Financial markets are always at the mercy of certain impactful phenomena and newsworthy events. This is why you always hear on the news about certain politicians, especially legislators, who either directly create a big wave or event through new legislation or they are simply informed about upcoming important events, and how they use such information to purchase or dump stocks.

The foreign exchange market or forex is the largest financial market in the world. As such it is even more so impacted by news events and happenings.

As a result, you can never truly be a professional trader, unless you know how to monitor and utilize such events to your own advantage in the market.

In this article we want to discuss at least 10 of the most important news events that can seriously impact the forex market, in addition to perhaps some honorable mentions.

What Types of News Influence Forex?

The most important question to ask at first is to find out which types of news can even influence the forex market. This is significant because you need to know what to be on the lookout for. The sheer amount of news content that is released and published is just too much for any trader to keep up with.

So, what should you listen for out there in the market?

There are basically two categories of news events that can impact the forex financial market. These two categories would be predictable and unpredictable news events.

Predictable News to Observe as a Trader

Of course predictable news events are those that should always be in your calendar and radar. These are news releases that are published at regular intervals and have a major impact on every single financial market including forex. These news releases are naturally financial data releases that are mostly published once a month. Since the data coming out of the US is significantly more important and impactful on the market, the relevant data pertaining to the US economy is much more important for the forex market than any other country’s data.

- Interest Rate (Monetary Policy)

- Inflation (Consumer Price Index)

- Employment Rates

- Consumer Confidence Index

- Trade Deficit

- Private Sector Production

Interest Rate (Monetary Policy)

monetary policy

Interest rates are among the most important economic data in any country. For instance, in the US economy, or any other economy for that matter, when the central bank or the Federal Reserve in this case increases the interest rate, it could potentially drive people to alternative markets in order to protect their assets. The reason is that consumers’ trust in the fiat currency of that country might temporarily dip and this drives them to other assets, such as commodities like gold, which is regularly traded in forex as part of the XAU/USD trading pair.

Inflation (Consumer Price Index)

Inflation or consumer price index is among those news and data releases that are published regularly and in fact on a monthly basis. Inflation can heavily impact various markets. In terms of its influence on the forex market, inflation plays a significant role, since it basically defines the worth and value of fiat currencies. And of course fiat currencies are the main assets traded in forex markets. Data shows that there have been certain fiat currencies that have lost as much as 80 percent of their value against the US dollar during a damaging bout of inflation.

Employment Rates

Another crucial economic indicator is the employment rate, or the half empty side of the glass which is the unemployment rate. In either case, the percentage of people who are under one form of employment and also the percentage of people who are actively seeking a job are both released on a monthly basis and quarterly basis in the US. Higher employment rates could technically be tied with a booming private sector while higher unemployment rates could be signs of a recession.

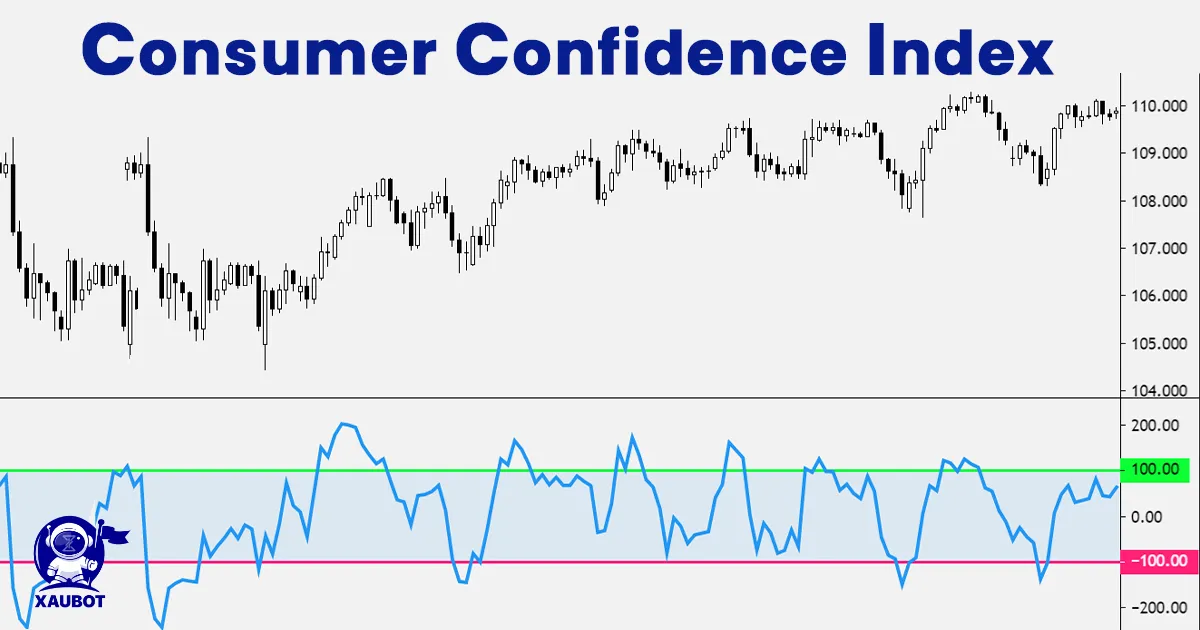

Consumer Confidence Index

Consumer Confidence Index

There are certain economic indicators that are based on surveys conducted by various organizations and governments. One of the most widely accepted and acclaimed surveys is the consumer confidence index or CCI. The data pertaining to CCI are also published regularly and are considered to be a marker for the health of an economy. Simply put, higher consumer confidence means people are spending more money and the economy is booming. On the other hand, lower confidence by consumers is indicative of lack of spending and possible recession.

Trade Deficit

trade deficit export import

Trade deficit can be simply defined as the deficit or the spread between the amount of exports and imports in any given economy. Clearly, a higher trade deficit is a sign of an economy and industry in recession. One that is not producing as much as it should. On the other hand, if the exports are higher, that would mean the economy is healthy enough to produce more for exports. In either case, the data related to trade deficit can impact the financial markets, which includes the forex market.

Private Sector Production

One last piece of economic news that is published periodically is related to the amount of production by the private sector. This is clearly yet another economic indicator that is tied with the health of the economy. And another important point about these data is the fact that they are all interrelated with one another somehow. Higher private sector production means higher employment rates, higher consumer confidence and spending, most probably the lack of recession.

Unpredictable News Events Changing the Course of the Market

There are certain news events that can heavily impact the market in their own right. However, the difference is that such news events cannot be predicted. As such, they are referred to as unpredictable news events.

- Natural Disasters

- Political Events (including elections)

- Wars and Conflicts

- Statements by Significant Figures

Natural Disasters

Large scale natural disasters can heavily impact the financial markets for a variety of reasons. Anywhere from public mourning which diverts their attention from finances by and large, and also other issues that could disrupt the markets for much longer, such as the issues caused in the supply chain.

Political Events (including elections)

Also, upcoming political events can potentially impact the financial markets such as forex. Although certain political events are predictable, such as when elections are held, their results are certainly unpredictable and as we have seen in the past, they can cause serious changes.

Wars and Conflicts

Devastating geopolitical events such as wars and conflicts can really impact the financial markets and commodities. Wars can seriously disrupt the supply of certain goods, services, and commodities. All of which can adversely impact the forex market.

Statements by Significant Figures

Sometimes, certain high profile figures can issue statements that can create serious changes in the market. This statement can be even a small tweet. As we have seen in the case of a certain crypto, currently being used as the temp logo for Twitter!

Conclusion

Newsworthy events that take place in various places and various aspects of the world can impact the market partially or even deeply. A professional trader, especially day traders, need to keep up with such events.

As we have seen, some of these news events can be predicted and scheduled so that as a forex trader you are prepared for them in advance.

On the contrary, some news events simply cannot be predicted. Such as unfortunate events like wars and natural disasters or even political events that are heavily impactful.

Yet, a seasoned trader will have already been prepared to account for such events and their outcome after their initial moment of occurrence.

Follow XAUBOT to update your information and knowledge in forex