The success of trading in any financial market for the professional trader will ultimately depend on the trading strategy that they use. More often than not, it is up to the trading system and strategy that they develop based on their trading conditions and aims.

While there are many different approaches that traders can take toward developing a successful trading strategy, time-based trading systems are among the most popular and also proven.

These time-based rule systems can range from shorter term approaches such as 1-hour timeframes to much longer timeframes such as 4-week systems.

And that is exactly what we are going to focus on in this article. We are going to see how you can develop successful trading systems that are time-based, from 1-hour to 4-week rule systems.

Understanding Trading Strategies and Time Frames

What exactly makes up a trading strategy? A well-structured and designed trading strategy would include a set of rules and frameworks that guide the process of trading carefully and precisely. It is like a frame that you put around your trading so that it doesn’t get out of control and always goes according to the plan that you had devised before.

All told, a trading strategy should be able to clearly define entry into a position, exit from that position, the risk management required, and of course position sizing for each trade.

- Entry signals (when to buy or sell)

- Exit signals (when to close a position)

- Risk management (stop losses, take profits)

- Position sizing (how much to trade)

So now what about the time frame? In simple terms, a time frame would refer to the duration in which a trade remains open but it might also include the time of analysis.

Basically, the time frame refers to the entire duration of a trade, which can range from minutes to hours and then to days and weeks depending on the time frame of the trading strategy.

The time frame of the strategy is extremely important as it will define so many important factors such as risk management, profit goals, etc.

Why Time-Based Rule Systems Matter

One of the most important advantages of time based rule systems in trading is that such systems are able to clearly divide trading strategies only based on time frames which gives clear guidelines with respect to the degree of risk management and profit expectations.

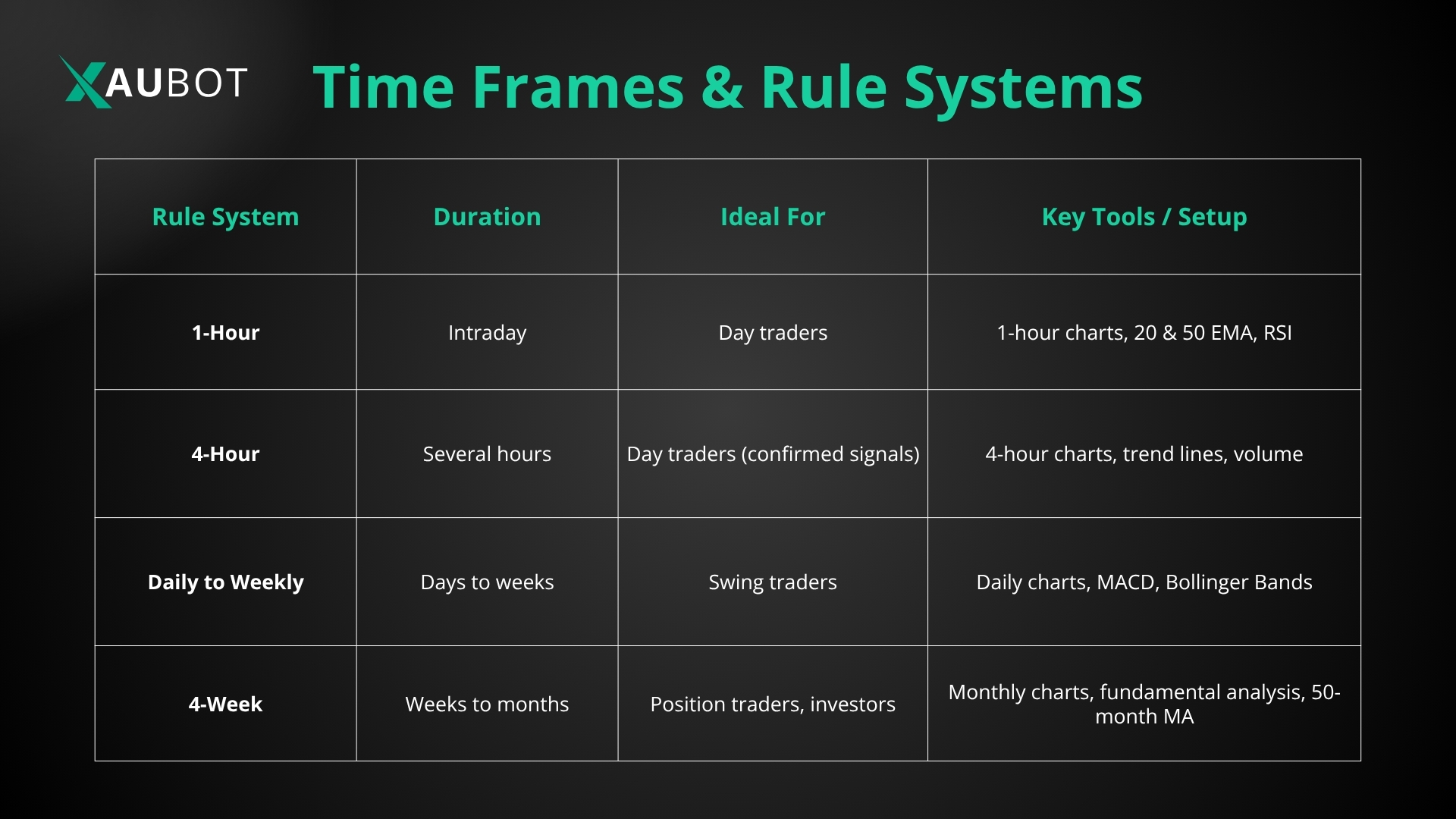

We can define the following time based rule systems in trading:

- 1-Hour Rule Systems: these trades are executed based on the 1-hour charts

- 4-Hour Rule Systems: these would be rather medium term trades that would last hours

- Daily to Weekly Rule Systems: here we have a clearly longer term approach to trading which is done with the help of daily and weekly charts instead of hourly charts. In this approach, the trader would hold on to the position for days to weeks

- 4-Week Rule Systems: Strategies focused on monthly cycles, ideal for longer-term investors and swing traders.

Each time frame that we just discussed is suitable for different market conditions. Understanding them is crucial in developing the right time based trading system for any professional trader.

In the following sections, we will show you step by step how you can successfully develop such a time based system.

Step 1: Define Your Trading Goals and Style

First and foremost, you need to define the goals and aims that you hope to achieve from a time based system. Define exactly what you want. These questions can help you do that:

- Are you looking for quick profits or steady growth?

- How much time can you dedicate to trading daily?

- What is your risk tolerance?

It also heavily depends on the kind of trader that you are. If you are a full time trader who can monitor the market all the time, then of course shorter time frames might be more suitable for you. But if you consider yourself more of an investor/trader who has a full time job, then obviously longer time frames can benefit you more.

Step 2: Learn Technical Analysis Basics

Time based trading systems rely a lot on technical analysis. In fact, we can even say that technical analysis forms the foundation of such trading strategies. So you need to already be familiar with them or learn about them.

Here are the most important aspects that you need to know:

- Trend identification: Uptrend, downtrend, or sideways

- Support and resistance levels: Price points where markets tend to reverse

- Indicators and oscillators: Moving averages, RSI, MACD, Bollinger Bands, etc.

- Chart patterns: Head and shoulders, double tops, flags, triangles, etc.

Step 3: Develop Specific Rule Sets for Each Time Frame

Alright now let’s dive right into the time based systems and discuss each one to see who they are ideal for, what is their typical setup, their entry and exit rules, and also their risk management.

1-Hour Rule Systems

- Ideal for: this is ideal for traders who are actual day traders and want to use opportunities intraday.

- Typical setup: use 1-hour charts with a combination of moving averages (e.g., 20 and 50 EMA)

- Entry rule example: buy when the 20 EMA crosses above the 50 EMA and the RSI is above 50.

- Exit rule example: sell when RSI moves above 70 (overbought) or price touches a defined resistance level.

- Risk management: because this is high speed trading, you need to use tight stop losses (for example 0.5-1% of price)

4-Hour Rule Systems

- Ideal for: this would also include day traders, but traders who would like to spend more time on trades and confirm their signals with more strength and assurance.

- Typical setup: use 4-hour charts with trend lines and volume analysis.

- Entry rule example: enter on a breakout above a resistance level with increasing volume.

- Exit rule example: exit on a close below the breakout level or if the price retraces 3-5% against your position.

- Risk management: the risk is lower than 1-hour, so use moderate stop losses

Daily to Weekly Rule Systems

- Ideal for: this time frame is specifically ideal for swing traders who would like to hold on to their positions from days to even weeks

- Typical setup: use daily charts with indicators like MACD and Bollinger Bands.

- Entry rule example: buy when MACD line crosses above signal line and price touches the lower Bollinger Band in an uptrend.

- Exit rule example: exit when MACD crosses below the signal line or price reaches the upper Bollinger Band.

- Risk management: because the size of these positions are normally much larger than smaller time frames, it might be a good idea to opt for a larger stop loss (2-3%) and position sizing adjusted to account for holding periods.

4-Week Rule Systems

- Ideal for: this would be the longest time frame for traders who have chosen the position trading style

- Typical setup: use monthly charts with fundamental analysis and major moving averages.

- Entry rule example: buy when price closes above the 50-month moving average

- Exit rule example: sell when the price closes below the 50-month moving average

- Risk management: the positions here would normally be the biggest in size, so capital preservation is key and position size carefully.

Step 4: Backtest Your Strategy

Whichever one of these time frames you have finally decided is suitable for your trading process and have built a trading strategy around it, it is highly important that you fully backtest your strategy before using it in the live market. Backtesting allows you to find any flaws or gaps that might exist in your strategy with the help of historical data and fix it.

Look for these in the report of the backtest:

- Win rate (% of winning trades)

- Average gain/loss per trade

- Maximum drawdown

- Risk-to-reward ratio

- Profit factor (gross profit divided by gross loss)

Step 5: Paper Trade and Adjust

When the process of backtesting is fully done, it is time to paper trade.

Paper trade means trading in a controlled environment with virtual money or demo trading. Demo trading will let you get as close to the real market as possible because you will receive real market data with a delay. But it is safe because you are using virtual money.

This is the last step to fix anything that might have slipped through the backtesting.

Step 6: Execute and Monitor

When you feel reassured that your strategy is ready to take into the market, begin executing trades. But make sure to always monitor the process.

- Avoid overtrading

- Keep a trading journal

- Review weekly or monthly

Conclusion

A successful trading strategy can mean the difference between profit and loss in any financial market. Therefore, as a professional trader, you need to dedicate careful time and planning to develop your trading strategy.

In this article we focused on time based rule systems which are trading strategies that are focused around the time frames of their trades, which would include time frames from 1-hour to daily, weekly, and even monthly.