Expert advisors have come to fully dominate the domain of automated trading in the forex market. This is obviously because of the dominance of the trading platforms MetaTrader 5 and 4 in this market. With this huge dominance, you need to know all the ways that you can access them and the pros and cons of these methods. As it stands, there are two major methods by which you can access expert advisors. There are of course Pre-Built EAs that you can acquire. And then there are custom expert advisors (EAs) which you can build on your own on EA generator platforms.

In this article, we are going to take a look at both of these approaches, talk about their upsides and downsides, and see which method is better for you.

What Are Pre-Built EAs?

For the longest time in the forex market, we have only had ready-made expert advisors. These are of course software or algorithms that have already been designed and developed by a company or platform.

They already have decided on all the elements and have already designed them into the expert advisor. This means you will get a finished product and have to use whatever that they give you.

Of course, it is almost always possible to input certain settings and options and configure the expert advisor to some degree. But naturally there are limitations as to how much you can configure an already developed expert advisor.

Most traders tend to use pre-built expert advisors because everything has already been decided for them, so it’s the easier choice. But there is much more to them. Let’s peek into their ups and downs.

Advantages of Pre-Built EAs

Immediate Availability

First and foremost, ready-made expert advisors are just that, ready! You can simply purchase and begin using them immediately. This is a huge advantage because you can start automated trading right away in the fastest time possible.

Lower Initial Cost

This one really depends on the expert advisor that you are purchasing. But in general we can say that ready-made options are more cost effective than platforms that allow you to develop and build your own expert advisor. And of course cost is an important factor for all traders.

Tested and Backtested

Ready-made expert advisors are of course fully tested and have gone through the process of backtesting by the platform that developed it. This is even more so the case if the platform is more reputable. If you make sure to choose the right platform, then you can make sure that they have performed all the necessary tests on the expert advisor so you will not have to do so.

Community and Support

Don’t also overlook the users who employ the expert advisor. Well-known expert advisors have a community of users around them. This is a huge upside, because this community of users will act like a support group. Since they have been using the same expert advisor as you, you can ask and get help from them for different issues and even get suggestions on how to work better with the expert advisor.

Disadvantages of Pre-Built EAs

Generic Strategies

A potential downside of ready-made expert advisors is that the trading strategy they use is not specifically going to be adapted to your special needs. Such expert advisors use generic trading strategies.

Lack of Flexibility

As we said, a ready-made expert advisor is the finished product. So more often than not, you do not actually get to make changes into it. While it is possible to configure and change the settings that are available, these settings and configs are limited to what the platform will allow you to do.

Risk of Overhyped Claims

There are some EA platforms that invest heavily into advertising. As a result, they might create a serious hype about their product, EA, especially in social media through promising high profits.

But in reality, they will unfortunately not be able to deliver their promised claims. This means you must be much more cautious while picking an expert advisor.

Custom Expert Advisors: Tailored Trading Solutions

What Is a Custom EA?

Now let’s discuss the other option which is a custom expert advisor. What is it? A custom expert advisor, as the name suggests, is a custom built EA that traders can build for themselves on some platforms. These platforms are known as EA Generators and they allow traders to build and design their own expert advisor according to the features that they provide them.

Of course different EA Generator platforms have different capabilities and options. Now we shall look at their pros and cons.

Advantages of Custom EAs

Perfect Strategy Alignment

Obviously, the biggest upside of custom expert advisors is that they are perfectly aligned with your trading needs, trading conditions, and trading aims. You get to build and design them piece by piece and factor by factor to be exactly what you are looking for.

Full Control and Flexibility

Because you are the developer and the coder, so-to-speak, you are also in charge of the product. You are the owner, the developer and the designer. You can make changes whenever you want and adjust the expert advisor later on as your trading conditions and aims change as well.

This means you are not faced with a finished product that cannot be changed or adjusted like ready-made expert advisors.

Integration of Complex Features

There are some features that might be difficult for less experienced traders to use in their trading process. But since the EA generator gives the trader full control, advanced traders can choose to incorporate advanced features as they wish.

Disadvantages of Custom EAs

Higher Upfront Cost

Although this is not a certain case, overall EA generator platforms will cost higher than platforms that just offer you a ready-made option.

Need for Technical Expertise

This will also depend on the EA generator platform that you are using. Some have made sure to make it as easy as possible for the users in terms of the interface and such. But ultimately, you must have a certain degree of technical expertise in order to be able to work with the platform and choose the right options and configurations for your expert advisor.

No Guaranteed Success

This is perhaps shared between ready-made and custom options. But it becomes more significant for custom expert advisors. Because these tools are custom built, traders will expect a higher rate of success from them.

But in actuality the success of a custom expert advisor solely depends on how they are developed and how well you have matched it with your trading conditions and aims.

Conclusion: Which Is Best for You?

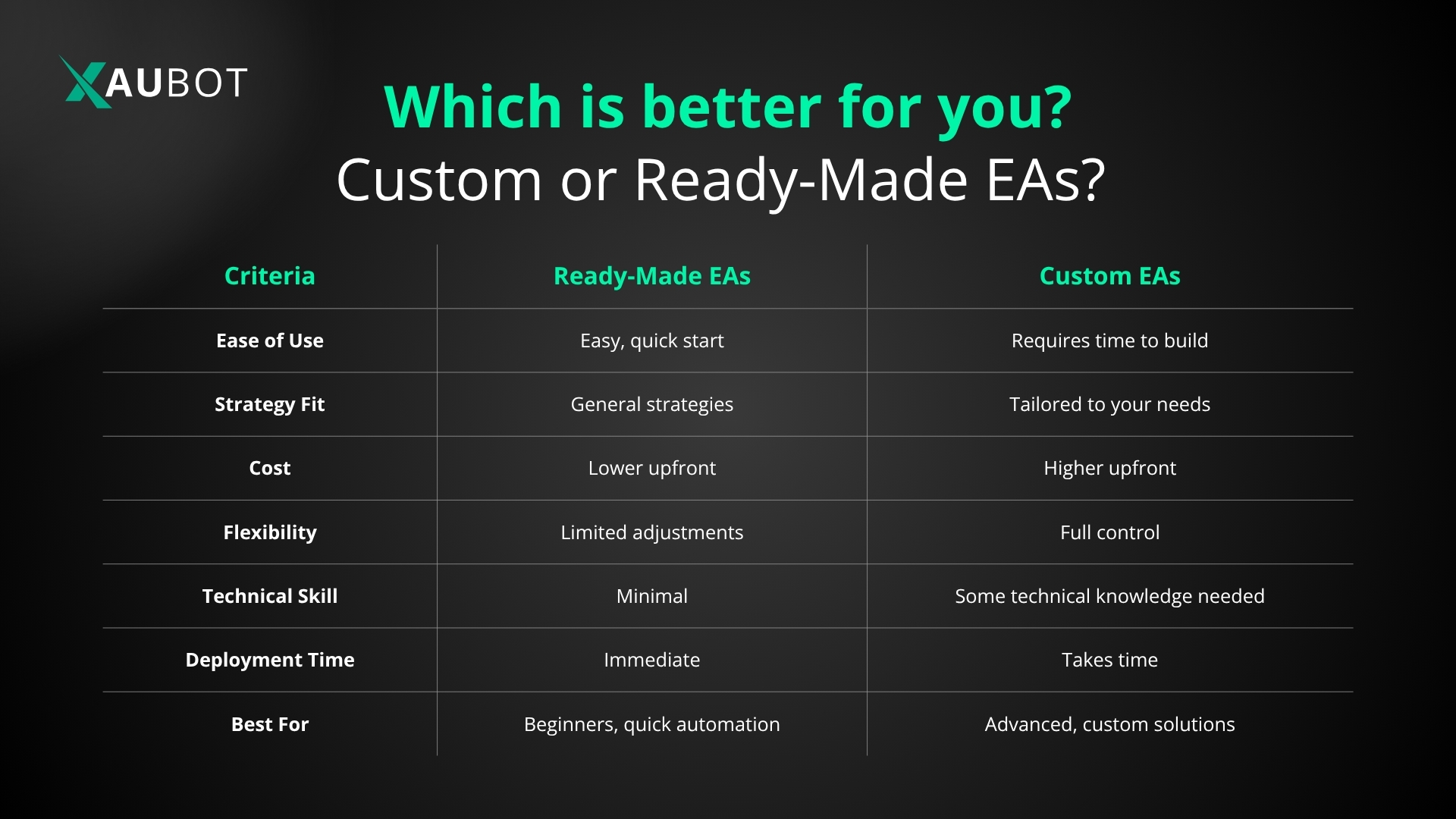

There is never a clear path for you to choose. So there really isn’t a straightforward answer to the question of which one is better for you, ready-made or custom expert advisor. You will need to weigh in and evaluate your conditions and aim to see which option will be better for you.

- If you are looking for an easy option and a general approach to automated trading, then a ready-made option will probably be just fine for you.

- If you are looking for an advanced expert advisor with specifically designed and built features that are tailored to your trading requirements, then a custom expert advisor is a better choice for you.