As you know algorithmic trading, or algo trading, has been an absolute revolution in the forex market and changes this market forever. Now, between 70% to 90% of trades in the forex market are done with the help of algorithms in one way or another. So, increasing your understanding of algo trading as a trader is an essential. The more you know the better. In this article we are going to take a peek behind the algo trading curtain and take a look at some of the most common algorithmic trading strategies for the forex market.

Trend-Following Strategy

Trend following strategies are among the most common and widely used trading strategies across algorithmic trading tools.

The idea behind this form of trading strategy is that there are basically long term trends in the market, either upward or downward, and prices might have ups and downs but they will move along in the same direction as the trend.

Key Features:

- Entry Signal: the most important entry signal in this type of tool is when there is a strong sign a trend is forming or if the trend has formed, there ought to be a signal that the trend is going to continue.

- Exit Signal: the most likely situation for the end of a trend following position is when the algorithm senses a reversal in the direction, even temporarily, but enough to close the position.

Advantages:

- Simple to implement: perhaps the biggest advantage behind trend following strategies is that they are very easy to implement in the form of an algorithm. That is because their underlying principle is quite straightforward.

- Works well in trending markets: and of course when there is a major trend in the market, these algorithms and strategies can work very well.

Common Tools:

- Moving Averages (MA): Simple Moving Averages (SMA) or Exponential Moving Averages (EMA) can be excellent tools to gauge the direction of a trend.

- Average Directional Index (ADX): the ADX is also exceptionally useful for when you want to measure the strength of a trend.

Read more about trend-following strategy

Mean Reversion Strategy

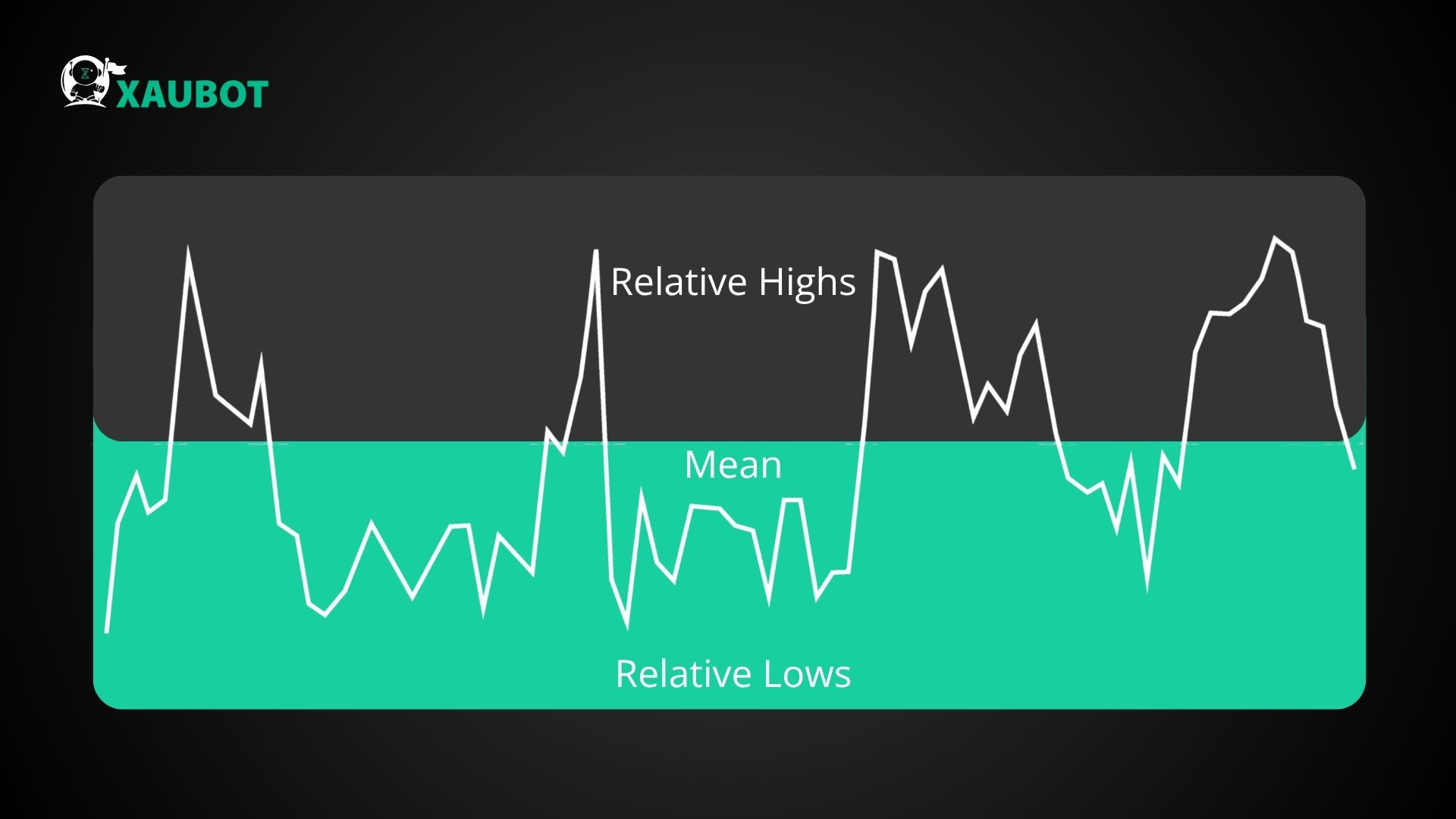

The mean reversion concept is about the historical patterns of assets.

What does that mean?

It means in this strategy, the idea is that assets have historical patterns and even if they change they will eventually get back to those patterns.

So in the case of the forex market, mean reversion says that there might be fluctuations in the value and price of currency pairs, but they will return to their historical average or mean.

Key Features:

- Entry Signal: there is a baseline considered by the algorithm. This baseline is the historical average of the asset.

Basically, when the price falls below the average, the algorithm will buy (buy low)

And when the price goes above the average, the algorithm tends to sell (sell high)

- Exit Signal: most likely the exit signal comes from the reversion to mean as it was expected by the algorithm.

Advantages:

- Effective in range-bound markets: there are situations when the market is not trending or we cannot detect a strong trend in the market.

This is when we say the market is range bound or trending sideways.

Mean reversion works especially well in these conditions.

- Can offer quick profits: this trading strategy is also good for capturing short term price changes and profiting off of them.

Common Tools:

- Bollinger Bands: because of its structure with an average line and two upper and lower limits, this indicator works really well with mean reversion.

- Relative Strength Index (RSI): detecting when the asset is overbought or oversold through the RSI can also provide valuable insight for a mean revision algorithm.

Scalping Strategy

Scalping is one of the most well-known trading strategies across all financial markets and also one of the most widely used in algo trading tools.

This is one of the short term trading strategies that takes advantage of timeframes such as 1-m or 5-m to profit from small movements.

Scalping is considered a high paced trading approach with quick positions that capture even the smallest profits.

Key Features:

- Entry Signal: the most important signal that triggers a scalping algorithm to open a position are the small price movements or small volatilities.

- Exit Signal: the signal for such algorithms to close a position is usually a small threshold of profit. Once obtained, the position will be closed to avoid loss.

Advantages:

- High-frequency trading: scalping is able to make profits even from small movements because it has a high frequency of trades. So after a while the marginal profits can build up and be significant.

- Reduced market exposure: because the positions are very short, there is minimal market exposure and certainly no overnight positions.

Common Tools:

- Order Book Data: a scalping algorithm might get insight from order books to find out potential areas when the prices might fluctuate.

Remember, price fluctuation is like fuel for scalping.

- Stochastic Oscillator: this indicator detects overbought and oversold conditions, which in turns helps identify volatilities.

Breakout Strategy

The idea behind breakout strategy is directly tied to support and resistance levels.

As you know, the support level refers to the lowest price that an asset falls to in a given time period and resistance refers to the highest price that an asset can go to in that time period.

Support and resistance levels are extremely crucial in forex and are used in numerous indicators and analysis methods.

Breakout strategy says that when an asset is able to break through support or resistance it will be able to continue in that direction.

Key Features:

- Entry Signal: first of all, this type of algorithm will identify levels of support and resistance and wait for any breakouts to open positions.

- Exit Signal: usually a signal to close the position is obtained by the algorithm when there is a sign for reversal or prices lose their breakout momentum at that time.

Advantages:

- Captures large price moves: usually speaking, support or resistance breakouts lead to substantial trends and this form of strategy is able to very well capture such movements.

- Works well in volatile markets: mean reversion also works really well when the market is volatile and does not bounce between support and resistance.

Common Tools:

- Support and Resistance Levels: of course the support and resistance levels are the foundation of this trading strategy.

- Average True Range (ATR): this popular indicator can help the algorithm measure volatility in order to see how powerful the breakout is going to be and how far it is going to go.

News-Based Strategy

This one is the most different strategy mentioned on this list because it looks outside the market for its source of analysis.

Obviously, as the suggests, such algo trading strategies rely on fundamental factors and in order to obtain them they use AI to monitor news platforms and economic news calendars and they also rely on sentiment analysis and try to obtain such information from social media.

Key Features:

- Entry Signal: such algorithms mainly focus on news for their source of entry signal and usually use an upcoming news event such as the release of economic data to open positions.

- Exit Signal: this type of trades are usually closed when the impact of the news on the market has gone and the market goes back to its normal activities not affected by the fundamental factors at that moment.

Advantages:

- Relying on Fundamentals: trading algorithms that rely on this type of trading have the advantage of being able to use fundamental factors to your advantage.

- Profits from Market Turbulence: when the market is hit by a news event it goes through a period of turbulence. Such algorithms can help you take the most advantage from these periods in the market where technical analysis tools were not able to predict them.

Common Tools:

- Sentiment Analysis: any tools, recently most of them are AI-based, that can help the algorithm monitor social media and measure the sentiment of traders toward a certain asset.

- Economic Calendars: of course these algorithms rely heavily on economic calendars to keep a look on the upcoming events and news releases.

Arbitrage Strategy

Last on our list we have arbitrage. This is actually again one of the most popular trading strategies across various markets, not just forex.

Arbitrage works based on price difference.

This can be different in each market and depending on the financial asset that is traded in that market.

How does arbitrage work in forex?

One way is basically related to the difference between the price of a currency in one broker or exchange compared with the price of that currency in another broker. The idea is to buy low and sell for that higher price and profit from the price difference.

There is another form of arbitrage in forex that is more complex, called triangular arbitrage. In this form of arbitrage, you go through a number of currencies. For example, you might buy USD for Japanese Yen and then use that USD to buy EUR and then exchange that again for Japanese Yen. Through the difference between these currencies, you can ultimately profit.

Key Features:

- Entry Signal: the most common form to obtain an entry signal is to find price differences between platforms or brokers.

- Exit Signal: the trade will be closed when profit has been made from the price difference and there is no more room for profit.

Advantages:

- Low risk: generally, such strategies are low risk because you do not keep positions for long and hope to profit from price differences at the moment.

- High precision: arbitrage algorithms are very precise and efficient in this strategy because they can atomically search for these differences across numerous platforms, something that would be difficult and time consuming for a human trader.

Common Tools:

- Order book data: data from order books can help algorithms so much to find price differences or discrepancies.

Conclusion

Algorithmic trading is a way to provide an enhanced level of speed, accuracy, and efficiency to your forex trading process. In algo trading, you can have the algorithm execute trades for you. In this article, we discussed 6 of the most common and top trading strategies that are used by algorithms in this type of trading.