A trader who wants to take on the world of forex trading will do so with a quiver full of various tools to handle the challenges of this financial battle. A particular arrow in this quiver are the moving averages. These are technical indicators and tools that can provide extremely valuable information to traders with respect to the overall movements that are taking place in the market. There are different types of moving averages that provide different kinds of information and are used in conjunction with different indicators.

They can either stand alone and be an indicator in and of themselves or they can be used in conjunction with other tools to create a more complex indicator. In this article, we are going to take a deep look into the notion of moving averages and see what they can bring for you as a trader.

What Are Moving Averages?

As the name suggests, a moving average is a formula that is used to provide us with an average of price movement that can be interpreted in different ways, especially when combined with other tools and formulas. This gives traders a great overall insight into which trajectory the market is moving. Users can also implement moving averages to find out about prevailing trends in the market.

A moving average can be calculated based on various time periods, which can range from 20 days or less to 90 days or more. This depends on the specific indicator that is using the moving average and also the purpose of the trader.

What Are the Different Types of Moving Averages?

As we have discussed so far, there are various types of moving averages. In the following sections, we will review the most important types of moving averages.

-

Simple Moving Average (SMA)

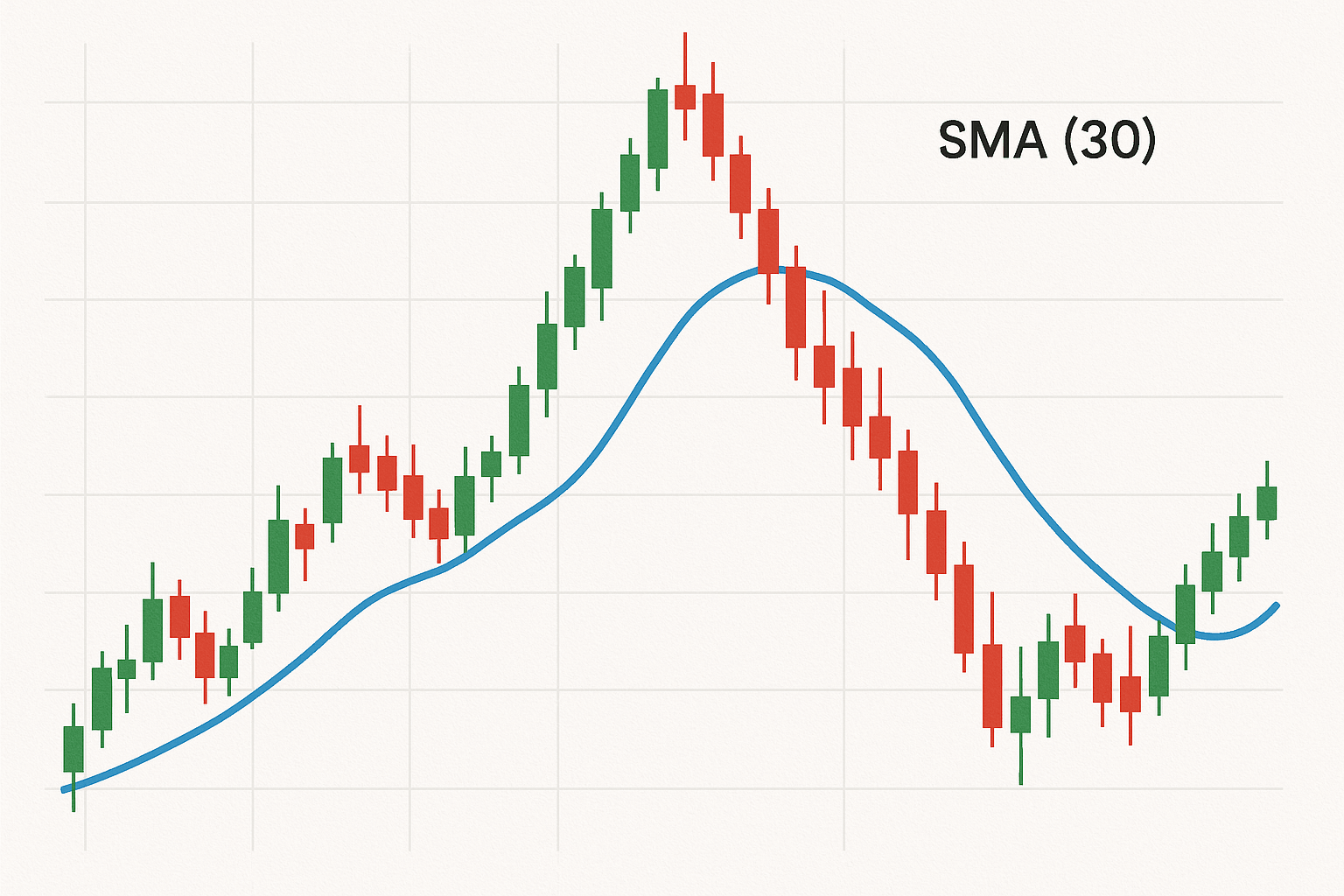

As the name suggests, this is the simplest form of a moving average otherwise known as an SMA. Being the simplest form, you can imagine what information it provides; it shows you the average prices over a period of time. As such, the SMA takes into account a number of closing prices in a period of time to calculate the average.

For example, a 30-period simple moving average is one that will take into account the last 30 closing prices and then provide an average of those. For this reason, a simple moving average is a smooth line which is easy to understand for traders. With an SMA, traders do not need to be concerned about all the ups and downs in the changes that occur in the price of an asset or a currency pair in the forex market. Instead, just by looking at the moving average line, they can get a glimpse into the overall changes that have taken place in price in the given time period.

-

Exponential Moving Average (EMA)

Next on the list we have the exponential moving average or the EMA. As it is clear from its name, this moving average is exponential. This means the EMA gives much more weight to price changes and thus provides more information than the simple moving average. Because of this heightened sensitivity to price change, the exponential moving average is used by many traders in order to find out points of entry as well as exit.

And also due to the key characteristic of the exponential moving average, i.e. being more sensitive to price change, many consider using this indicator when prices in the market are particularly moving fast.

-

Weighted Moving Average (WMA)

Last on the list is the weighted moving average otherwise known as the WMA. In this indicator prices are basically assigned weights. This means some carry more weight than the others. The way the weighted moving average works is that the most recent price will always have the most weight while the previous prices keep descending on their weight scale such that the oldest recorded price will naturally have the lowest weight. While the weighted moving average is by far less popular than the simple moving average or the exponential moving average, it is regardless used in various indicators and can provide users with highly valuable information.

How Can Forex Traders Use Moving Averages Effectively?

Now that we have a general understanding of what moving averages are and also their different types, let’s take a look at how you can implement them in your trading process.

Identifying Trends

One of the most important applications of the moving averages is identification of trends in the market. At all levels of usage, whether it is a simple moving average or when it is integrated into much more elaborate indicators, a moving average can provide insight into market trends.

There are various ways that we can use moving averages to identify trends. For instance, given a simple moving average, if the currency price of a currency pair in the forex market is higher than the moving average, then it can suggest an uptrend. On the other hand, if the price of the pair is under the moving average, then it suggests a downtrend.

Another way is to use moving averages together to get a clearer image of the prevailing trends in the market. So, imagine we have two moving averages. One of them is for the 200-period, counting for the last 200 closing prices, usually the past 200 days, and the other one is a 50-period SMA. Now the relationship between these two simple moving averages can tell us what the major trend in the market is. If the 50-period moving average is above the 200-period, then it means right now we have an uptrend. And if the 50-period is below the 200-period moving average, then it means we are going through a downtrend.

Generating Buy and Sell Signals

You can also use moving averages in order to find long and short signals. The way it works is actually quite simple. For this purpose, you would need to implement two simple moving averages with different time periods. The first one ought to be short like 10-period and the second one longer like 50-period.

The relationship between these two shorter and longer moving averages will then provide you with the necessary information to realize whether it is a good point to go long or the ideal time to go short with a position. When the short term moving average crosses above the longer term moving average, then it is a good idea to go long or buy. On the other hand, if the shorter term moving average goes below the longer term moving average, then it is a sign to go short or sell.

These are actually among the most important and at the same time reliable signals that can be retrieved with the help of the simple moving average lines.

Support and Resistance Levels

Another significant use of the moving average lines in forex trading is to assign support and resistance meaning to them. While they are not technically support or resistance lines, they can be used as de facto lines in this regard.

So for example when the market is going through an uptrend, the moving average line can be regarded as the support level from which prices will keep bouncing back up, given the fact that the market is in an uptrend. On the other hand, during a downtrend, the moving average line can be thought of as the resistance line which prices try to break through and get out of the downtrend.

This is how moving average lines can even help you with respect to potential support and resistance lines.

Combining with Other Indicators

Another significant application of the moving average line is to combine that with other technical indicators in order to obtain confirmation regarding the information that the indicator is providing. This is quite important because relying on a single source of analysis and information can result in erroneous judgement, since the forex market is quite complex and intricate.

So for instance, you can use the simple moving average with the technical indicator, the relative strength index or RSI in order to confirm that the signal obtained from the RSI is reliable.

Conclusion

Moving averages are among the most important and applicable tools in the forex market. They can provide users with highly valuable insight about price movements and the potential moves that they can make in the market. There are different kinds of moving averages, each with its own unique way of providing averaged out data to users. By understanding the differences between these types and also the applications of the moving averages in general, traders can make better and more reliable decisions while trading in forex. In this article we covered the concept of moving averages, its different types, and also its different applications.