A smart trader is one who is aware of Automated Trading and multiple factors at the same time. Factors that could play a consequential role in the outcome of their moves in the market. Ordinarily, traders would regard day to day price movements as the most important factors impacting the result. But alas, there is much more to any financial market.

There are certain financial factors that are quite large in their scale that are impactful on how the market behaves. This is where we get to the fundamental analysis side of the equation. Big picture economic criteria that weave the tapestry of all financial markets.

Due to its breadth and extensive nature, it is clearly hard for ordinary traders to track the processes involved in the economy at large. This is another area where the use of trading robots can come in handy. And this is going to be the focus of the current article. Basically, how we can leverage fundamental analysis with the help of automated trading.

Fundamental Analysis and Relevant Factors

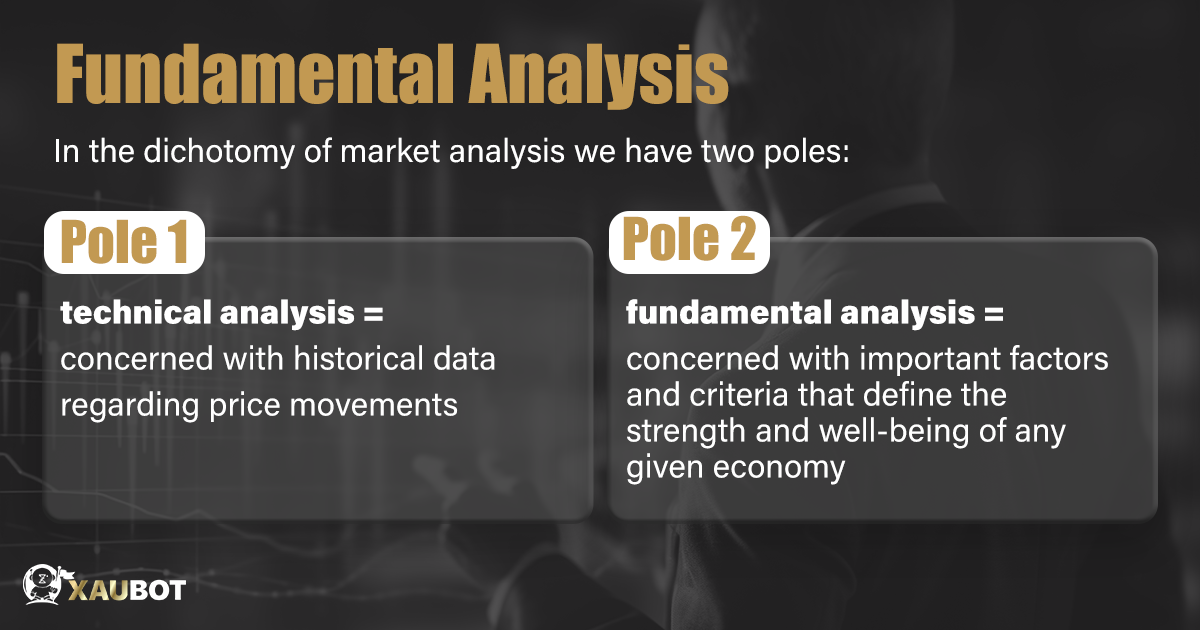

Fundamental analysis is involved with the literal fundamentals involved in any financial market. And what are the fundamentals in any financial market? Well, the economy of course and all the related factors that work to make up the mechanism the runs any economy.

These would be factors that would impact any other part of the economy as well as the forex market. For instance, indicators that show the health and wellbeing of an economy that are also used in order to measure the strength of any given economy.

For instance data such as growth domestic product or inflation that are published on a regular basis and show how well an economy is doing. Also other important indicators that show the relationship between supply and demand in the market and whether an economy is a productive and manufacturing economy or if it is more of a consumer economy.

Even the trade deficit of an economy can define the outcome of prices in financial markets. The reason is that all of these factors are evaluations as to how strong the economy is. For instance if there is a huge trade deficit, it is clearly indicative the economy in question is a consumer one and thus it is at the mercy of other nations that are largely exporting to it.

So this is what is meant by fundamental factors that impact the forex market. Although they are larger in their scale, they are, however, much more difficult to understand and analyze compared to technical analysis.

The reason is that unlike technical analysis, in fundamental analysis we have basically countless variables that could come into play at any time. Among these variables some of them are predictable. But, as mentioned, some are totally unpredictable and can occur suddenly at any time.

So let’s turn our focus away from the definitions and to the actual fundamental factors that are complex to take into account and see what they actually are.

You should read: Best Prop Trading Firms 2024

Scheduled News and Economic Events

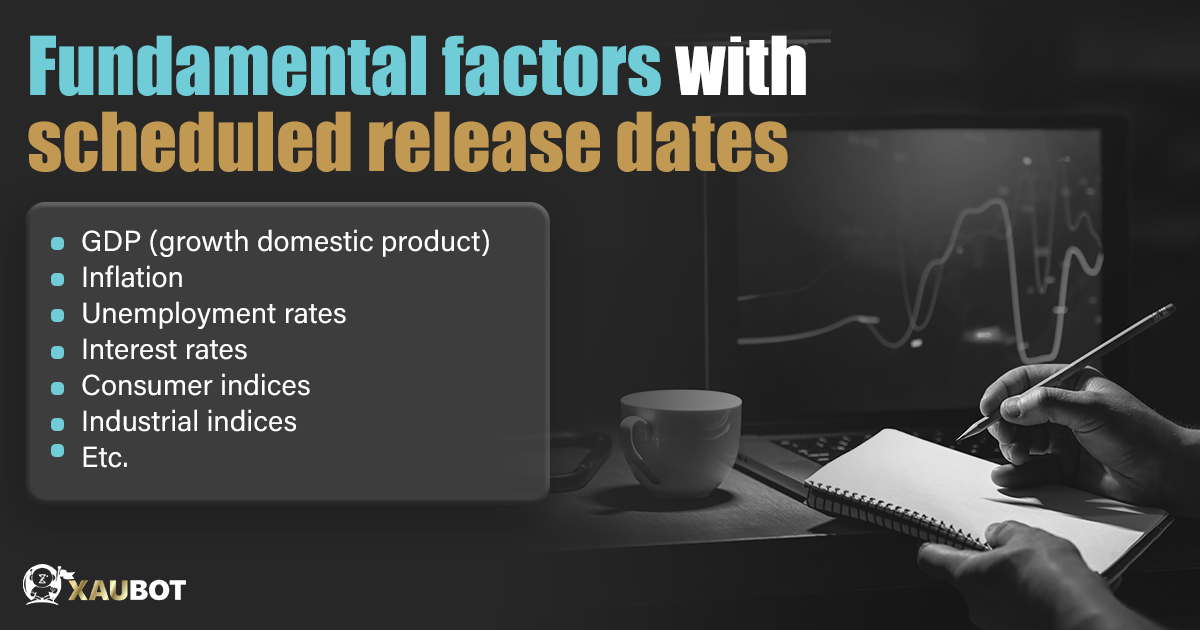

The first category of fundamental factors are those that are predictable and can be put into a strict schedule.

On the surface of these things we have the predetermined and scheduled release of important economic data such as GDP, inflation, consumer indices, trade deficit, unemployment, and the bell of the ball, interest rates.

All of these can and will have an impact on the forex market when they are announced and especially when they undergo a serious change. In fact, as we said, they are so important that sometimes their mere announcement can impact the market.

But among them perhaps nothing is more potent with regard to its impact on the foreign exchange market than the announcements related to interest rates.

Interest rate is a percentage announced by the central bank of any country, which basically defines the amount or percentage of interest that other commercial banks have to pay the central bank in exchange for the loans that they take out, which is then given to their own customers. It is a form of trickle down economics whereby big banks loan money to smaller banks, and then smaller banks loan the money to the customers.

Interest rates are an extremely potent market of an economy’s health and thus the strength and potency of that economy’s currency.

You should read: How Much Can Prop Trading Make 2024?

Sudden Geopolitical and Economic Incidents

There are, on the other hand, certain events that are not possibly scheduled. These are sudden events that take place in the world without any warning. But nonetheless they are of course potent enough that will impact any related financial market if not all of them.

Such events that are powerful in their scope of influence include dramatic geopolitical events such as war. A prime example would be the ongoing war between Ukraine and Russia. It had so much economic impact it would take a whole other article to unpack. But just look at the impact it had on the currencies on each nation directly involved in this war.

Even the threat of war is powerful enough to impact national currencies and thus the forex market.

Unexpected outcomes of elections and decisions made by important political figures that are announced and unexpected can also be quite influential.

A good example would be the newly elected and sworn in president of Argentina who has long promised he would abolish the Argentinian national currency and instead employ the US dollar as their new national currency.

XauBot Pro: the Best Automated Trading Solution for Fundamental Analysis

Because of the difficulties and challenges associated with fundamental analysis, traders can choose forex trading robots to have an ideal and optimal experience with this method of trading.

The best automated trading platform for leveraging fundamental analysis is XauBot Pro. It is an expert advisor developed for MetaTrader 4 that is compatible with both technical analysis and fundamental analysis. This trading bot works with all the foreign exchange currency pairs and can trade multiple pairs at the same time with up to 5 pairs simultaneously.

Though it comes with highly advanced technical analysis features, XauBot Pro also specializes in fundamental analysis tools, namely news filter and holiday filter.

What is unique about these features is that when you turn them on, the bot will automatically take fundamental analysis into account for its trading process.

So you do not have to do anything, if you choose to activate the news filter, the bot will automatically monitor the world of news and consider important events and their possible impact on trades.

This is how XauBot Pro can be used to leverage fundamental trading and analysis in its automated trades.

You should read: Optimizing Parameters: A Deep Dive into Trading Robot Configuration

Conclusion

Fundamental factors are quite impactful on the forex market, as this financial market is composed of foreign currencies, which themselves are at the mercy of their economies. You can get help from algorithmic trading solutions, i.e. forex robots, in order to automate the use of fundamental indicators in trading.