Before we take a deep dive into expert advisors risk management, we need to first take a peek into the functionality of expert advisors? How do they work? Can they have a weakness? An expert advisor is basically an algorithm, a code, or a software – think of it as you like. The point is, there is an algorithm behind how they execute trades.

They can use various methods and techniques in the process of trading, such as using technical indicators, price analysis, finding out entry and exit points, etc., based on the specific type of expert advisor.

So they offer a lot of advantages. Numerous benefits, in fact, when you compare them with human or manual traders. For instance, we no longer have the issues such as emotional bias, fatigue, erroneous judgement, greed, fear, and all the other negative aspects that are usually found when a human trader is manually trading.

But, an expert advisor is only as strong as its algorithm.

What does it mean? It means, the strength and reliability of an expert advisor depends on its algorithm or coding. This means, based on the strategy that is coded into the expert advisor, it may perform with weakness in some circumstances and better in others.

Choose a Reliable and Proven Expert Advisor

If you have read the last paragraph carefully, you can definitely guess what we are about to say. Expert advisors are not equal with each other. Some of them have a better algorithm and some others may have a poorer algorithm. Want it simpler?

No problem. Here it is: some EAs have a better and more effective trading strategy while others might have weaker and less efficient trading strategies.

This means your first line of defense in EA forex trading is picking a reliable expert advisor.

You can look for various factors when you are picking an expert advisor that will help you find an EA that is reliable and offers better risk management. While there are many factors, consider the following as the most important:

- The performance of the expert advisor should be verified

- This verification can be found on third party audit websites such as MyFxBook

- Look that its performance is consistent over time

- Go through user comments and testimonials and check out their experience

- Also make sure that they platform offers good and responsive customer support for whenever you might have an issue or question

Last but not least, there are countless expert advisors that can be found for free on social trading, community trading, and various other platforms and forums. A good example is MQL5. If you head there right now, you can find numerous free expert advisors.

It is true that some of them might have their merit. But a good way to begin picking a reliable expert advisor is to get one from the developer’s platform. This way, you can make sure that there is a whole team behind the development of the EA.

Start with a Demo Account

In the forex market, we basically have two main types of accounts. One is known as a live account, which is any ordinary and real trading account in the market where you trade with real money and you can face profit or loss.

The other is known as a demo account. In this type of account, you trade with virtual currencies and there is no actual profit or loss in terms of real money. But the market data that is fed into your account is real time data. What does it all mean?

When you first start with an expert advisor, you can test it on a demo account, which is basically an account with real market data but virtual currency, so you can train first.

Of course, this is why demo accounts are used in many cases. Basically, whatever you want to test first, you can and should do it with a demo account. This includes a new strategy, a new approach, a new indicator, and of course a new expert advisor.

Diversify Your Strategies

As the old adage goes, “do not put all of your eggs in the same basket.”

The way we can use that in this case is to not use all of our assets in the forex market with a single expert advisor that runs a single trading strategy. That would probably not bode well in the end. Because the forex market is as dynamic as markets are.

But if you diversify your approach in expert advisor trading, you can increase your odds of success and also increase your overall risk management.

So it would be better if your approach to EA trading including the following:

- Use multiple EAs with different strategies

- Trade across various currency pairs

So the key point that we are trying to tell you here is to bring diversity into your automated trading approach. Bringing diversity on its own can be considered as a defensive shield to increase your risk management and improve your defense mechanisms.

Monitor the Performance of Your Expert Advisor

It is true that these trading systems are known as automated trading systems or tools. But it does not mean that they should be left entirely on their own. You as the trader should still constantly monitor their performance.

By monitoring their performance, you can look for certain factors and criteria about their performance.

Among the most important factors are the following:

- Win/loss ratio and overall profitability.

- Adherence to risk management rules (e.g., stop-loss levels).

- Performance during high risk events, such as major economic announcements.

Use Proper Risk Management Techniques

After all, how can we avoid risk without risk management, right? You should stick to a proper and organized approach to risk management if you want to have a safe expert advisor trading experience in forex. These are the most important factors to keep in mind with regard to risk management:

- Position Sizing: don’t use large position sizes that are too big you cannot handle any loss. The size of your positions should be proportionate to the amount of money you have.

- Leverage Control: while using leverage can mean a higher chance of profit, it also means a higher chance of loss. So be careful with the ratio of leverage that you want to use with your expert advisor.

- Stop-Loss Orders: stop loss orders are excellent in controlling the amount of loss.

- Drawdown Limits: how much money can you lose? Half of your money? All of it? None of it? Whatever it is, you need to define the maximum drawdown that you can tolerate.

Is There an Expert Advisor that Can Offer Everything?

The title of this section is a great question to ask at this point of the article. We have talked about many factors that you need to keep in mind if you want to have a safe experience of trading with expert advisors. So, is there an expert advisor that can offer everything?

Oh just go with XAUBOT and put yourself out of the misery once and for all then!

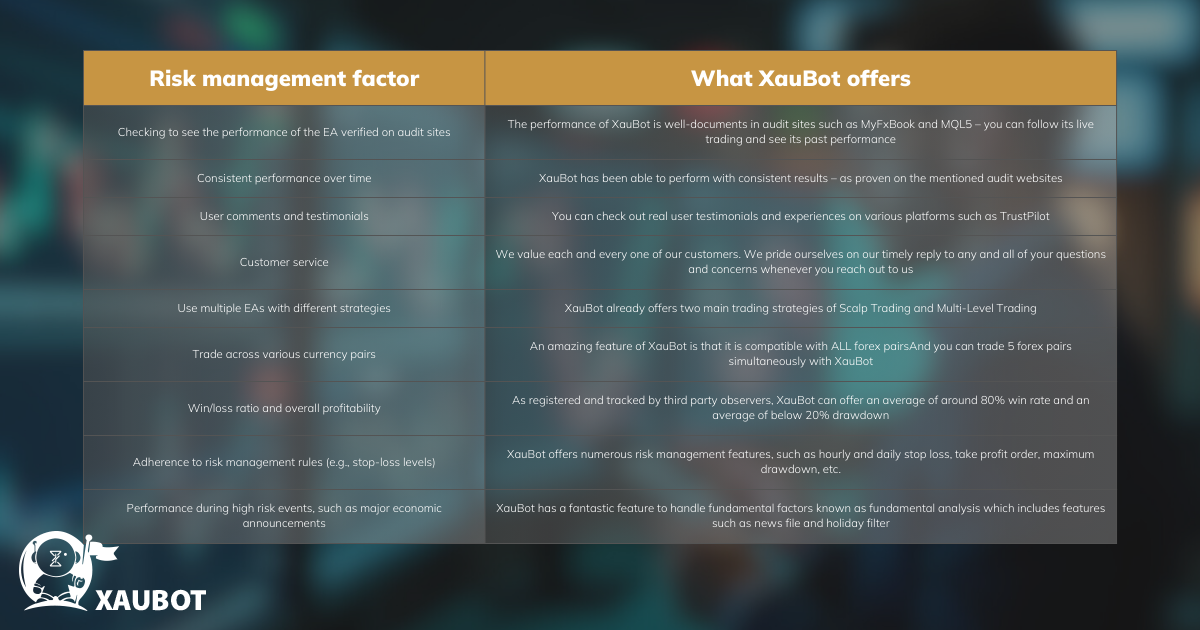

But on a more serious note, XAUBOT can offer literally every single one of the factors we mentioned so far. Here is a full break-down of the factors and how XAUBOT handles them:

Conclusion

Using an expert advisor is an excellent method of bringing discipline and consistency to your forex trading. While they offer numerous advantages, especially when compared with manual trading, there are still some risks associated with them.

But if you understand exactly how risks work when it comes to expert advisors, you can learn to manage them and get the best out of your EA trading in forex. In this article that is exactly what we tried to show you. We discussed the most important factors that you should keep in mind when it comes to EA risk management. We also showed you that if you go with our expert advisor XAUBOT, you can have all the factors that we discussed in this article for a safe and reliable EA trading experience in the forex market.