There are certain essential concepts that anyone in the financial world must know; especially those who intend to invest in financial markets.

Also, there are some concepts that are used in so many occasions and in similar domains that they basically become interchangeable; when in fact they are different.

Among these important concepts are stocks (or shares) and index (or indices).

So take the time to read through this article to fully understand what a share is and what an index is once and for all.

What Is a Stock (Share)?

Let’s start with stocks.

Stocks or shares are like the pieces of a company that you can actually own. In this way, owning stocks represents owning a part of the company.

Imagine if a pizza is divided into 100 pieces and buy 20 pieces or 20 shares.

In this way, you own 20% of the entire pizza.

This is exactly how stocks work with a company. But the number of total shares differs from company to company.

For example, as of late 2025 and early 2026, it is estimated that Apple Inc. has a total of about 14.8 billion shares.

This means the entire value of Apple Inc. is divided into 14.8 billion pieces. And each one of these pieces can be purchased and represent ownership over the value of the company.

Therefore, if you purchase 100,000 Apple shares, it means you own about 0.0006% of the Apple company.

The value of a company’s shares will go up or down depending on the performance of the company and various financial indices that the company is able to achieve in a fiscal year or other relevant periods.

So if the company is doing well, such as selling really well, then it means the value of the company goes up and when the value of the company increases, so does the value of its stocks.

Example:

Apple Inc.

Total number of shares (2025-2026) = about 14.8 billion shares

Each apple share = $285 (as of late 2025)

Total value of Apple (market cap) = total number of shares × value of each share

Total value of Apple (market cap) = 14.8 billion × $285 (as of late 2025)

Total value of Apple (market cap) = about $4.2 trillion

You buy 100,000 shares

100,000 = $28.57 million

You own 0.0006% of Apple

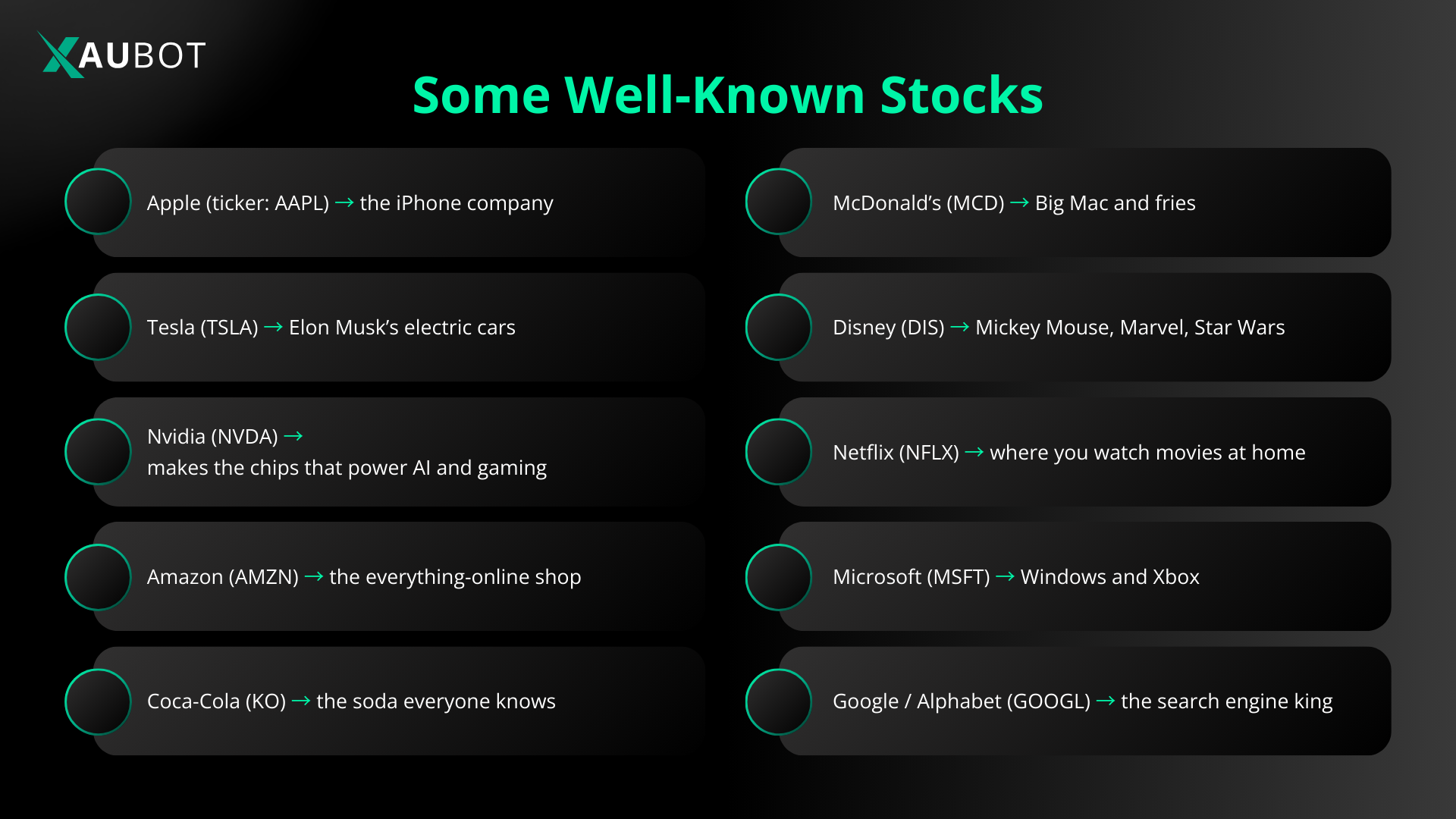

The following is a list of the most well-known stocks listed on reputable stock markets from the giants of various industries. In order for a company to be able to sell its shares it has to be listed on a stock market. Here, you can see the name of the company as well as its ticker (the symbol with which it is represented in the stock market):

What Is an Index (Indices)?

Now let’s get to an index, or indices which is just the plural.

In very simple terms, an index represents the stocks of many companies all bundled together.

In other words, an index will track the performance of stock value of a group of companies together. For example, one of the most famous indices is the index known as S&P500.

S&P 500 tracks the performance of stock of the top 500 companies in the United States.

So a share or stock represents that value of a single company. But an index represents the value of many companies.

The value of an index is not really tied to a single company, but to the performance of the overall market and all of these companies.

If we go back to our pizza analogy, an index is like a basket that has slices of pizza from many different pizzas all in one place.

How can you buy or invest in indices?

Because an index tracks that value of so many companies all under a single umbrella, you cannot directly purchase it like shares on the stock market.

But there are two ways you can invest in an index.

There are financial firms which are known as funds that track these indices. Some of the most well-known funds are BlackRock, Vanguard, or Fidelity. Perhaps you have heard of these before.

So through these funds, you can invest in an index.

There are basically two ways:

(a) first you can buy the index fund. This means you directly invest in the fund and the fund will in return purchase shares from all the companies in an index and manage the money for you.

Your money goes to the fund and the fund will purchase the index. For instance, if the fund invests in S&P 500, it means your money has been invested in the stocks of all these 500 companies.

(b) you can purchase an ETF or exchange traded fund. An ETF is like a stock version of the index that allows you directly purchase it.

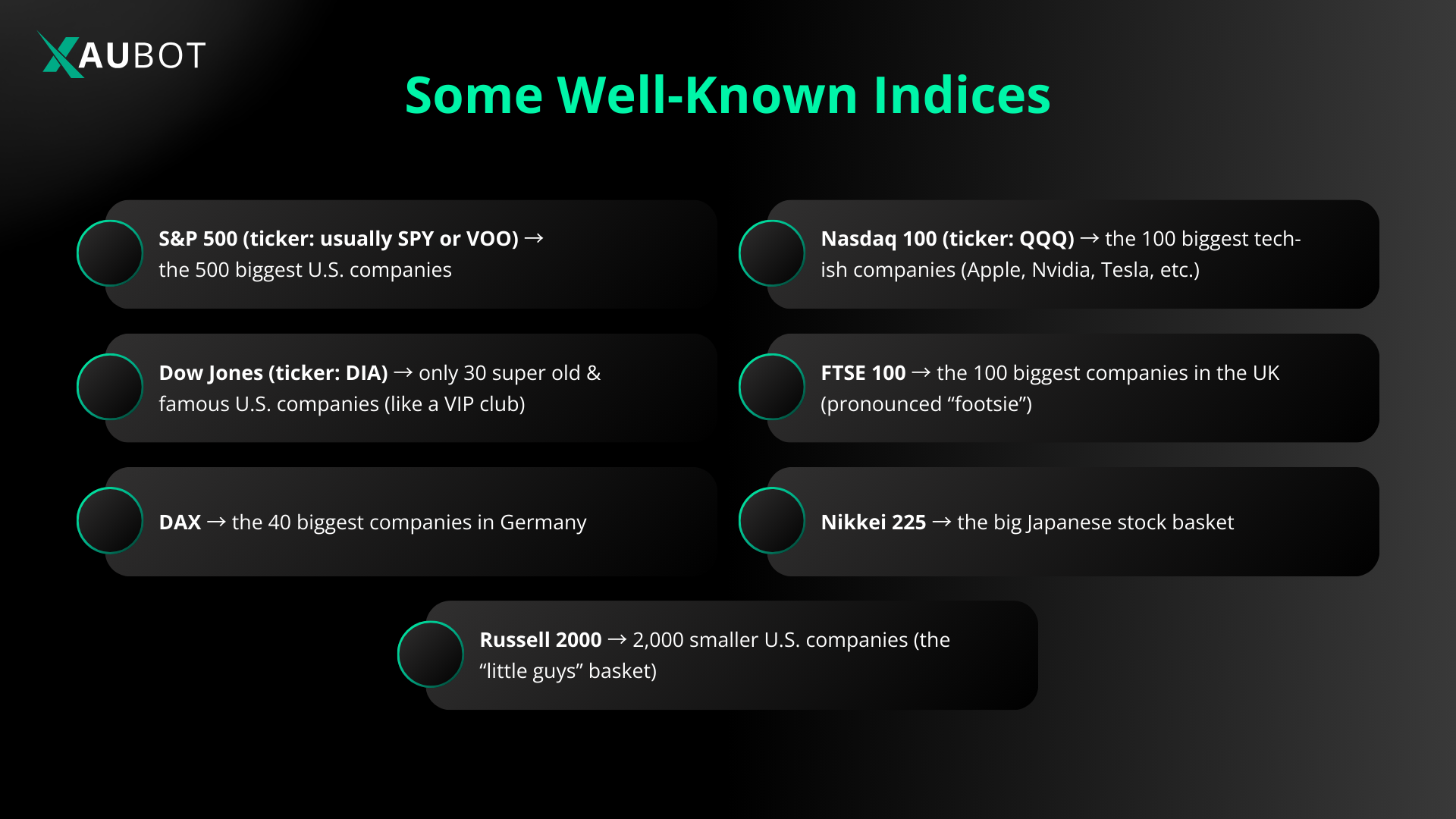

The following is a list of the most well-known indices that track the most important companies and corporations in different domains and industries:

What Is the Difference Between Index and Stock?

Let’s wrap things up so far:

Stock (share): owning stocks means you own a small piece of a company.

Like buying Apple shares and owning a very small piece of the entire company.

The value of the stock goes up and down based on the performance of the company.

You can buy stocks on stock markets.

Index (indices): an index tracks the performance of many companies altogether.

For example, S&P 500 tracks the performance of the top 500 U.S. companies.

You cannot directly buy an index like a stock.

But you can invest in them through an index fund or ETF.

This way you have invested in a large number of companies at the same time.

The value of an index goes up or down depending on the overall performance of the market (all the companies).

Is It Better to Invest in an Index?

So which one is better for you?

It all depends on what you are looking for.

Investing in stocks:

When you buy a stock, you are buying into one company.

If the company goes down, you will lose all of your investment in the stocks. And if the company does extraordinarily, you can make a huge sum of money quickly.

Investing in indices:

Investing in an index will bring you diversification. You invest in a group of companies instead of just one.

Investing in an index is less risky, because if one company does horribly, it will have little effect on the overall value of the index.

However, you won’t see big and huge changes based on the performance of one company.

Profiting happens over time and steadily.

In summation, investing in stocks means investing in one company and can have quick ups and downs.

But investing in an index is investing in a group of companies. No quick profits, but has diversification of assets and stability.