To get started in the Forex market, you first need to have a trading account or an account with a Forex broker. In any case, these forex accounts form the basis of what you can do in the Forex market. There are some basic account types that differ from one another. And then there are even more account types that are offered by Forex brokers.

The different account types that are offered by forex brokers are part of the features that they offer their users and it obviously varies from broker to the other. This is something very much like a varied selection when you are buying. But the fundamental account types are crucial and you must know about them to pick the right one.

And there are specific factors that divide these fundamental account types in Forex, such as your initial equity and the size of your positions. In any case, in this article we will go through all of them to check all the different types of forex accounts.

| There are different account types in forex

Some are offered by brokers as their different account types But there are also fundamental account types These fundamental account types form the basis of all trading activities Such forex account types are divided based on different factors such as initial equity and the size of positions In this article we will cover all fundamental forex account types |

You should read: What Is the Difference between Trader and Analyst?

Forex Accounts Based on the Lot Size

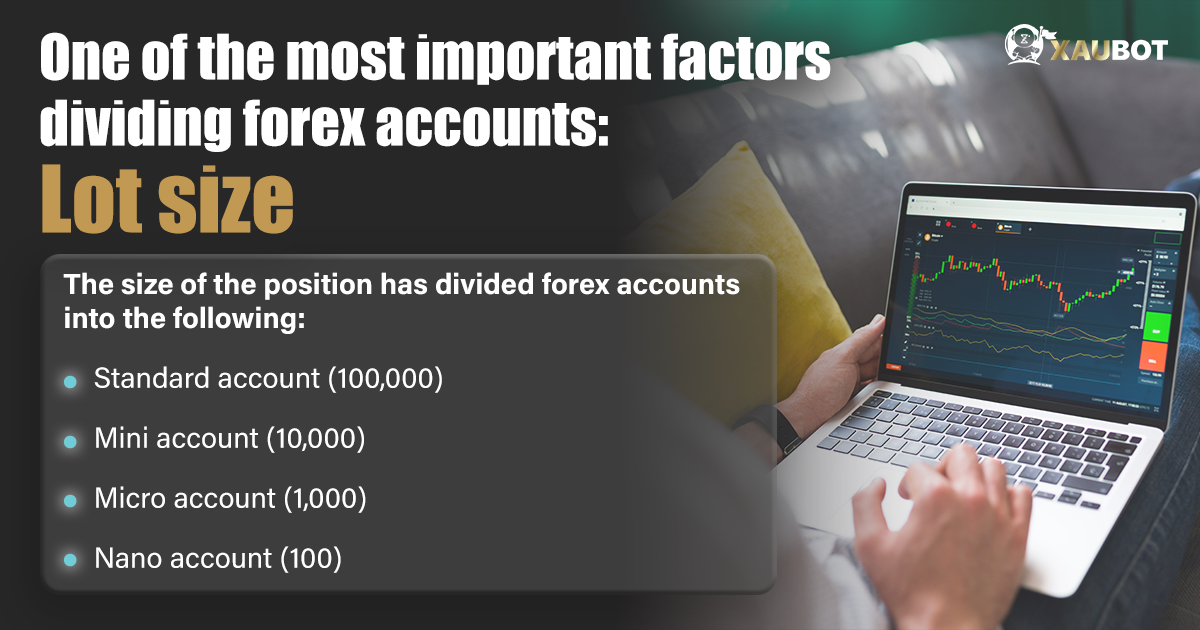

As we briefly mentioned, one of the most important factors in dividing main forex account types is the lot size of those accounts. In simple terms, lot size refers to the size of each position that can be opened with that account type.

For instance we have a standard account type in forex that states the number 100,000 as its lot size, which is also known as a standard lot size in forex. This number is the number of units of base currency whenever you want to open a position in the forex market with this lot size.

As you can see it is quite a large size for most traders as they may not have this much equity at their disposal. This is why there are other accounts types similar to the standard account that are divided based on their lot size.

And they are all basically a denomination of the standard forex account type. And it is understandable too, after all it is the standard account type.

Based on this we have 3 other main forex account types based on position size. After the standard account we have the mini account type which has a lot of 10,000 units which means it is ten times smaller than the standard account type.

The other two accounts are similarly ten times smaller than their previous account type. As a result we get the micro and nano account types which offer a lot size of 1,000 and 100 units of base currency respectively.

As we said, each broker also offers its own different types of forex accounts. But differences that relate to the lot size are really important because they are directly related to the trader’s assets and trading capital.

For instance, a nano account will let you begin trading in the forex market with next to nothing. You can even use this account type to build up experience and also confidence and then work your way toward bigger account types in terms of lot size.

You should read: What should we not do after a loss in trading?

Forex Cent Accounts: The Opposite of a Standard Account!

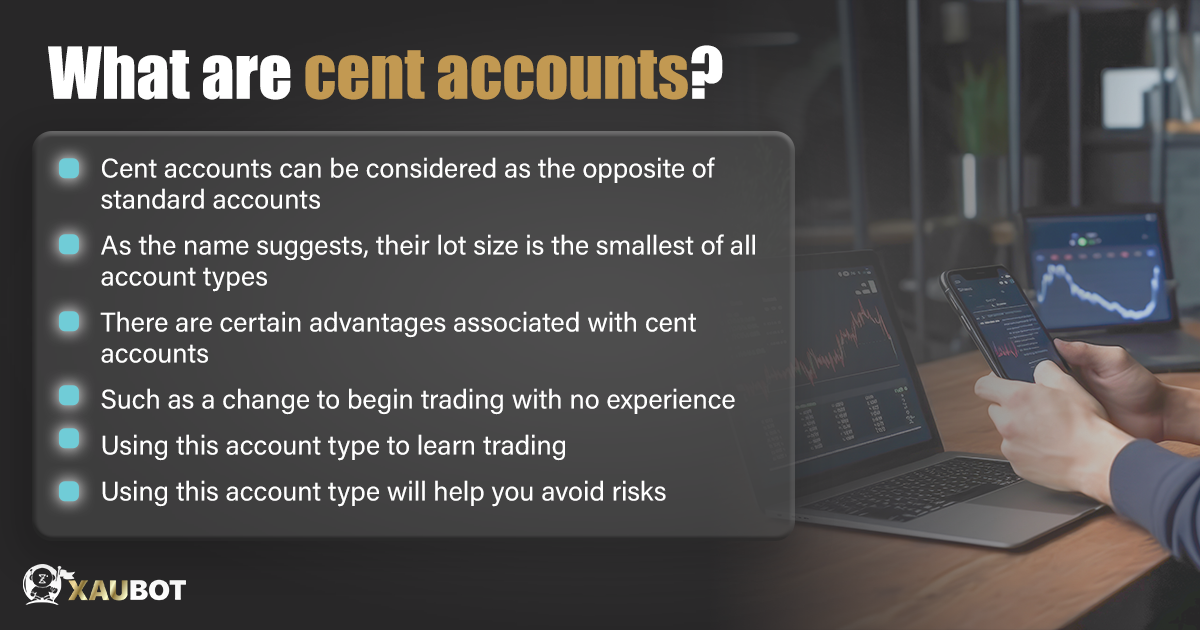

Another type of forex account that is popular is known as a cent account. A cent account as the name suggests has the smallest lot size among all other forex account types.

The name of the account type naturally refers to the smallest denomination of a US dollar. If you divide the US dollar into 100 parts, then each part would be a cent. And that is exactly what you are dealing with in these account types. Instead of large lot sizes that other account types have, such as standard account or even smaller ones like micro, with a cent account you will have the smallest account size in the forex market.

But let’s take a closer look at what cent accounts really are. To understand cent accounts better, you need to look at the concept of one pip. Each pip in the forex market refers to the fourth decimal figure in the quoted price of the currency pair. For instance, if you consider the trading pair made from the British Pound and the US Dollar, which is of course shown as GBP/USD, the quoted price would look like something like this:

1.2650

Any change in the fourth decimal figure is known as one pip. And because this pair is based on the US dollar, then it means that each pip is equal to one cent. And that is exactly how with a cent account you can trade even one pip.

But that is not the point of cent accounts. This was just to show you how they work.

The actual application of a cent account is in the really low level of risk that is associated with it. Because you get the smallest lot size, you also get the lowest risk with cent accounts in forex. As a result, such accounts can be a good way to begin trading if you do not have a lot of experience or trading capital.

You should read: How Does Burnout Occur in a Trader?

You should read: What is meant by account liquidation? Examining the concept of liquidation

Forex Demo Accounts: Not Real But Necessary!

Last but not least, we have forex demo accounts. A demo account, as you can probably guess from its name, will provide traders with a chance to trade in a virtual market and in a controlled environment. This is basically the best way any new traders can enhance their trading skills and increase their experience.

Brokers offer demo accounts to users in order to entice them to sign up with them and after they have learned trading in that controlled environment they can move on to a real account.

Different brokers have different types of demo accounts. Consider the following two factors when you are choosing a demo account:

- The amount of virtual currencies that the broker will provide for you – for instance some brokers give you 10,000 virtual dollars to trade with.

- The latency between the real market and the demo market. Brokers will update the demo market with the information taken from the real market. But you should check to see how long the latency is between the actual market and the time the virtual demo market is updated.

You should read: What is the metaverse? The most comprehensive article about Metaverse virtual worlds

Conclusion

In the forex market we have many different types of accounts. These different account types are divided based on different factors. One of the most important factors that divide these account types is lot size. Of course forex accounts can be divided based on other factors. In this article we discussed all the major types of forex accounts.