How to Trade Gold ?

Gold continues to be one of the most popular instruments for traders in both the forex and commodities markets. Its high liquidity and steady price movements make it attractive, but its volatility can be a double-edged sword.

To trade gold successfully, you need a solid strategy, good risk management, and the ability to stay aware of market trends as they change. A disciplined approach that adapts to shifting economic conditions can make all the difference.

What is XAU/USD in Forex?

1

In forex trading, XAU/USD is the symbol for gold (XAU) priced in US dollars (USD). When you trade XAU/USD, you're buying or selling gold based on its dollar value. It's one of the most popular assets, especially when the economy is uncertain.

2

Gold is known as a safe-haven asset, meaning people often invest in it during market stress to protect their money. The symbol "XAU" stands for one troy ounce of gold, and "USD" is the US dollar , so XAU/USD shows how much one ounce of gold costs.

3

You don’t need to own real gold to trade it. Many brokers let you trade gold easily using platforms like MetaTrader or cTrader by simply speculating on price changes.

XAU/USD shows the price of one ounce of gold in USD. Traders try to profit by predicting whether it will rise or fall.

Example: If XAU/USD is $4,000, that’s the cost of one ounce of gold.

What You Should Know Before Trading XAU/USD?

Gold is traded under the symbol XAU/USD, which shows the price of one ounce of gold in US dollars. A standard lot size for gold is 100 ounces, and the value of each pip (a small price movement) depends on your trade size — for example, in a micro lot, one pip is worth $0.10. Gold often moves in the opposite direction of the US dollar, and the most active times to trade it are during the London and New York sessions. It also reacts strongly to big economic news, such as inflation reports or decisions made by the Federal Reserve.

Why People Trade XAU/USD?

The Benefits of Trading Gold in Forex

Gold (XAU/USD) is one of the most actively traded assets in forex. Traders are attracted to it because its price moves frequently, offering opportunities to profit. Gold is also considered a safe-haven asset, which means people often buy it during times of uncertainty, like inflation or geopolitical tensions, which can drive its price higher.

It often moves inversely to the U.S. dollar, helping balance portfolios, and its clear trends make it well-suited for algorithmic trading, bots, and AI tools.

$200 Billion

Average daily trading volume

1-2% on average

Daily price fluctuation

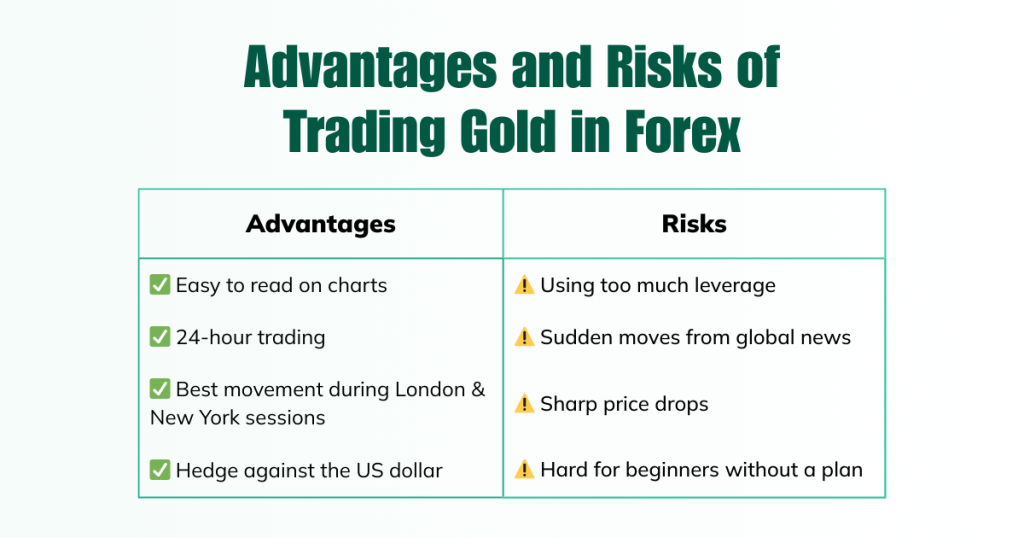

Risks of Trading Gold in Forex

Trading gold in forex can be exciting and profitable, but it also has risks. Gold prices can change fast, so you can win or lose money quickly. One big risk is using too much leverage. While it lets you trade bigger with less money, it also means even small moves can cause big losses.

Gold is also sensitive to news and global events. Things like inflation data or political problems can move the price in ways you didn’t expect, even if your strategy looked right.

Some new traders believe gold is always a safe choice, but that’s not true – gold can drop sharply too. To trade safely, use stop-losses, keep your trade size small, and always follow a clear plan. Learning before risking real money is key.

The Past and Future of Gold

What History and Trends Tell Us

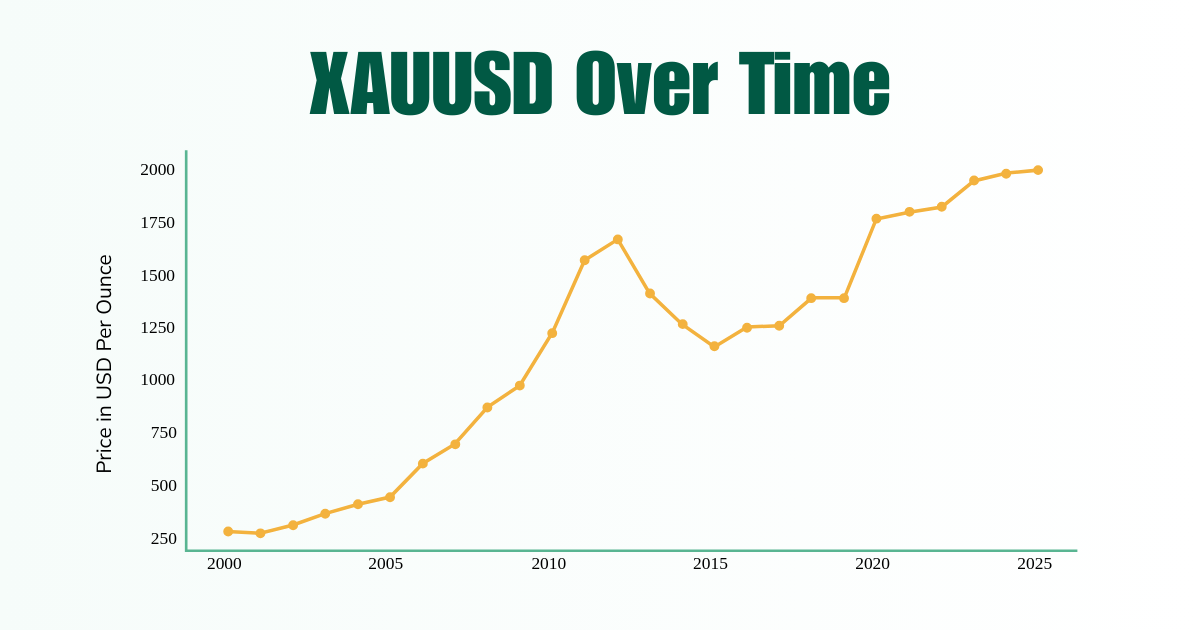

Gold has been a trusted store of value for centuries. From under $500 in the early 2000s, it soared past $1,900 in 2011 and broke $2,000 in 2020.

In 2025, gold has shattered records again, reaching over $4,200 per ounce and currently trading near $4,070 which is about 55% increase this year alone.

With ongoing inflation concerns, geopolitical risks, and strong central bank buying, most analysts expect gold to remain strong, with 2026 price targets ranging from $4,000 to $5,000+.

History proves it: when uncertainty rises, gold shines.

Year-to-date increase

Can AI Trade Gold?

Many traders now use AI bots to trade gold (XAU/USD) faster and more efficiently. These tools can follow trends, manage risk, and even place trades without human emotion.

Gold is perfect for automation because it reacts strongly to news and often follows clear patterns. A good trading bot can help catch these moves at the right time.

While AI doesn't promise profits, it can make your trading more consistent and less stressful.

Try XAUBOT for FREE and start trading GOLD with your custom-built trading bot today!

Find your Gold Strategy

Trend Following

This strategy means trading in the direction of the current trend — buy when the price is going up, and sell when it’s going down. Traders use tools like moving averages to help spot the trend and enter at the right time.

Breakout Trading

With this method, traders wait for gold to break above or below a strong support or resistance level. When that happens, it often leads to a big move. This strategy works well during high-impact news or market openings.

Range Trading

Gold sometimes moves between two price levels (a range). In this case, traders buy near the bottom of the range and sell near the top. It’s best to use this strategy when the market is calm and not trending.

Forecast & Predictions

Gold prices never stand still, and the big question for traders is always: will gold go up or down next? No one has a crystal ball, but current trends and expert views point to a clear direction.

Short term: Gold remains highly sensitive to inflation reports, Fed decisions, geopolitical events and conflicts, and dollar moves. Stubborn inflation, delayed rate hikes, or fresh global tensions typically send prices higher, while a surging dollar or aggressive tightening can trigger pullbacks.

Long term: Most analysts expect gold to keep climbing steadily, fueled by ongoing uncertainty, strong central bank buying, and its classic role as an inflation hedge. Within the next 3–5 years, many forecasts now see gold reaching above $5,000 per ounce.

With this precious metal already trading around $4,070 and breaking records in 2025, now is a smart time to keep gold on your radar, whether you’re looking for protection against inflation or a reliable safe-haven. As always, do your own research and trade responsibly.