The 5-3-1 rule stands out as one of the simplest yet most powerful frameworks for building discipline in trading.

Especially popular among forex traders, this approach helps cut through the overwhelming choices in markets that run around the clock with countless pairs and endless strategies.

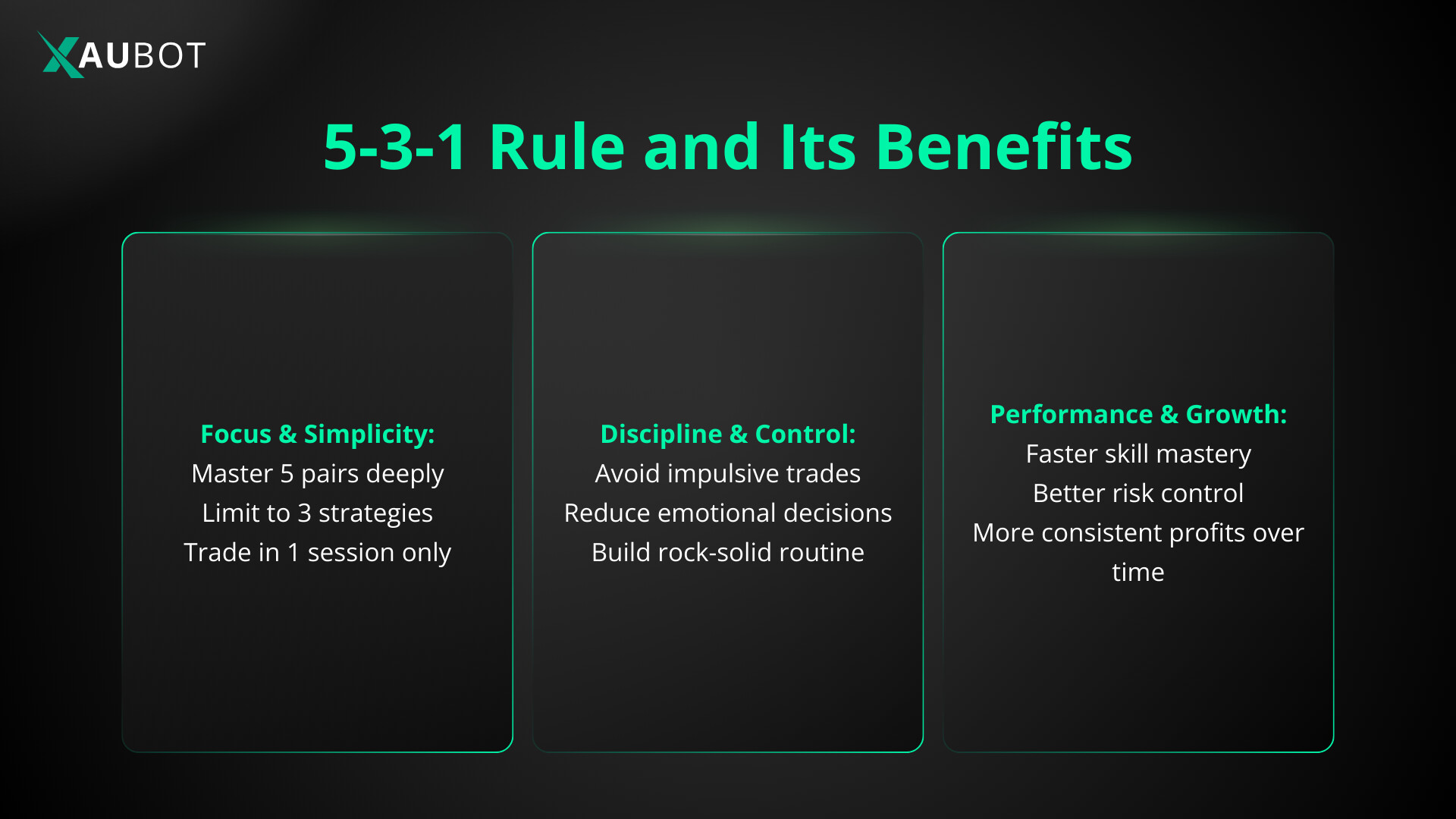

By limiting focus to just a few key elements, traders avoid scattered decisions, reduce emotional trading, and build deeper expertise over time.

At its core, the rule breaks down into three clear limits that promote consistency and quality over quantity.

The Meaning Behind 5-3-1

The numbers represent practical boundaries designed to simplify your trading routine.

- 5 stands for focusing on only five currency pairs (or trading instruments). Instead of jumping between dozens of assets, you master a small group. This allows you to study their behavior, key levels, news impacts, and typical movements in depth. Popular choices often include major pairs like EUR/USD, GBP/USD, USD/JPY, AUD/USD, and USD/CHF because of their high liquidity, tight spreads, and reliable patterns.

- 3 means sticking to just three trading strategies. Rather than chasing every new indicator or system, you develop and refine three solid approaches that suit different market conditions. For example, one could be trend following with moving averages, another breakout trading on support and resistance, and the third mean reversion using oscillators like RSI. Mastering a few keeps you adaptable without constant switching that leads to confusion.

- 1 refers to trading during only one specific time of day or session. You pick one consistent window, such as the London open, New York overlap, or Asian session, and trade only then. This matches your lifestyle, avoids fatigue from watching charts all day, and lets you capitalize on the volatility and liquidity that suit your style best.

This structure encourages depth instead of breadth, helping traders turn random attempts into repeatable processes.

Why the 5-3-1 Rule Works So Well

Many traders struggle because the forex market offers too much freedom. Endless pairs, strategies, and hours lead to overtrading, poor risk management, and emotional burnout. The 5-3-1 rule counters this by forcing focus.

Benefits include:

- Sharper market understanding from specializing in fewer pairs

- Better strategy execution since you refine only a handful

- Stronger discipline by committing to one trading window

- Reduced stress and clearer decision-making

- Easier backtesting and improvement over time

Traders who follow similar focused approaches often report more consistent results because they spend energy mastering what works for them rather than scattering efforts.

How to Apply the 5-3-1 Rule Step by Step?

Start by building your personal version of the rule.

First, select your five pairs. Choose ones you already understand or that align with your timezone and risk tolerance. Test them on historical data to confirm they suit your style.

Next, define your three strategies. Pick ones with clear entry, exit, and risk rules. Backtest each thoroughly on your chosen pairs to ensure they perform across trending, ranging, and volatile conditions. Include solid risk management, such as never risking more than one to two percent of your account per trade.

Then, pick your one trading time. Consider your schedule and when your pairs move most. For instance, if you prefer high volatility, the London-New York overlap often delivers strong moves in majors. Stick to this window religiously to build routine.

Finally, implement the rule in practice. Use a demo account first to confirm everything fits together. Once live, review trades weekly to tweak without breaking the core limits.

Integrating 5-3-1 with Automated Trading

Custom bots and expert advisors shine when built around focused rules like 5-3-1. You can generate bots tailored to your selected pairs, strategies, and preferred trading hours for export to MT4 or MT5.

For example, program one bot per strategy on your top pairs, set to activate only during your chosen session. This automation enforces discipline while you sleep or handle other tasks. Test combinations extensively to find the most reliable setups.

The beauty lies in simplicity. By limiting scope, your bots gain precision and your overall trading becomes more sustainable.

Final Thoughts on the 5-3-1 Rule

The 5-3-1 rule, like other rules in trading, proves that less often means more in trading. It transforms chaos into clarity, helping both beginners avoid common pitfalls and experienced traders sharpen their edge. Start small, stay consistent, and let focus drive your progress.

Whether manual or automated, embracing this framework builds the foundation for long-term success in dynamic markets. Refine your five, three, and one, then watch how structured trading changes your results.