With the rising demand in the use of forex trading robots, it becomes necessary to learn how to optimize them through proper Trading Robot. Although you might think trading bot are specifically designed to relieve you of this duty, there is still a lot you can do as a trader in order to set up a trading bot.

While they do provide a level of autonomy on their own part, hence being called automated trading, certain trading bot also provide the space for traders to configure them to fit their own personal preferences and needs.

To address this aspect of auto trading, in this article we will delve into forex robot configuration to see what it is and how it can help you get a better result from automated or algorithmic trading.

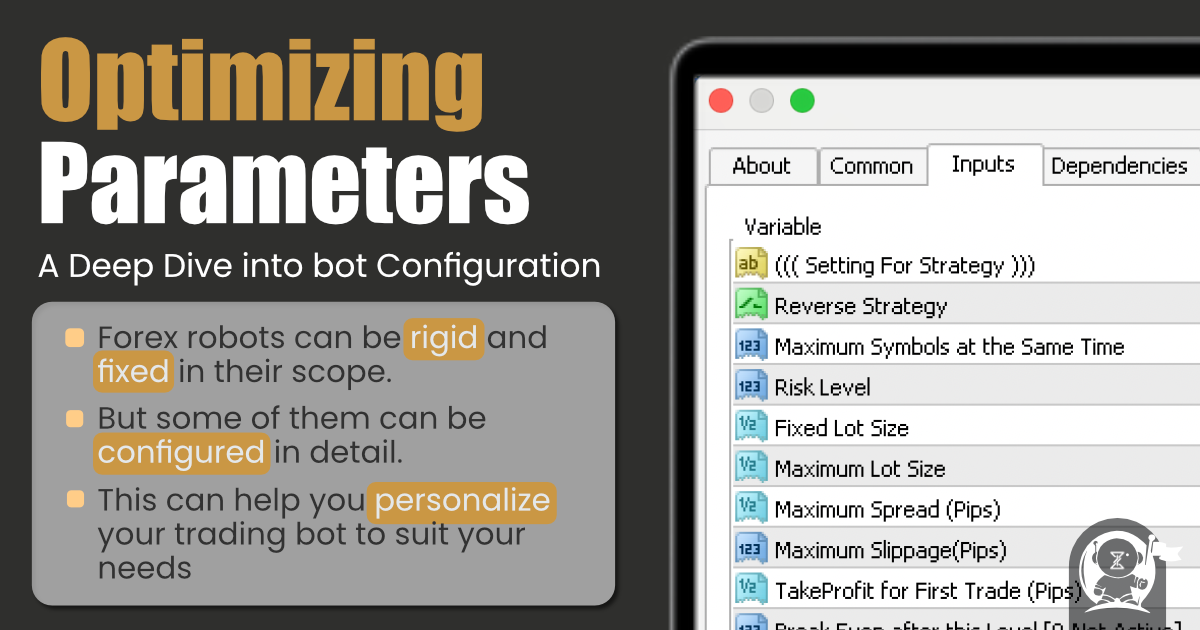

- Forex robots can be rigid and fixed in their scope

- But some of them can be configured in detail

- This can help you personalize your trading bot to suit your needs

What Is Forex Robot Configuration?

At its core, the notion of automated trading is so that the user does not have to be involved in many of the complex processes that result in a profitable trade in the market.

These processes can be anything from carrying out technical analysis of the day to day price movements, looking out for the fundamental factors that could impact the big picture status of the market, finding the most ideal entry and exit points, all the way down to the actual execution of the trades themselves.

Because the process is known as automated trading, many think that you only need to purchase or acquire a trading robot in some way and then apply it to your trading platform and have it execute trades one after the other without any input from you as the individual trader.

While that may be true in the case of some trading bots, as we will see in the next section, there are those trading robots that allow users to configure them and apply their own preferences so that the bot will trade for them in accordance with their own trading strategy and style.

In essence, the process of bot configuration involves setting or changing values for the bot that will ultimately impact the process of choosing entry points and exit points – i.e. the entirety of opening and closing a position.

Naturally, these preferences and initial inputs can include various things such as stop loss, lot size, among many other variables.

So to sum up, the process of robot configuration is one through which you can customize the trading robot to suit your own personal preferences as a professional trader.

Before we talk about the actual process of configuration, let’s see if all robots require this step or not.

- What Are the Aspects of Robot Configuration?

- you can optimize your bot in terms of technical analysis

- the aspects of fundamental analysis can also be optimized (if the bot permits)

You may like: Best Prop Trading Firms 2024

Do You Need to Configure Your Trading Bot?

At this point in our discussion, it is quite necessary to ask this question: do all trading bots require configuration? And if so, how should we do that?

First of all, the configuration of the trading robot depends on the bot itself and also the trader who has purchased the bot. There are certain trading bots that do not allow for much configuration.

This can be regarded as both a disadvantage and advantage. It totally depends on your vantage point – pun intended!

The way this can be regarded as a disadvantage is from the point of view of a professional trader who wants to configure their trading bot as much as they need in order to customize it for their own specific situation.

And the way it can be regarded as an advantage at the same time, is the fact that a novice trader has gone down the route of automated trading for the reason that they want to leave it all to the bot.

But since we are discussing bot configuration, we are going to focus on those trading bots that do indeed allow for proper configuration.

As we said, there are those traders who would like to configure the trading bot to meet their own criteria – criteria by the way that is mostly related to how much they want to risk and how much they want to trade.

With that segue, let’s dive into the “how” of this process.

- Why should you configure your trading bot?

- to make it dynamic and not rigid

- to make it suit your demands and conditions

- remember, the trading bot can trade exactly how you want it, if only you know how to optimize it

How Should You Configure Your Trading Bot?

The way you can go about configuring your trading bot is related to the way you want to set it up.

What does it mean?

It means you want to define for the robot yourself with regard to how much of your assets you want to put at risk in the market and what percentage of your assets you want to trade with at any one point in the process of trading.

As we mentioned above, these factors can include the risk threshold of the account. This on its own includes factors such as stop loss and also the lot size.

There are some bots, as we will provide an example below, that allow for stopping the process of trading during certain times that are deemed unfavorable for trading. Times such as when important economic news are going to be released, which is when the market usually experiences volatility.

Example of Forex Auto Trading Configuration

A great example of auto trading configuration can be seen with the auto trading platform XauBot.

The reason we believe XauBot is a great example to show you how the process of configuration works is that they offer different services to meet the needs of traders at different levels of professionalism and with different levels of experience.

The basic auto trade solution itself, called XauBot, can be used by both novice and professional traders. Novice traders can use XauBot to automate their trading without much knowledge of the trading world with the settings that XauBot can provide for them.

At the same time, more advanced traders can also enjoy XauBot in that it allows for advanced configuration options.

Since this platform also offers another trading solution called AI Trading Tools, available automatically with the XauBot Pro version, advanced traders can define so many different parameters for this automated trading service.

In essence, traders can turn XauBot into a highly sophisticated trading calculator, where they are able to feed it their info and requirements and XauBot will tell them what to do and how to do it. This is essentially what XauBot money management can do for users.

After you install XauBot on your MetaTrader 4 account, when you run the expert advisor on your terminal for the first time, you will see many prompts that include these settings and configurations.

As such you can define all the parameters of auto trading that you would like XauBot to handle for you.

- There are different ways for optimizing and configuring your trading bot

- for example XauBot will let you do this in the following ways:

- you can use a trading platform, such as MetaTrader 4 and backtest the bot with that

- you can also use the backtesting file that XauBot will provide for you

You may like: How Much Can Prop Trading Make 2024?

Conclusion

Forex trading robots can provide you with an easy solution to automate the process of trading with the help of advanced algorithms. But sometimes these algorithms are developed in order to provide a comprehensive and perhaps general solution. This means you might need to optimize the parameters of the robot yourself in order to achieve the highest possible level of efficiency in your own terms.