The interrelations and interactive mechanisms that exist in and among all financial markets drive them forward and are the most important factors for anyone to keep track of a given financial market.

The foreign exchange market is much bigger than most financial markets, almost in any aspect, whether sheer size of numbers or the widespread markets that exist all over the world.

Due to this great reach of the market and its distribution around the world, the forex market is affected by so many different factors. And in order to be a good trader, aside from the ability to directly assess and analyze the market and your chosen trading pair at the moment, you also need to be able to analyze the bigger picture.

There are numerous economic indicators that can impact the forex market. In this article, we want to go through these indicators so that you can take them into account to make more well-informed and thought out decisions.

Employment and Unemployment Rates

The rates regarding employment and unemployment are two of the most important financial indicators in every single economy in the world.

Employment and unemployment are respectively defined as the percentage of the workforce currently under one form of employment and also the percentage of the workforce who are currently seeking employment.

Out of these two, of course unemployment is more important due to its sheer force on the market, and this of course includes the foreign exchange market. Among the peculiarities of the unemployment rate is that it will fall, or rather increase more into the negative, even after the GDP has stopped decreasing. So unemployment rates can be even more damaging to the economy. This, in turn, will damage the fiat currency belonging to that economy.

Furthermore, unemployment rates can impact consumer indexes such as consumer confidence and consumer price index. As a result, it can further drive the value of the correlated currency down.

This is why when unemployment rates, especially those of major economies, experience a negative change, they can impact the forex market.

Gross Domestic Product (GDP)

Gross Domestic Product (GDP)

There are certain economic indicators that are used to measure the strength of any economy. Among them is of course the gross domestic product or GDP.

The unique characteristic of the gross domestic product is that in order to measure this figure, such vast and wide ranging factors are taken into measurement. Therefore, the GDP of any economy can tell a lot about that economy. Hence GDP is the most important factor for the health of an economy.

Therefore, when the GDP of any economy is pronounced, experienced traders can almost instantly and directly be able to forecast the upcoming changes in the economy that will eventually manifest in the fiat currencies.

GDP is perhaps the most important economic indicator in the foreign exchange market.

Inflation Consumer Price Index (CPI)

Consumer Price Index (CPI) in forex

Another significantly impactful economic indicator in the forex market is the consumer price index, which is more commonly known as inflation. Almost all major economies in the world release data pertaining to inflation on a monthly basis.

The consumer price index or inflation is also among those economic indicators that sharply and directly impact the foreign exchange market. The reason being that inflation literally occurs when the value of a country’s currency drops.

This is how any increase or decrease in the rates of inflation will almost instantaneously impact the foreign exchange rates.

But similar to many other economic indicators, the consumer price index can also impact other economic aspects, including the GDP, consumer sentiment, and of course the overall living standards of citizens. All of these will ultimately impact that fiat currency of that economy either positively or negatively, thus impacting the foreign exchange rates.

Trade Deficit

Another economic indicator that is effective in how the prices turn out in the forex markets and is also impactful on the overall health and strength of a country’s economy is known as the trade deficit.

Trade deficit or trade balance is defined as the difference between an economy’s exports and imports. Of course, when a country’s exports outweigh its imports, there is a positive trade balance. The positive trade balance means the economy is so strong that not only is it producing enough for the needs of its country, but also it has enough and high quality products to be a major exporter.

The other side is an undesirable feature that no economy wants to have. When the trade balance is negative or when there is a big trade deficit in an economy, it means that the economy imports more than it exports. Clearly, this is indicative of a weak economy – one that is not able to produce enough to itself and of course not enough either to export to other economies.

Major economies also publish their trade balance figures regularly. A positive trade balance, i.e. a powerful economy will naturally have a more valuable fiat currency.

Consumer Confidence Index (CCI)

Consumer Confidence Index (CCI) in forex

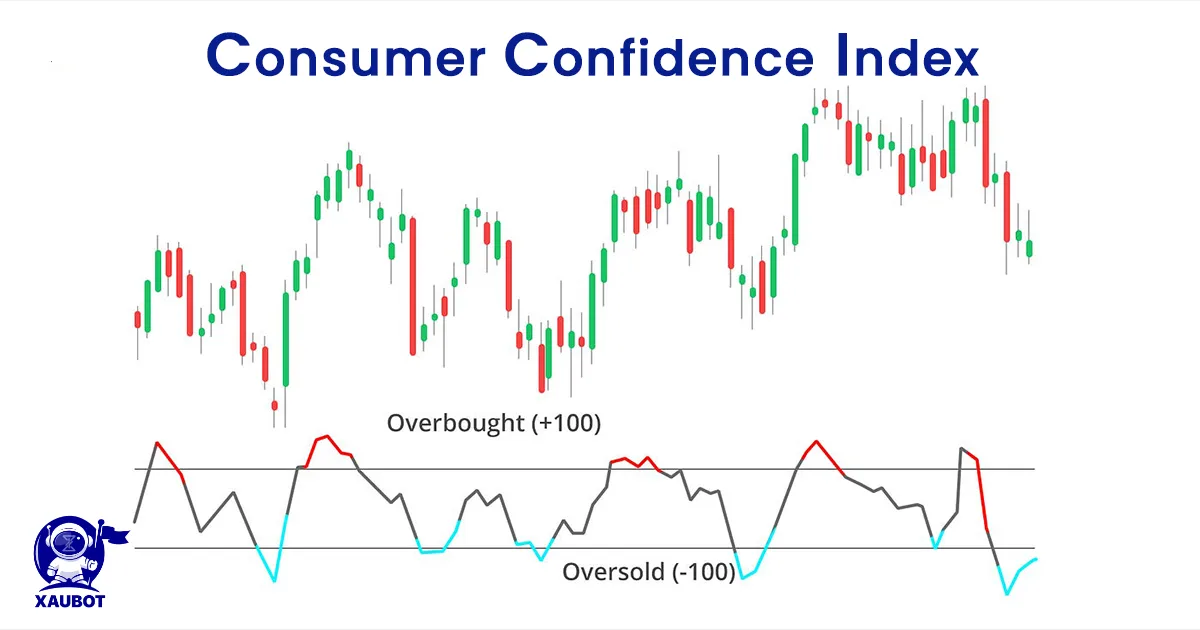

There are many different types of consumer surveys in all economies. In our list of economic indicators that impact the forex market, we have already discussed the consumer price index. Now, we want to take a look at the consumer confidence index or CCI.

Before discussing the consumer confidence index, let’s see why consumer indices are important in the first place. Almost all economies around the world, especially major economies, are operated based on one or another form of capitalism. And the most important pillar of capitalism is the consumer. How consumers feel about the economy and spending money is extremely important to these economies.

The consumer confidence index simply shows how much confidence the consumers have in their economy. This confidence is manifested in how much assurance people have in their job safety, retirement plans, pensions, salaries, prices, inflation, etc. Of course, when the consumer confidence index is high, it means people are not economically panicked and they trust the financial apparatus of their country.

This, in turn, will drive consumer expenditure higher. When people have trust in their economy, they get out and spend their money with ease of mind, not being afraid of what the future might hold.

Higher spending is another factor for the health of the economy. As such it will ultimately translate as the higher value of the country’s fiat currency.

This is how the consumer confidence index can be an important indicator for forex traders to keep in mind.

Federal Interest Rates

Interest rates in any country are crucially important for the forex market, because they can impact the value of that country’s fiat currency.

So, why are we discussing the US interest rates? The reason US interest rates or Federal interest rates are so important for the forex market is that the trading pairs that include the US dollar are responsible for the majority of the trading volume in foreign exchange trades.

This is why when the Federal Reserve tampers with the interest rates, they can directly impact the value of the almighty US dollar.

Forex traders follow US interest rates closely, as it is even more important than many other factors for the US dollar, since many factors never get too bad for the mother of capitalism.

Industrial Production Index (IPI)

Industrial Production Index (IPI) in forex

The last economic indicator on our list is another report from the US and published by the US Federal Reserve, which is the equivalent of a central bank in the United States.

The industrial production index refers to the amount of industrial output – this output is not measured in terms of dollars rather than the quantifiable amount of produced goods and materials.

The reason industrial production is impactful even in the forex market is that these figures can impact the amount of exports of the US and also the overall domestic health of the US economy.

Conclusion

The foreign exchange or forex market is a vast and deep ocean of financial maneuvering. It takes a very intelligent and smart trader in order to survive and thrive in this market.

So what makes a trader a smart trader? A smart trader is one who has a thousand eyes. Sounds impossible? Well, this is exactly what separates the countless amateur and unsuccessful traders from the seasoned and vastly affluent few traders.

Some of those sharp trader eyes must be set on the bigger picture economic indicators that can impact the forex market. In this article we saw the most important economic indicators, and perhaps the most interesting fact is just how many of them are related to the US economy.

FAQ:

Q: How do economic indicators affect the forex market?

A: Economic indicators can have a significant impact on the forex market because they provide information about the state of a country’s economy. Positive economic indicators, such as a strong GDP growth rate, can lead to increased demand for a country’s currency, which can result in a rise in its exchange rate. Conversely, negative economic indicators, such as high unemployment rates or low inflation, can lead to decreased demand for a country’s currency, resulting in a decline in its exchange rate.

Q: What are some of the most important economic indicators for forex traders to watch?

A: Some of the most important economic indicators for forex traders to watch include GDP, CPI, unemployment rate, retail sales, and trade balance. These indicators can provide insights into the overall health of a country’s economy and its potential impact on its currency.

Q: How often are economic indicators released?

A: Economic indicators are typically released on a regular schedule, with some being released monthly, quarterly, or annually. The release dates and times of economic indicators are typically scheduled ahead of time and can be found on economic calendars.

Q: How do forex traders use economic indicators in their trading strategies?

A: Forex traders use economic indicators to help them make informed trading decisions. They may use technical analysis or fundamental analysis to analyze the impact of economic indicators on the market and adjust their trading strategies accordingly. Some traders may also use economic indicators to identify potential trading opportunities or to determine when to enter or exit a trade.