The world of Forex Trading is filled with pitfalls and traps that could lead any trader astray, no matter how skilled or experienced they might be. Naturally, if we want to talk about all the factors that could possibly confuse the traders or otherwise make the process of trading go wrong, then it might take a hundred articles. So in this article we want to focus on a specific type of bias that can impact your trades in the forex market. And that is behavioral bias.

Becoming a successful trader takes more than having a substantial initial capital and a good trading strategy. It also demands a lot on the side of your character and personality. It is in fact the mind of a seasoned and disciplined trader that defines the outcome of his or her trades.

So read along with us in this article as we discover the notion of behavioral bias in the forex market and in trading in general, as well the different types of behavioral bias and the many guises under which it can appear to you as a trader.

Behavioral Bias in Forex Trading

In very simple terms, behavioral bias, as the name suggests, is the wrong direction or wrong judgment you make because of a behavioral reason. In fact, this field is so extensive in the world of finance and trading that there is a whole field of economics that deals with the psychological and behavioral aspects of trading.

Biases in the forex market, and of course in any other financial market, can exist for a number of reasons. They can be there because of our own inherent misconceptions that we have or because of how our mind has been wired to think about the market, trading, profits, losses, finances, and even money in general.

And as we said, it really doesn’t matter just how much experience you might have, you can even be 10 years into a trading career and still be swayed in the wrong direction as a result of mental biases that are haunting your trading process.

Basically, there is not a single person that would be exempt from these biases as a default mode. We all have them. So what can we do about them?

The only way to manage these biases is to know and understand them. When you know what they are, then you can take action to tackle them in the best way possible.

You should read: Creating Profitable Forex bot Trading Strategies in 2024

A Full List of Behavioral Biases in Forex Trading

So far we talked about the notion of bias in general in the financial market, and in specific behavioral biases that have their roots in our personalities and mindset.

As we saw, the only way we can combat them in our trading process and make sure that our trading decisions are not made under their influence, is to know them and understand them completely.

So the following is a full list of the most well-known mental and behavioral biases that affect our trading.

-

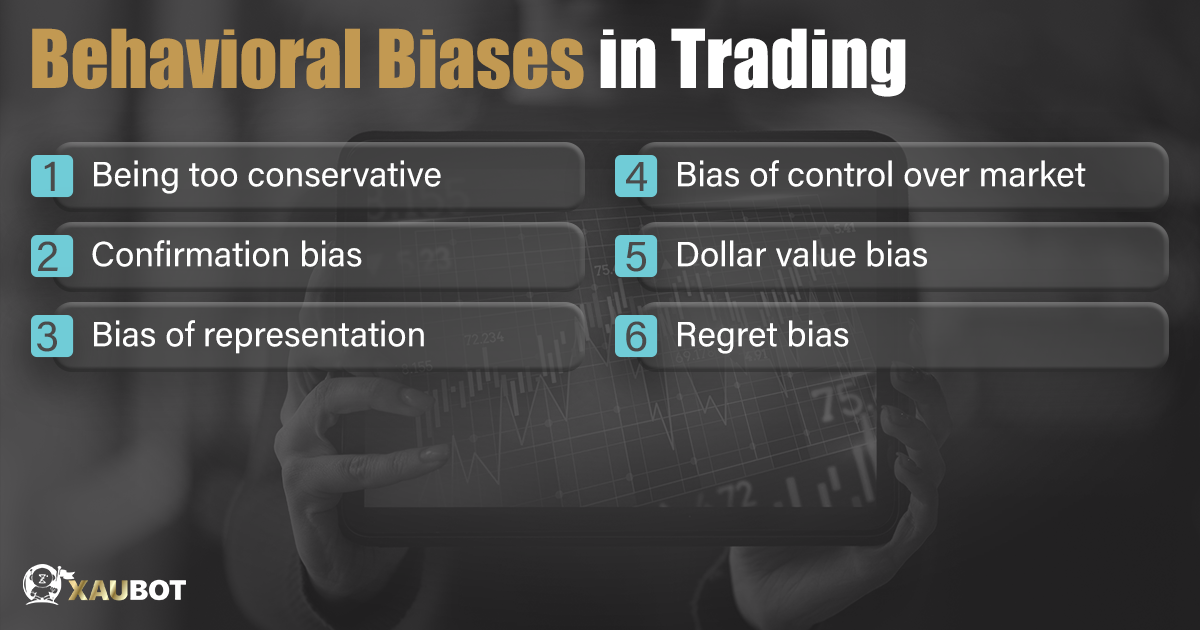

Being too conservative

This bias is regarding a trait in which the trader will not let go of their preconceptions with regard to trading and financial markets. We all come into the market and begin trading with a certain mindset about trading and profiting. These beliefs can easily hold us back if we are not willing to let go of them. In fact, this is the case with many traders, whereby their trading process is held back by their own insistence on their old beliefs. Remember that a good trader is always learning and growing. So keep yourself dynamic.

You should read: A Step-by-Step Guide to Setting up Your Forex Trading Robot in 2024

-

Confirmation bias

This is one of the most common biases and quite a devastating one at that. According to this bias, your brain will try to find evidence in order to prove what you already believe. So if you already have the opinion that prices are going to increase in the next week, then you will do your best to find evidence in the market that points to that direction. But this gives you tunnel visions and you will lose sight of the bigger picture.

-

Bias of representation

According to this bias, your mind will take patterns and consider them as representations of their condition and circumstance. So when you find a certain pattern in the market you will generalize it and associate it with your previous understanding of that pattern because you think they represent the same thing, while they do not.

-

Bias of control over market

This is one of the most dangerous biases in trading, whereby traders believe that they know full well how the market is going to change. What you need to know is that no one, literally no one, knows how the market is going to change for sure. It is all hunches and calculations. So make sure you do not get weirdly conspiratorial about your powers of market prediction!

-

Dollar value bias

This is an important bias especially in a market such as the forex market. According to this bias, traders will keep thinking about their profits in terms of their dollar value. While this is clearly wrong and you need to think about your profits in terms of percentages. Why? Because profiting $100 with an initial deposit of $500 is a profit of 20%, which is quite amazing. But profiting $100 with an initial deposit of $5000 is a profit of 2%. So clearly, while these two profit figures are both $100, they are not at all the same.

You should read: Troubleshooting Common Issues with Forex trading robots

-

Regret bias in Forex Trading

The last on our list is regrets bias. In this behavioral bias, a trader will not be able to remove the negative experiences of the past in their trading and those experiences will continue affecting their future trades. But that is clearly wrong. You need to know that loss is an inevitable part of trading in all financial markets and you should not beat yourself on the head too much if you have sustained losses at one point. Without letting it impact your confidence and future trades, you need to move on from a loss while trying to learn from it and improve your trading approach for the next ones.

You should read: Scalping vs. Swing Trading with Forex bots in 2024

Conclusion

Behavioral bias is the misconception that we have with regard to trading that comes from our character or mindset. These biases can lead a trader toward a path that is not profitable in the long term. So it is very important to know these biases and tackle them. In this article we discussed the notion of behavioral bias in trading and also presented you with a list of the most important biases in this regard.