Your mentality can play the most important role in the outcome of your trades. This is quite similar to any other area of life, where our mindset basically dictates that outcome of every situation.

It is not just market analysis, indicators, numbers, and such. The way you feel, the way you think, your mentality, and how much you let your mental biases affect your trading process will all be influential in whether your trades are profitable or not.

So in this article we want to discuss the most common cognitive biases that can potentially impact the outcome of your trades in the forex market so you know how to avoid them and not be impacted by their detrimental impact.

You should read: 6 Ways to Reduce Stress in Financial Markets

What Is a Mental Bias and How Can It Affect Trading?

Before we actually discuss the mental biases that are negatively impactful in the process of forex trading, let us take a quick detour to talk about a mental bias itself.

What is a mental bias?

A mental bias is a wrong preconception that you have about a certain phenomenon. This misconception can be about a limited number of phenomena or it can be about your entire worldview. So a mental bias can be a misconception that drives all of your life decisions toward the wrong direction.

You can think of a mental bias like a layer that clouds your judgment and does not allow you to think clearly and make the right decision.

And what is interesting about mental biases is that some of them are inherently part of us and some of them form in us as a result of external factors. This means no one is without mental biases. We all have them. Some of us have more and some have less. But more importantly, some of us have our biases under control and some do not.

In any case, the only proven way to control your biases is to be aware of them. If you know what mental biases you have, you can control them much easier. And now let’s go over some of the most common cognitive biases in the trading world.

You should read: The Stages of Making a Forex Trading Strategy

The Most Common Cognitive Biases to Avoid as a Trader

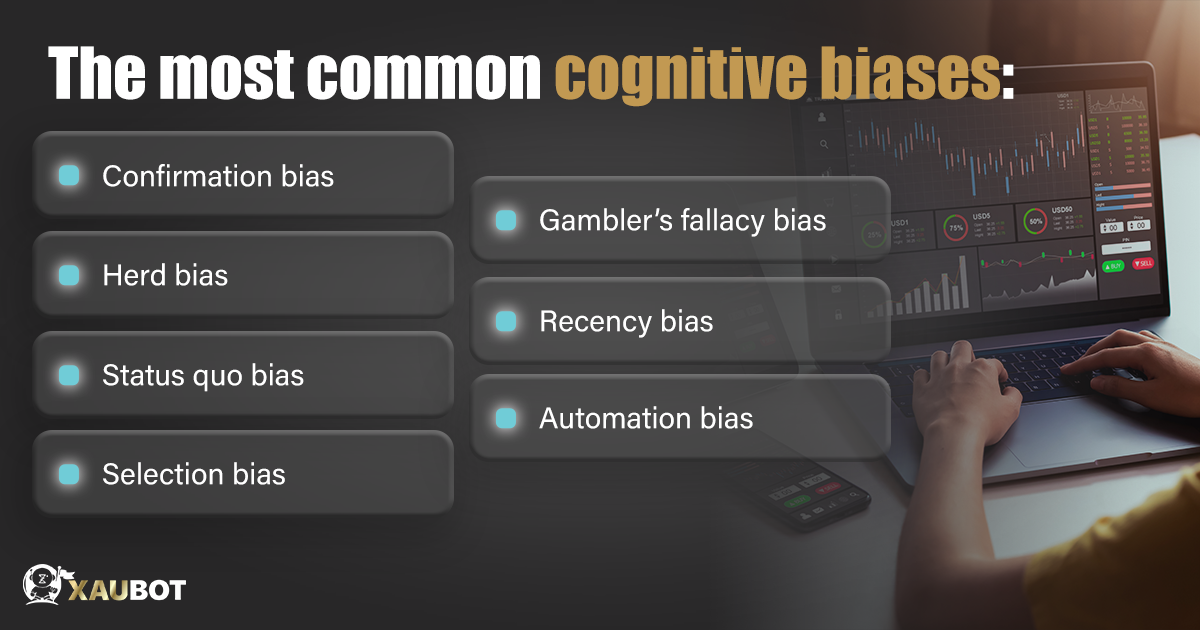

Now that we are familiar with the concept of mental bias altogether, let’s take a look at the most common cognitive biases that can afflict traders in all financial markets. Here is a list of these biases in no particular order:

- Confirmation bias: this is perhaps the most common mental bias that we all have. According to the confirmation bias, your brain will seek out only information that confirms your already existing ideas and beliefs. As such if you have a misconception about the market in which you trade, you will only seek information that will confirm those opinions, thus missing the big picture and other relevant information that could be potentially influential.

- Herd bias: this is another bias that most people have. This is a social bias and a social effect. According to this bias you will do what the majority of people are doing. This is a deep rooted bias in our minds because we do not want to be different from the herd. We want to blend in. So we go where the herd goes. This can be quite detrimental if you follow the herd in any financial markets.

- Status quo bias: this bias is rather similar to the herd bias, where you do not want to change what is already in place. This bias will lead your thought pattern toward a direction where you want to stick with conventions and traditions and not try to change things. In the forex market, the status quo bias will force your mind to keep going with the approach and strategy that you already have because your mind is afraid of changing it.

- Selection bias: the selection bias is exactly what it says. We all have misconceptions about the choices that we make in our life. It can be as simple of the choices we make during shopping or the choices we make in the financial markets. The manifestation of such bias can easily be seen in the forex market where traders are faced with the choice of picking the right trading pair or picking the right time to trade. The misconceptions that are part of misleading such decision making processes are all part of the selection bias.

- Gambler’s fallacy bias: this is yet another common bias among traders that has its root in the world of gambling. According to this bias, gamblers will keep on betting their hands because they think ultimately they will big win and balance out their losses. But unfortunately this does not work in the gambling and it certainly doesn’t work in the financial world. If you keep trading with the same strategy and the same approach hoping that it will pay out eventually, you will only sustain losses.

- Recency bias: as the name of this bias suggests, traders will stick to what has been working for them in the most recent past and they will think that the same strategy and technique will keep on working for them indefinitely. But the reality is that what has worked for you recently has no guarantee that it will keep working.

- Automation bias: according to this bias, traders might leave too much to automation without adjusting it ever again. You see, similar to your own trading strategy and approach, an automated trading approach also needs to be adjusted every once in a while. It is true that automation can be a very helpful way of increasing the efficiency of your trading process and enhancing the chances of profitability. But if you leave the automation process on its own for too long, then it can take some distance from what you ideally want from it. As a result, traders need to be aware of the automation bias and make adjustments in their automated processes whenever needed.

You should read: Training on making a trading strategy in TradingView?

Conclusion

Mental biases are misconceptions that all of us have in our worldview and in our decision making process. Naturally, our mental biases can negatively impact our trades in any financial market, including the forex market. In this article we discussed the most common cognitive biases so you know how to avoid and control them.