Trading stock indices lets you track the movement of an entire market with just one trade. And with MetaTrader 5 (MT5), you get one of the most complete platforms to do it well. Instead of jumping between individual stocks, you can focus on overall markets using popular indices like the S&P 500 (US500), Dow Jones (US30), Nasdaq 100 (NAS100), DAX40 (GER40), or FTSE 100 (UK100), all in one place.

In this article, we are going to take a look at why you should trade indices instead of individual stocks, how to access them on MetaTrader 5, and then go through some specifications of index trading on MT5.

Why Trade Indices Instead of Individual Stocks?

Trading indices is attractive because it cuts through the noise and highlights the real market trends that matter. Here’s a clearer look at why many experienced traders choose them:

1. Lower Idiosyncratic Risk

A single stock can potentially drop 20% overnight as a result of the following:

- poor earnings

- insider scandals

- product failures

- regulatory actions

- CEO resignations

- lawsuits

- etc.

But this is not the case for an index. An index is spread out or diversified across dozens or hundreds of companies. One stock plummeting will barely have any impact on it at all.

An index, however, is diversified across dozens or hundreds of companies. One stock crashing barely registers because its weight in the index is small.

This makes your trades far less vulnerable to sudden, unpredictable events. Instead of reacting to random company-specific news, indices tend to move based on larger economic factors. For this reason, they are more stable.

This makes indices better suited for:

- trend trading (macro trends last for months)

- swing trading (cleaner wave structure)

- news trading (index-level reactions are fast and consistent)

- algorithmic strategies (indices create smoother datasets)

2. Cleaner, More Predictable Technical Behavior

Indices tend to react more cleanly to chart patterns because they mirror the behavior of big institutions. When hedge funds, pension funds, and major banks shift large amounts of capital, their combined activity creates smoother, more structured price movements.

These are some of the most common behaviors that are usually observed with indices:

- Trendlines hold longer because large traders defend key levels

- Breakouts follow through more often, especially after important news

- Pullbacks are cleaner, making them easier to time

- Volatility clusters around sessions and news events, offering predictable opportunities

- Gaps often fill, especially on US indices

Therefore, traders appreciate indices because they form consistent, repeatable patterns.

3. Clearer Reaction to Macro Events

Economic data has a big impact on indices. While a single stock might ignore broader news unless it directly affects the company, indices respond quickly and predictably because macroeconomic forces influence the whole market.

Examples:

- S&P 500 reacts aggressively to CPI, NFP, ISM, and FOMC statements

- DAX40 responds strongly to ECB rate decisions and German economic data

- NAS100 is extremely sensitive to interest-rate, tech earnings, and bond yields

These are the criteria that cause major movements in indices:

- inflation reports

- employment data

- central bank meetings

- GDP releases

- geopolitical events

- bond yield movements

- major corporate earnings (especially tech)

If you understand what drives the economy, trading indices gives you a real advantage. You’re basically trading the overall pulse of the global market.

How to Access Indices on MetaTrader 5 (Step-by-Step Guide)

Indices aren’t visible by default. They must be enabled based on your broker’s offering. MT5 simply displays whatever the broker provides.

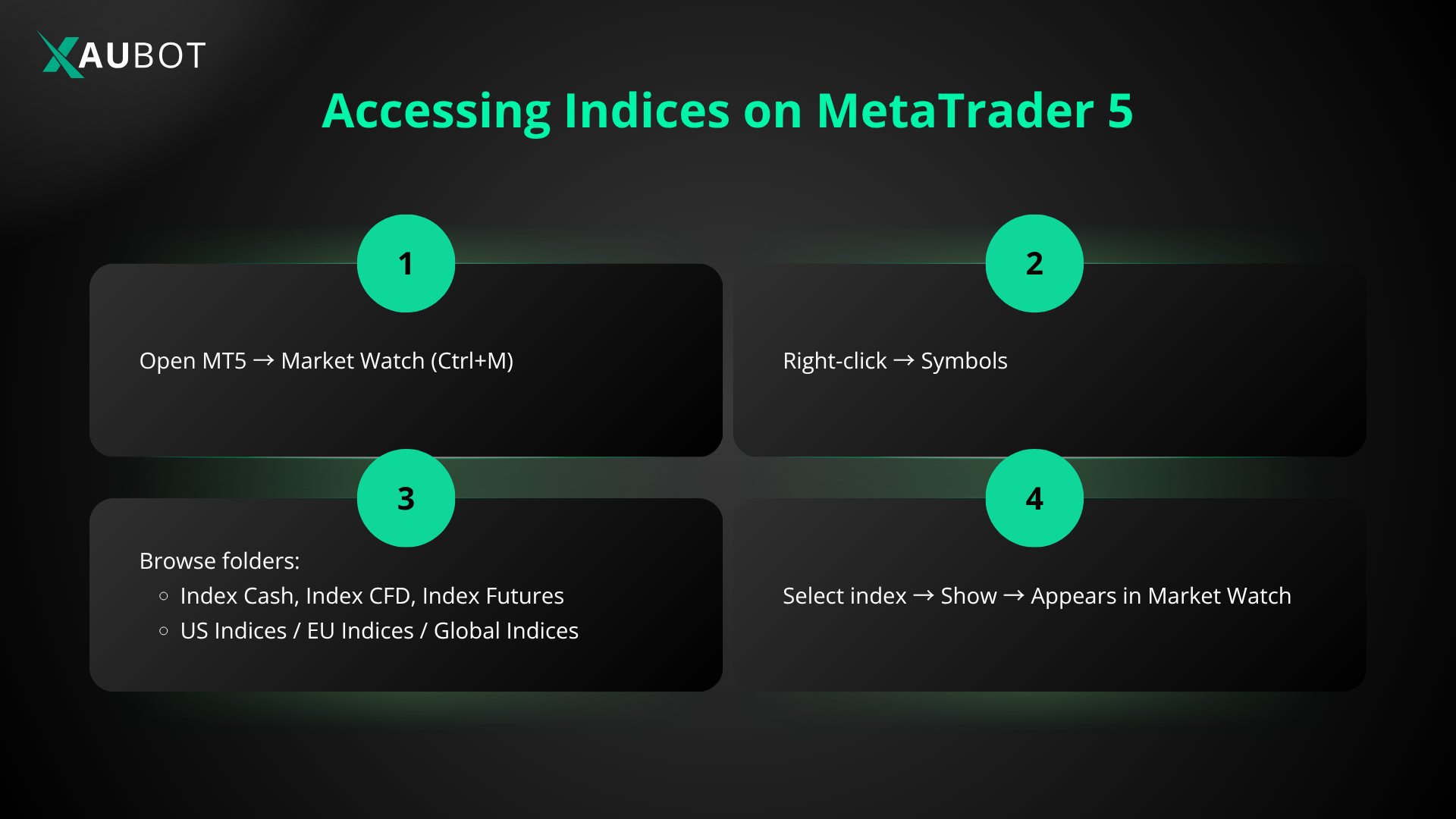

Steps:

- Open MT5 and then Market Watch (Ctrl+M)

- Right-click anywhere and then “Symbols”

- Look for folders such as:

- Index Cash

- Index CFD

- Index Futures

- US Indices / EU Indices

- Global Indices

- Select your preferred index

After showing the symbol, it will appear in your Market Watch window, allowing you to open charts, place trades, or view specifications.

Important Notes

- Brokers often use different names for the same index. For example, NAS100 might also appear as NDX100, US100, TECH100, or NASDAQ100.

- Spreads and contract sizes can differ a lot between brokers. One broker might offer a 1-point spread on the US500, while another charges 4–6 points.

- Some brokers offer “Cash” indices (tighter spreads, but swaps apply) and “Futures” indices (wider spreads, but no swaps).

Always check the Specification window before trading. It shows exactly how your contract works.

Understanding Index Specifications on MT5

Many traders skip this and end up losing money because of wrong position sizes, unexpected margin requirements, or misunderstandings about trading hours. Take a minute to check the Specification window before you trade any index.

To open it, right-click the index and select Specification.

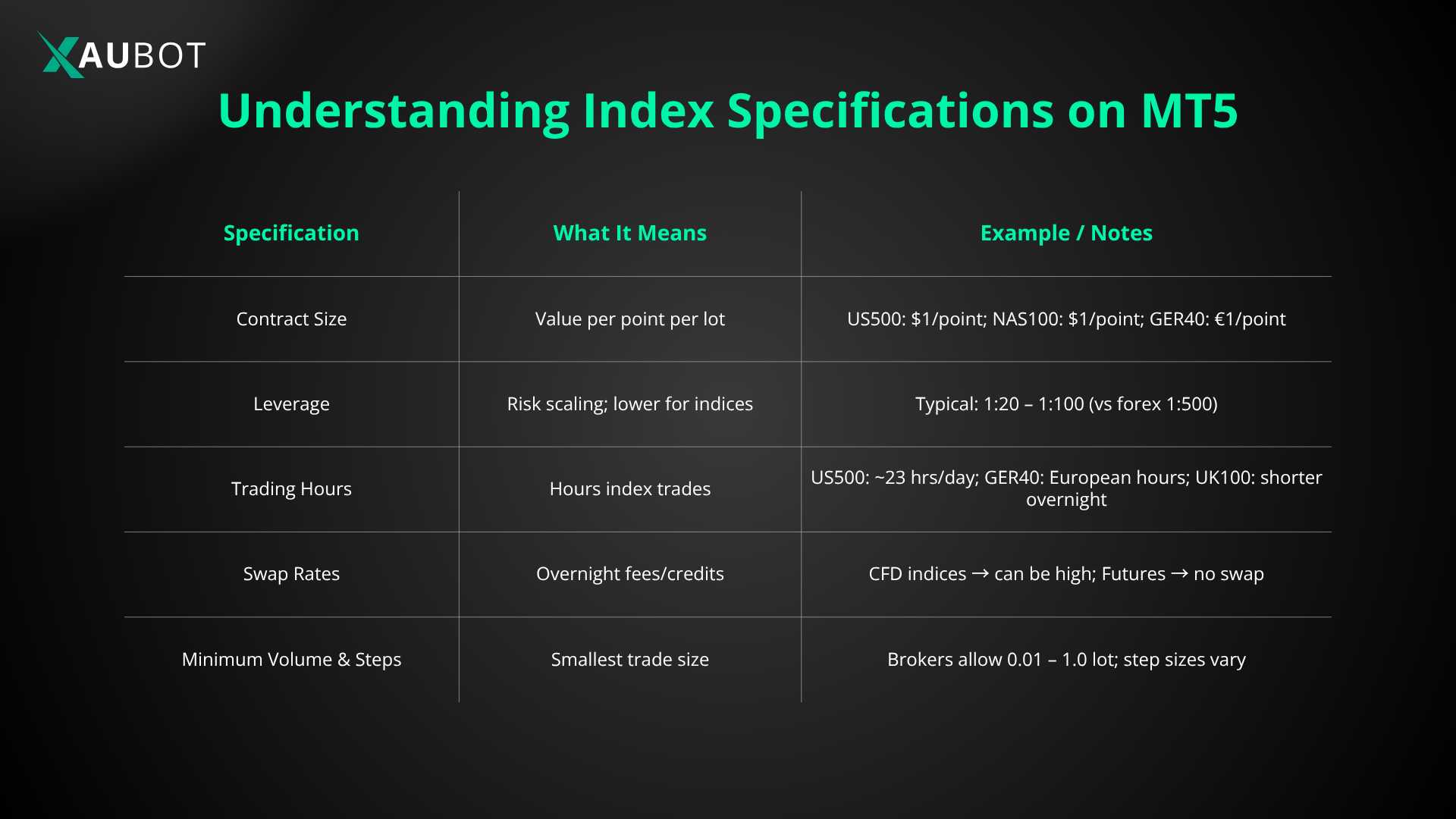

Here’s a closer look at the key fields and what they mean:

1. Contract Size

This tells you how much one point of price movement is worth per lot.

Typical examples:

- US500 (S&P 500): 1 lot = $1 per point

- NAS100 (Nasdaq): 1 lot = $1 per point

- GER40: 1 lot = €1 per point

Some brokers use fractional point values or different scaling, for example:

- 1 lot = $0.10 per point

- 1 lot = $5 per point

Why it matters

If GER40 moves 200 points in a day, that is €200 per lot. If you accidentally trade 5 lots instead of 0.5, your exposure multiplies instantly.

2. Leverage

Index leverage is usually lower than forex because indices are more volatile and there are regulatory limits.

Common ranges:

- 1:20 to 1:100 for indices

- 1:500 for forex

Lower leverage is normal and actually helpful because indices can move quickly, especially during US or EU market opens. A 1% move in NAS100 happens often, while a 1% move in EURUSD is rare. Using high leverage with indices is unnecessary and risky.

3. Trading Hours

Indices follow the hours of their underlying exchange, but CFD versions often trade for longer periods.

Examples:

- US500 trades almost 23 hours per day, with a short maintenance break

- GER40 trades during European hours, but CFD versions extend into US hours

- UK100 has shorter overnight access and wider spreads

Why it matters

During rollover periods or low-liquidity times, spreads can widen a lot and volatility becomes unpredictable. Try to avoid trading during:

- daily rollover

- low-liquidity pre-market hours

- holiday sessions

Knowing the trading hours helps you avoid slippage and unnecessary costs.

4. Swap Rates

Since indices are CFD-based, holding a position overnight can earn or cost you swap, depending on the index and the trade direction.

Important for:

- swing traders

- long-term trend followers

- hedging strategies

Some indices have very high negative swaps, especially for long positions. Your trade needs to justify these costs, or you could slowly lose money. The futures version of an index usually has no swap but wider spreads. Choose the version that fits your trading style.

5. Minimum Volume & Steps

Brokers set different rules for the smallest trade size you can use.

Some brokers allow:

- 0.10 lots minimum, which is great for new traders

- 0.01 lots on rare brokers

Other brokers require:

- 1.00 lot minimum, which means bigger exposure

It’s important to know:

- the minimum lot you can trade

- the lot step (for example, 0.10 increments)

- the maximum lot allowed per trade

This helps make sure your trades fit your risk management rules.

Conclusion

Trading indices on MetaTrader 5 lets you follow the overall market without getting caught up in the ups and downs of individual stocks. Indices move more smoothly, respond predictably to economic events and technical levels, and let you focus on big-picture trends. MT5 gives you the tools to do this, including flexible charts, multiple order types, an economic calendar, and clear contract details.

Success comes from knowing each index’s structure, understanding trading hours and contract rules, and managing risk carefully. With this knowledge, MT5 becomes more than a platform. It’s a place to trade strategically, make informed decisions, and approach the market with confidence.