The ultimate trading competition in the forex market and Forex Robot comes down to the competition between manual trading and automated trading, otherwise known as robot trading.

There are many dichotomies in the world that are the source for great controversies. Such as the dichotomy of using conventional cars run by fossil fuels or using modern vehicles that are run by electric power. There are, indeed, many examples of this contention between the conventional method of doing something versus the modern and innovative approach.

The same is true for the foreign exchange market and the matter of trading. And again similar to all the other dichotomies between convention and innovation, there are both points for and against on either side of the argument. So let’s take this discussion to the next step and take a look at forex robot trading and manual trading in comparison with each other.

A Look into Manual Forex Robot

First of all, what exactly is manual trading? Well, as the name suggests, manual trading is when the trader is involved in a hands-on fashion in the process of trading.

Naturally, it is the conventional method of trading, whereby the traders themselves are directly executing trades. The more conventional methods of this form of trading used to be where traders would physically go to trading floors and venues of different markets in order to carry out trades.

But of course with the advent of computers and modern technology, manual trading does not necessarily entail a physical aspect whereby you have to be present in a certain location. The process of manual trading can be carried out using a computer.

This is especially the case with the forex market, where we have a decentralized network of online markets around the world.

So in the manual forex trading experience, it is the trader himself or herself who makes all the decisions. You have to spend adequate time coming up with a comprehensive trading style and strategy, analyze the market, and finally execute the position yourself.

In other words, forex manual trading is the typical image you have in mind of a trader who sits behind a computer or laptop all day opening and closing positions in the market.

You should read: Understanding Algorithmic Trading Robots

The Advent of Robot Trading

The other side of this discussion is of course forex robot trading. If we want to talk about the terminology a little bit, it should be said that this form of trading goes by many different names.

While it is largely known as robot or bot trading, it is more technically referred to as automated trading, since it is used as a means of automation for the process of trading, or algorithmic trading, since it is literally a piece of algorithm that is able to execute trades.

In any case whatever name it may have, robot trading is the form of trading whereby a software helps the trader in the process of trading.

It began with simpler tasks such as a trading assistant where it would simply help the trader in the process of analysis. And now we have highly complex and sophisticated automated trading solutions such as XauBot where you have an extensive and complete algorithm able to carry out every single aspect of forex trading, including technical analysis, fundamental analysis, money management, and of course execution of trades.

To sum up, forex robot trading is the application of a software to trade for you. Now that we have a basic understanding of both manual and robot trading, let’s see their pros and cons.

The Pros of Manual Trading

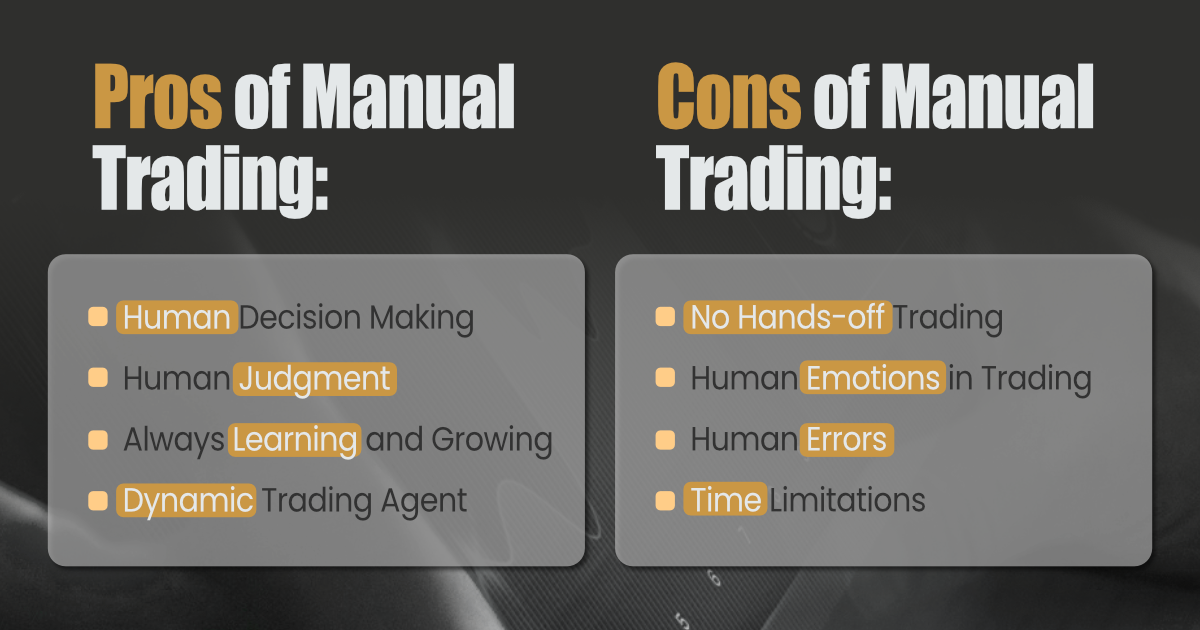

All the advantages of manual trading can be seen in the human agent of the argument. It is the human in charge that brings all the pros for this form of trading.

As a result, the most important upside in manual trading is that you get to make all the decisions yourself. The trader is the one who decides when and how to trade. Therefore, provided that the trader is experienced and knowledgeable, nothing can quite beat that.

There are and have been excellent traders who have reached such a degree of professionalism in the field of trading that they have invented new methods and strategies of trading that are now being used by many.

At the same time, as a human, in manual trading you are always learning and growing. You are never static like most of the robot trading options that are available. A human trader is always dynamic and improving. This is also another important advantage of manual trading.

You should read: Common Technical Challenges in Forex Robot Trading

The Cons of Manual Trading

There are also blatant disadvantages to manual trading, especially in the forex market.

First of all, one of the most important features of the forex market is that it is always active, 24 hours a day 5 days a week. But unfortunately, with manual trading there is no hands-off trading.

The trader has to be there in order to execute trades. So right off the bat you are missing out on the majority of trading opportunities in the market because you have to sleep and engage in other activities besides trading.

There are also time limitations with human trading in terms of the delay between realizing a profitable opportunity and executing the trade. Something that is not seen with automated trading.

These are only a few of the drawbacks associated with manual trading. Now let’s look at the upsides and downsides of forex robot trading.

The Pros of Forex Robot Trading

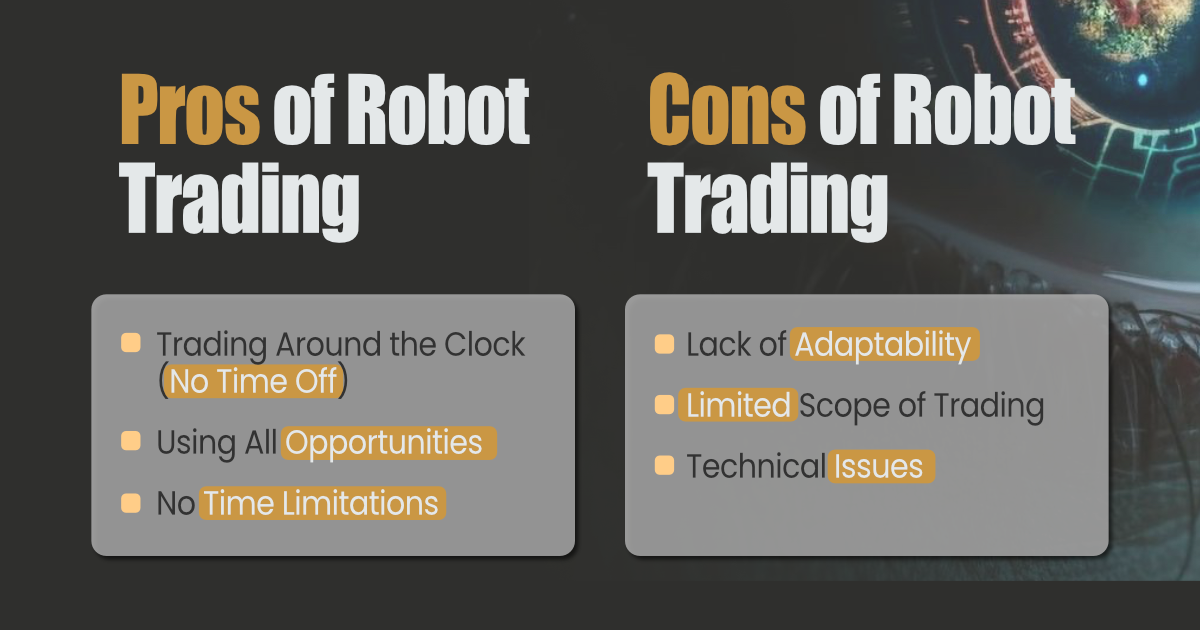

On the other hand, we have robot trading which of course has numerous advantages.

One key upside that is seen specifically with the forex market is the fact that trading robots can trade around the clock, meaning there is no off time for them, unlike human traders.

This is crucially important in the foreign exchange market, because there might be opportunities at any moment with the slightest volatilities in the market. So being ever present becomes much more prominent here.

Additionally, trading robots lack the negative aspects of the human trader; i.e. there are no human emotions associated with the decision making process with regard to the trades. All the decisions are made according to an algorithm and the input data.

But please keep in mind that all the advantages of robot trading are present if you choose your trading bot carefully and with adequate research.

You should read: Top Forex Trading Robots in 2024: A Review

The Cons of Robot Trading

The dismal side of robot trading in the forex market, however, is also present with many trading bots.

These include the lack of programmability and adaptability. This is exactly the opposite of what we said about the human trader at the beginning. The human trader is dynamic and always learning, but most of the bots that are designed for the forex market are static and unchanging.

Therefore they have a narrow scope of trading or they have a limited number of trading strategies, making them unsuitable for different market conditions.

There are also other limitations with this type of trading including technical issues that can occur at any moment to sever the bot’s connection to the market, most importantly the need for a non-stop internet connection.

Conclusion

Manual trading and automated trading, otherwise known as bot or robot trading, are the two major types of trading in the forex market. Both of these forms of trading come with their upsides and downsides. In this article we took a look at the defining characteristics of manual and automated trading as well their advantages and disadvantages.