Before we can talk about developing a comprehensive and winning forex trading strategy, we need to take a look at the fundamentals of the forex market and how trading takes place in this financial venue.

There are certain aspects of the forex market that you ought to know in order to be able to develop the right strategy:

- Participants: first of all, you need to understand the type of participants that are present in the forex market. Aside from retail, individual traders, there are much bigger participants such as banks and financial institutions like hedge funds that play a serious role in the potential direction of the market.

- Pairs: of course these are the financial instruments that are traded in the forex market. This is also very important in how you decide to arrange your trading strategy. This is because certain pairs require riskier strategies with high frequency and others might be more suitable with long term and less risky strategies.

- Analysis: last but not least, another hugely important factor to consider is the type of analysis. There are two major analyses in the forex market, one being technical and the other being fundamental analysis. Ideally. Your trading strategy should accommodate both of these analysis types.

These are only the fundamentals of trading in the forex market that you need to know. In the following sections, we will take you through step by step and a to z planning guide to see how you can develop a winning trading strategy in the forex market.

Set Clear Trading Goals

First and foremost, step in building a winning trading strategy is to define your goals. If your strategy is not aligned with the goals that you have in mind, then what is the point of having a strategy in the first place?

So your trading strategy must be a reflection of your expectations from the forex market and trading in forex.

You need to define very clearly whether you are looking for short term profits only or whether you want to be in the market for the long run and profit from longer term positions.

It is also important to define how much risk you can tolerate and how much money you can stand to lose without having to leave the market.

In summation your goals should include:

- Your profit targets

- Your risk and loss tolerance

Make Sure to Use MT4 Features

Now remember, we are specifically talking about developing a winning trading strategy for the trading platform MetaTrader 4. Therefore, you need to know that there are certain features integrated into this trading platform that you can use in this regard:

- Charting Tools: make sure to use these varied charting tools in your analysis efforts to understand the market better and to make better decisions

- Technical Indicators: there are certain built-in technical indicators in the MT4 platform that can be extremely useful in many trading strategies, including RSI and various moving averages.

- Expert Advisors (EAs): your trading strategy can totally depend on an expert advisor, which is the automated trading tools and algorithms that can be integrated into MetaTrader 4.

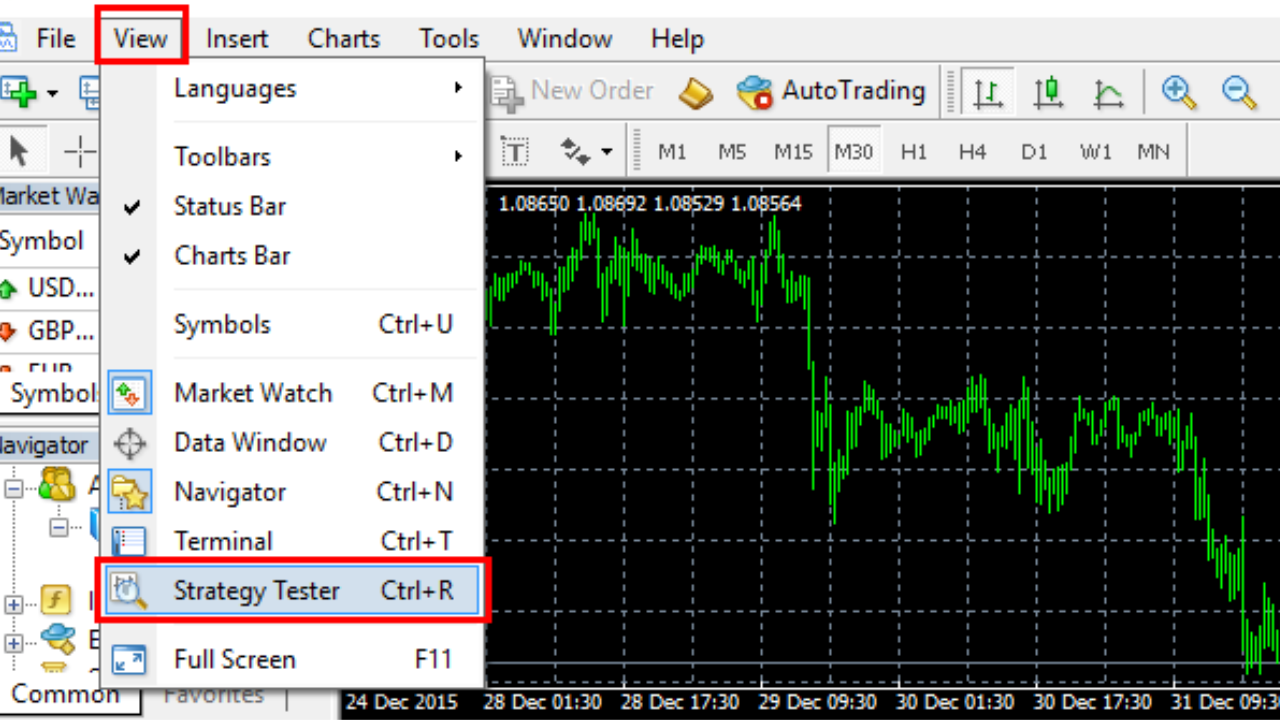

- Backtesting Tools: there are also the backtesting tools and features that are also integrated into MetaTrader 4 which you can use in order to test your entire strategy before using it in the real market, whether your strategy is mainly manual or automated through an EA.

Define Your Trading Style and Approach

Then you need to define your trading style which is the overall approach you have toward trading. This will also heavily be dependent on your trading goals. For instance, you can choose from the following styles, given your profit targets and also your risk threshold:

-

Short term and high risk style

This would be an approach such as scalping or day trading. Basically any high frequency trading strategy (HFT) can fall within this category. Naturally, in this style of trading, the frequency of trading and also the potential risks are high. But so are profit potentials. Although, profits are marginal in this style.

-

Long term and low risk style

This is naturally the opposite of the styles mentioned above. Styles and approaches such as position trading or swing trading fall within this category. This type of trading style is longer term, offers less risk but also takes longer to achieve profitability.

Define Your Entry and Exit Criteria

Whichever trading style or approach you have chosen as the main style of your MT4 trading strategy, it is extremely important to properly define entry and exit criteria for your strategy. Obviously, these would define when new positions ought to be opened and when existing positions ought to be closed.

Your overall entry and exit strategy can be based on various factors such as technical analysis including candlestick patterns and also various orders directly related to risk management such as stop loss, trading stop loss, take profit, etc.

Integrate Risk Management

This is where we basically build the foundation of a trading strategy. This is because having a winning strategy will mean nothing if it cannot be sustained. So a proper winning strategy is one that can be sustained in the long run. Risk management is extremely important in any trading strategy. It can be quite comprehensive, but ultimately there are certain pillars that ought to be built into the structure of any risk management approach:

- Position Sizing: lot size for each trading needs to be calculated properly given the current market conditions, risk levels, profit potentials, etc. This process is of course known as position sizing.

- Stop Loss and Take Profit: the use of proper risk management orders such as stop loss and take profit are highly recommended and downright necessary.

You need to know that a good trading strategy is one that is able to minimize risk. Of course loss is never totally avoidable. You are going to lose at certain points. And that is okay. But the point is to manage the drawdown that your trading account sustains.

Test Your Strategy

Once you have finished building your trading strategy, it is time to test it before actually using it. This can be easily managed through mechanisms such as the backtesting feature on MetaTrader 4.

This process is when you put your trading strategy to test using historical market data and then see how your strategy would have performed under those market conditions. Finally, you are presented with a report about the performance of your strategy against those data.

Then you can use this report to make adjustments to your trading strategy wherever necessary.

Conclusion

In this article, we focused on how you can go about developing a winning trading strategy for the trading platform MetaTrader 4. We went through tangible steps as to how you can build this strategy in order to be a sustainable and successful trader in the forex market.