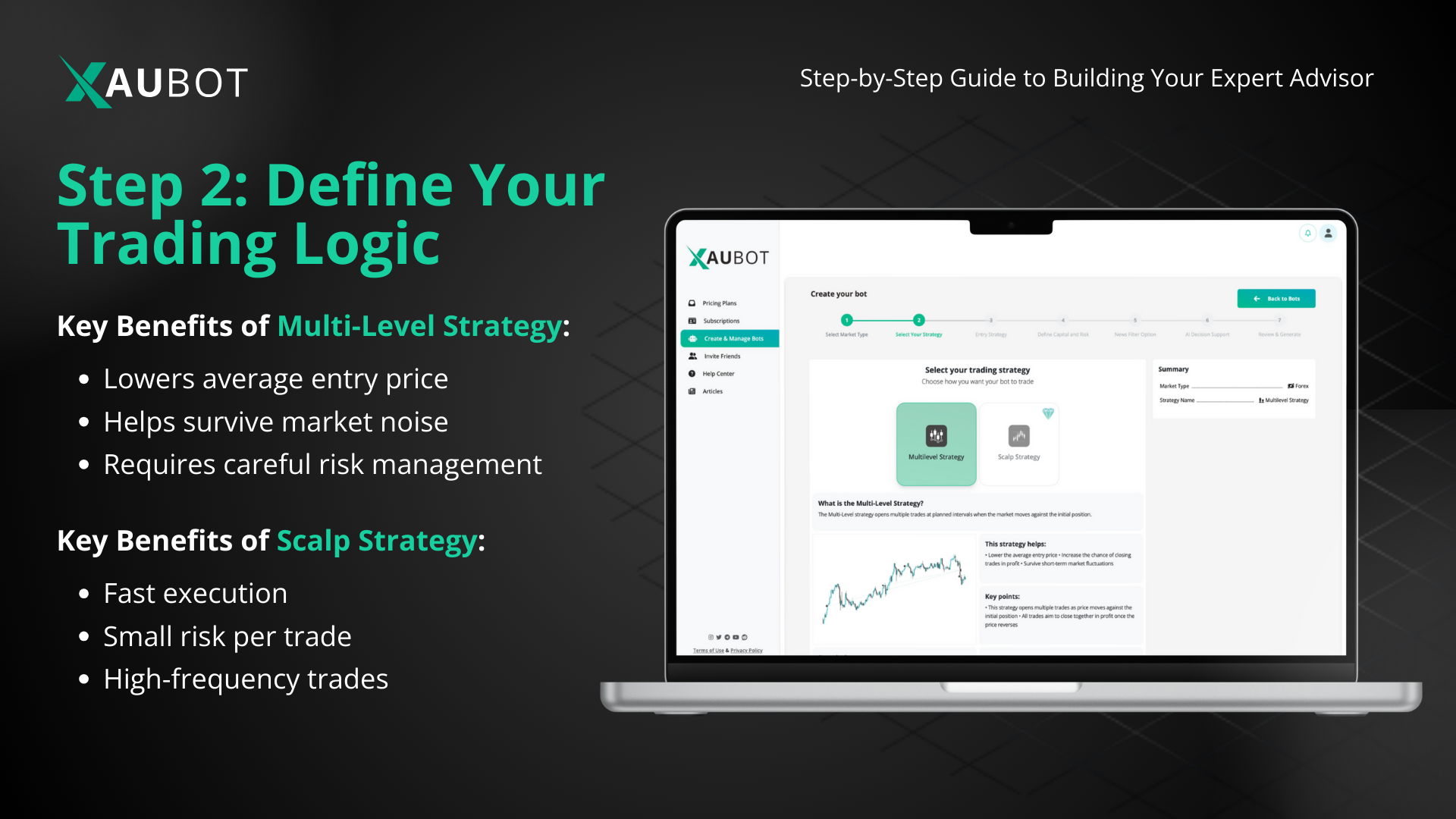

Step 2: Define Your Trading Logic

After you have selected the financial market for your bot, it is time to define the overall approach of your bot. XAUBOT offers two major trading methods which are the multi-level trading strategy and the scalp trading strategy.

Multi-Level Strategy:

This is one of the most proven methods of trading across the financial market. In this approach, the bot will open multiple trades at planned intervals. These would be in increasing order of position size against the first position.

It means if the initial positions end in loss, as the size of positions keep increasing, when coming positions income, they will make up for all the previous loss. It is also likely to turn the tide on a number of trades in the multi-level approach and yield a bunch of returns.

One of the best uses for the multi-level trading strategy is prop trading and passing prop challenges.

Key Benefits:

- Lowers average entry price

- Helps survive market noise

- Requires careful risk management

Scalp Strategy:

This is perhaps the most well-known trading strategy in any market. Scalping is a form of fast paced and high frequency trade execution strategy in which the aim is to accumulate small returns for a bigger aim.

Key Benefits:

- Fast execution

- Small risk per trade

- High-frequency trades

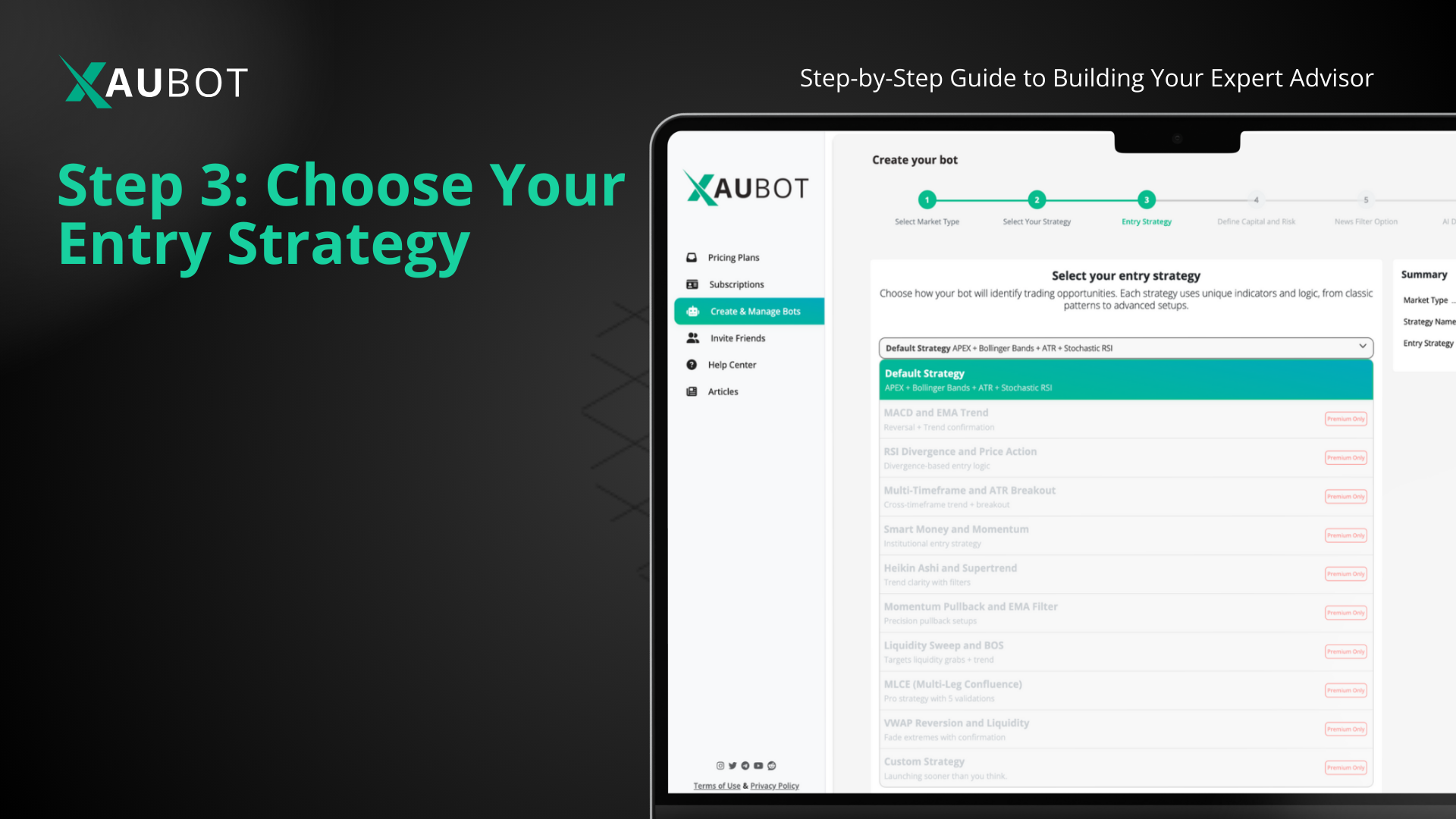

Step 3: Choose Your Entry Strategy

One of the most defining features of any trading bot is the strategy used to open positions or enter into one. This is clearly very important because the first step defines the final outcome of every trade. XAUBOT offers multiple entry strategies to choose from. The top 10 strategies are:

Deafult Strategy – XAUBOT:

This is the default and the most default strategy for entry on XAUBOT Bot Generator. The way this strategy works is that it uses a combination of RSI, Bollinger Bands, and Stochastic Oscillator indicators to detect high-probability reversal points.

XAUBOT entry strategy can be the ideal choice for most traders as it fits most trading strategies as well. But XAUBOT also has considered many other options to give traders the freedom of choice in order to build their custom bot exactly according to their needs.

Other Notable Entry Strategies:

- MACD + EMA Trend: Combines momentum reversal (MACD) and trend confirmation (EMA crossover).

- RSI Divergence + Price Action: Detects early reversals via RSI divergence, confirmed by price action.

- Multi-Timeframe + ATR Breakout: Aligns multiple timeframes and volatility breakout confirmation.

- Smart Money + Momentum: Institutional-level logic tracking liquidity zones and momentum.

- Heikin Ashi + Supertrend: Trend detection and confirmation via smoothing indicators.

- Momentum Pullback + EMA Filter: Trades pullbacks within trends.

- Liquidity Sweep + Break of Structure: Spot stop hunts and market structure shifts.

- Multi-Leg Confluence Engine (MLCE): Uses multiple layers of validation for high precision.

- VWAP Reversion + Trend Filter: Trades mean reversion near volume-weighted average price extremes.

Step 4: Configuration and Risk Management

This is an extremely important step. This is where you should very clearly define a money management regimen. Here you will define how much capital you have for trading, how much you are willing to risk, and of course how much you are hoping to income with your bot.

Make sure to pay the utmost attention to this step, because otherwise you will not be able to get consistent results.

Here we need to diverge into two paths, given the main trading strategy that you had already chosen earlier.

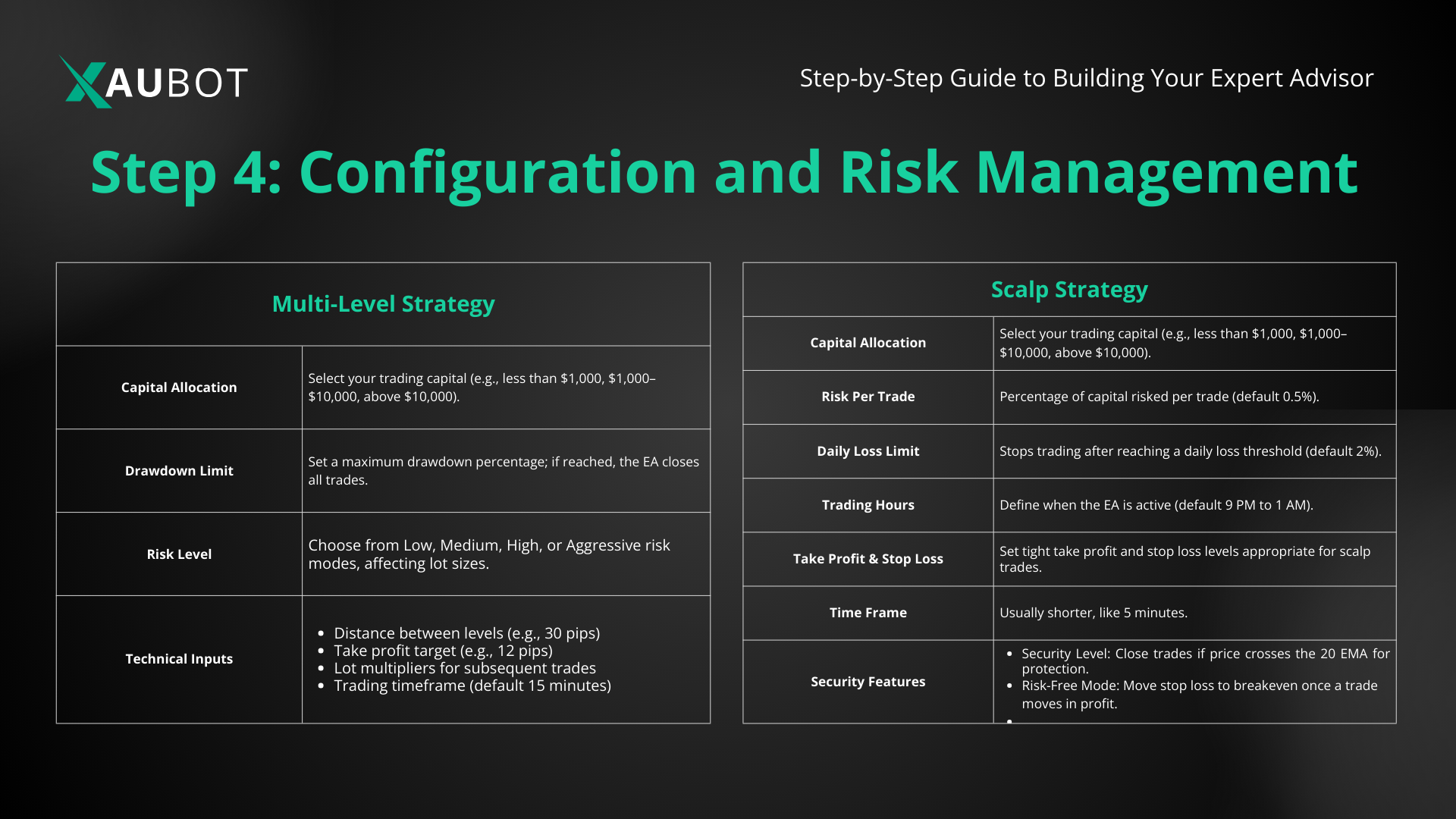

For the Multi-Level Strategy, the main capital and risk management inputs include:

- Capital Allocation: Select your trading capital (e.g., less than $1,000, $1,000–$10,000, above $10,000).

- Drawdown Limit: Set a maximum drawdown percentage; if reached, the bot closes all trades.

- Risk Level: Choose from Low, Medium, High, or Aggressive risk modes, affecting lot sizes.

- Technical Inputs:

- Distance between levels (e.g., 30 pips)

- Take profit target (e.g., 12 pips)

- Lot multipliers for subsequent trades

- Trading timeframe

For the Scalp Strategy, these options are as follows:

- Capital Allocation (same as above).

- Risk Per Trade: Percentage of capital risked per trade (default 0.5%).

- Daily Loss Limit: Stops trading after reaching a daily loss threshold (default 2%).

- Trading Hours: Define when the EA is active (default 9 PM to 1 AM).

- Take Profit & Stop Loss: Set tight take profit and stop loss levels appropriate for scalp trades.

- Time Frame: Usually shorter, like 5 minutes.

- Security Features:

- Security Level: Close trades if price crosses the 20 EMA for protection.

- Risk-Free Mode: Move stop loss to breakeven once a trade moves in profit.

This step is perhaps the most important configuration that you need to do while you are building your trading boy. Remember, this step is directly related to your capital and risk levels. Even the smallest mistake can lead to loss or less than ideal returns.

Step 5: News Filter

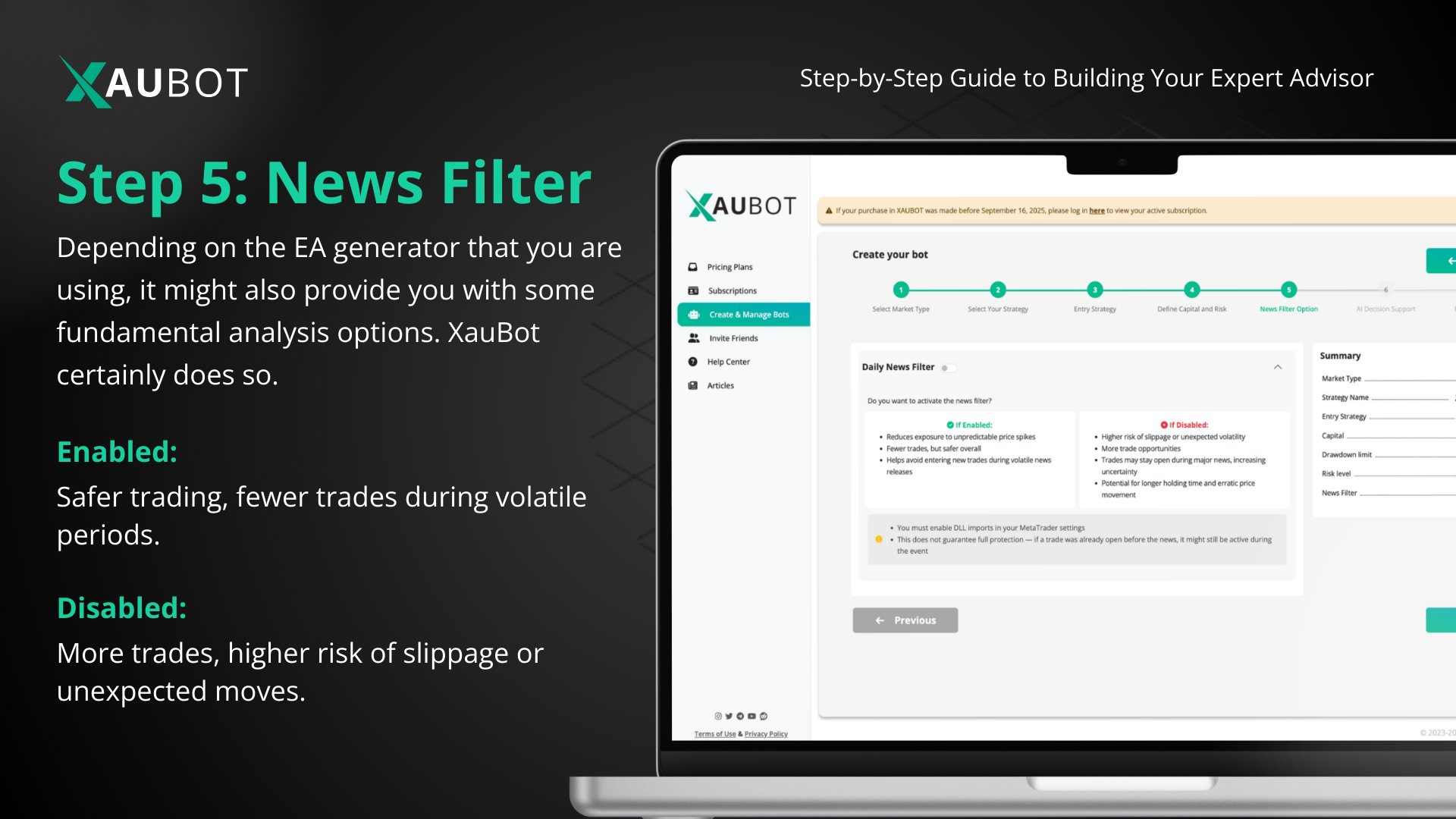

Depending on the bot generator that you are using, it might also provide you with some fundamental analysis options. XAUBOT certainly does so.

We offers fundamental analysis through the news filter. At this stage you can choose to activate the news filter or not. If activated it will stop the bot from trading during important and high impact news events that can increase risk and unpredictability of the market.

- Enabled: Safer trading, fewer trades during volatile periods.

- Disabled: More trades, higher risk of slippage or unexpected moves.

Step 6: AI Decision Tool

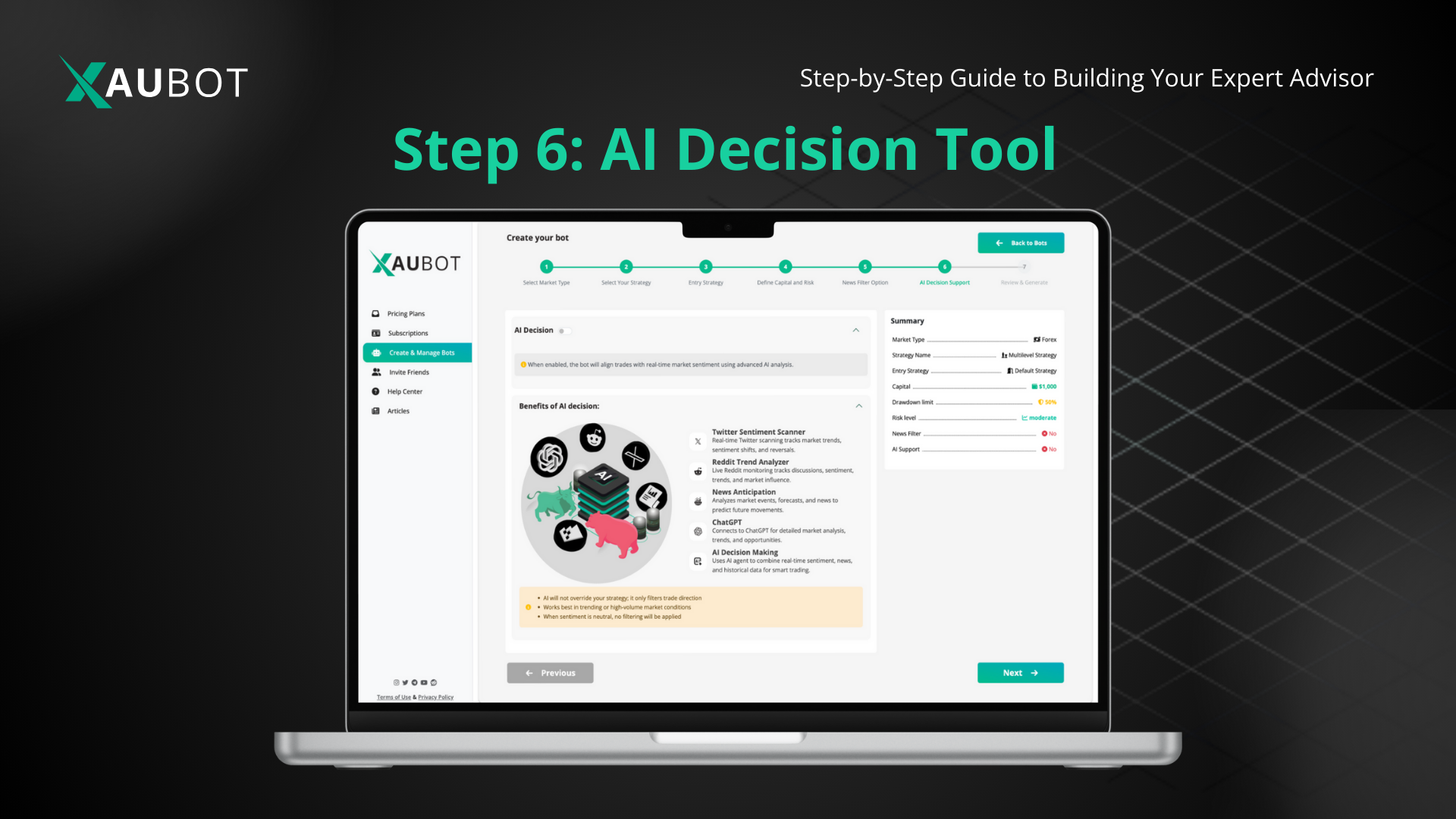

This last step is a specialty of XAUBOT. This is the newest feature of our platform. In this step you can choose to activate a tool known as the AI Decision Tool.

The AI Decision Tool of XAUBOT has four main phases.

- It offers sentiment analysis by automatically scanning and analyzing social media platforms such as Twitter (X) and Reddit. Then it can tell you in real time whether social media users feel positive or negative about a certain financial asset.

- Fundamental analysis through real time scanning of news websites that are important to the market that you have chosen for your bot. And then analyzing those data to see whether fundamental analysis says buy or sell for that asset.

- Artificial intelligence insight through direct information from ChatGPT. It simply asks about the financial asset from this AI model to see what it says about it.

- And finally, according to all the information above, it will provide you with a final verdict on the financial asset and whether you should buy or sell.

Read more about AI Descision Tool

Conclusion

In this article we took a look at how you can build and develop your very own trading bot with special focus on the XAUBOT Bot Generator platform which is of course also applicable with other platforms. Because by and large, the steps toward making an expert advisor or trading bots are similar. Of course each platform has its own special features, like the news filter or the AI Decision Tool that XAUBOT offers.

Be sure to pay the most careful attention while you are developing your trading bot, as the entire profitability depends on how you configure it according to your trading capital and trading aims.