Automating gold trading on MT5 is no longer reserved for developers or people who enjoy staring at code until their coffee goes cold. Today, the smartest way to automate gold is to use a flexible bot generation platform that lets you design logic visually, control risk precisely, and export a ready to use EA for MetaTrader 5.

Gold is fast and sometimes dramatic. Your automation setup needs to be calm, logical, and slightly smarter than the average market panic. That is where a structured bot building approach makes all the difference.

Outlook of Gold for 2026

Gold enters 2026 already trading at historically extreme levels after breaking above the 4,000 USD mark in late 2025. This move has fundamentally shifted long term expectations, with gold no longer viewed as a slow moving hedge but as a highly active macro driven market. Most forward looking forecasts now assume elevated prices and sustained volatility throughout 2026.

Key gold predictions for 2026

- Projected price range

Most institutional forecasts expect gold to remain above 4,000 USD per ounce for much of 2026, with a broad working range between 4,000 and 5,000 USD. Short term spikes above 5,000 are considered possible during periods of extreme geopolitical or financial stress. - Bullish macro bias

Central bank accumulation remains one of the strongest structural drivers. Many banks and sovereign institutions continue increasing gold reserves, creating long term demand that supports higher price floors. - Interest rate and currency impact

Expectations of lower or capped global interest rates reduce the opportunity cost of holding gold. A weaker or unstable US dollar further supports elevated gold prices rather than triggering deep corrections. - Persistent volatility

Despite the bullish bias, gold is expected to remain highly volatile. Sharp intraday swings around economic data, central bank decisions, and geopolitical headlines are likely to continue, creating frequent expansion and retracement phases. - Strong institutional participation

Liquidity in gold continues to deepen, with increased algorithmic and institutional trading. This favors systematic strategies that rely on structure, momentum, and volatility rather than discretionary judgment.

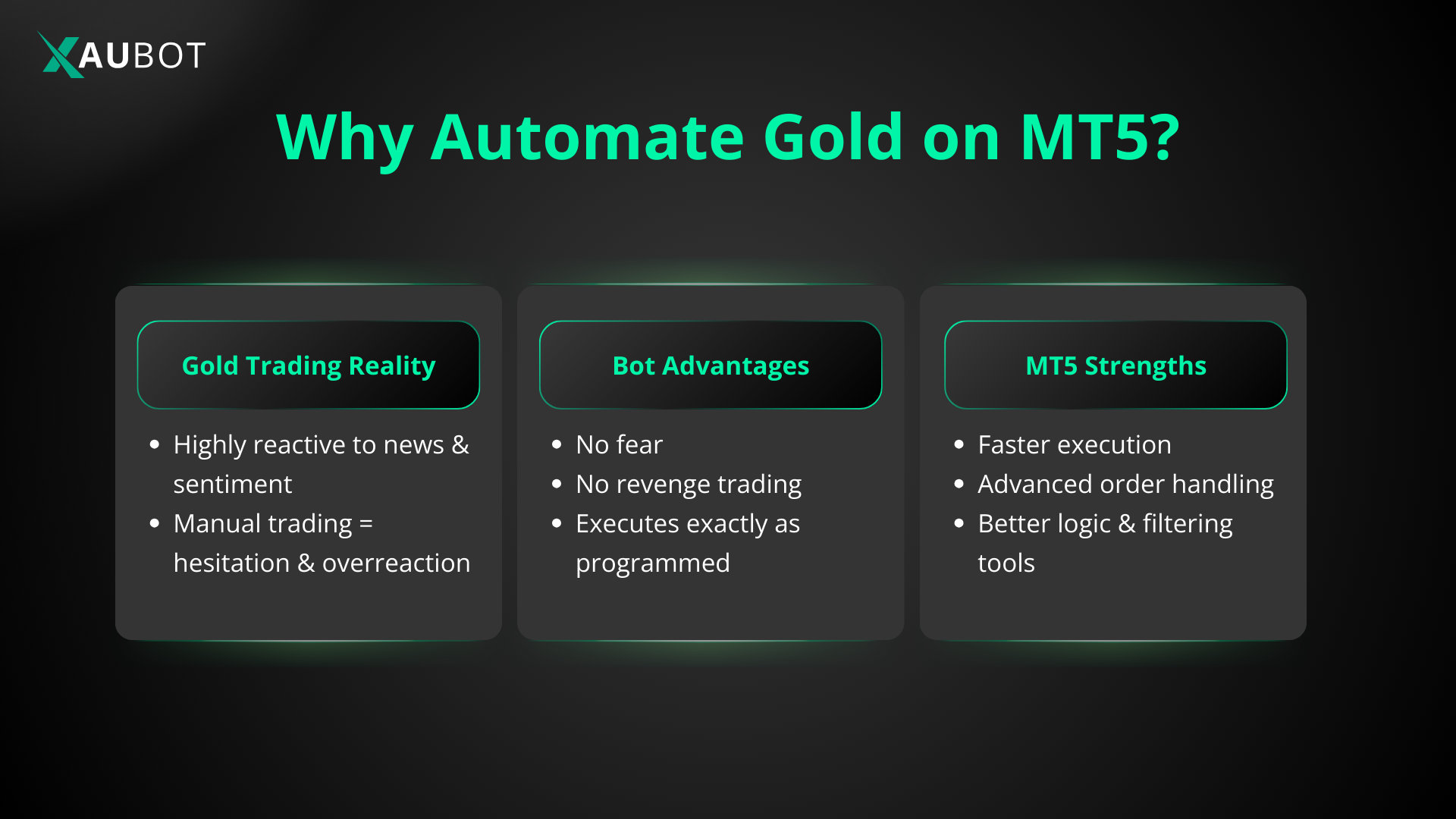

Why Automating Gold on MT5 Makes Sense

Gold is one of the most actively traded markets in the world. It reacts strongly to news, sentiment shifts, and liquidity events. Manual trading often fails because humans hesitate, overreact, or revenge trade. Bots do none of that. They execute exactly what you tell them, no fear, no greed, no staring at the screen hoping the candle feels sorry for you.

MT5 is also ideal for gold automation thanks to faster execution, better order handling, and support for advanced logic and filters.

The Problem with Most Gold Trading Bots

Most traders look for a ready made gold EA, install it, and pray. This usually ends with disappointment because fixed bots cannot adapt to different risk levels, broker conditions, or trading styles. Gold behaves differently across sessions, volatility regimes, and account sizes.

The best automation is not buying a bot. It is building one that matches how you want to trade.

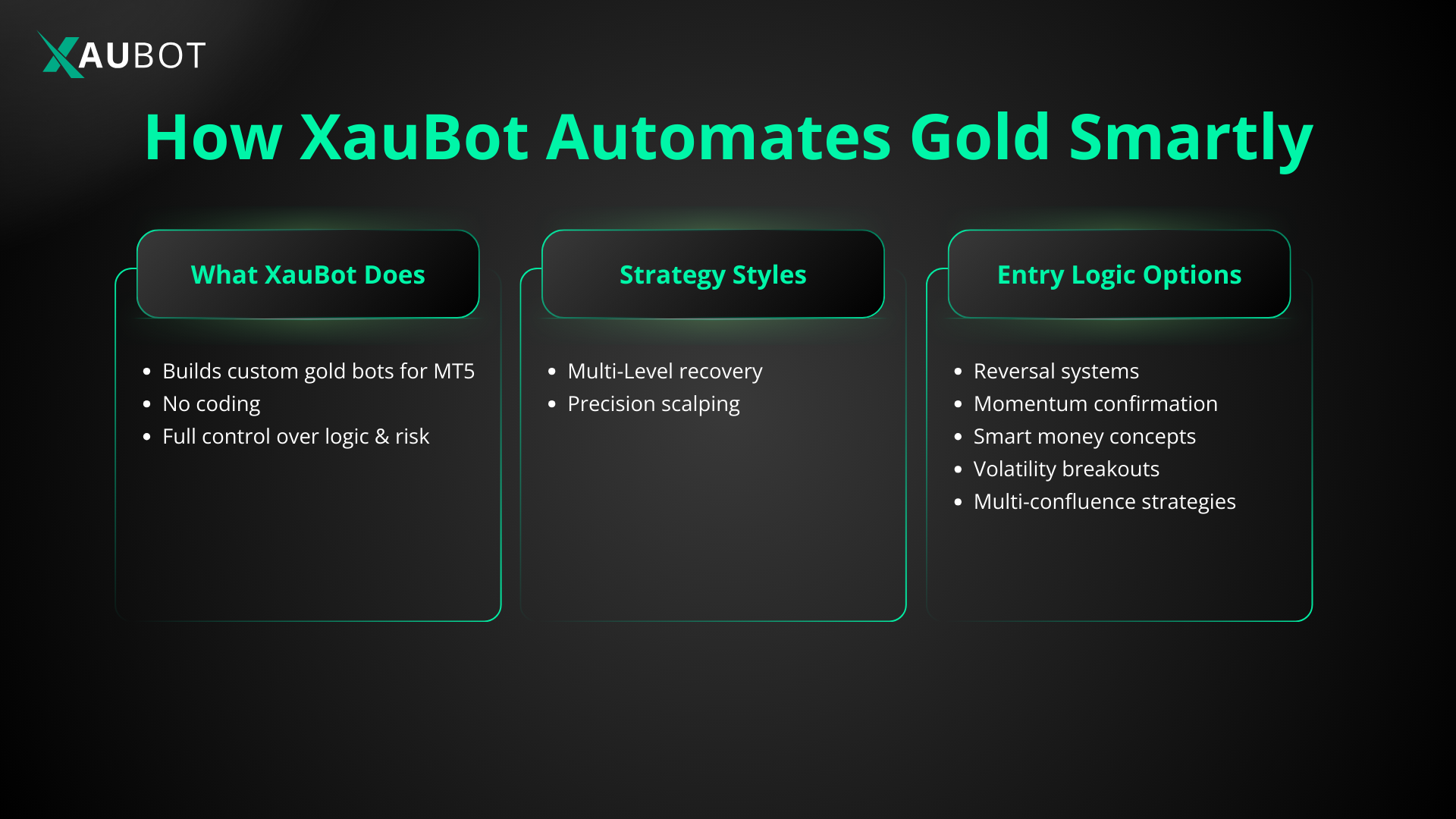

How XauBot Automates Gold the Smart Way

XauBot allows you to generate a custom trading bot specifically tailored for gold trading on MT5, without writing code. Instead of forcing you into one rigid strategy, the platform lets you choose how your bot thinks, enters, manages risk, and exits.

You start by selecting your market and defining how the bot should trade. For gold, this often means choosing between a multi level recovery approach or a precision scalp strategy, depending on whether you prefer patience or speed.

Next comes entry logic. You can build gold bots using reversal based systems, momentum confirmation, smart money concepts, volatility breakouts, or multi layer confluence strategies. Each option is designed to handle real market behavior, not fantasy backtests.

Technical Setup for Automating Gold Inside XauBot

When generating a bot for gold, the first technical decision happens at market selection. Inside XauBot, users should choose the Metals market. This ensures the EA is optimized for gold specific behavior such as higher volatility, wider spreads during news, and sharper intraday moves compared to major currency pairs.

After selecting Metals, the next critical choice is the trading logic. For gold, this decision shapes how the bot survives volatility.

The Multi Level strategy is often preferred for gold when trading reversals or ranges. It allows the bot to place additional entries at predefined distances if price moves against the initial position, lowering the average entry and aiming to close the full basket at a common take profit. This approach requires careful drawdown limits and realistic capital allocation, especially on smaller accounts.

The Scalp strategy is better suited for traders who want fast, controlled trades during specific sessions. Gold responds well to short bursts of momentum, especially during London and New York hours, making scalping effective when paired with strict stop loss and daily loss limits.

Choosing the Right Entry Strategy for Gold

Gold does not reward random entries. Inside XauBot, users can select from multiple entry engines depending on market conditions.

Reversal based systems such as the XauBot strategy or RSI divergence with price action are effective during ranging markets where gold frequently stretches into extremes and snaps back.

Trend aligned systems such as MACD with EMA confirmation or multi timeframe trend with ATR breakout are better during strong directional moves driven by macro sentiment.

Advanced users often favor smart money or liquidity based strategies, which take advantage of stop hunts and structure shifts that are common in gold due to its deep liquidity and institutional participation.

Each entry engine is paired with indicator validation and structure logic, so trades are only triggered when multiple conditions align.

Risk and Configuration Details That Matter for Gold

Gold bots should never be generated without strict configuration rules. XauBot requires users to define capital range, acceptable drawdown, and overall risk level before the EA is created.

For Multi Level setups, parameters such as distance between levels, take profit size, and lot multipliers must be realistic. Aggressive multipliers on gold can escalate exposure very quickly, so conservative settings are usually more sustainable.

For Scalp setups, users should define risk per trade, daily loss limits, trading hours, and precise stop loss and take profit values. Gold spreads and execution speed vary by broker, so these inputs should always be tested on demo first.

Additional protection layers like EMA based security exits and risk free activation can further stabilize performance during sudden volatility spikes.

News and Ai Filtering for Gold Volatility

One of the smartest ways to automate gold is to avoid trading when the market is about to explode for the wrong reasons. XauBot includes an optional news filter to block entries during high impact events.

For traders who want an extra layer of confirmation, AI based sentiment filtering can align trades with broader market direction. It does not replace your strategy. It simply prevents your bot from fighting the crowd when sentiment is clearly one sided.

Exporting to MT5 and Going Live

Once your bot is configured, XauBot exports it directly for MT5. You install it like any other EA and run it on demo or live accounts. Because the logic is yours, you can tweak, test, and improve it instead of guessing what the bot is doing behind the scenes.

Final Thoughts

The best way to automate gold for MT5 is not finding a magical robot. It is building a disciplined system that matches your risk tolerance, trading style, and market understanding.

With XauBot, automation becomes a controlled process instead of a gamble. Gold stays wild. Your trading does not have to.

1 Comment

Va bene queste indicazioni , ma vorrei se possibile avere una lista dei setting per un bot profittevole e dedicato in particolare per xauusd. E possibile avere queste indicazioni ?

Grazie