In the realm of technical analysis Trading, we might have various different technical indicators for the same purpose and for the same end. But of course each of them can have a different result and yield a different end point. One of those groups of indicators are those that measure the overbought and oversold positions in the market. More specifically, the money flow index, which is itself one of those technical oscillators.

The focus of this article is going to be discussing the concept of the money flow index on its own as a technical indicator and also how it can be used to your advantage in the process of trading in the foreign exchange market. We are going to look at the specific feature of XauBot Pro dedicated to this index known as Money Flow Limits and how it works to help you.

Take a look at: Holiday Season Trading Made Easy XAUBOT’s Holiday Filter Explained

What Is the Money Flow Index in Forex?

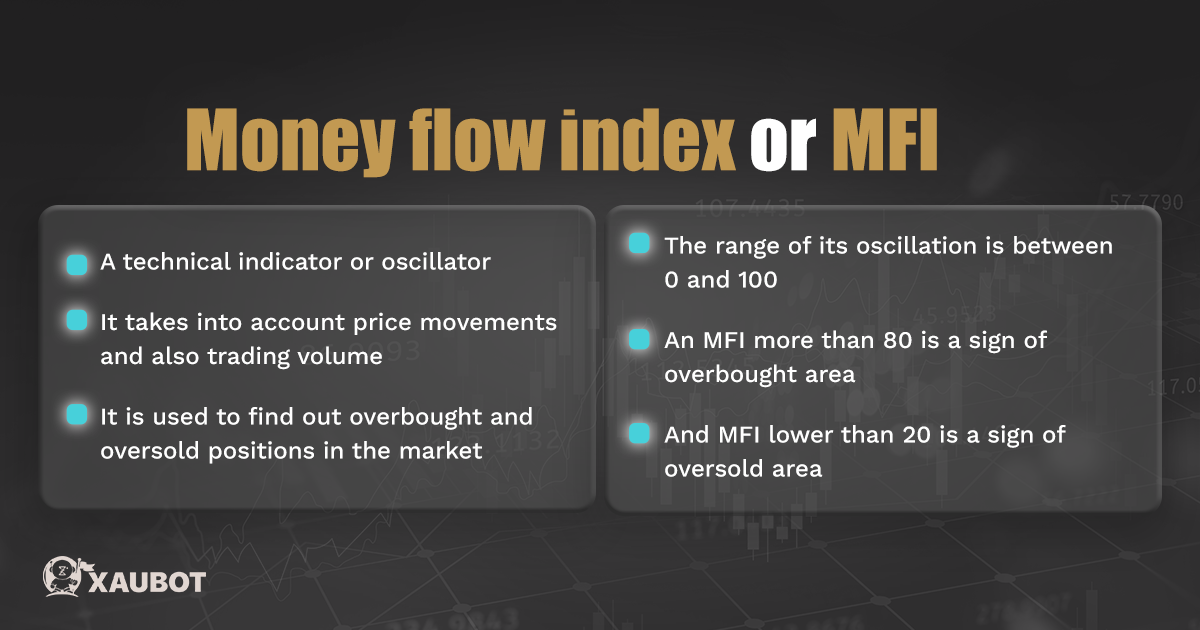

The money flow index which is also known as MFI is a technical indicator or a technical oscillator. Being an oscillator means that MFI oscillates between two extremes, or goes back and forth between two values.

It is similar to many other oscillators that are used in the forex market, such as the relative strength index. But it goes more than that. It is more similar to these indicators than just the type of function. The information that it provides is also similar to the RSI. Why? Because the money flow index also provides information about overbought and oversold positions in the market. But with a key difference.

Whereas the relative strength index takes into account only price movements, the money flow index considers trading volume as well as the price movements. So in this way many consider the money flow index as a super version of the RSI.

So how does the money flow index oscillate? The oscillation of this technical indicator is also similar to other oscillators, like the relative strength index. This means it oscillates between 0 and 100 in order to show the areas where in the market are overbought and oversold.

The way the oscillation of the money flow index is interpreted is that if the value of MFI is more than 80, then it means the positions in the market are overbought. On the other hand, if the value for MFI is lower than 20, then it means the positions in the market are oversold.

This is how we can get a basic understanding of the money flow index and what it can tell you about the market. In the next section we will take a look at the money flow limit feature of XauBot Pro and then how to use this technical oscillator.

Take a look at: How to Become a Disciplined Trader

How Does the Money Flow Limit in XauBot Pro Help You?

The money flow limit is a feature integrated into XauBot Pro that lets you receive alarms for this technical indicator. This is one of the features of XauBot Pro that we can see with different technical tools.

The advantage of such parameters is that you actually receive alarms and notifications for the information that is provided through these indicators. And you can see how important it is to make a move on such information as fast as possible. Especially on a market that moves as fast as the foreign exchange market.

Similar to other parameters of this type, the money flow limit will help you define thresholds for this expert advisor with regard to the value of the money flow index. You can set these values based on your own preferences in trading.

So for instance you can set the value at 10, which means when the money flow index moves up or down you will receive a notification whenever it crosses the 10th percentile threshold on either side, whether toward the upper limit of 100 or whether toward the lower limit of 0.

In this way you can find out just how strong a trend in the market is based on the number of people or traders who are behind it. So naturally if the MFI limit for XauBot Pro indicates the upper limit, then it means traders are pushing to buy which means prices are going to move higher. And if it indicates the very bottom of the money flow index range, then it clearly means traders are pushing to sell and prices are likely going to go down further.

Now let’s take a look at how you can actually use the money flow index.

Take a look at: Teaching sentimental analysis and its tools

How to Use Money Flow Index to Your Advantage?

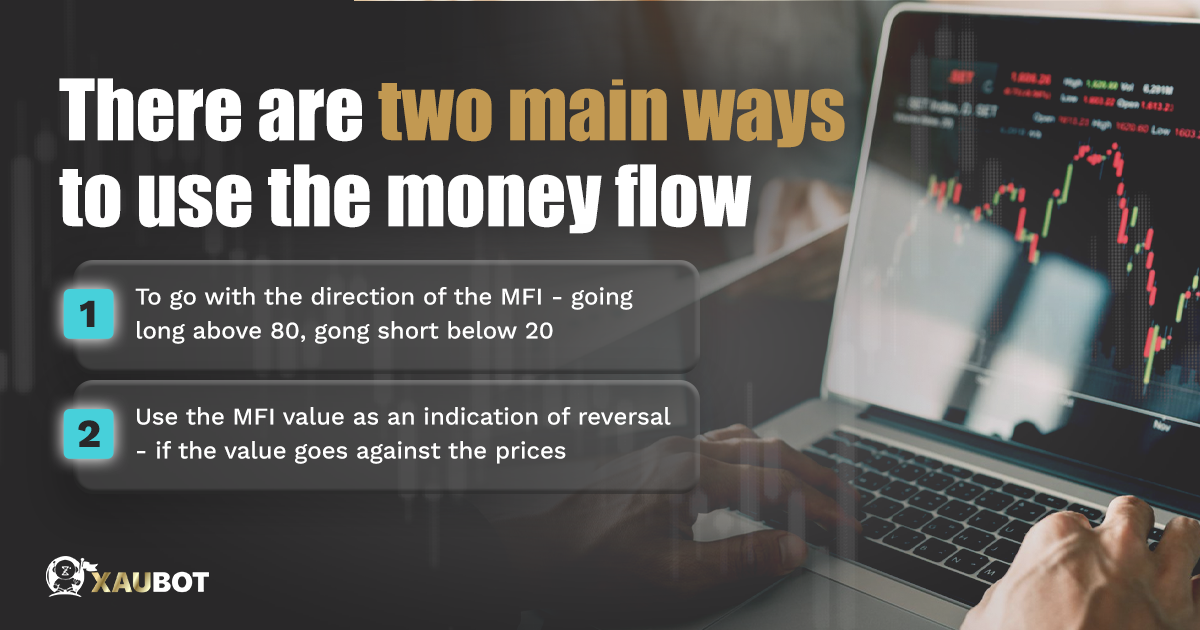

There are two main ways to use the money flow index:

- The first way is to go with the direction of the MFI itself. This means whatever the value of the MFI is, you just go with that and assume a position in the market in accordance with that number. So for instance if the value of MFI is above 80, you might want to assume a long position and ride the bullish wave. On the other hand, if the value for MFI is below 20, you can assume a short position to ride the bearish wave.

- The second way is to use the MFI value as a sign of reversal. This can be the case when the value of the MFI does not match the prices that are in the market. So for instance if the prices are pushing higher and the MFI is a low figure, then it means there could be a potential reversal. Similarly, if the prices are pushing low and the MFI is indicating a high value that also means a potential reversal might be on its way.

Take a look at: Introducing the Term Pip and Pipette in the Forex Market

Conclusion

In this article we took an in-depth look at the technical oscillator known as the money flow index and how it works. More significantly, we discussed the money flow limit feature of the XauBot Pro and how it can help you take more advantage of this indicator.