For a very long time, MetaTrader 4 had the ultimate share of the trading world when it came to trading platforms. This was universally the case across multiple financial markets. But as we will see in this article, during the past few years, MetaTrader 5 has come to make some serious waves in this domain and has taken the place of MT4 in certain areas.

Given the rising popularity and application of MetaTrader 5, we are going to take this opportunity and discuss how you can create and optimize your very own expert advisor (EA) for MT5.

What Is MetaTrader 5 (MT5)?

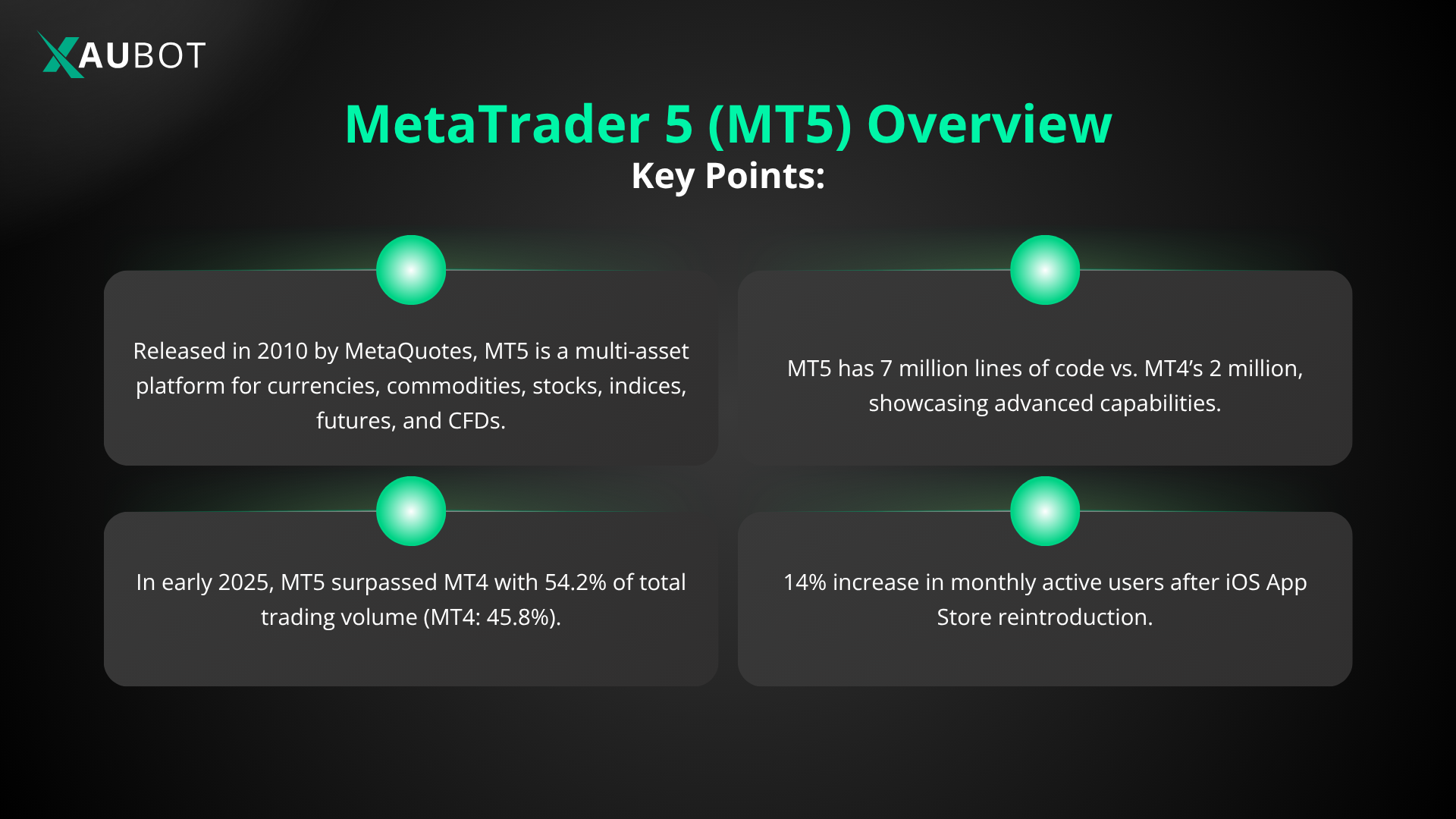

MT5, released in 2010 by MetaQuotes, is a multi-asset trading platform succeeding MT4. It supports trading in currencies, commodities, stocks, indices, futures, and CFDs. Key milestones highlight its rise:

- In early 2025, MT5 overtook MT4 with 54.2% of total trading volume compared to MT4s 45.8%.

- MT5s codebase has 7 million lines, compared to MT4s 2 million, reflecting its advanced capabilities.

- After its App Store reintroduction for iOS, MT5 saw a 14% increase in monthly active users.

What Is an Expert Advisor (EA)?

An EA is an automated trading algorithm for MT5, written in MQL5. You can either purchase pre-built EAs or create your own. Platforms such as XauBot simplify this process by offering a no-code interface to build custom EAs, which you can export as MT5-compatible files.

Creating Your Own MT5 EA with XauBot

XauBot is a user-friendly platform that empowers traders to generate tailored EAs for MT5 without coding skills. It guides you through a structured process, culminating in a downloadable EA file ready for MT5. Here is how it works:

Step 1: Market Selection

Choose the market your EA will trade, for example, Forex or Metals. This choice shapes the bots optimization for specific market dynamics, like the stability of major FX pairs or volatility of metals.

Step 2: Trading Logic

Define your EAs core trading behavior. XauBot offers:

- Multi-Level Strategy: Places trades at intervals as the market moves against your position, aiming to lower the average entry price and close in profit on reversal. It is ideal for navigating market noise but requires careful risk management.

- Scalp Strategy: Targets quick, small price movements with tight stop losses and take profits. It is suited for low-volatility periods but needs precise broker-specific tuning.

Each strategy includes detailed explanations and risk considerations to inform your choice.

Step 3: Entry Strategy

Select how your EA identifies trading opportunities. XauBot provides options like:

- XAUBOT (Popular Strategy): Combines RSI, Bollinger Bands, and Stochastic for high-probability reversal trades, focusing on price extremes with multi-indicator confirmation.

- Custom Strategy: Build your own logic step-by-step for fully personalized setups.

Each strategy details entry conditions, operational mechanics, and tips for effective use.

Step 4: Configuration

Customize risk and technical parameters based on your chosen strategy. For Multi-Level Strategy:

- Capital Allocation: Select from less than $1000, $1000–$10000, or above $10000, with guidance on account types, for example, cent accounts for smaller capital.

- Drawdown Limit: Set a percentage (1%–100%) to close all trades if losses reach your threshold.

- Risk Level: Choose Low, Medium, High, or Aggressive, balancing profit potential and exposure.

- Technical Inputs (Optional): Set Distance (default 30 pips), Take Profit (default 12 pips), Multipliers, and Time Frame (default 15m).

Step 5: News Filter

Enable or disable a filter to pause trading during high-impact news. Enabling reduces volatility risk but may limit opportunities. Disabling allows more trades but increases exposure to unpredictable price spikes.

Step 6: AI Decision Tool

Activate AI-powered trade direction filtering to align trades with real-time market sentiment from sources like Twitter, Reddit, and Investing.com. This enhances trade alignment with market momentum but does not override your strategy.

When completed, XauBot generates a custom EA file for direct import into MT5.

Backtesting and Optimization in MT5

Creating your EA is only the beginning. Testing and optimization are critical to ensure performance. MT5 has the Strategy Tester and optimizer features, which are powerful tools that allow you to optimize your EA for reliability and profitability.

Backtesting with Strategy Tester

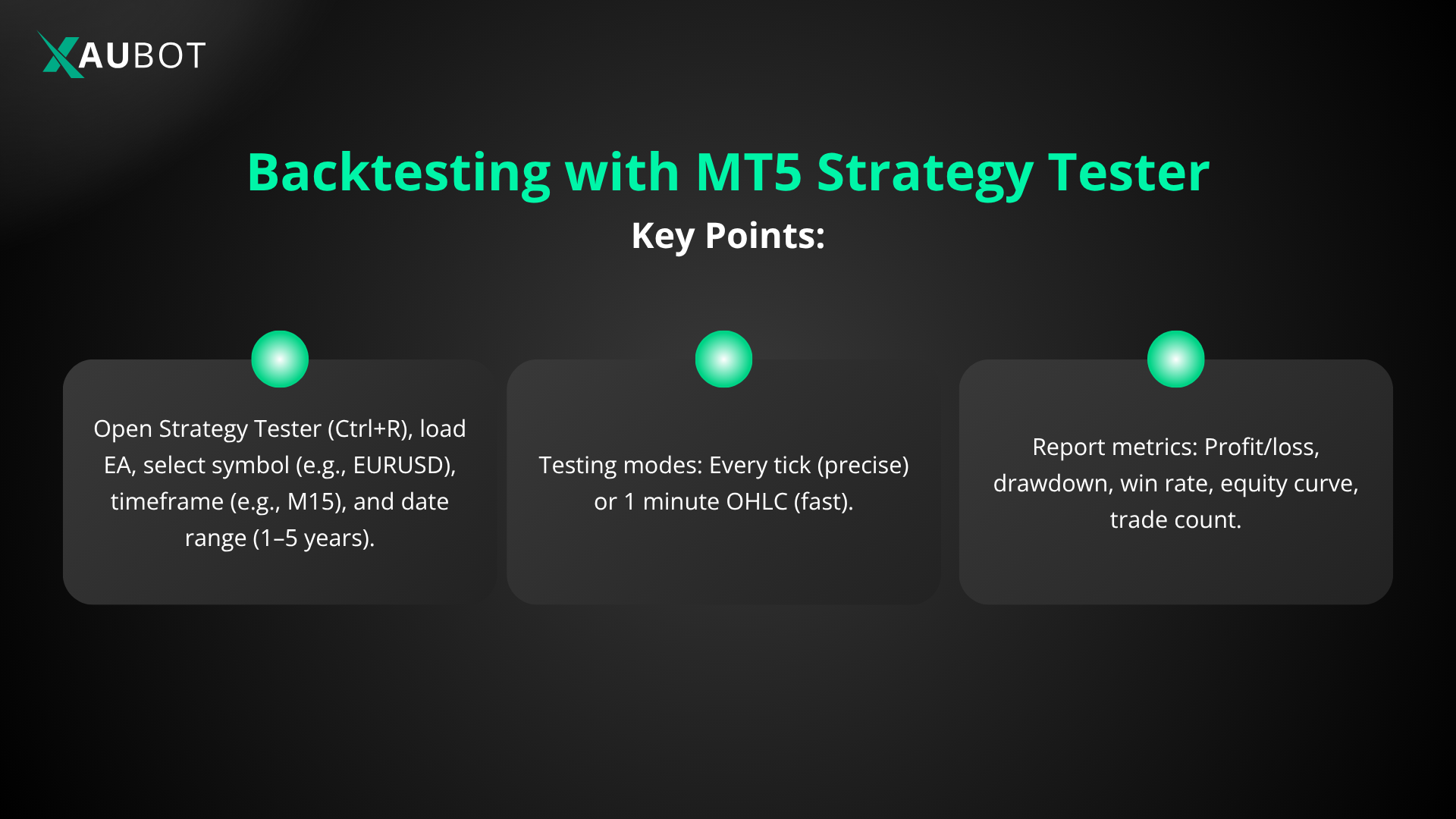

Backtesting evaluates your EAs performance against historical market data in a simulated environment. Here is how to do it:

- Open Strategy Tester in MT5 (Ctrl+R).

- Load your EA file from XauBot.

- Select the symbol, for example, EURUSD, timeframe, like M15, and date range, past 1–5 years.

- Choose a testing mode: Every tick for precision or 1 minute OHLC for faster results.

- Run the test to generate a comprehensive report, including:

- Total profit/loss

- Maximum drawdown

- Win rate

- Equity curve

- Trade count and average profit per trade

This report highlights your EAs strengths and weaknesses, helping you identify areas for improvement without risking real capital.

Optimization for Maximum Performance

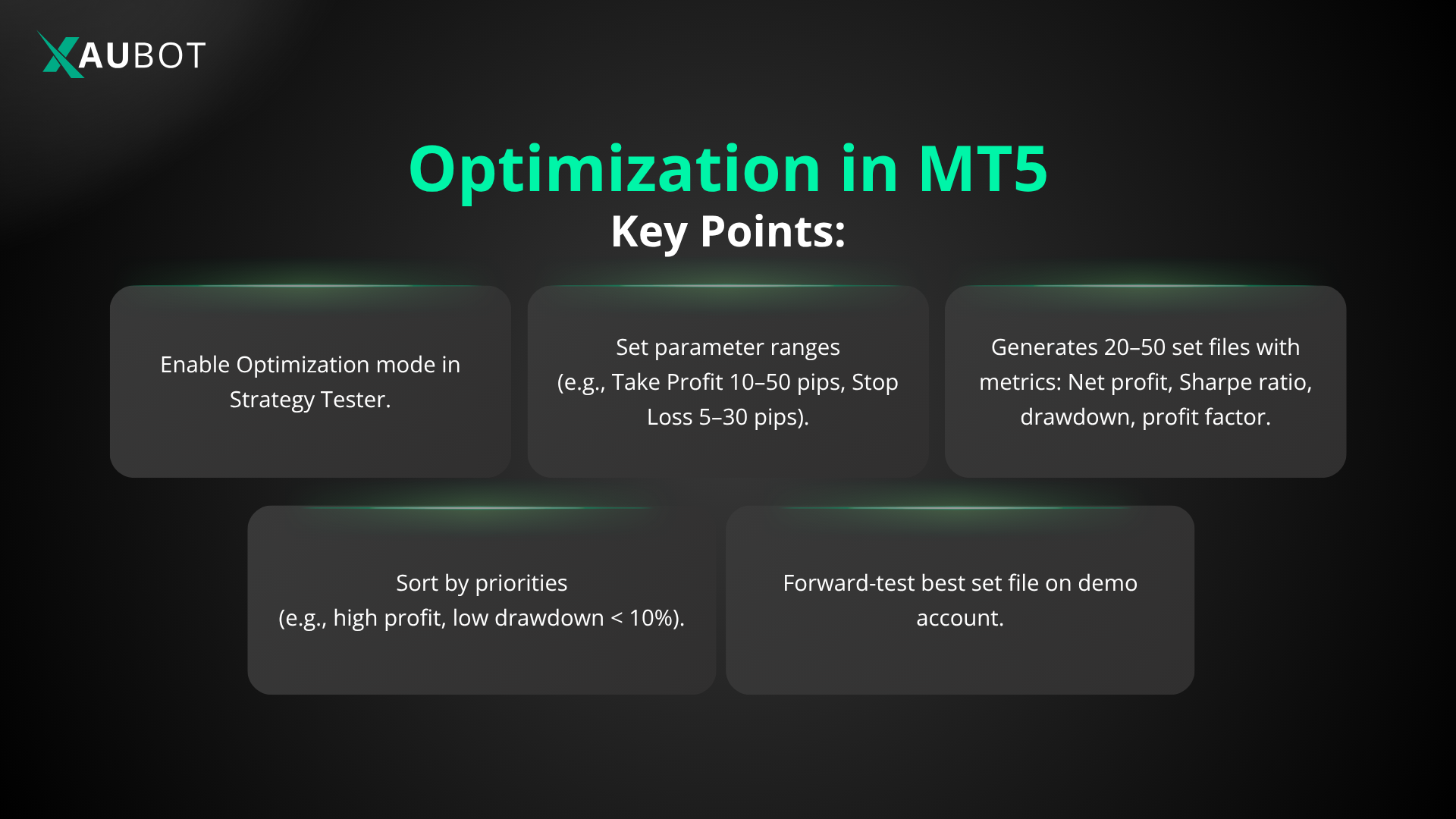

MT5s optimizer automates the process of finding the best parameter combinations for your EA, significantly enhancing its performance. Here is the process:

- In Strategy Tester, enable the Optimization mode.

- Define ranges for key parameters, for instance, Take Profit from 10–50 pips, Stop Loss from 5–30 pips, or Distance from 20–60 pips.

- Set constraints, like maximum drawdown or minimum profit factor, to filter results.

- Run the optimizer. Depending on the parameter ranges and data period, this can take hours or days, as it tests thousands of combinations.

- Review the results: MT5 generates multiple set files, typically 20–50 optimized configurations, each with metrics like:

- Net profit

- Sharpe ratio, risk-adjusted return

- Drawdown percentage

- Number of trades

- Profit factor, gross profit divided by gross loss

- Sort results by your priorities, for example, highest profit with drawdown below 10%.

- Select the top-performing set file that aligns with your risk tolerance and trading goals.

- Forward-test the chosen set file on a demo account to validate performance under live market conditions.

By combining XauBot’s flexible EA creation with MT5’s advanced testing tools, you can create a powerful, market-ready trading bot tailored to your strategy.

Final Thoughts

Even though MetaTrader 4 has been the dominant name among trading platforms for a very long time, recently we are seeing the rising popularity of MetaTrader 5, surpassing its predecessor in different areas year by year.

Given the rising importance and relevance of MT5, in this article we have discussed how you can create and optimize your own expert advisor for MetaTrader 5.