If there’s one thing every trader learns sooner or later, it’s that market volatility never ends. Prices jump, trends flip, and unexpected spikes appear out of nowhere. For manual traders, this can be stressful. But if you’re building your own trading bot with the help of the XauBot platform, volatility isn’t something to fear, it’s something to design for.

In this article, you’ll learn how to configure your bot to perform efficiently even when the market becomes unpredictable. We’ll walk through how each stage of the XauBot bot generator process, from market selection to AI filtering, can be optimized for volatile conditions.

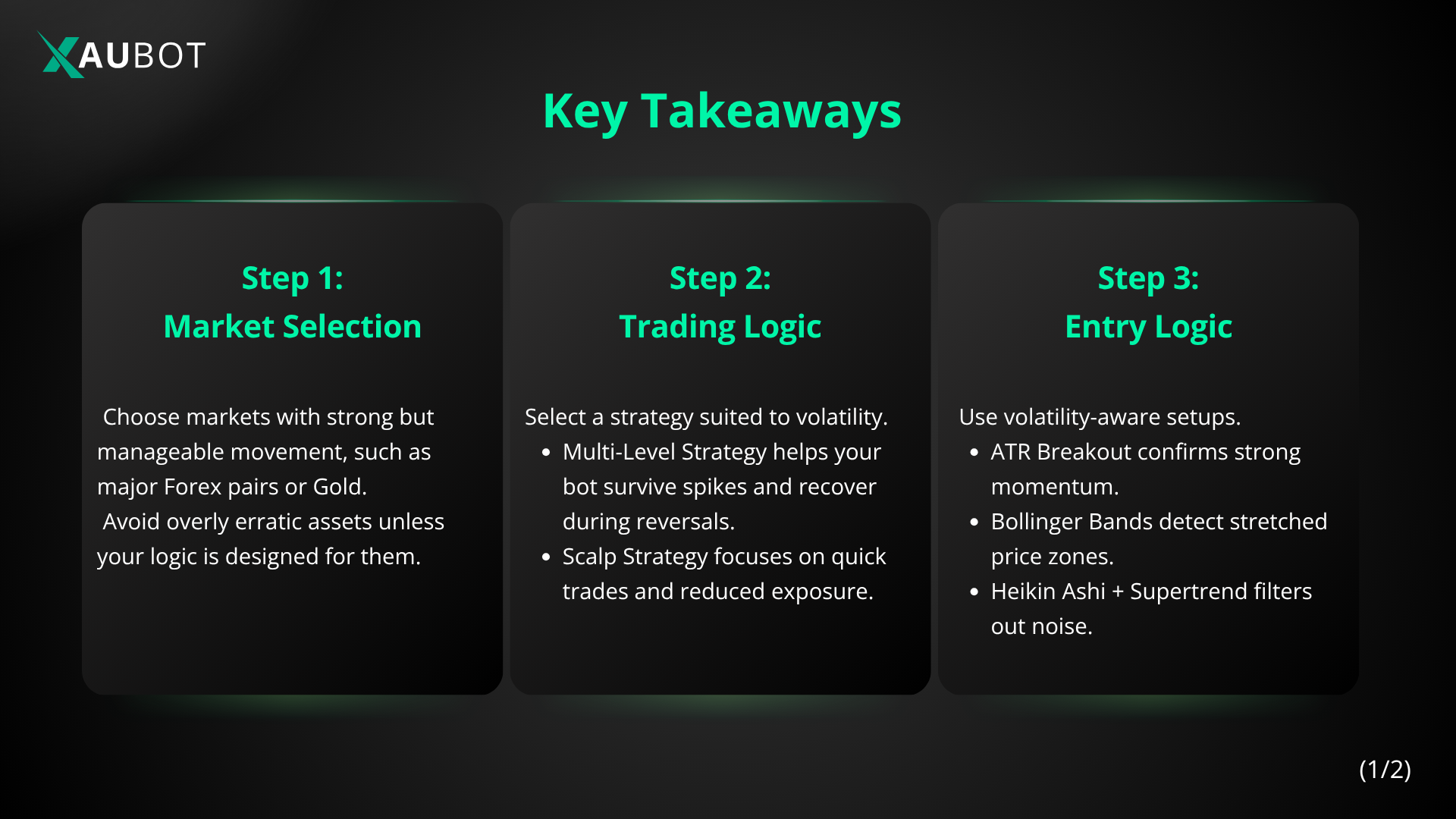

Step 1: Market Selection, Choose What Moves Fast but Manage Risk

Volatility varies across markets. If your goal is to make your bot resilient, select markets with healthy but manageable movement, like major Forex pairs (EUR/USD, GBP/USD) or Gold (XAU/USD).

Avoid extremely erratic pairs unless your strategy is designed for them. For instance, metals like gold show strong directional volatility that works well with XauBot’s multi-level or ATR-based breakout strategies.

Step 2: Trading Logic, Pick the Right Foundation

In volatile markets, the strategy architecture defines your bot’s survival.

- Multi-Level Strategy: Excellent for volatile periods where prices spike against your initial position. The bot opens additional entries at better prices, aiming to recover when the market reverses.

- Helps smooth out drawdowns and handle “market noise.”

- Requires strict drawdown and lot-size management.

- Scalp Strategy: Ideal when volatility is high but short-lived. Fast entries and exits reduce exposure.

- Combine with news filters and tight stop-loss settings to avoid flash spikes.

Step 3: Entry Logic, Equip Your Bot with Volatility Awareness

When selecting your entry strategy, favor setups that measure or react to volatility, such as:

- Multi-Timeframe + ATR Breakout uses ATR to confirm strong momentum before entering.

- Bollinger Band-based XAUBOT strategy detects when price moves too far from its mean, which acts as a natural volatility indicator.

- Heikin Ashi + Supertrend Filter reduces false signals caused by noise.

Combine volatility-based indicators like ATR and Bollinger Bands to make your bot become aware in a way of market turbulence before it reacts.

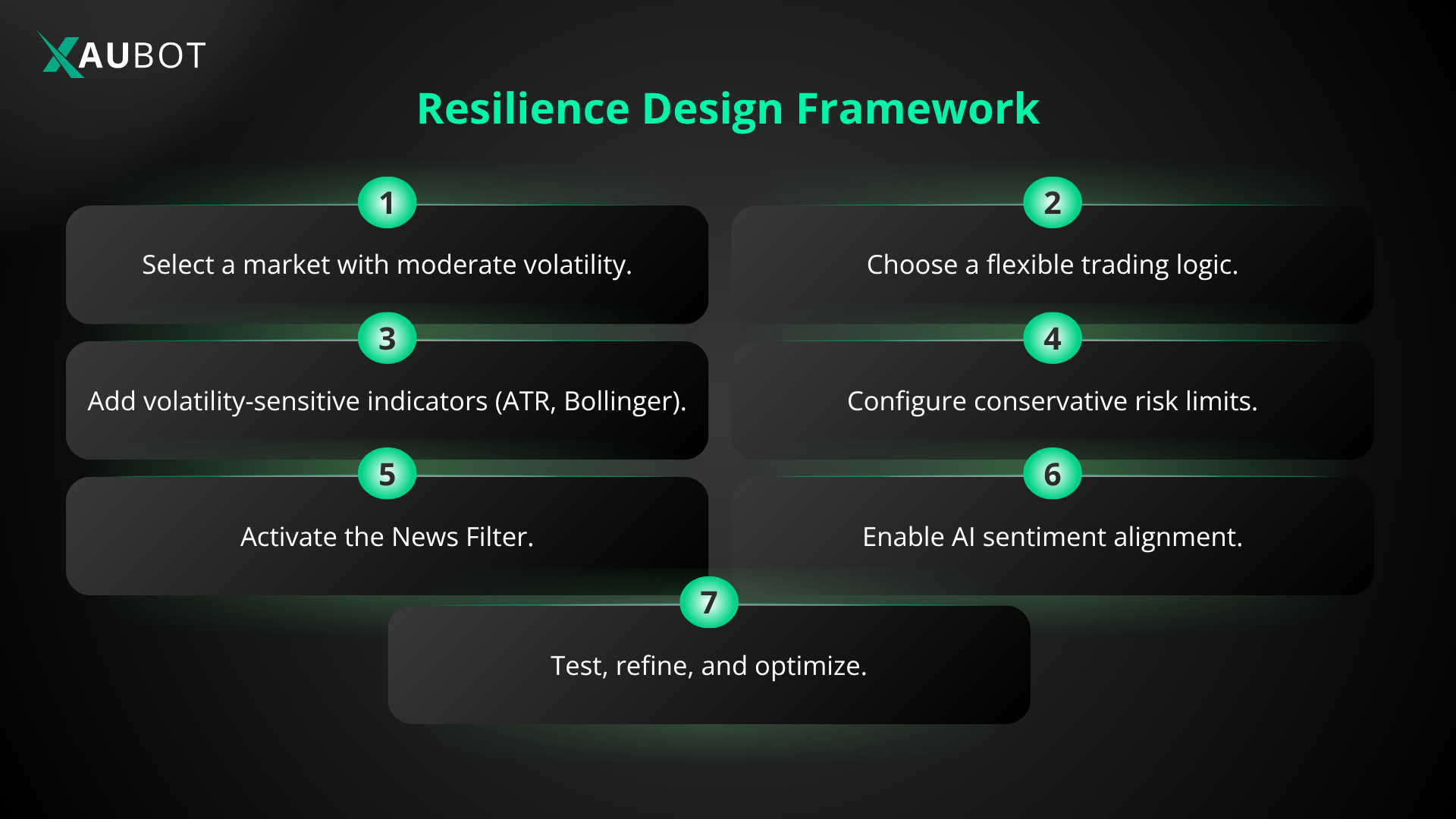

key steps towards developing a bot for volatile markets with XauBot

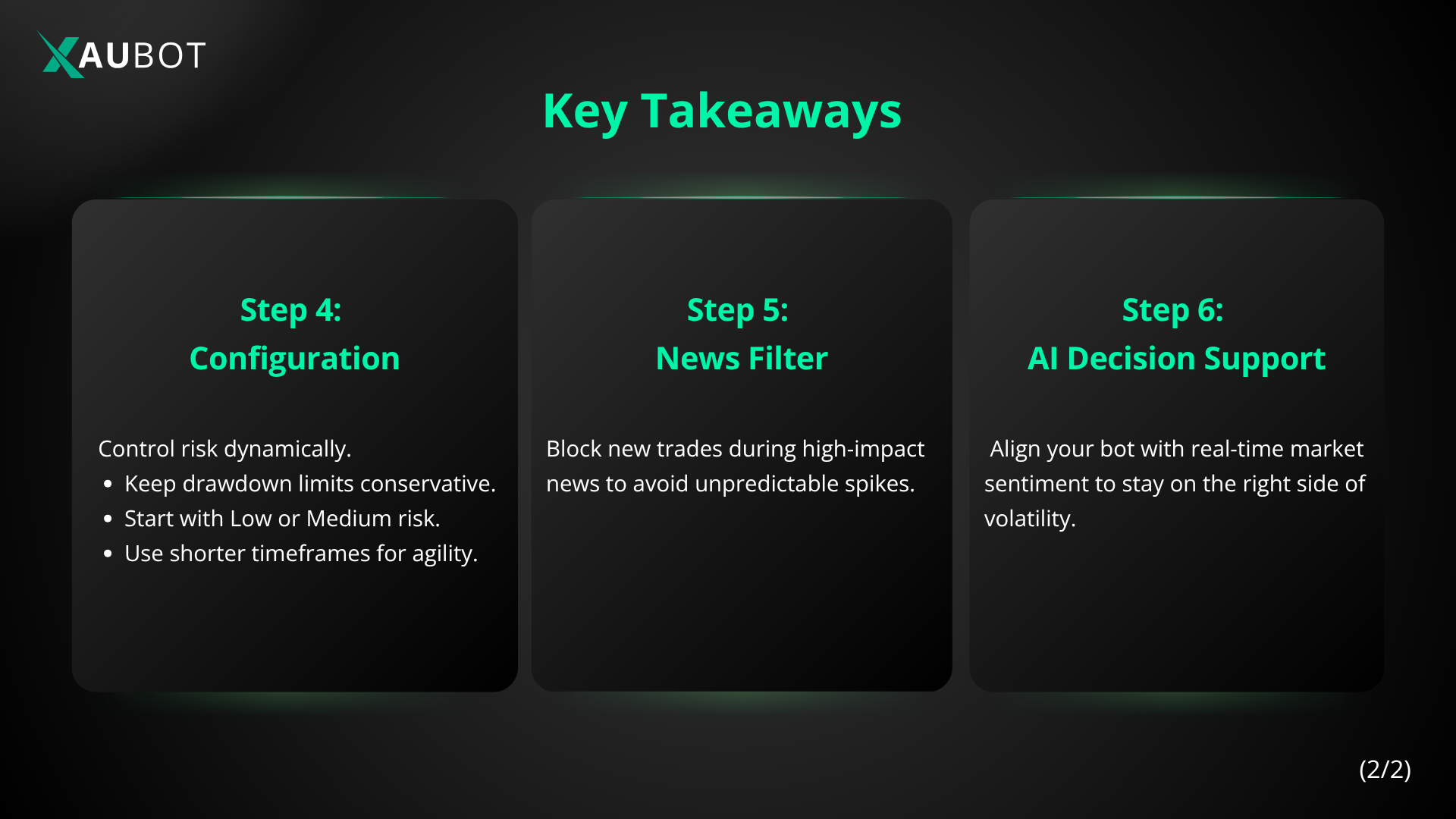

Step 4: Configuration, Control Risk Dynamically

Your configuration step determines how much volatility your bot can tolerate.

- Drawdown Limit: Keep it conservative, for instance under 30 percent, to auto-close all trades if the market swings too far.

- Position Size or Risk Per Trade: Start with Low or Medium risk until your bot is tested.

- Time Frame: Set shorter timeframes (M5–M15) for quicker decision-making.

For Multi-Level bots, adjust the “Distance” and “Multiplier” values carefully, since too aggressive spacing can magnify losses during unpredictable spikes.

Step 5: Activate the News Filter, Shield Against Chaos

Volatility often spikes during news events. Enable the News Filter in XauBot to prevent your bot from entering trades during these moments.

- Fewer trades but safer overall performance

- Protection against unpredictable price gaps

- If a trade is already open, it will remain active, so combine this feature with your risk rules

further steps for developing bots to stand against volatility in markets

Step 6: Enable AI Decision Feature, Adaptive Intelligence for Volatility

Activating the AI Decision tool gives your bot access to real-time market sentiment. This helps it align with the dominant market direction instead of fighting it, which is a major advantage during volatile sessions.

The AI tool processes live sentiment from news, social media, and trend data to adjust trade bias dynamically, keeping your bot adaptive even when human traders panic.

Step 7. Test, Refine, and Optimize

No configuration is complete without testing. Run your bot in demo mode or with small capital first. Monitor how it behaves during volatile sessions. Adjust your parameters, especially drawdown, stop loss, and volatility thresholds, based on performance data.

Conclusion

Volatility doesn’t have to be your enemy. When you build your bot intentionally, with the right logic, protective filters, and dynamic parameters, it becomes a system that thrives in chaos. The next time markets move unpredictably, your bot will already be prepared.