Expert Advisors continue to transform automated trading on platforms such as MT4 and MT5. Selecting the right timeframe stands as one of the most critical decisions when building or running a custom trading bot.

The timeframe directly influences signal quality, trade frequency, risk exposure, and overall performance in live markets.

In recent years, successful automated systems have shown clear preferences depending on strategy type. Data from various high-performing EAs highlight distinct patterns across different approaches.

What Is a Timeframe?

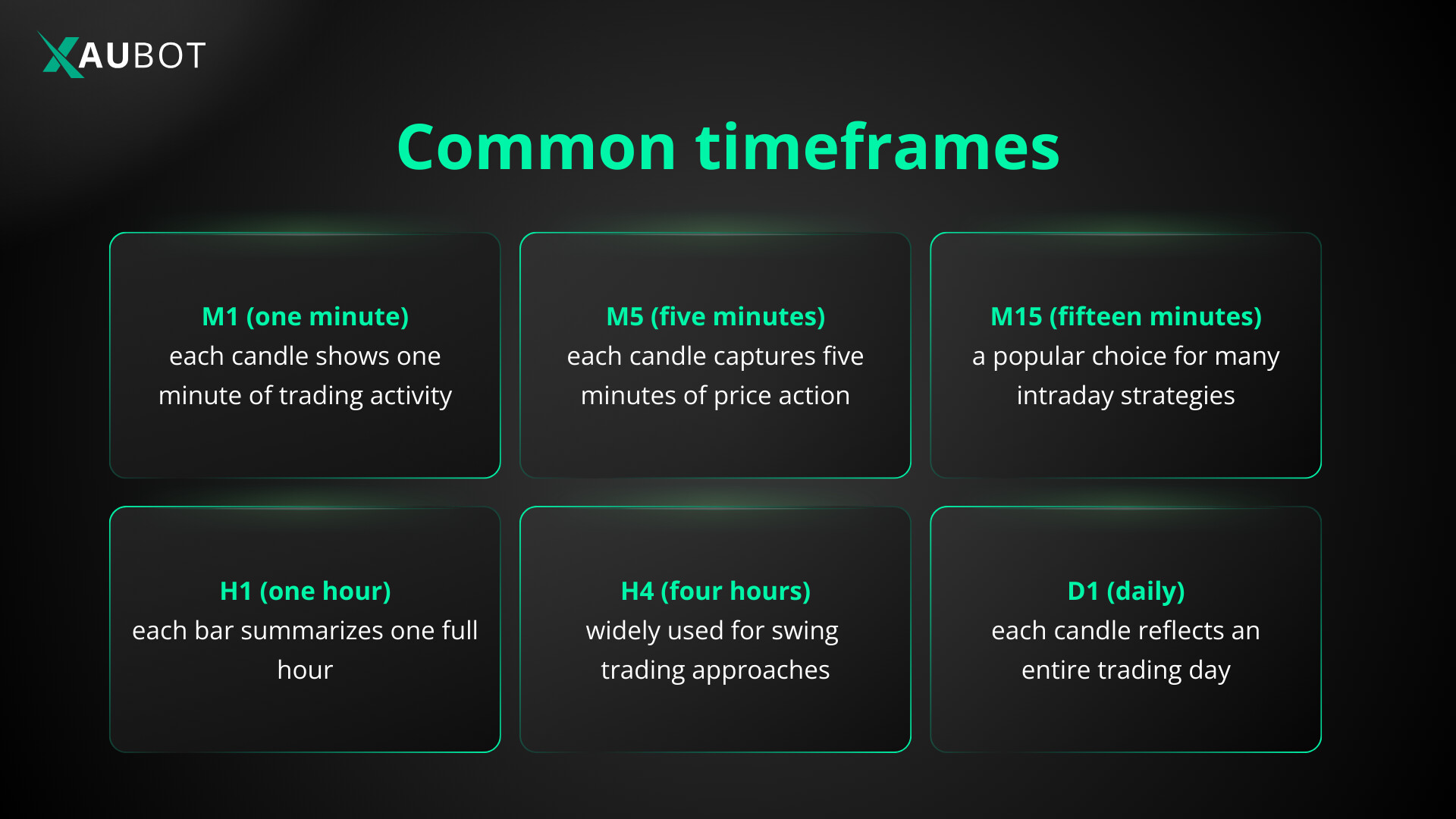

A timeframe represents the duration each candlestick or bar covers on a price chart. It defines the period used to group price data, showing how the market moved during that specific interval.

Imagine you are watching a movie of the market price. The timeframe decides how much of the movie each single picture (candle) shows:

- M1 (1-minute)

Each candle shows only 1 minute of trading. You see every small wiggle in price. This is like watching the market in super slow motion with lots of detail, but it can feel very busy and noisy.

- M5 (5-minute)

Each candle covers 5 minutes. It still shows quite fast movements but groups the tiny ups and downs into slightly bigger steps. Many traders like this speed because it gives a good mix of detail and clarity.

- M15 (15-minute)

Each candle represents 15 minutes of trading. This is one of the most loved timeframes for people who trade during the day. It cuts out a lot of the small random noise while still letting you catch good intraday moves.

- H1 (1-hour)

Each candle shows a full hour of price action. Now you start seeing clearer patterns because the chart ignores most of the tiny back-and-forth that happens every few minutes. It feels calmer and more organized.

- H4 (4-hour)

Each candle covers 4 hours. This is great for traders who do not want to stare at the screen all day. It shows the stronger, more important swings in the market and is very popular for swing trading (holding trades for several days).

- D1 (daily)

Each candle shows everything that happened in one full trading day. This timeframe ignores all the hourly ups and downs and focuses only on the big daily direction. It is perfect if you prefer very patient, low-stress trading and want to follow major trends.

The timeframe you select determines the level of detail visible on the chart. Shorter timeframes reveal more granular movements and produce more signals, while longer timeframes smooth out noise and highlight bigger trends.

Short Timeframes for High-Frequency Strategies

Scalping and fast-paced bots thrive on ultra-short charts where small price movements create numerous opportunities.

Popular choices include:

- M1 (1-minute) charts for aggressive gold scalpers that rely on precise pending orders and tight risk controls

- M5 (5-minute) charts for versatile scalpers targeting quick profits in major pairs or volatile assets like XAUUSD

These lower timeframes generate high trade volumes, often dozens per day. They suit bots designed for low-spread environments and rapid execution. However, they remain sensitive to broker conditions such as slippage and spreads, which can erode profits during volatile periods.

Many top-rated scalping EAs in 2026 operate effectively on M5 or M15, delivering consistent results when optimized properly.

Medium Timeframes for Balanced Performance

A growing number of reliable Expert Advisors favor mid-range charts that reduce noise while maintaining reasonable trade frequency.

Key performers often use:

- M15 (15-minute) charts for trend-aligned entries with strong win rates in major currency pairs

- H1 (1-hour) charts for robust signals that filter out minor fluctuations

Several prominent systems show exceptional net profits on M15, with high percentages of winning trades over multi-month periods.

This timeframe strikes an excellent balance for bots that incorporate AI pattern recognition or multi-indicator logic. It allows sufficient data for meaningful analysis without the excessive noise of shorter charts.

Higher Timeframes for Stability and Trend Following

For traders seeking lower stress and fewer but higher-quality trades, longer timeframes deliver superior reliability.

Common recommendations include:

- H4 (4-hour) charts for swing-style automation that captures larger market moves

- D1 (daily) charts for position-based bots focused on major trends

Higher timeframes produce signals less prone to false breakouts, making them ideal for trend-following or mean-reversion strategies. They suit conservative approaches where drawdowns stay controlled over extended periods.

Matching Timeframe to Your Strategy Type

The optimal choice always aligns with the core logic of your bot.

- Scalping bots excel on M1 to M15, capitalizing on micro-movements in high-liquidity sessions

- Day trading or intraday bots perform strongly on M15 to H1, benefiting from intraday volatility without overnight risks

- Swing or trend bots shine on H1 to D1, prioritizing signal strength over quantity

Many advanced custom bots now employ multi-timeframe analysis, confirming entries on lower charts while using higher ones for overall direction.

Final Thoughts on Choosing Timeframes

The best timeframe rarely remains static. Market conditions evolve, so regular optimization keeps your automated system competitive. Start with popular proven options like M15 or H1, then refine based on backtests and forward performance. This approach maximizes the potential of your custom trading bot in today’s dynamic markets.