As a trader you might think that you need to understand the market to be a good and profitable trader. Understand how prices move and what they mean. And even try to understand external and fundamental factors that could affect the market.

But it’s never easy, is it?

That’s right. It doesn’t end with that. To be a good trader, you even need to know how other traders think and feel. This is what we call Market Sentiment.

Yes, we know, this sounds overly complicated. But this is exactly what we are going to talk about in this article. We are going to take a closer look at market sentiment, see what it is, how it works, what factors are involved in it, and how it can affect your trading strategy.

By understanding market sentiment, you can make better and more reliable decisions as a trader. So, stick around to find out more about market sentiment.

What is Market Sentiment?

We already mentioned that how other traders think and feel is kind of the definition of market sentiment. But let’s make it clearer.

Market sentiment refers to the entire attitude and feeling of the participants in the market about a financial asset.

So, who are the participants in the forex market? Well, it varies from individual traders to institutional traders.

And what are the financial assets in the forex market? Currency pairs of course.

Therefore, we can say in the forex market, market sentiment refers to how traders feel about a certain currency pair.

In very simple terms, we can say market sentiment is the mood of the market. And that is very important. When you want to talk to someone you kind of check their mood to make sure how you approach them.

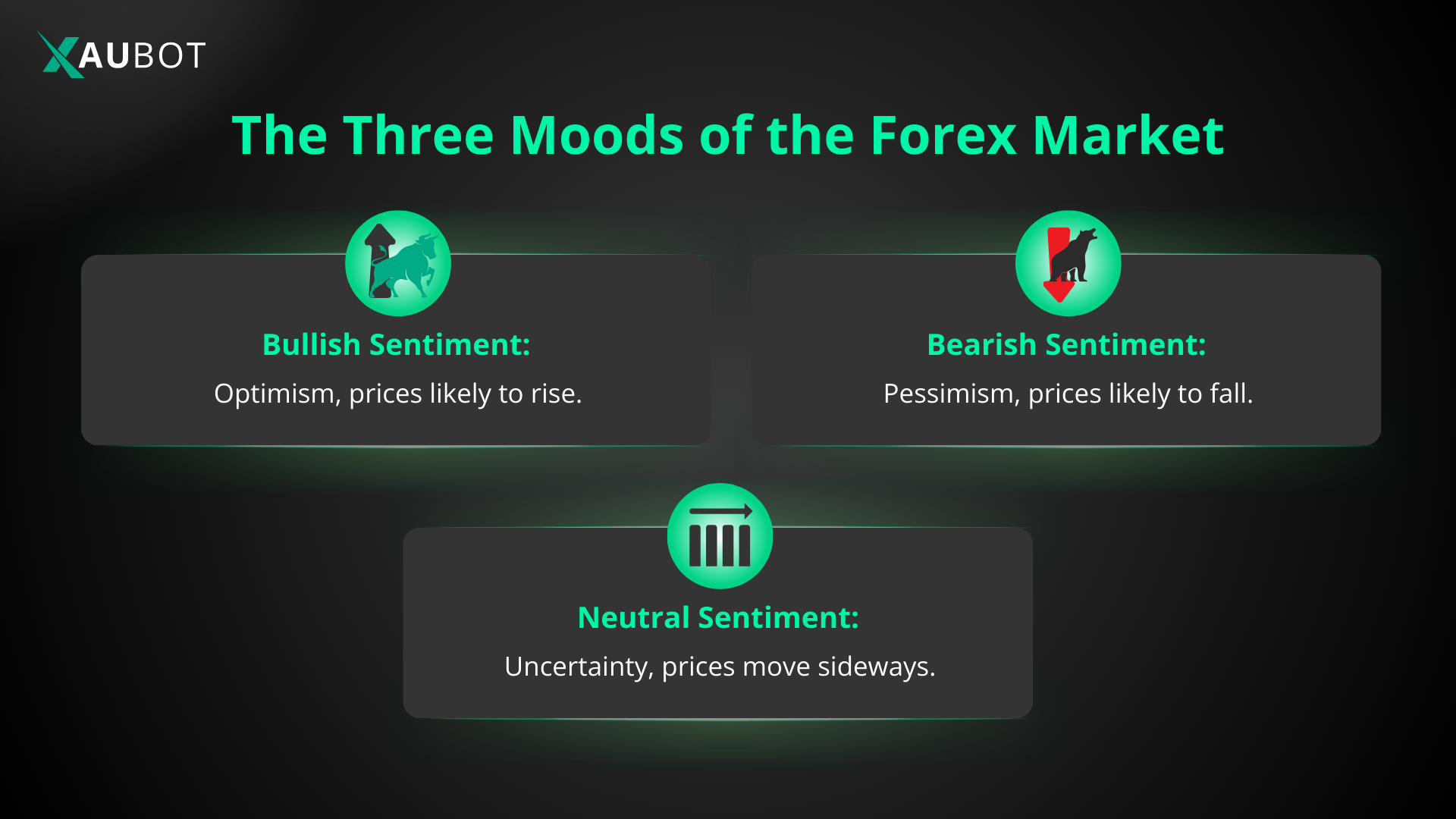

The same is true with financial markets. You need to check their mood before approaching them. Here the main three moods of the forex market:

Bullish Sentiment

This is of course when market participants are optimistic or happy about how the market is going to go. Therefore, the mood or market sentiment becomes bullish. Under these conditions, it is highly likely the prices will continue to rise and the bullish trend will keep going ahead.

Bearish Sentiment

This is of course the opposite of the above. In bearish sentiment, traders do not feel very optimistic about a certain currency pair. So, when the market sentiment is bearish, it is highly likely that prices will continue to decrease.

Neutral Sentiment

This is when traders are unsure or uncertain about how they feel exactly about the market or the currency pair. We can say this is similar to a sideways trend on the chart where prices are neither going up nor down very strongly and obviously.

How Does Market Sentiment Impact Forex Prices?

Although there are different factors that impact the forex market and the price of currency pairs. Market sentiment plays a hugely important role.

So, here we want to see how market sentiment can impact the price and value of currency pairs in the foreign exchange market.

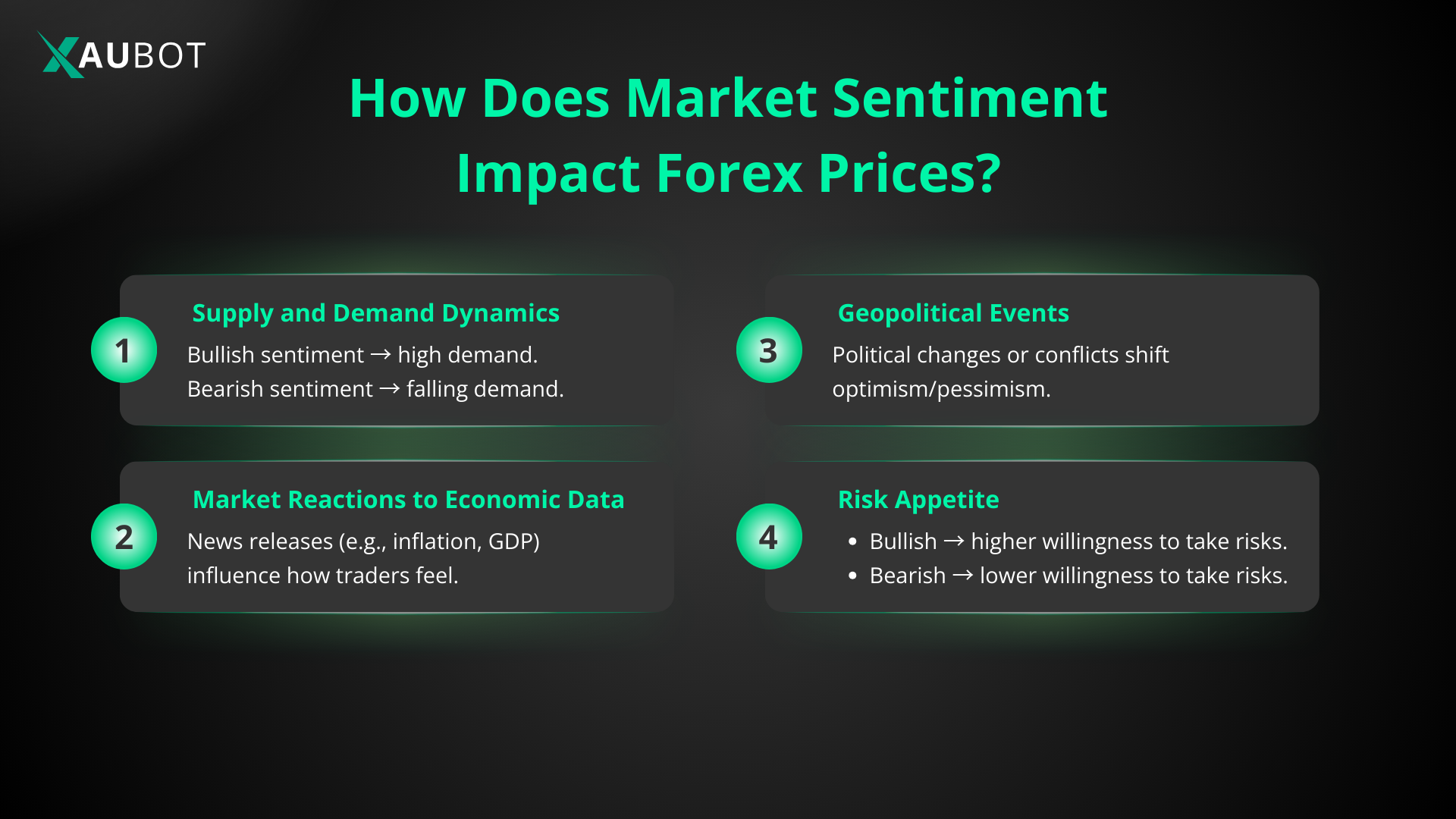

- Supply and Demand Dynamics

First and foremost, market sentiment is directly related to the notion of supply and demand.

At its score, market sentiment can show you the demand of the users. Clearly, when the sentiment is bullish it indicates that there is a high demand for the currency pair. On the other hand, a bearish sentiment would be a sign of falling demand.

This will in turn translate into trading volume and we all know just how important that is.

- Market Reactions to Economic Data

The thing about market sentiment is that it is also under the influence of other factors.

This is similar to the forex market itself where we have various factors influencing the market. And these factors could just as well be important for market sentiment.

The way it works is that market sentiment can be affected by fundamental factors such as various news releases. Because these news releases impact the way traders feel about the market and the future of the financial world.

So, for instance, if there is a report that inflation rates have decreased in the U.S., it will bring hope among consumers and make market participants more optimistic. This will drive market sentiment toward a bullish area.

- Geopolitical Events

Another way that market sentiment can impact the forex market is seen through geopolitical events.

Important and defining geopolitical events impact the sentiment of traders and that will impact the market.

For example, records showed that the recent election in the U.S. where president Trump was elected into the office for a second term, brought optimism among market participants. This might be related to the fact that traders see Trump as a businessman himself and so they hope he can bring incentives for those who want to participate in the market.

So, when this event took place, it made market participants more optimistic about the future of the market.

- Risk Appetite

Another concept that can help us understand how market sentiment can affect the market is known as risk appetite.

As the name suggests, this concept simply refers to how much appetite or willingness traders have for risk.

It is easy to see, when the market sentiment is bullish then traders have a higher risk appetite and are willing to take more risks in the market.

On the other hand, when the market sentiment is bearish then traders are not willing to take many risks and risk appetite would come down in the market.

Tools for Gauging Market Sentiment

Now that you know what market sentiment is and how it can impact the forex market, let’s see how you can gauge and measure market sentiment.

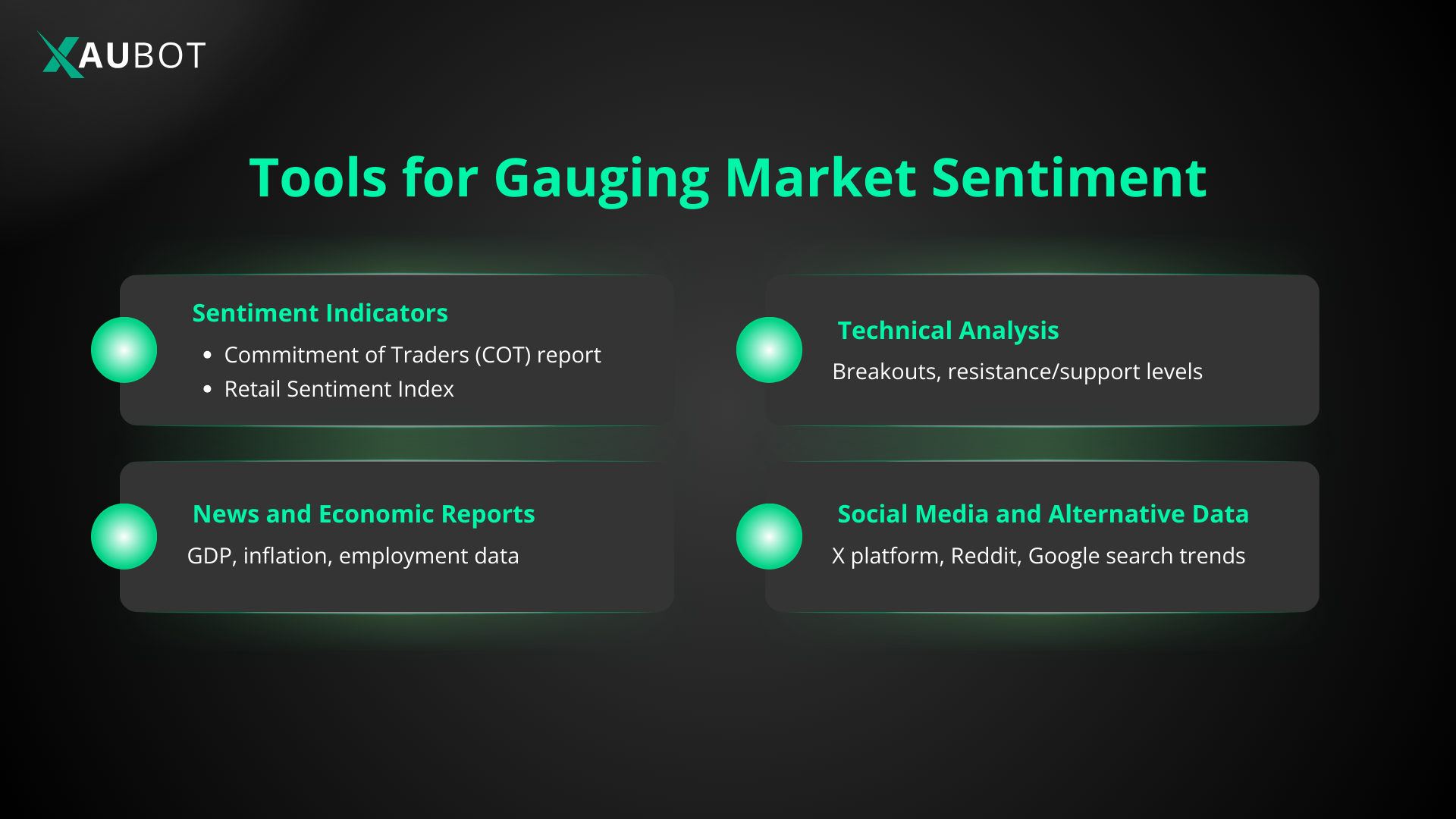

- Sentiment Indicators

The easiest and most accessible method is to rely on reports such as the Commitment of Traders (COT) report or the Retail Sentiment Index.

Commitment of Traders (COT) report: the COT is a report released by the Commodity Futures Trading Commission (CFTC), which is a well-known U.S. agency.

This report can show the position of large market participants, such as institutional participants with a lot of money in the market. So, by looking at their positions, you can get an idea of the overall sentiment of traders in the market.

Retail Sentiment Index: this is another index that can be good for understanding market sentiment. Unlike the COT report, the retail sentiment index follows the position of retail traders.

- News and Economic Reports

Another great way to be able to predict and measure market sentiment is through news and economic reports.

We already mentioned that market sentiment is affected by fundamental factors like economic reports and releases.

So watch out for these reports and releases and see if they are positive or negative and then you will be able to predict whether market sentiment will go toward a bullish or bearish area.

An example is the regular economic reports such as GDP or inflation. When these figures are ideal, you can expect that market sentiment will increase positively and vice versa.

- Technical Analysis

Of course, you can also use technical analysis tools to analyze market sentiment.

We can use data from technical indicators to predict and measure market sentiment. For example, if there is a sudden break through the resistance level, it would not be wrong to conclude that market sentiment is bullish and vice versa.

- Social Media and Alternative Data

Recently, data obtained through social media can also tell us whether traders feel optimistic about a market or negatively.

These data can be obtained from platforms that traders use more, such as the X platform, Reddit, and even Google search trends.

These data can show the tendency of traders toward a certain currency pair.

The Role of Market Sentiment in Trading Strategies

The last stop in our analysis of how market sentiment affects forex trading is to take a look at the role of market sentiment in trading strategies.

1. Identify Potential Trend Reversals

A good way to use market sentiment is for identifying potential trend reversals. For instance, when market sentiment shifts suddenly, then you can also expect a sudden change in the direction of the trend.

2. Confirm Technical Analysis

Another way that you can use market sentiment to your advantage is to confirm technical analysis.

When you use technical indicators and obtain certain analysis, you can use the current market sentiment to approve or disapprove that analysis. How? For example, if the technical analysis indicates that the market trend is going to be bullish but the overall market sentiment is heavily bearish, then you should doubt the result of technical analysis. You can also use market sentiment in the exact opposite way to confirm the result of technical analysis.

3. Trading the News

Market sentiment is even beneficial when trading with the help of fundamental analysis.

So, when you are trading the news, you can use market sentiment to see when there might be a bullish or bearish run in the market according to the reaction of traders to news releases.

Conclusion

In this article we talked about a very important concept known as market sentiment. This is a very important concept when it comes to forex trading because it shows the tendency and feeling of traders toward the market or a specific currency pair. Market sentiment can be either bullish, bearish, or neutral.

Understanding market sentiment and also how to measure it can be of great benefit to your trading process and trading results.