One of the most fundamental decisions you make with regard to forex trading is to choose the market in which you want to participate, or rather the financial instrument you want as the main instrument of trading. Depending on the market we have a whole lot of financial instruments that are suitable for trading, from stocks all the way to commodities, currencies, bonds, and others.

It is easy to get confused among all these different terms and financial notions. Two of these terms and markets that are often confused with each other are the forex market and the trading of futures. But even if you are not confused about them, it is still a very good question to ask as to which one of these is a better option for trading?

Is it better to trade foreign currencies in the forex market? Or is it better to trade futures? That is what we are going to focus on in his article.

What Exactly Is Forex Trading?

The word forex itself stands for foreign exchange. Naturally you can see that it is a market where foreign currencies are traded. Of course you might know that there are many different ways for exchanging and trading foreign currencies with one another. Forex is just one of them.

But what is so peculiar about forex?

The special feature of trading foreign currencies in forex is that you are dealing with their spot prices and you are in fact engaged in spot trading. This means you speculate on the price of the currencies against each other right then and there and make a decision to trade them.

This means you are not actually exchanging foreign currencies with each. You are merely making speculation about their price when they are put together. This putting together of currencies forms something known as a trading pair in the forex market.

A forex trading pair is how you are able to speculate on the value of currencies. For instance, if we consider the very popular trading pair GBP/USD we have the case where the British pound is put to be traded against the US dollar. This means in this pair the British pound is denominated by the US dollar.

So when you trade this pair you are not actually exchanging dollars with pounds or vice versa. You are merely making speculations about the value of the British pounds in terms of their dollar value.

This is a huge advantage of the forex market in terms of trading foreign currencies. Not only do you not have to exchange currencies literally, you have a chance to trade their spot prices and benefit from any changes that might occur at any moment.

This and many other advantages are why the foreign exchange market or forex has turned into the biggest financial market in the world with the highest trading volume on a daily basis.

Now that we know what forex is, let’s take a look at trading futures.

You should read: How to trade the Pound in Forex

What Does It Mean to Trade Futures?

Another form of trading is known as futures. There are two important facts that you need to keep in mind about futures:

- Futures are not limited to a certain type of asset or market. You can trade almost anything as futures, such as commodities, stocks, oil, and even currencies.

- Futures are merely a form of contract that allows you to trade such currencies mentioned above

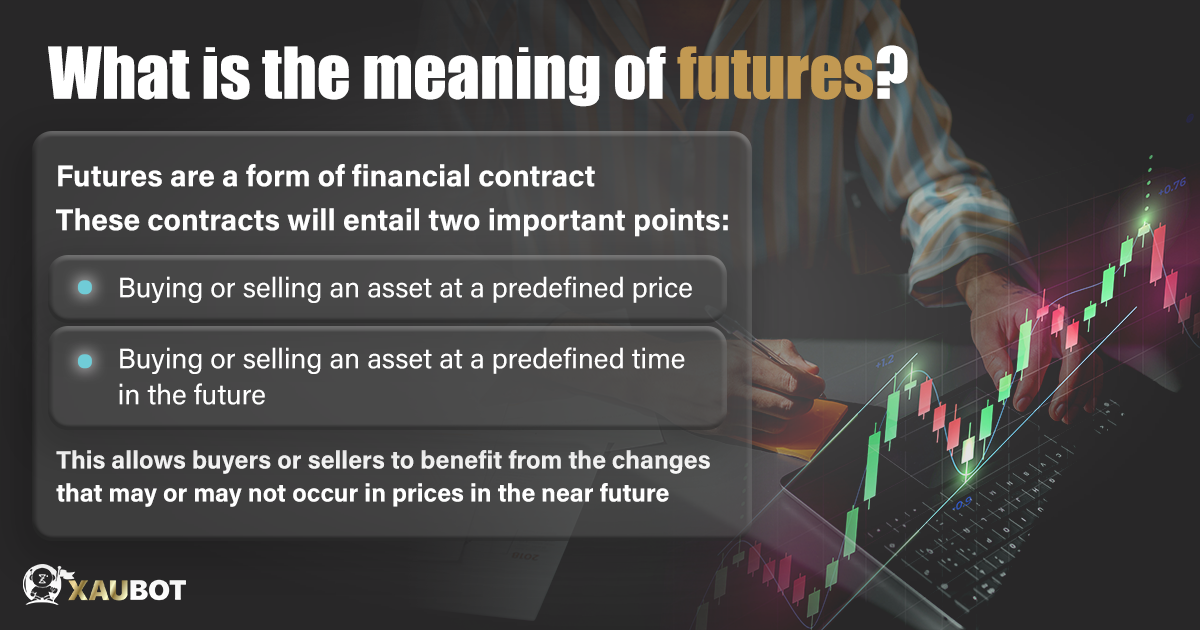

So we learned that futures are not limited to one type of financial asset or the other. There are so many different classes of assets or financial instruments that can be traded with the help of futures and in the form of futures. The second point mentioned above also says that futures are merely a form of contract. But what kind of contract exactly?

The kind of contract that takes form as part of the futures trading process is a contract between the buyer and the seller for the sale or purchase of an asset at a predefined price and also at a predefined time in the future.

So in futures trading, the price is already defined and accepted by the buyer and seller and there is even a time at which the exchange or trade will take place in the future.

Trading futures will have benefits for both buyers and sellers alike. It gives traders a change to agree upon and fix a price ahead of the time of trading or exchanging. From the point of view of the seller, it can give them assurance that even if prices fall, they will not sustain losses.

On the other hand and from the point of view of the buyer, trading futures gives them the chance to lock in prices ahead of time so they know they won’t miss out on the chance for profit even if prices change.

You should read: Learn how to trade the Chinese Yuan symbol in Forex

Comparing Forex Trading and Trading Futures: Which Is Suitable for You?

So far in the article we discussed the notion of trading in the forex market and what it means to trade foreign currencies in the forex market and we also took a look at what it means to trade futures.

Knowing both of these concepts and how they work, it is rather easy to see which one is more suitable for your trading needs.

The forex market is a decentralized and rather unregulated space for trading foreign currencies on the spot by speculating their prices. Futures, on the other hand, give you a chance to lock in prices ahead of time. But of course this requires a very precise and accurate market analysis.

In any case, if you have decided to trade foreign currencies, make sure to weigh the pros and cons and the different conditions of the forex market and trading them in the form of futures.

You should read: How to make money with arbitrage strategy in Forex

Conclusion

Trading foreign currencies is the most popular method of trading in the world, because it has the highest trading volume among all other financial assets. As such there are different modes and methods for trading them. One is to do it in the forex market and the other is to do it in the form of futures. In this article we discussed both of these methods of trading for foreign currencies.