Portfolio or rather a diversified Forex portfolio is the key term that is thrown around a lot these days. Everyone suggests or rather persists that you need to have a diversified portfolio. The thing is you can have a diversified portfolio within the same market, such as the forex market.

It is important to know how to build a successful and proper portfolio in the forex market. There are many details and twists to this approach. This is why in this article we want to bring this topic under close examination and see how traders can build an ideal trading portfolio in the forex market. We will also discuss creating an investment portfolio in this market.

You should read: Maximizing Efficiency Running Multiple Forex Robots in 2024

The Importance of Having a Portfolio

Why is it important to have a portfolio in the first place? A portfolio is basically your profile in the financial markets. If you don’t have a clear account of where your money is and where you have invested, then there is no way of properly managing your capital.

What having a clear and understandable portfolio will give you is the capability to fully manage your investments. This is important because as an investor you need to know which one of your investments are paying off and which ones are not. This way you can control where you ought to invest and where it would be better not to invest.

The same goes for traders. As a trader, having an optimal portfolio can help you manage your trades much better. Perhaps there is an opportunity that requires more of your capital for trading. Having a well-built portfolio can help you manage your trades in the best way possible.

Overall, a portfolio is the best way for managing your money flow. You need to know where the money comes from and where it goes. Without it, you simply do not have the necessary control over your assets.

The interesting thing is that you can build a proper portfolio even in the same market. So this doesn’t necessarily mean that you need to invest in many different markets, even though that can also be a good idea. But the point is that you can still have a diversified portfolio within the same market. And that is exactly what we are going to show you in the coming sections.

You should read: Forex Robot Development and Trends in 2024

Choose Your Forex Portfolio Type (high risk low risk shit etc.)

Now let’s get down to the brass tacks of building a forex portfolio. Where to begin? One of the very first steps is to decide on the risk level you want to have for your portfolio.

Are you looking to have a high risk forex portfolio? Or are you looking to have a more stable approach to building a portfolio? These are extremely important questions because they ultimately determine the strategies that you choose for trading and also your overall trading style.

They also play an important role in your risk management and the development of your risk control strategies. High risk strategies usually have high rewards but they also have a higher chance of loss with them. On the other hand, low risk strategies could pay off in the long run with a much lower chance of loss.

After deciding on your risk level, you need to calculate the amount of capital you want to bring in the forex market. Although the general rule is that the more money you have the more profits you can make, you can still build a very good portfolio in the forex market with little capital.

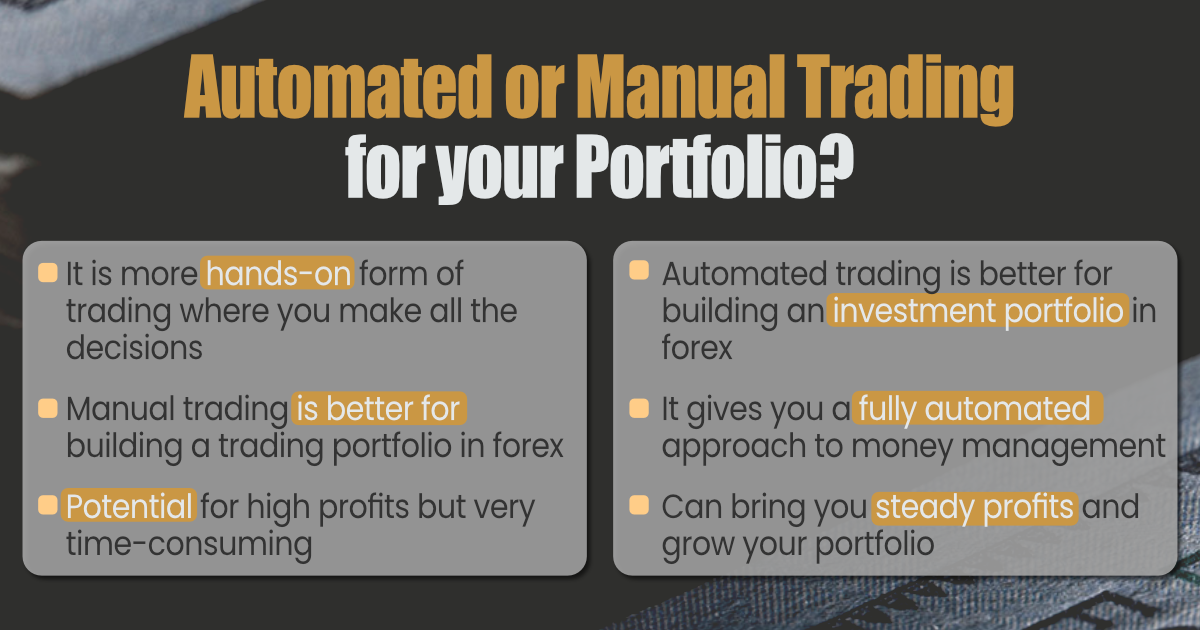

One final important decision is to pick the manual or automated trading approach for your portfolio in forex.

You should read: Is Prop Trading Better than Hedge Fund 2024?

Build a Portfolio in Forex with Manual Trading/Automated Trading

As we discussed earlier, another important decision in building your portfolio in forex is picking the overall approach to trading. As you know there are two methods of manual and automated trading.

If you build your portfolio with the help of the manual approach to trading, then you have to make all the decisions. You need to divide your capital on different forex trading pairs based on your own analysis and market knowledge.

Naturally if you decide to build a portfolio with manual trading, you need to understand the market deeply and be able to read into different signals. While this is a rather more difficult approach, it can have potentially higher profits.

The other approach, automated trading, is much more suitable and can lead you to having an investment portfolio. This is because you won’t actually be trading with this method. And your portfolio is more similar to an investment than trading.

You can use automated trading solutions such as expert advisor like XauBot Pro that can guarantee steady and stable profits on a monthly basis. One huge upside of XauBot Pro is that it will allow you to pick 5 pairs to be traded at once. In fact, because it is compatible with all trading pairs, you can build a truly diversified investment portfolio in forex with the help of this automated trading solution.

Another upside of using the automated method for building your portfolio in the forex market is that it will give you the opportunity to have enough time to build up portfolios in other financial markets.

You should read: What Is Behavioral Bias in Forex Trading?

Conclusion

Having a well-defined portfolio will give you the opportunity to better manage your assets and your capital. It gives you the chance to oversee the flow of your capital. In this article we discussed how you can build a forex portfolio and talked about the different factors that are involved in this process.