It is not often that we see a huge movement in any given financial market. They do happen from time to time. But something that is always happening are small movements and fluctuations. No matter which financial market you are trading in, there are always going to be small price volatilities on a daily or hourly or even smaller basis.

For this reason, there are trading strategies poised to take advantage of these small movements. Among all of them, perhaps none stands out more than scalping. In this article we are going to take a precise and technical look at the top scalping strategies for the 1-m and 5-m time frames for successful scalp trading strategy.

Why Scalping Works on 1-Minute and 5-Minute Time Frames

The 1-minute and 5-minute time frames remain the preferred choice for scalpers in 2025 for three main reasons.

- Higher Trade Frequency These short charts produce many new candles every hour, creating far more potential setups than higher time frames. Scalpers can place dozens of trades in a single session and compound small gains quickly.

- Lower Market Exposure Positions last only minutes, sometimes seconds. This dramatically reduces the risk of sudden news events or large adverse moves that often hit longer-term trades.

- Instant Feedback Each trade closes fast, giving immediate insight into what works and what does not. Scalpers can refine their edge in real time and adapt to changing market conditions within the same trading day.

Of course it is not just advantages, as there are also downsides. All this high speed, quick execution, and high frequency can also be a huge downside if the scalping method is not handled carefully and professionally. Let’s see how you can do this. The following is a list of top scalping strategies for the above-mentioned time frames.

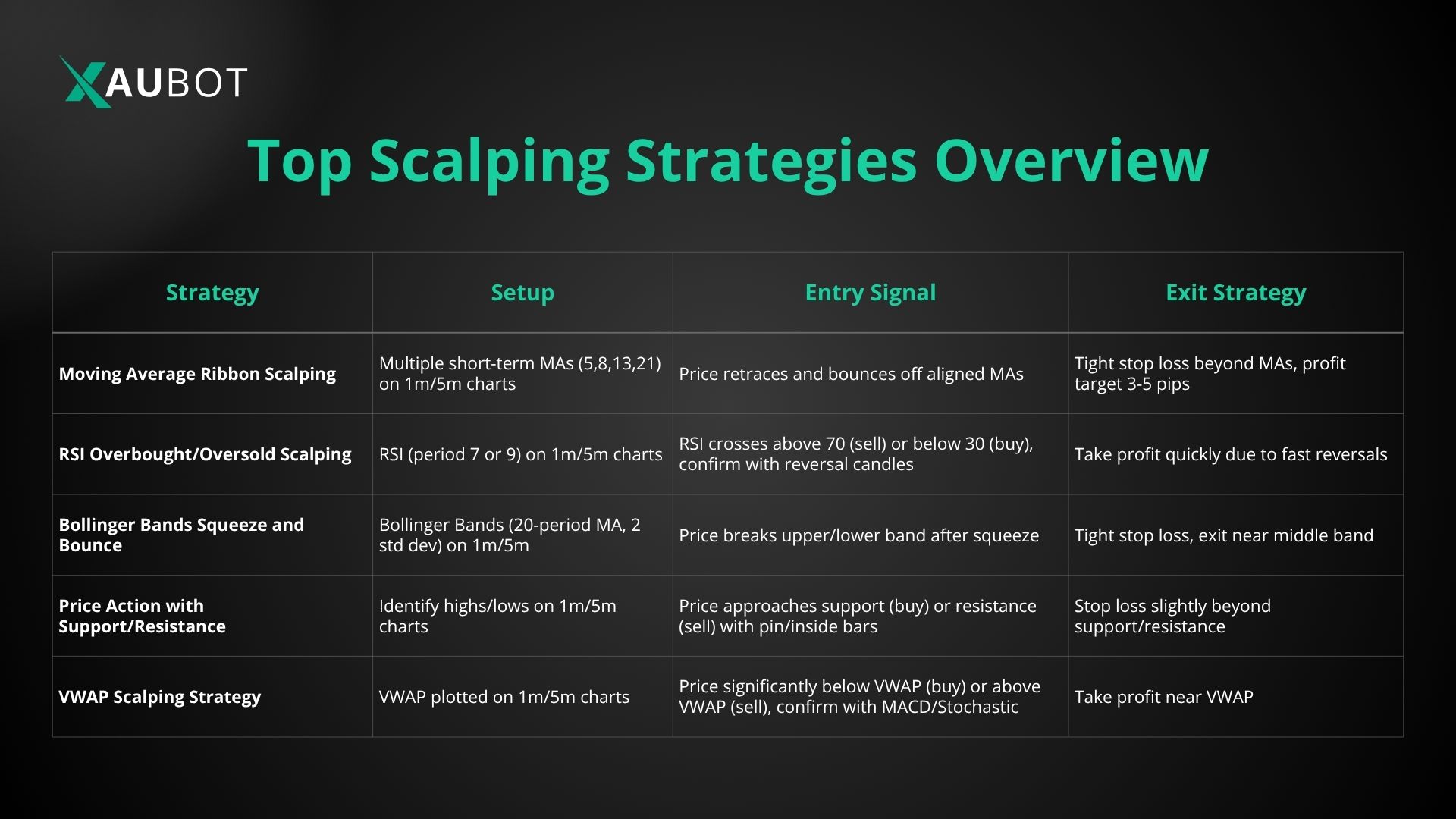

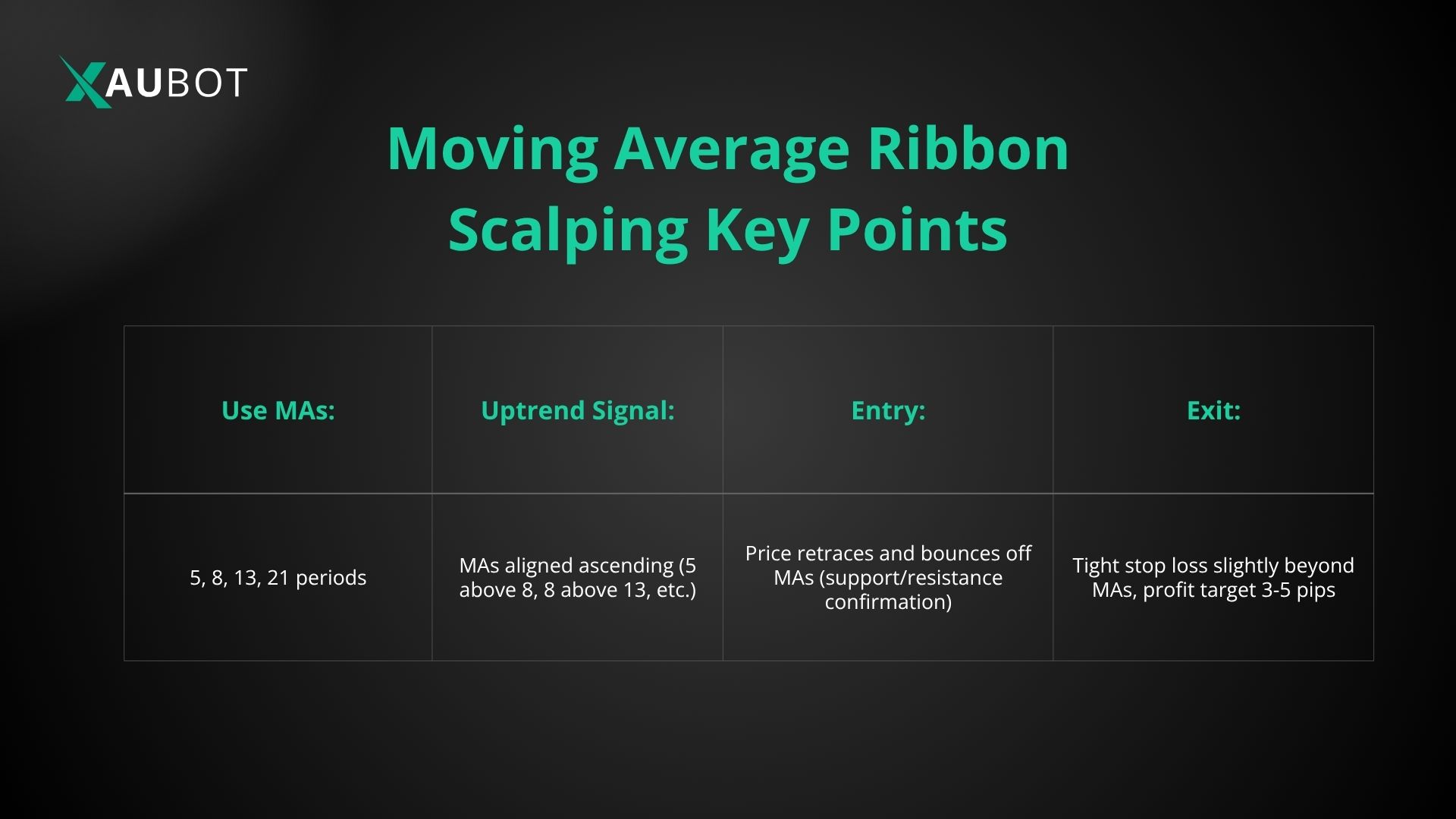

Moving Average Ribbon Scalping

Overview: this is one of the most common strategies in scalp trading. In this method, the traders use multiple moving averages (MAs) in order to identify where the short term trends in the market are and also what their momentum is.

- Setup: combination of short-term MAs (e.g., 5, 8, 13, and 21 periods) plotted on a 1-minute or 5-minute chart.

- Signal: you need to pay attention to the moving averages and when they align in ascending order (5 above 8, 8 above 13, etc.), it is a strong sign of an uptrend. Naturally, this is a sign to go long or to buy. The reverse if of course for shorting the market or selling.

- Entry: enter when price retraces a small degree and then bounces off the moving averages, because this would confirm support or resistance.

- Exit: make sure that you use a tight stop loss slightly beyond the moving averages and set a small profit target, often 3 to 5 pips.

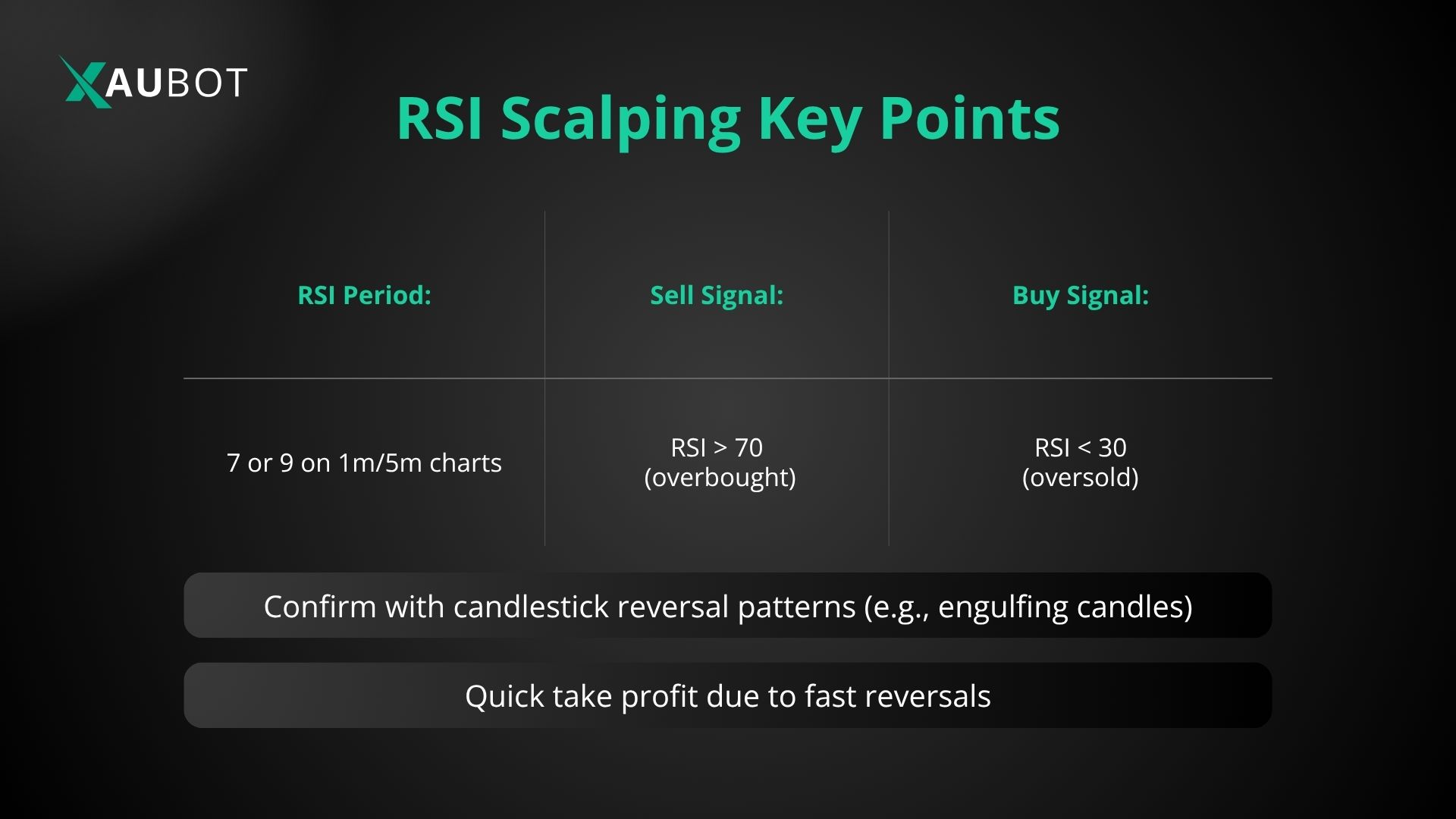

RSI Overbought/Oversold Scalping

Overview: one of the most well-known and widely used technical indicators is the Relative Strength Index (RSI). This indicator can detect overbought or oversold conditions in the market and it can even do it on very short time frames.

- Setup: you can use the RSI but with a short period setting, such as 7 or 9, on a 1-minute or 5-minute chart.

- Signal: you can go short or sell when the value for RSI crosses above 70 (which is a sign for overbought conditions). On the other hand, you can enter into a long position or opt to buy when RSI goes below 30 (this is the sign of oversold conditions in the market).

- Entry: you can confirm your signal for entry with candlestick reversal patterns like engulfing candles.

- Exit: reversals in short time frames can be very quick and short lasting, so take profit quickly and close fast.

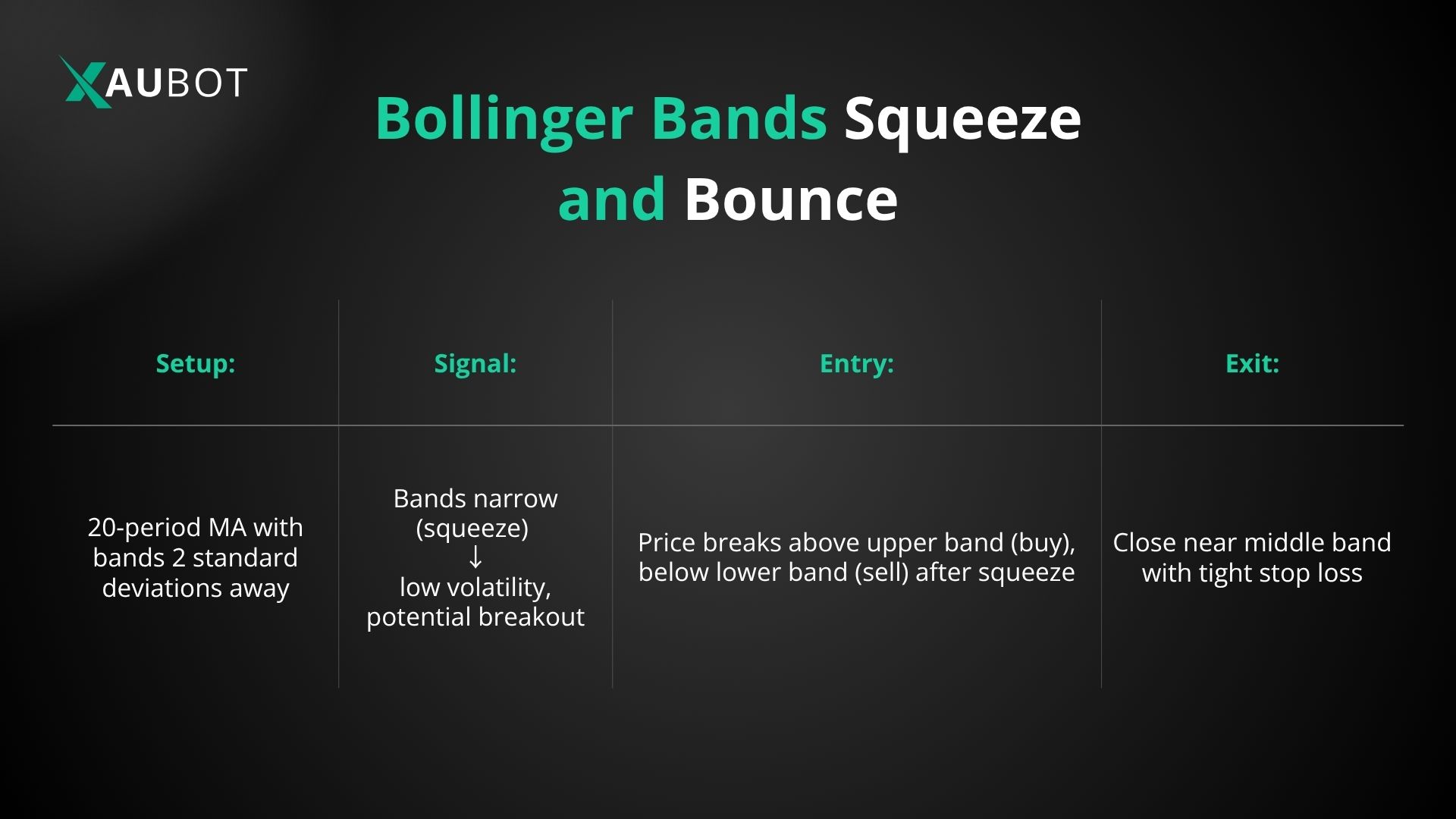

Bollinger Bands Squeeze and Bounce

Overview: here is another technical indicator which is quick especially well-adapted for scalping trading strategy. This technical indicator is Bollinger Bands and the reason it works so well with scalping is because it is used to measure volatility and can signal breakout and reversal points.

- Setup: obviously, you need to begin by using the Bollinger Bands (standard settings: 20-period MA with bands 2 standard deviations away) on 1-minute or 5-minute charts.

- Signal: the signal in this method is primarily when the bands narrow in Bollinger Bands significantly. This is called a squeeze and it signals low volatility and potential breakout which.

- Entry: your entry signal in this strategy is when the price breaks above the upper band followed after a squeeze. This is when you should go long or buy. The other side of it is when price goes below the lower band, and that is when you enter short.

- Exit: make sure to use tight stop loss orders for this strategy and exit when price gets close to the middle band again.

Price Action Scalping with Support and Resistance

Overview: this is a special scalping strategy for pro traders. These are called price actions traders who solely rely on price movements for their analysis and trading decisions. In this approach you would only focus on support and resistance levels for scalp trading.

- Setup: the main setup for this approach is to identify the highs and lows on the 1-minute or 5-minute chart.

- Signal: the idea behind the signal in this strategy is quite simple. You would go long when the price approaches support and go short when the price approaches resistance.

- Entry: you can use candlestick patterns, like pin bars or inside bars, to prepare the entry signal for this strategy to indicate rejection of these levels.

- Exit: to prepare for any potential exit, make sure to place your stop loss just slightly above the support/resistance level.

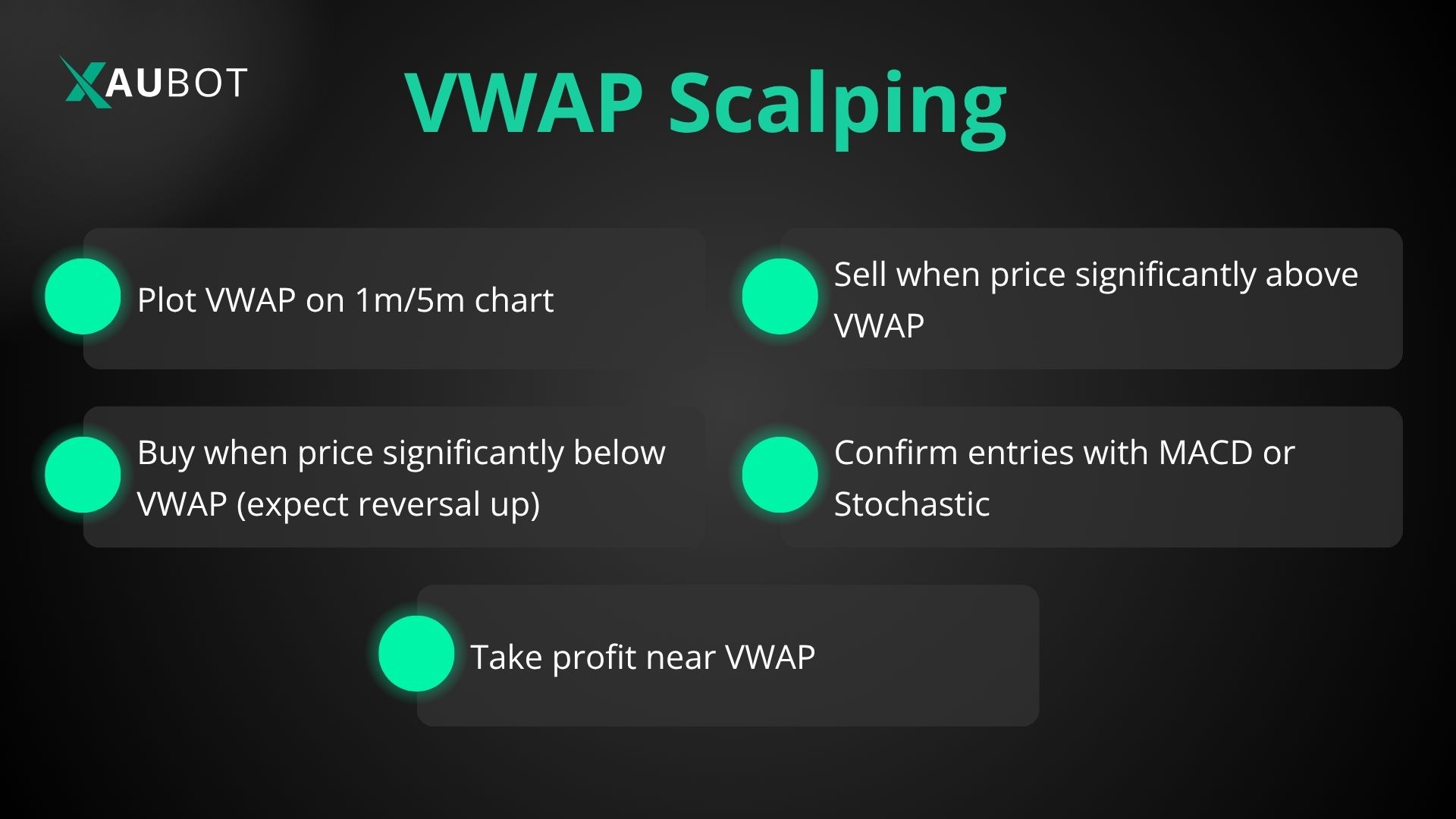

VWAP Scalping Strategy

Overview: here we have a highly advanced technical indicator known as the Volume Weighted Average Price (VWAP) which is widely used by institutional traders and offers dynamic support/resistance levels.

- Setup: the setup of this strategy involves the trader just to plot the VWAP on the 1-minute or 5-minute chart.

- Signal: the way signals for this strategy are obtained solely rely on VWAP. This means if the price goes significantly below VWAP, it may reverse upwards, and so you should opt for a long entry. And of course if the price goes above the VWAP and it is significant then go for short.

- Entry: you can confirm your signal for entry with the help of momentum indicators like MACD or Stochastic.

- Exit: when the price is getting closer to the VWAP that is the signal for taking profits.

Conclusion

Scalping remains one of the most popular and potentially profitable trading styles across all financial markets when executed with discipline and the right approach. In this article, we focused specifically on the 1-minute and 5-minute time frames – the two most widely used charts for scalpers.

We covered several proven strategies that work particularly well on these fast charts, each built around reliable technical indicators and clear entry-exit rules. The best strategy for you will depend on your personal trading style, risk tolerance, and schedule. Test each one thoroughly on a demo account first, then choose the setup that consistently matches your goals and delivers the highest win rate in live conditions.

Master one solid scalping strategy on the 1-minute or 5-minute chart, combine it with strict risk management, and it can become a powerful source of regular trading income.