Did you know that it is actually possible to develop and build your own algorithmic trading system without the knowledge of coding of advanced programming? There are many traders who are interested in algorithmic and automated trading but lack the necessary programming and coding skills to develop their own systems.

It is still possible for any trader to create their own automated trading system and implement their trading strategy of choice. They can also add any tool or indicator that they want to make it as customized and personalized as they want.

In this article you are going to learn about how to build an algorithmic trading system from scratch without any coding. So stick around to figure out where to start.

Step 1: Define Your Trading Strategy

At the very heart of any algorithmic trading system there is a trading strategy. All automated systems are based upon a strategy. Naturally, the first step is for you to pick your own trading strategy that will make the foundation of your algorithmic trading tool.

Because the trading strategy is the foundation of any trading system, you need to consider certain factors in it to make sure everything will go as you wish. Here are the most important factors to consider for this purpose:

- Entry signals: this is the beginning of any position. In order to open any position, you will need to have a signal for entry – or rather your algorithm does. So you need to define how it will go about calculating this entry signal – for example it can use various indicators such as RSI, support and resistance levels, etc.

- Exit signals: of course the other side of an entry signal is the exit signal. Your positions need to have a clear strategy for exit in order to lock in the profits and avoid losses. So you need to define clearly for your algorithm when it should close positions. This can be with the help of orders such as stop loss and take profit.

- Risk management: what level of risk are you going to have with your algorithm? This is where you need to define clearly for your algorithm how much capital to risk per position and also its important rules regarding drawdown.

Remember that when you are defining these factors for your algorithm, you need to be very clear and transparent. These are the building blocks that will ultimately form your algorithm and make the basis for every trade.

Step 2: Use a No-Code Trading Platform

The way to develop an algorithmic trading system without coding is to find a no-code platform that helps you automate your trading strategy.

As platforms are getting more and more user-friendly, there are likewise more and more platforms that allow users a lot of freedom to develop their own tools and systems with various elements that are also easy to use.

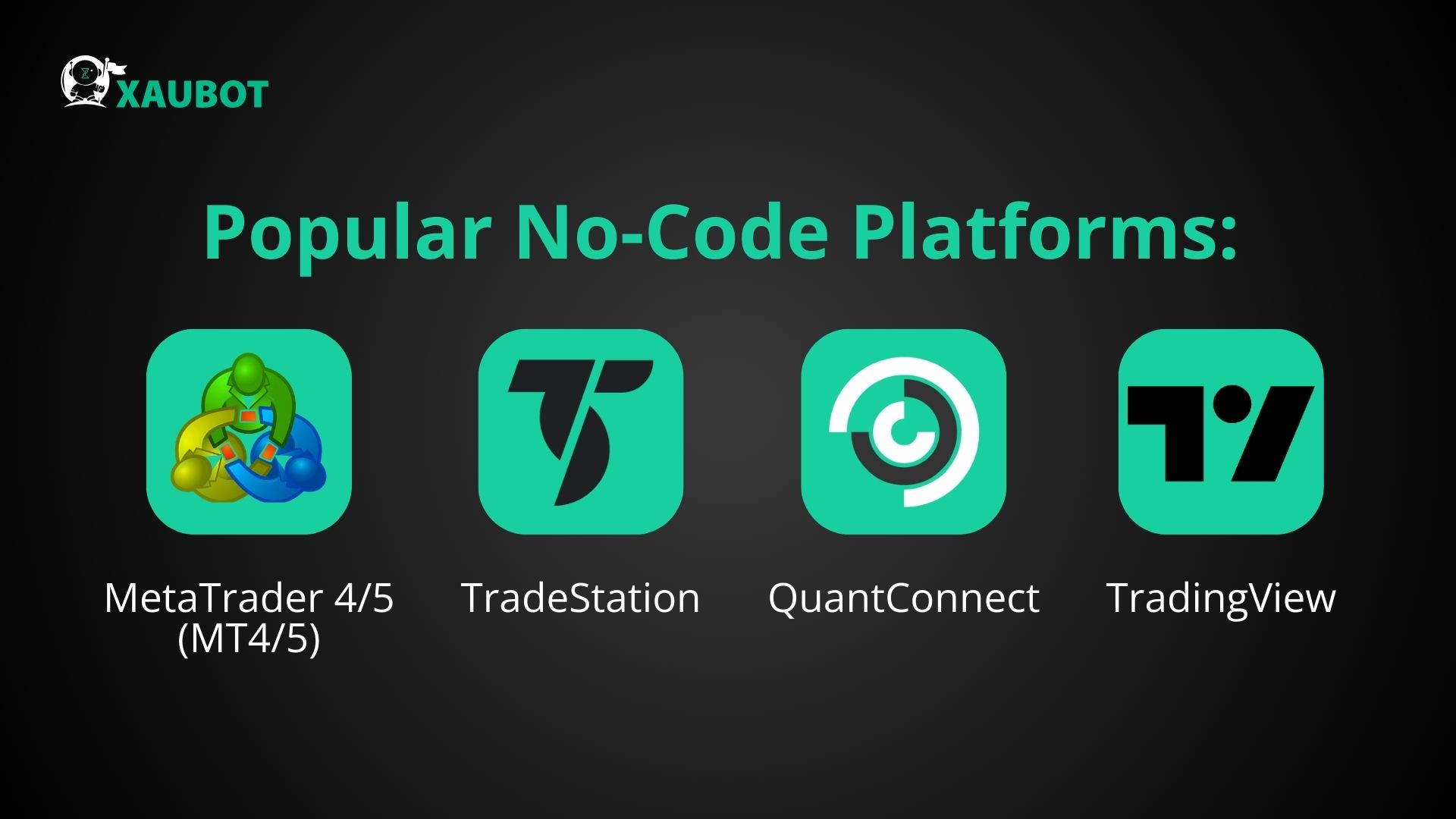

Here, we want to introduce to you the most well-known of these platforms that can help you bring your trading strategy to life!

Popular No-Code Platforms:

- MetaTrader 4/5 (MT4/5): this is something that a lot of traders don’t know about MetaTrader either 4 or 5. There is a feature on these platforms where you are able to create your very own simple algorithms. This is with the help of built-in templates and indicators.

- TradeStation: now this is a platform that is designed to help users create their own algorithmic trading tools with the help of its EasyLanguage scripting tool. This is a user friendly and easy to use approach compared to coding.

- QuantConnect: with this platform you will not need to have any coding knowledge to design and test your strategy. This platform has a feature known as drag-and-drop interface. You can easily design strategies and use its backtesting feature to test it.

- TradingView: surely you have heard of this platform. TradingView is quite well-known for being extremely user-friendly and indeed user-based as it has a great community of users and some of its features are even related to this community.

Users can use the Pine Script editor feature of this platform to develop their very own trading indicators trading strategies, and use them in the process of automation. You can rely on this community to begin from strategies built by other users and edit them as you want.

These are some of the platforms that provide you with tools to develop custom indicators, trading strategies, and tools that can be used as algorithmic trading tools.

Step 3: Backtest Your Strategy

At this point you should have a tool that is ready for backtesting. It might even be the early versions or the very first version of your tool, but it is through backtesting that you can find where it needs improvement.

Here are the factors to keep in mind when you backtest your algorithm trading system.

Key Backtesting Metrics:

- Net Profit: this is the total amount of profit that was made during the process of backtest.

- Win Rate: this is the ratio of winning trades compared to losing ones.

- Max Drawdown: this refers to the maximum amount of money lost.

- Risk-to-Reward Ratio: and this is another important factor that says how much was risked in each trade for how much potential profit.

But of course you should not rely on a single backtest. You can run the backtest again and again and see how your tool performs under different conditions.

Also, change the conditions of the backtest each time to get a better and more comprehensive test of your algorithm system’s performance.

Step 4: Implement Risk Management Rules

The aim of this article is to show you how to use no coding and still develop an algorithmic trading system. Here in this section we want to show you how you can implement risk management rules without any coding.

You can enhance the risk management approach of your system by these simple and yet powerful rules.

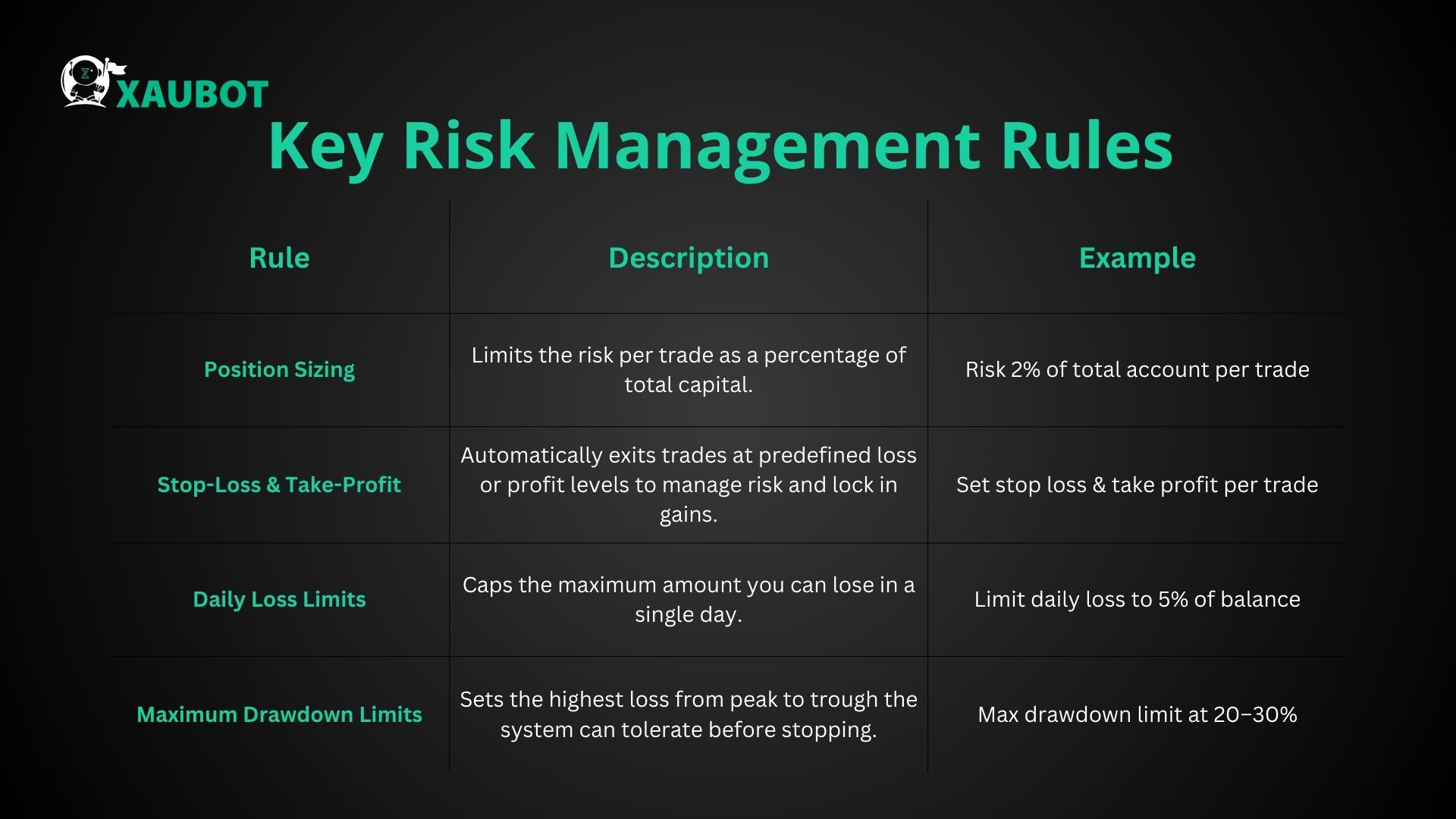

Key Risk Management Rules:

- Position Sizing: this rule will calculate how much you risk per position. For example, a position size of 2% means a maximum of 2% of the total account capital will be taken into the position.

- Stop-Loss and Take-Profit: both stop loss and take profit are extremely important pillars of risk management. Stop loss will close a position once it enters into a loss threshold defined by you. On the other hand, a take profit order will close a position once it has accrued enough profits, which is also defined by you.

- Daily Loss Limits: you need to set a maximum amount of loss that your system can tolerate on a daily basis. This depends on your strategy and your needs. An example can be 5% of the total account balance.

- Maximum Drawdown Limits: and no algorithmic trading system is complete without a maximum drawdown limit. You can set a percentage of the total account balance as the maximum drawdown, such as 20% or 30%.

Step 5: Use a Demo Account Before Going Live

Once you have a somewhat finished product, you might think it is time to take it live and use it with a real account. But you would be wrong!

Because now is the perfect time to use a demo account before going live. A demo account will give you the chance to test your system with virtual currency and real time market data with latency. So, it is very close to a live market but with virtual currency. This way you can see if there are any final improvements needed.

Step 6: Go Live with Small Capital

At this point you can of course take your system to the live market and use real capital with it. But there are also certain considerations to keep in mind for this purpose:

- Start Slow: even though it is time to test your system with real capital, it doesn’t mean you should go all in. You need to start small and add to your trading capital gradually. This can be a great way to avoid unnecessary risk exposure.

- Monitor Performance: all the while when you are trading with your system in the live market, you need to monitor its performance and make sure that its performance is as you want.

Building an Algorithmic Trading System On Your Own: Breaking Barriers

So now you know that building an algorithmic trading system without coding or programming knowledge is actually possible. There are many tools and platforms that can help you do just that. There are countless built-in capabilities, indicators, charting tools, etc. found in various platforms that can help you customize and build your very own algorithmic trading strategy.