Being active in any financial markets means being a decision maker. It all depends on the decisions that you make. And what ruins that decision making process? Stress of course. So in other words the best performer in any financial market is the person who is best at managing stress.

And it is completely understandable why there would be an uptick in stress in the financial markets that we have in today’s world. With all the uncertainty and sudden changes that have occurred many times in different markets, traders and investors tread the financial waters with perhaps a bit too much caution than necessary.

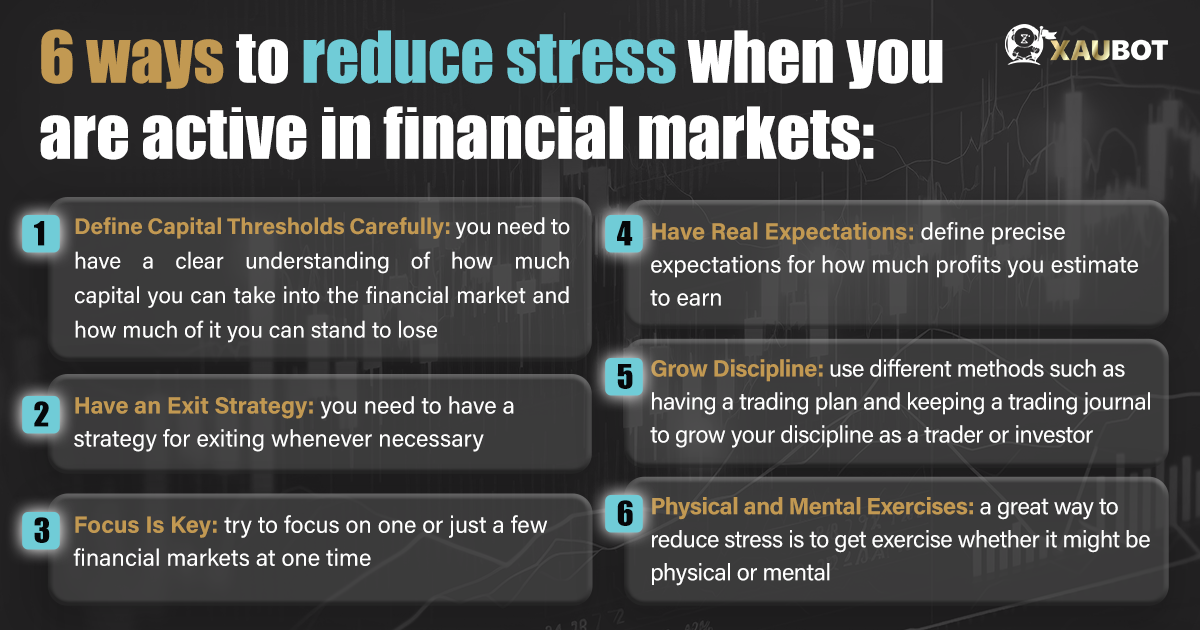

So in this article we want to present you with the six best ways that can help you manage and reduce the stress you get while engaging with any financial market.

Best Methods for Managing Stress in Financial Markets

-

Define Capital Thresholds Carefully

One ideal and at the same time rather easy way to reduce your stress in financial markets is by precisely defining your capital thresholds. What does it mean? It means you need to calculate two important figures. First of all the capital that you take into the market and secondly the capital that you can stand to lose without sustaining unrecoverable damages.

The first one, trading or investing capital, should ordinarily be calculated based on the liquidated capital or assets that you have that are not tied up in any market in any manner. This means money that is not in the form of a reliable asset such as precious metals or money that is not itself part of a diversified portfolio such as in the form of bonds or stocks. Aside from that, the money you have at your disposal can be considered as the capital to be used in financial markets.

On the other hand, when we are talking about the amount of capital that you can stand to lose, we mean the amount of money that you can lose in financial markets such that you can easily bounce back and continue your activities in the market.

You should read: Investment traps in the financial markets that you should watch out for!

-

Have an Exit Strategy

If you burn all the bridges behind you, then you will always have the stress that if you make any wrong moves then it is the end for you and your finances. This is why it is imperative and highly necessary for you to have a well-thought-out exit strategy. Your exit strategy can also include the maximum amount of money that you can possibly lose and perhaps even future plans for investing the capital that is taken out of the first market.

Furthermore, your exit strategy can be detailed and work at a small scale as well. For instance you can have an exit strategy for when your position in the market goes into loss and you need to pull out.

-

Focus Is Key

You need to remember that with almost anything in life moderation is the key. While it is a great idea and in fact it is encouraged that you have a diversified portfolio, you should be careful about extending your net too far. So when you are active in the financial world be careful that you do not lose your focus.

It might be the optimal for you to be active in only one market such as the forex market or the stock exchange, given the amount of the capital that you have. It also depends on your level of skill and expertise. If you are new to trading or investing, it might be a better idea to keep your focus by limiting the number of markets for involvement and engagement.

-

Have Real Expectations

Another great step that you can take in order to reduce your stress as much as possible is to set realistic expectations with regard to your profit goals. If your goals of profitability are set too high and impossible to achieve, then your goals will only give you more stress.

To avoid this, careful and precise calculations must be carried out by considering your assets and capital first and then setting relative and proportional goals for profit expectations.

You should read: The Concept of Market Sentiment and Its Importance in the Forex Market

-

Grow Discipline

A trader or investor who is stressed out is one who lacks discipline. If you have a disciplined approach then there would be no room left for unnecessary stress because you have already planned everything in advance.

There are two recommended ways to grow discipline. One is to have a trading plan, which means having a fully and clearly defined trading strategy and risk management strategy. And the other is having a trading journal.

The first one, i.e. the trading plan, will give you the sense of calm and assurance that you have already taken into account all the relevant factors and have devised a plan to meet the conditions of the market at that point.

On the other hand, having a trading journal will give you the opportunity to look back on your trades and examine them in retrospect. In this way you have a chance to find any areas of weakness and improve upon them.

-

Physical and Mental Exercises

Last but not least, you can very effectively reduce your stress with the help of both physical and mental exercises.

Being a trader, especially a day trader, will naturally involve endless hours of sitting behind a computer and lacking physical activity. This can easily build up stress. So by getting regular physical stress you can reduce such anxieties.

Also you can get mental exercises such as meditation to calm your mind and even brain games and brain teasers to sharpen your mind and be more ready for the financial market in which you are active.

You should read: What is the COT report and how can it be used in Forex market?

Conclusion

When you ask anybody what their biggest source of concern is, the majority of people will talk about their finances in one way or another. And it is quite natural that such matters and activities in financial markets are fraught with anxiety. You are dealing with your capital and possessions after all. But there are ways to manage and reduce the stress associated with such markets. In this article we presented you with six ways that can help you better control the stress you feel as a trader or investor in financial markets.