For many aspiring traders, the chance to pass a funded trading challenge and secure a funded account feels like achieving a dream goal in their trading journey.

These traders do not look at trading as a simple way to invest some of their money. A funded trader is a professional trader, one who stands above all other traders. So such a position is certainly regarded with a lot of respect and admiration.

Naturally, getting to such a position is not the easiest thing you can do as a trader. The process can be quite challenging. There are targets that you must achieve for this purpose. But is it actually possible to pass a prop challenge on your first attempt?

In this article we want to show you that it is indeed possible to be successful on your first attempt and officially become a funded trader.

What Is a Funded Trading Challenge?

A funded trading challenge is a process whereby you have to pass certain challenges and achieve certain targets in trading. It is only after you have passed this challenge that you can receive the fund from the firm and become a funded trader.

But what sorts of targets are there?

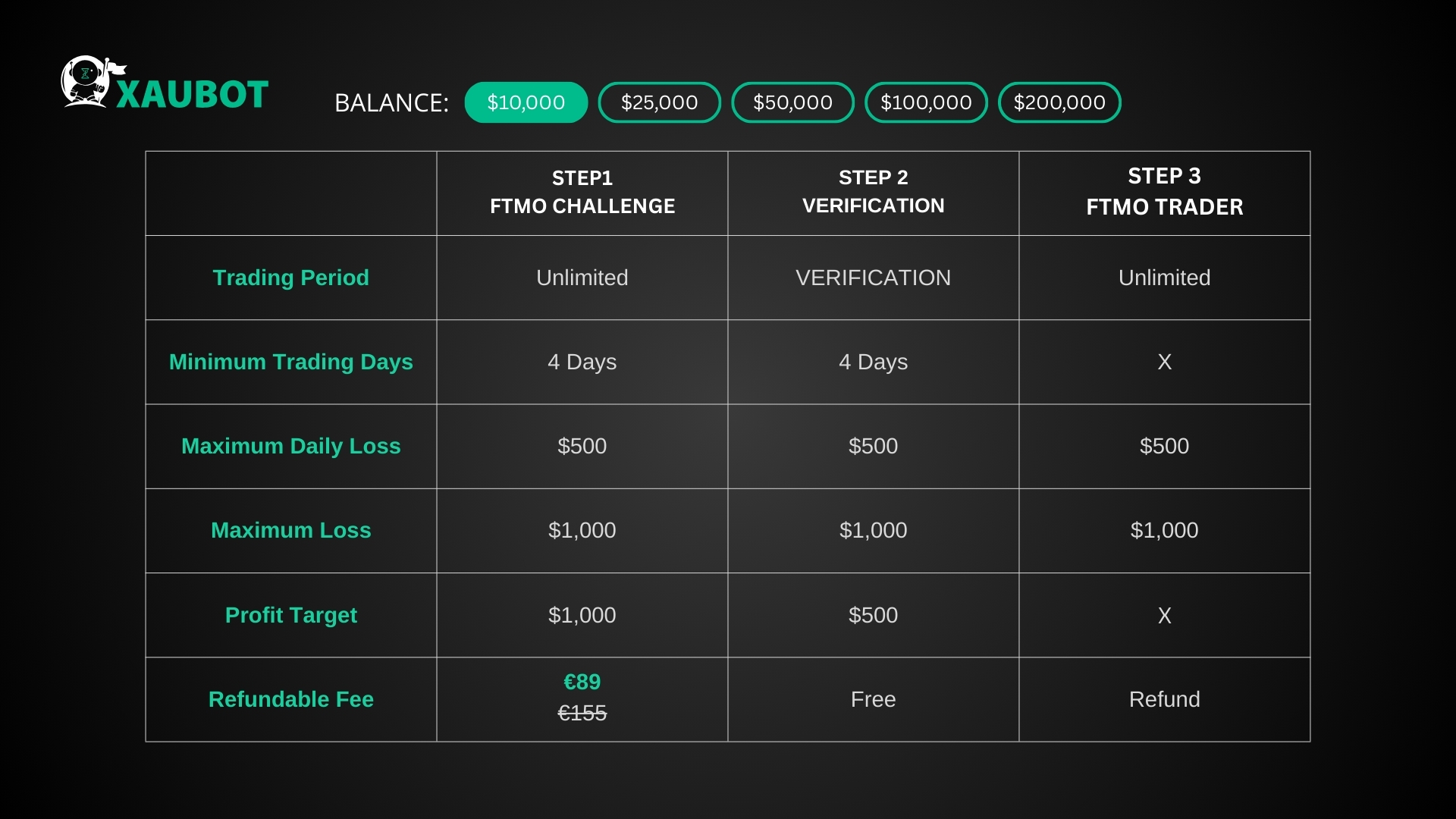

- Profit target: most importantly, you have a profit target that you must achieve. This amount is usually a percentage of the initial trading capital provided in the process of challenge. Additionally, there are time limits for such challenges, usually 30 to 60 days.

- Drawdown limits: there are limits on how much money you can lose. These drawdowns are in two forms of daily and total drawdowns. Hitting either one of them makes you disqualified.

- Trading rules: each firm has different rules about trading, such as how many positions, lots, position size, etc. that you have to follow. For example, the well-known firm FTMO says that at least 50% of the profits that traders bring in the challenge must be from positions that last longer than 2 minutes.

So, as you can see the trading rules that are set by these firms can be quite specific. It is after you have achieved these criteria that you can be said to have successfully passed the funded trading challenge.

You can take these challenges again and again. Depending on the firm, on many occasions you have to pay for the challenge. So taking them again and again could cost you a lot.

But our aim here is to avoid this situation. Let’s go step by step and see how it is possible to pass a funded account’s challenge on the first attempt successfully.

Step 1: Understand the Rules and Set Realistic Goals

As we said, the rules that are set for you by these platforms and firms can be quite specific. If you do not know exactly what you need to follow, you can easily get disqualified. Again another example can be mentioned from the prop firm FTMO where traders are NOT allowed to use any third party signals for their positions.

If you are not familiar with such rules, you can easily fall prey to your ignorance. Therefore, the very first step is to completely familiarize yourself with the exact rules that you have to follow.

Key Rules to Review:

- Profit target: the first thing to check are the profit targets that are necessary for traders. There are usually different levels that you need to pass to officially receive a funded account. There are some platforms that require you to first pass a challenge with 10% of the total capital profitability and then something like 20% or so.

- Drawdown limits: definitely make sure to check the drawdown limits and maybe even write them down and then tape it in front of you!

This is because the drawdown limit is like the off button on the process. Once hit, everything ends. And remember that there are always two forms of drawdown limits. One daily, which is usually about 5% of the starting capital, and then a total drawdown which is usually about 10% of the starting capital.

- Trading restrictions: what is the purpose of a funded account? To provide funds to the most skilled trader. So it is completely natural that there must be many rules and restrictions in the challenge process.

Completely familiarize yourself with all of these rules and restrictions. Because if you do not know them, you can lose to something that you don’t even know.

For example, most platforms state that the daily drawdown limits do not only include closed positions but also floating ones (from open positions).

Step 2: Focus on Risk Management

Because hitting the drawdown limits means the end of your challenge process, you should pay utmost attention to risk management if you want to pass the challenge on your first attempt.

You need a balanced risk management approach that can protect your positions and at the same time provide you with the space and freedom to open profitable positions with ease of mind and safely.

What are the most important things to consider in your risk management?

Here are some of the most significant factors for your risk control:

- Risk no more than 1-2% per trade: have a personal rule to not risk more than 1% to 2% of the total starting capital per each position. Even platforms themselves might have rules about this. For instance, some firms say that your maximum risk per trade cannot exceed 3% of the starting capital.

- Use stop-loss orders: make sure to always use stop loss orders to have a cap on the amount of loss that you want to tolerate per trade.

- Position sizing: this one is really important, because it is directly related to risk management (loss and drawdown) and also your ability to profit. There should be a fine balance that defines a safe position size that can at the same time bring you substantial profits.

- Daily loss limits: it is also a very good idea to have a daily stop loss defined for yourself. It is okay to have losses. It is how you react to losses that matters. Having a daily loss limit for yourself can prevent further losses within a given trading day. You can stop, reassess, and resume stronger the next day.

Step 3: Stick to a Proven Trading Strategy

You can always set out to develop your own trading strategy that is customized and tailored to your own strengths and skills. But remember that this process can be time consuming and also risky.

Because the aim here is to pass on the first attempt, it might be a better idea to use a proven trading strategy. You can even reach out to funded traders and ask for their opinion and seek help from them in this regard. Some of them have YouTube accounts and quite well-known social media presence.

Here are a few tips to remember when picking a trading strategy:

- Keep it simple: although we said that it is a good idea to use a proven trading strategy, especially one that has been used by other traders for this purpose, make sure to avoid those strategies that are overly complex.

- Use technical and fundamental analysis: never forget to use powerful technical indicators that can help you, such as moving averages, RSI, MACD, and also fundamental analysis to find potential opportunities for trade and be ready for condition changes.

- Backtest your strategy: finally, whatever strategy you end up choosing in the end, remember that it is extremely crucial that you backtest it more than once to be sure of its performance under various conditions.

Step 4: Trade with Patience and Discipline

During the process you must be in a state of total Zen. It means you have to be calm and composed as if you are practicing meditation.

Fun fact: top prop firms actually offer mindfulness training and even mindfulness coaches to their funded traders.

This must show you just how important psychology is behind every successful, funded trader. During the funded trading challenge, you have to be your own mindfulness coach! Develop a habit of being patient and practice discipline to avoid emotional thinking and emotional decision making.

Here are a few practices that can help you trade with patience and discipline:

- Avoid overtrading: don’t wear yourself out. It is true that you must hit profit targets. But you need to get there patiently and carefully. Overtrading will not help you. It might help you profit in singular instances. But it can only end in loss eventually.

- Stick to your plan: in order to avoid emotional thinking and decision making, it is important that you stick to the trading plan that you have. This will provide you with a guideline and structure to follow strictly under mental pressure.

- Take breaks: let’s be honest, who doesn’t like breaks!? Remember to give yourself a break if you feel like things are getting too much. One day of resting and taking a break from trading is much better than trading under the wrong mental conditions.

Step 5: Focus on Consistency, Not Perfection

This is such a beautiful and defining statement that we always try to tell our readers this:

A funded trader is not a perfect trader.

A funded trader is a consistent trader.

You can be perfect in one trading day or two trading days. Absolute perfect. But being a funded trader is like a job or career. You are not doing it for a couple of days, you know.

You are in it for the long run. The most important key in being a funded trader is being consistent.

You have to deliver results to the firm on a consistent basis.

- Slow and steady wins the race: don’t be the hare in the race who runs quickly but runs out of energy too quickly and then falls asleep.

Be the smart and patient tortoise who wins the race steadily with a consistent speed.

- Avoid taking unnecessary risks: a general rule for funded traders, either in the early challenge or during the actual period, is not to take risks that are not necessary. Remember, don’t be a hero. Be smart instead!

Step 6: Monitor Your Performance and Adjust

Last but not least, you must remember to track your process during the funded trading challenge. The challenge can last anywhere between 30 to 60 days.

And as we said, some firms such as FTMO have two levels of their early challenge. One is 30 and the other is 60 days. Consider that in total you will be trading for 3 months just for the challenge.

So it is not a short period. This means you have to fully monitor your performance during that time period so that you have the same level of performance throughout.

What to monitor?

- Win Rate: obviously the most important metric to track and evaluate is the win rate. It should be high and it should not fluctuate too much.

- Drawdown: another important factor is any drop in your account’s balance, either daily or over a period of time.

- Always Be Ready to Adjust: Of course the reason we say you must monitor your performance throughout the entire period of the challenge is to adjust whenever you are getting far from your ideal performance levels.

Funded Trader: Dream Position for Traders

In this article we discussed the process of passing the challenge to become a funded trader. And not just pass it, but to pass it on your first attempt. It is truly a difficult feat. But perhaps we can leave you in the end with a bit of extra motivation!

Did you know that funded traders also receive a fixed salary by most firms in addition to a share of the profits?

That’s right. Not only do you receive hundreds of thousands of dollars as capital from the firm to trade, share in the profit that you make from the trading, you also receive a fixed salary. Of course, depending on the prop firm, there can be other perks and bonuses.