The world of cryptocurrency is always moving. Trading in this market means opportunities come and go quickly and 24/7. This means, in order to be consistently successful in this market, as a trader you need to be disciplined and always present not to miss on any opportunity.

This is exactly where automation can take over the trading process in the crypto market. With automation, you can delegate crypto trading to your trading bot and never an opportunity in this fast moving market.

With the help of XauBot you can build your own custom MT5 trading bots and use them for Bitcoin trading on MetaTrader 5. Come along with us in this article, as we will discover why it is a good idea to automate BTC trading on MT5, how you can use XauBot to develop MT5 bots for this purpose, and all the needed details.

Why Use MetaTrader 5 (MT5) for Crypto Bots

MetaTrader 5 is among the most popular trading platforms worldwide and it supports automated trading through expert advisors (EAs) which are basically another name for trading bots for MetaTrader.

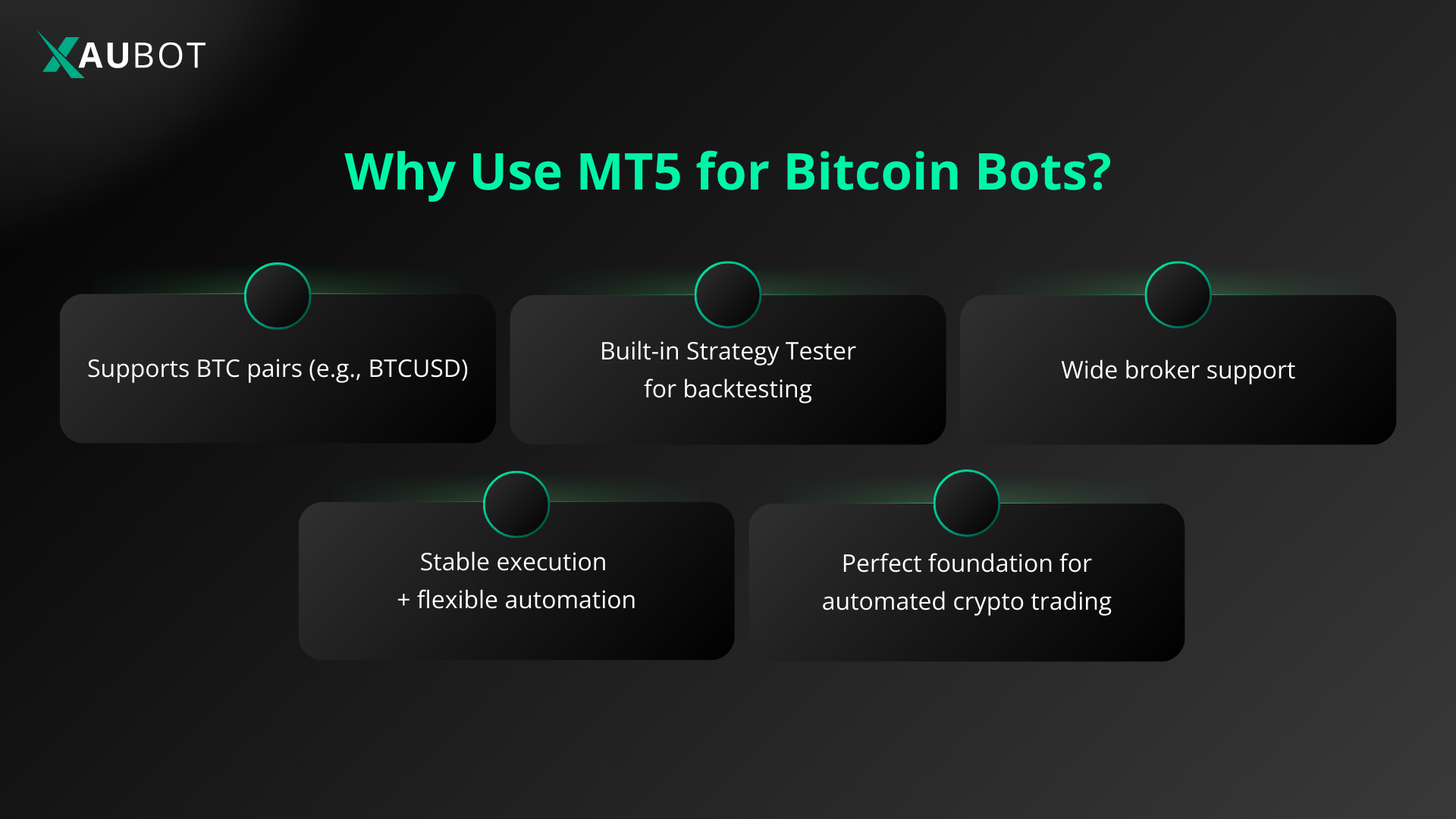

But why particularly MT5? Here are some of the key advantages that MetaTrader 5 offers for crypto or BTC trading:

- MT5 supports crypto-pairs like BTCUSD (or broker-specific BTC pairs), allowing bots to trade cryptos just like forex/CFD assets.

- It provides a built-in “Strategy Tester” which is a great feature that allows you to backtest your Bitcoin bots with the help of historical data to test your bot before using it in the real market

- It is a trading platform that is widely supported by brokers, with robust execution, order management, and interface for both manual and automated trading.

In short, MT5 offers the right infrastructure, necessary flexibility, and proven reliability, which is a perfect foundation for automated crypto trading.

How XauBot Lets You Build Custom MT5 Crypto Bots (Also for Bitcoin)

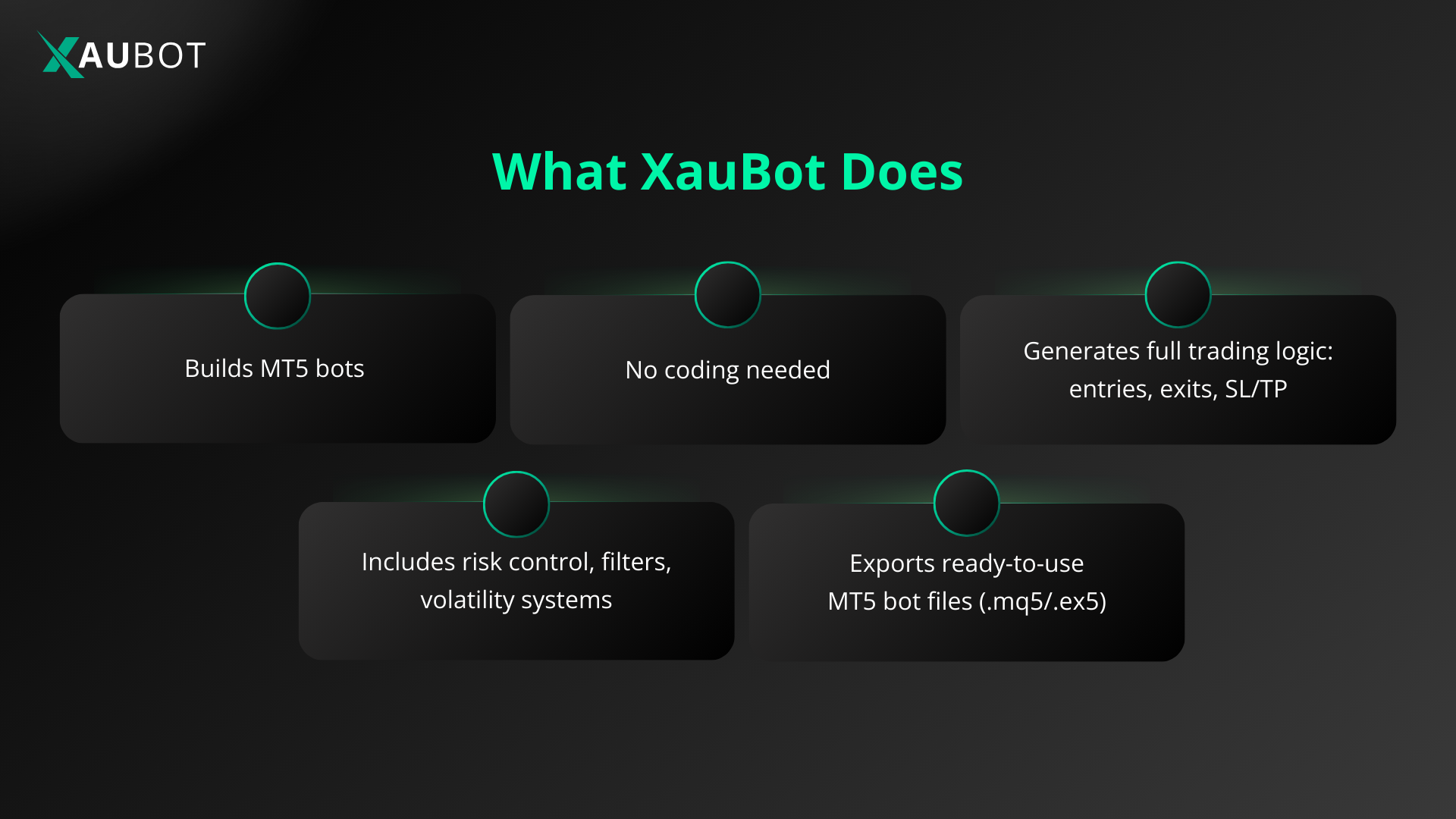

With XauBot even if you are not a coder you will be able to develop your own trading bot. Because we have developed a streamlined and full-featured bot generator platform where you can generate your own bots for different markets – which of course includes the crypto market.

So if you have an idea about a BTC trading bot for MetaTrader 5, here is how you can bring that idea into life with XauBot:

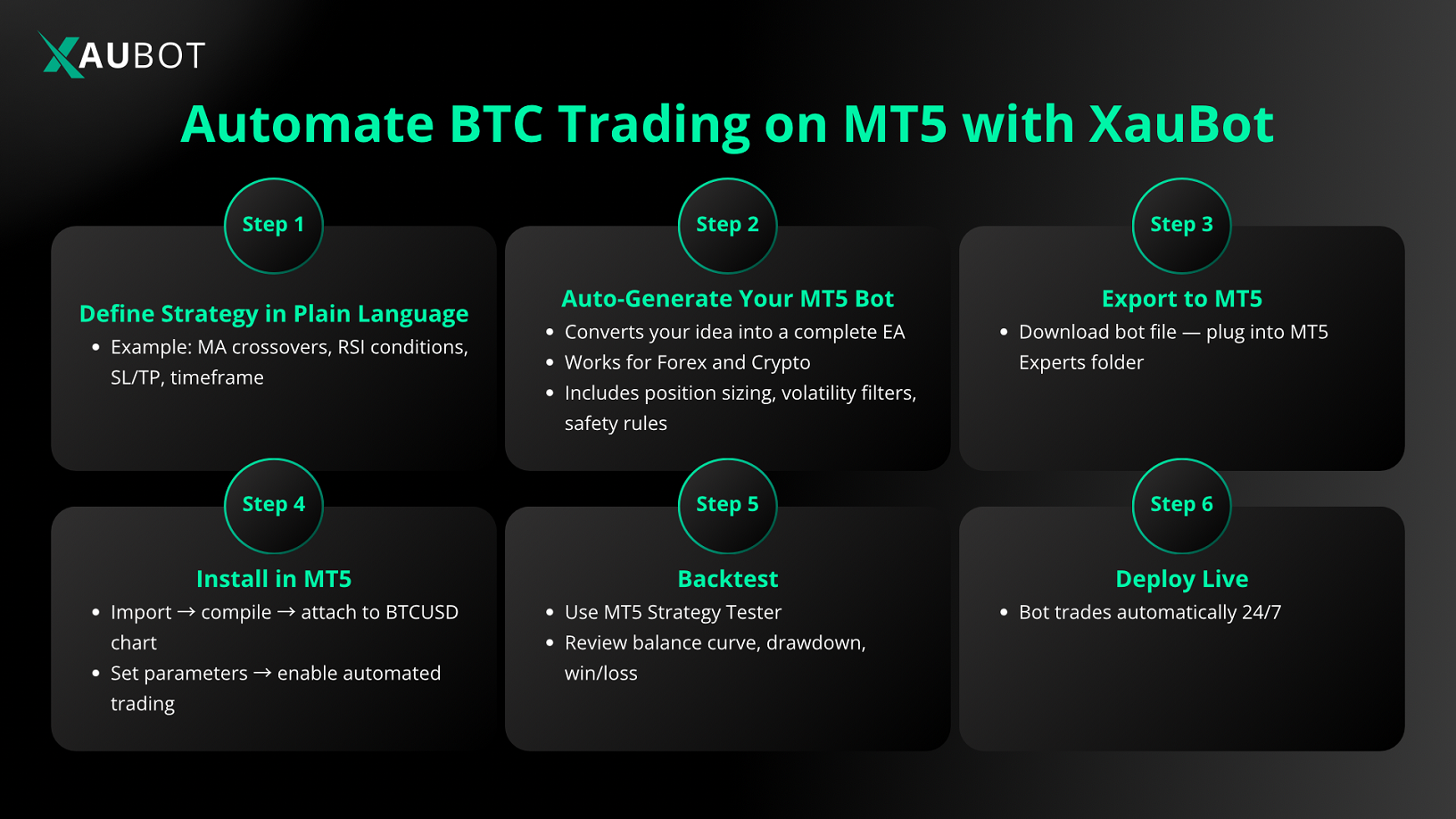

1. Define Your Strategy in Plain Language

Any idea always starts on the paper. So bring your idea on the paper in your own words, whatever the idea is. For instance, you might write “buy BTCUSD when 50-period moving average crosses above 200-period moving average on H1 timeframe; sell when RSI overbought; stop-loss 3%, take-profit 5%.”

You can then have a rough idea of what you are going to develop and have as your bot.

It is always a good idea to define your strategy and write it down clearly before you go into the bot generation process. Because you need to know your aims and goals and also the overall approach to trading in order to attain them.

2. Generate Bot Code Automatically — Tailored for Bitcoin Trading on MT5

This is the heart of XauBot’s power.

This is the main step where you actually build your trading bot.

Just choose your market (Crypto), choose how you want the bot to trade, and XauBot builds the entire trading engine for you, including entry logic, exit rules, stop-loss, take-profit, risk control, position sizing, volatility filters, and safety systems.

But to give you a real feel for what this means, here are four examples of the kinds of Bitcoin-friendly bots XauBot can generate automatically based on the build options you provided.

Example 1: Multi-Level Strategy Bot (Ideal for Bitcoin’s Big Swings)

Bitcoin is famous for sharp movements and deep pullbacks. XauBot’s Multi-Level Strategy is ideal for this kind of volatility.

When you choose this mode, your bot is automatically equipped with:

- multiple layered entries as price moves against you

- automatic averaging to lower your overall entry price

- unified profit targets for all active trades

- distance controls between levels (like 30 pips or user-defined spacing)

- adjustable lot multipliers

- built-in drawdown protection

- capital allocation guidance (including cent-account suggestions)

This style of bot works especially well on Bitcoin during liquidity grabs and sudden reversals. During such times, smart averaging can be the difference between a losing position and a winning one.

Example 2: Scalping Strategy Bot (Fast Bitcoin Trades, Tight Risk)

BTC is also known for extremely fast micro-moves, especially on M1–M5 charts.

Choosing the Scalp Strategy gives you a bot built for short, quick trades with strict controls:

- user-defined take-profit and stop-loss

- time-based filters (for example, only trade between 21:00 and 01:00)

- risk-per-trade settings

- daily loss limits

- optional “security level” that closes trades if price crosses the 20 EMA

- optional “risk-free mode” that moves stop-loss to breakeven automatically

This type of bot is great for Bitcoin channels, range breaks, session opens, and tight intraday volatility bursts.

3. Export the Bot ready for MT5

Once generated, users can export the bot in a format compatible with MT5 (and MT4 if desired). For this article, we focus on MT5 export.

You’ll receive the bot file (for example, .mq5 or compiled .ex5), ready to load into MT5.

4. Install & Configure in MT5

Using MT5’s file structure: copy the bot file into MQL5/Experts, compile (if needed), restart MT5, and you’ll see your bot under “Expert Advisors.” Then attach it to a BTCUSD chart, set parameters (risk limits, lot size, TP/SL, timeframes, etc.), and enable “Allow automated trading”.

This is all just standard procedure when deploying any MT5 expert advisor.

5. Backtest and Optimize with MT5 Strategy Tester

Before going live, run your bot on historical BTC data through the feature of MT5 known as Strategy Tester.

This lets you simulate how the bot would have performed across real past price swings, which is a crucial step for crypto’s volatility.

After reviewing results (balance curves, drawdowns, win/loss ratio, etc.), you can go back and refine your strategy or risk parameters.

6. Deploy Live and Let the Bot Do the Work

Once satisfied with testing results, attach the bot to live BTCUSD charts. From then on the bot monitors price, triggers entries/exits, manages risk automatically 24/7.

Risks & Best Practices — Because Crypto Is Unforgiving

Automating Bitcoin trading can be powerful. But you should always remember that the crypto market is really unpredictable, maybe even more than other markets. This market also exhibits a much higher rate of fraudulent activities compared with other markets. So you ought to be really careful. Here are some tips that can help you:

- Always backtest before going live. Use MT5 Strategy Tester to simulate historical BTC data.

- Use conservative risk settings, especially given crypto volatility. Avoid high leverage or oversized lots.

- Start on a demo or small live account. Make sure everything works as expected (execution, slippage, spread, order fills).

- Always monitor. Market conditions change. What worked last month may not work next. So, review and adjust strategy periodically.

- Understand there are no guarantees. Even the best bot can’t eliminate risk. Crypto markets remain unpredictable.

Conclusion

Automating Bitcoin trading on MetaTrader 5 can increase your chances of success in the already unpredictable crypto market, especially for BTC. In this article we showed how you can use XauBot to not only automate BTC trading but actually create a custom bot for this automation. For traders seeking discipline, speed, and round the clock execution in volatile crypto markets, custom MT5 bots offer a clear edge.