Price and trend breakouts are among the most important things to know when trading in forex markets. In fact, if you have enough information about them, you can gain a lot of advantage while trading any foreign exchange pair.

So in this article we will tell you everything you need to know about trend breakouts in forex and how to benefit from them.

What Do Traders Need to Know about Trend Breakout?

We have many different kinds of lines in forex trading; average lines, limit lines, etc. but perhaps none are more fundamental and basic than resistance and support lines. These two levels or lines are defined as the highest and lowest prices hit by a trading pair during a certain time period respectively.

Support and resistance levels are used in many forms of analyses and are foundational to many technical indicators. When defining a breakout, they come to play as well.

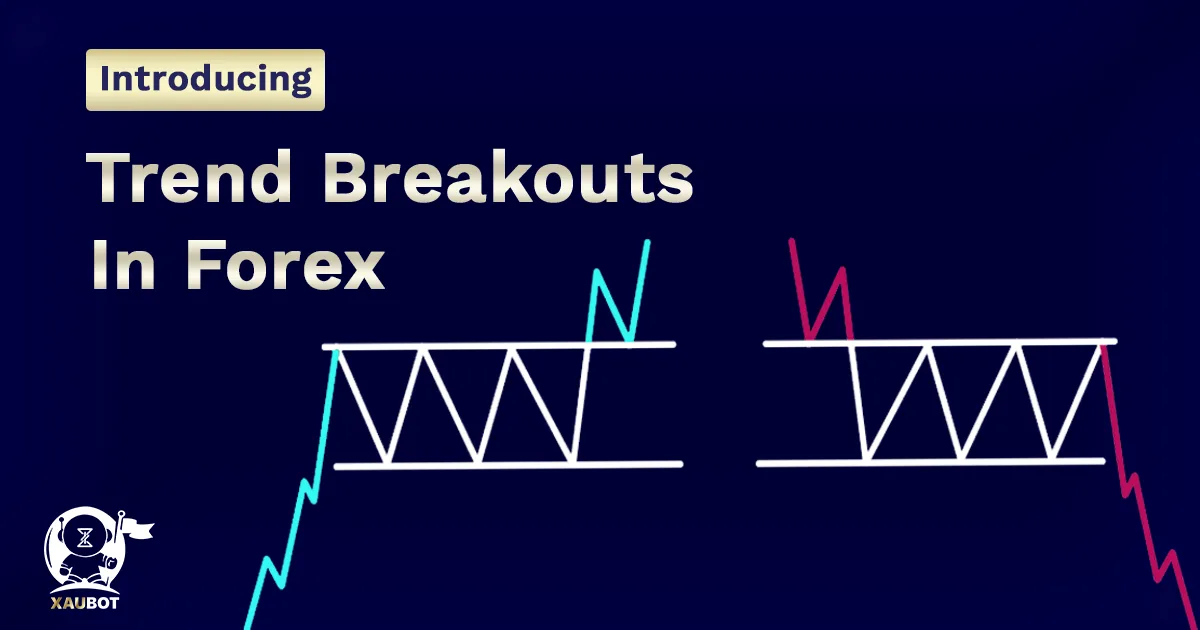

In the forex market, it is believed that a breakout happens when prices “break” or move over or under the support and resistance lines.

Naturally, this breakout can either be horizontal, i.e. a straight line up or down, or more frequently diagonal.

Clearly, a bearish breakout happens when a lower line such as the support line is broken through. And on the other hand, a bullish breakout is when a higher standing line such as resistance experiences the breakout.

However, it is not only the support and resistance levels that the breaking of which can constitute a breakout. Other specific levels that are defined can also be involved in a breakout. Lines or levels such as Fibonacci levels, pivot points, support, resistance, and others.

Now that you know what a trend breakout is, let’s see why it would even be beneficial for forex traders.

How Is Trend Breakout Advantageous for Forex Traders?

In most financial markets including the forex market, traders would highly favor the side of the market with higher volatility. The reason being that a higher degree of volatility or price movements would create a richer ground for profiting.

Of course, when the market, or in our case with the forex market, a trading pair gets a bit too volatile and price movements are higher than usual, it is also more difficult and the risk of loss increases along with the possibility for profiting.

We are going to take a deeper look into exactly how trend breakout can be used to your benefit in forex trading; but one general strategy that can prove beneficial here is to implement the breakout mindset when the water is calmer.

Imagine the volatility is close to flat. There is not much price movement. Things are quiet. This would naturally mean there are less opportunities for profit.

However, by being a smart trader, you can sit and wait for the upcoming breakout which is inevitable for basically any trading pair, since things don’t stay the same for long in forex.

This is a general approach to using the trend breakout to your advantage, though it might be a bit time consuming.

In any case, now we shall see how breakout patterns can be practically implemented in forex trading.

Practical Method of Using Breakout Patterns in Forex

There are variations in how different traders implement breakout patterns in their trading routine. The ultimate goal is to implement an approach which minimizes the risk compared to what is there to be gained; i.e. the risk to reward ratio.

As the practicality is to maximize the ratio of the reward, the most fundamental method of using breakout patterns is to depend upon something known as the wedge. The wedge is the area created between the resistance and support lines. Of course the wedge shape would occur when these lines get close and closer to each other – thus creating a wedge shape. Many traders even trade based on the wedge itself. But here our aim is to wait and see which way the wedge breaks.

Whether we see the breakout line cross resistance line upward or the support line downward, this would be our initial point of entry.

This is when we can decide and possibly identify the upcoming price movements. It is also crucial to know that prior to seeing a breakout in either direction, we will see the wedge getting tighter and tighter close to consolidation of the two lines of support and resistance.

But prior to entering a position, you need to wait for a retest. A retest will provide you with further confirmation and thus you will be able to trade with a higher degree of guarantee.

When to enter:

Let us imagine that we have support and resistance lines for the pair XAU/USD that are getting closer and closer to each other. As they consolidate, they are forming a wedge. As our wedge gets tighter, the price breaks above the resistance level toward a bullish uptrend. Now we must wait for the prices to lower and bounce off the previous resistance level. This former resistance level will now form our new support level. This is where it is recommended to enter. However, keep in mind that if the breakout is rather weak, it is also possible that a retest does not occur. Although it does in most cases.

Where to place the stop loss limit

depending on the direction of the breakout, it is advised to place your stop loss above or below the breakout candle. Therefore, if the breakout is breaking of the support line, then stop loss should be placed above the breakout candle and if the breakout is the breaking of the resistance line then stop loss should be placed above the breakout candle.

Where to place the target

naturally, this also depends upon the direction of the breakout. But going by our example of the XAU/USD hypothetical breakout toward the bullish trend, the retest of the previous resistance, i.e. the new support, became our new stop loss limit. Now, given enough price movements, the new resistance can be an ideal place to set our target. Obviously, if the situation is reversed, the target would become the new support line.

Conclusion

Trend breakout is a more reliable and dependable method of trading in forex, as it provides the trader with a more accurate pattern to follow. As was mentioned above, breakouts in price movements can take place in either direction, bullish or bearish.

But keep in mind that in order for a breakout to be more reliable and more accurate, the period of consolidation must be longer. The support and resistance lines consolidate and become closer to one another to form a triangular shape or a wedge. If the breakout occurs sooner during the formation of the wedge, then the breakout might be less reliable than otherwise.

You should know that breakout trading can come with downsides much like other trading strategies. So you should always consider a positive enough risk to reward ratio and also placing a proper stop loss limit is most crucial for managing risks involved.

In addition, depending upon a retest is also important in confirming a strong breakout. Because if the breakout keeps moving sideways for an extended period, then a retest may not even occur.

So these are some of the points to keep in mind while implementing breakout trading, which is a beneficial yet simple and elegant method of trading in the forex market.