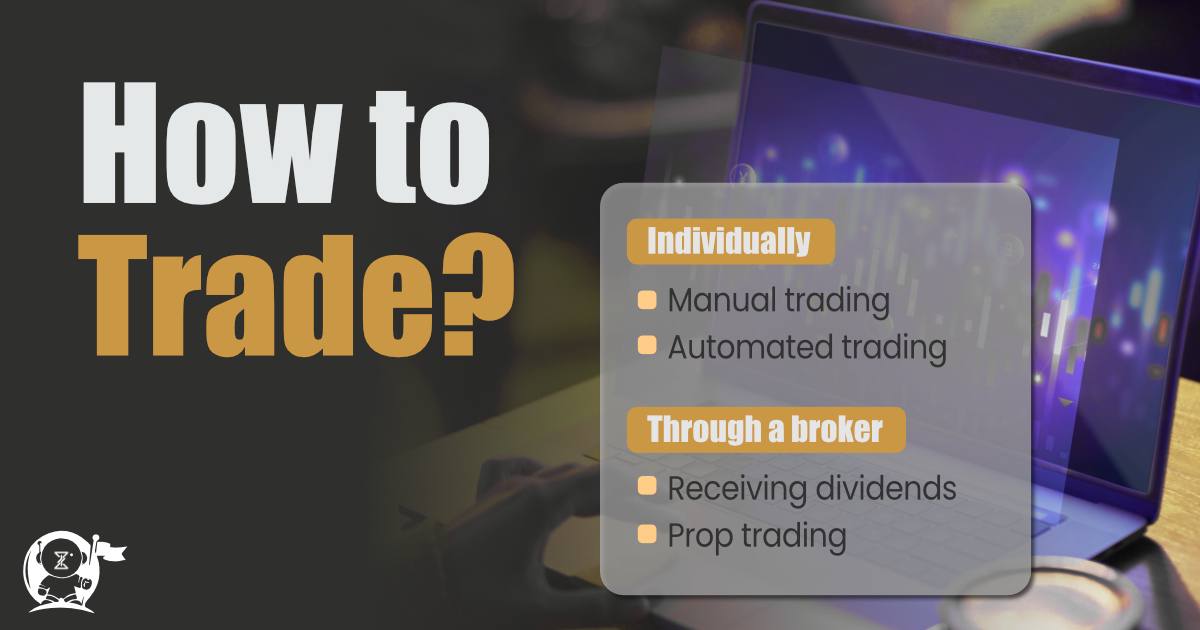

Whatever goal you might have in mind, there are many different ways of achieving them or getting to that destination. So is the case with financial markets and trading. If you have the idea to begin trading, there are many different ways in which this can be managed and obtained.

You can begin trading yourself, which is also branched out into manual trading or automated trading. Or you can use services provided by other companies and hedge funds where you can leave your money to them and receive dividends or return on your investment. This path is also branched out into different pathways – one of which is known as prop trading.

This is exactly what is going to be the focus on this current article. We will compare prop trading with non-prop trading and also see its advantages and how exactly it is carried out.

How to trade?

|

You should read: Best Prop Trading Firms 2024

Prop Trading vs. Non-prop trading

To understand prop trading, it is better to start off with defining non-prop trading first.

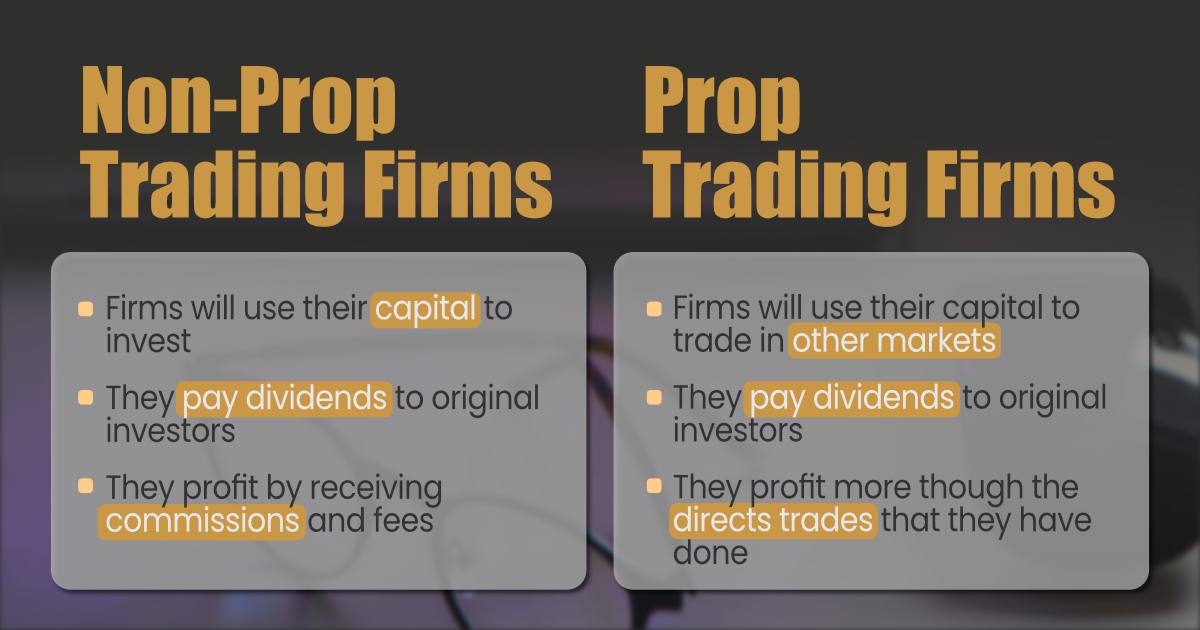

There are countless money management companies known as brokerage firms, hedge funds, venture capital companies, etc. What these companies will do is that they receive capital from their investors and then loan out the money or invest it in some form of project or investment opportunity.

Then, such companies would pay the resultant profits in the form of dividends to the original investors, which are individuals who provided the initial seed or the initial capital.

This is an old and conventional approach to investment. Basically a company is in charge of pooling all the capital from many individual smaller investors in one place and then using the resultant pooled capital for a bigger investment, which then would hopefully result in profits. Out of this profits, the company pays the investors in dividends and itself obtains small margins of profit, mostly in the form of commission or fees.

This is basically non-prop trading. But what about prop trading?

Prop trading, which is short for proprietary trading, is when the capital companies, such as hedge funds, pool the money from small investors and then use that money to trade. So in this case the pooled money is not merely used for a bigger investment which then can yield marginal profits for the firms in the form of commission.

Rather, in prop trading, companies and firms in charge will use the capital to execute trades. Now keep in mind that this could include trading in any market, such as the stock market or the foreign exchange or forex market.

In this way, they are able to obtain much more profit rather than simply investing the capital in other projects. How? Because they have a substantial and vast capital at their hands, they can use that to enter into positions. Now, if the position results in profits even a very small percentage, it can translate into a really huge dollar figure, since the starting lot was really high.

This can be especially beneficial in a market such as the forex market where we have marginal changes in price that result in marginal profits. In this situation, where prices move and yield a profit of, for instance, 0.8%, it would be much better to profit 0.8% of $100,000,000 rather than 0.8% of $5,000.

Non-prop trading firms

Prop trading firms

|

How Is Prop Trading Carried Out?

As we discussed, in essence the way prop trading works is that a financial firm will not use their capital in order to make long term investments. Instead, firms will use their capital to execute trades. And keep in mind that this can result in huge profits, given the fact that the amount of capital under the management of different firms can amount to stupendous figures – going into the billions more often than not.

So, basically there are two ways in which prop trading can be executed:

- Capital management companies, such as hedge funds and VCs, will use the capital earned through small investors in order to trade in financial markets. In this way, they will be able to pay dividends to their clients and they will also be able to directly profit from the capital rather than indirectly through commissions.

- Secondly, different firms and companies can use their own capital and trade in financial markets. This can be any company and does not have to be a capital management firm. This is actually a method of capital preservation for companies that want to keep their capital liquid and moving. Instead of investing them into projects, companies can use their capital to trade in different markets.

How does prop trading work?

|

You should read: How Much Can Prop Trading Make 2024?

What Are the Advantages of Prop Trading?

There are a number of advantages associated with prop trading that are quite significant to the firm that carried out prop trading.

First of all, the profits that are obtained through this method of investment, and it is a method of investment for companies, are huge. But more importantly, if the firm carried out this form of trading with their own capital then it is a great way to preserve the entirety of the capital and also adding to it through the profits. They don’t have to pay any dividends, commissions, fees, or other expenses that might otherwise reduce their overall profit.

On the other hand, because in prop trading we have firms and companies that have entered financial markets such as the forex market with a huge sum of capital, they essentially become a market maker. You see, any trade they might make in favor, long, or against, short, an asset or trading pair, will move the market toward that direction, solely due to the huge size of the trade.

Additionally, prop trading is also a great way of diversifying the portfolio of the firm. It is because, first the firm does not keep liquid capital as it is, secondly they purchase different assets in the form of stocks, shares, bonds, etc. with the capital.

Advantages of prop trading:

|

Conclusion

Prop trading or proprietary trading is when companies and financial firms will use the capital at their disposal in order to trade in financial markets. This will have clear benefits for the firms, including higher profits and basically becoming a market maker in whichever market they have decided to carry out prop trading.